Global economics and strategic corporate finance have become absolutely crucial in today’s fast-paced business environment, requiring CFOs to be able to handle these market challenges and corporate finance problems.

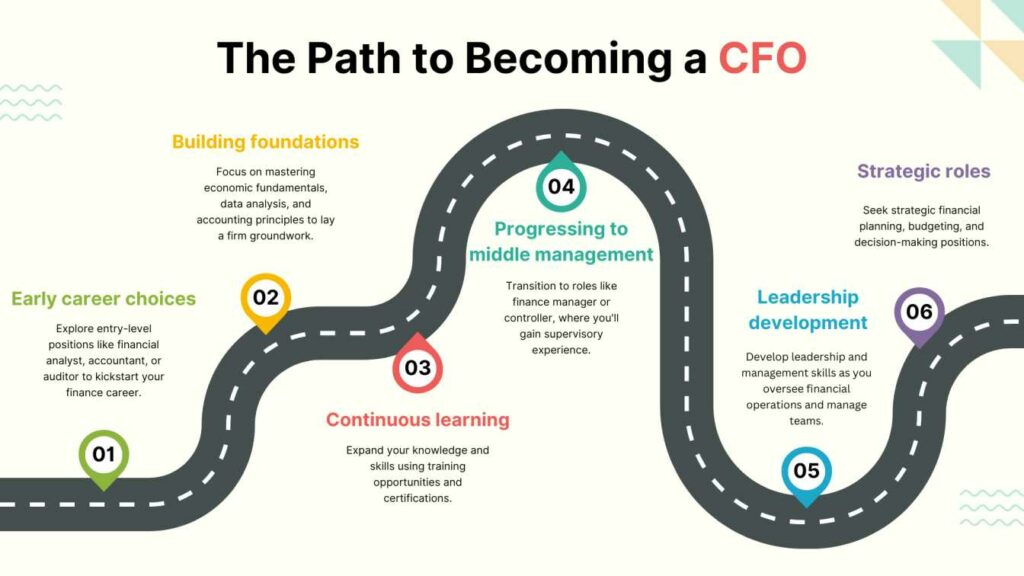

A solid CFO course will help you gain the necessary knowledge you need to become an expert in strategic corporate finance. You can also learn about global economics and various factors that affect it such as macroeconomic trends, geopolitics and market fluctuations in a CFO certification programme. Let us learn about strategic corporate finance and global economics in detail.

CFOs and Strategic Corporate Finance

Aligning financial decisions with overarching business objectives to promote sustainable growth and value creation is known as strategic corporate finance. By effectively allocating resources, managing investment choices, and optimising capital structure, CFOs and financial managers play a crucial role in strategic corporate finance. Assessing trade-offs between risk and return, analysing investment prospects, and putting financial strategies into practice that optimise shareholder value are important components.

Financial restructuring, dividend decisions and policy, mergers and acquisitions, and capital budgeting are all included in the category of strategic corporate finance. Businesses can maintain financial stability and resilience while boosting competitiveness, adjusting to market dynamics, and seizing growth opportunities by implementing a strategic approach to financial management.

Global Economics and CFOs

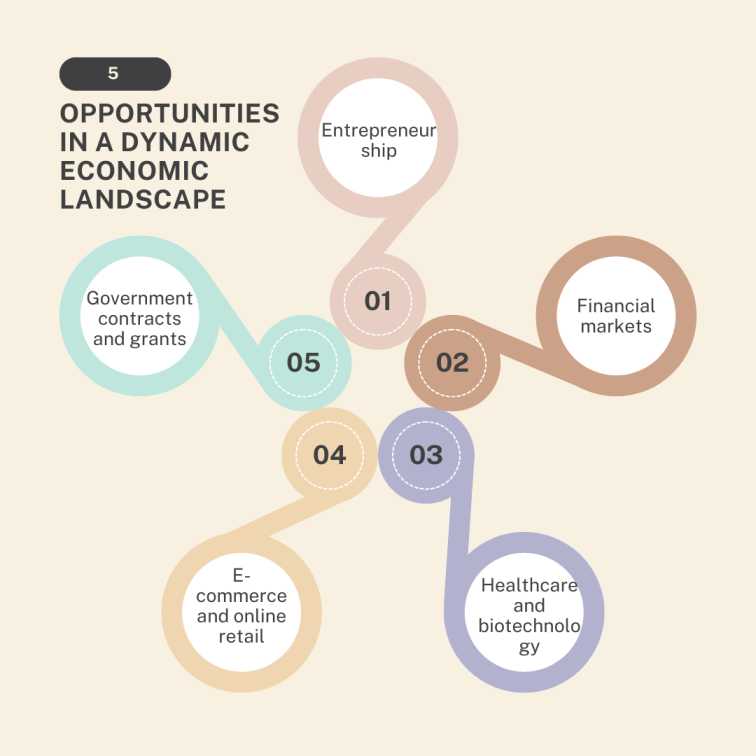

For CFOs, understanding macroeconomic trends, trade dynamics, and geopolitical factors that affect financial decision-making are all part of global economics. CFOs have to manage risks, pursue growth opportunities, and navigate market volatility, foreign regulations, and currency fluctuations. Evaluating market conditions, maximising capital allocation, and reducing cross-border risks are all part of strategic financial planning.

For the purposes of obtaining capital, encouraging innovation, and promoting sustainable growth, cooperation with financial institutions, stakeholders, and governmental organisations is essential. By staying informed, adaptable, and proactive, CFOs can effectively deal with the complexities of the international monetary system and global economy to steer their organisations toward long-term success.

Comprehending Worldwide Economic Trends

Numerous factors, including changing trade dynamics, technological advancements, various macroeconomic trends, geopolitical tensions, and demographic shifts, have an impact on the global economy.

One of the key features of the current global economic trends is the rise of emerging markets. The world economy has changed, and millions of people have been lifted out of poverty as a result of the rapid economic growth in countries like China, India, Brazil, and others.

Urbanisation, industrialisation, infrastructure, and technology investments have all contributed to this increase in economic power. As emerging markets continue to exert their influence, investors and global businesses are faced with both new opportunities and challenges.

Trade Dynamics in Flux

The dynamics of global trade have changed significantly in recent years due to a variety of factors, including trade tensions and technological advancements. Trade wars and tariff disputes are two examples of how the rise of protectionist measures has upset established supply chains and trade patterns.

Furthermore, the development of digital technologies has facilitated the expansion of e-commerce and digital trade, revolutionising the international exchange of goods and services. Both corporations and legislators must be flexible and strategically minded to navigate these changing trade dynamics.

Technological Transformations

Technological developments are bringing about unprecedented changes in economies and industries, impacting worldwide economic patterns. Technological advancements such as automation, the Internet of Things, and artificial intelligence are transforming manufacturing procedures, boosting efficiency, and creating novel business prospects. However, there are negative aspects to these advancements as well, like job losses and concerns about cybersecurity and data privacy. We must seize the opportunities presented by technology while mitigating its possible risks if we are to fully realise its potential for fostering global economic prosperity.

Geopolitical Uncertainty

Geopolitical tensions and uncertainties are increasingly impacting global economic trends. Geopolitical factors, which can range from trade disputes and territorial conflicts to geopolitical rivalries and sanctions regimes, frequently influence economic decision-making. Issues such as pandemics, migration, and climate change exacerbate the geopolitical landscape due to their significant impact on the economy. It takes a sophisticated understanding of political and economic dynamics to successfully negotiate this difficult geopolitical environment.

Demographic Dynamics

Demographic trends like aging populations, urbanisation, and migration patterns are causing changes in the global economy. While urbanisation drives demand for services and infrastructure in developing economies, aging populations in developed economies present challenges like rising healthcare costs and a labor shortage. Furthermore, migration trends have an international impact on social dynamics, consumer behavior, and labor markets. In an increasingly interconnected world, developing effective policies and strategies requires an understanding of the demographic drivers of economic change.

As the world economy continues to change and adapt to a rapidly changing world, it is essential to understand global economic trends in order to navigate uncertainty and take advantage of opportunities. When stakeholders understand how interconnected factors like emerging markets, trade dynamics, technological transformations, geopolitical uncertainties, and demographic shifts are, the more likely they are to thrive in an increasingly dynamic environment. As we chart our course for the future, having a solid understanding of global economic trends serves as a compass for navigating the complexities of our interconnected world.

Currency Fluctuations and Exchange Rate Risks

Currency fluctuations and exchange rate risks are integral aspects of the global economy, impacting businesses, investors, and economies worldwide. Fluctuations in exchange rates can significantly affect the competitiveness of exports and imports, the profitability of multinational corporations, and the returns on international investments.

Understanding Currency Fluctuations

The term “currency fluctuations” describes shifts in a currency’s value in relation to another on the foreign exchange market. Numerous factors, such as macroeconomic indicators, geopolitical developments, central bank policies, and market sentiment, can cause these fluctuations. Exchange rates are influenced by a number of factors, including trade balances, interest rate differentials, and investor preferences. Supply and demand dynamics for currencies are important. Exchange rates are prone to daily fluctuations, making currency markets intrinsically unstable.

Exchange Rate Risks for Businesses

Exchange rate risks can have a big impact on a company’s profitability and competitiveness if it trades internationally. The cost of imported materials, the competitiveness of exported goods in terms of price, and the value of foreign revenues and assets can all be impacted by the appreciation or depreciation of a company’s home currency in relation to other currencies. Accurately forecasting earnings for businesses can be difficult due to the uncertainty that fluctuating exchange rates can bring into financial planning, pricing strategies, and budgeting.

Mitigating Exchange Rate Risks

Companies and investors can use a variety of tactics to reduce exchange rate risks and guard against unfavorable currency movements:

- Hedging: Hedging is locking in exchange rates for future transactions using financial instruments like forward contracts, options, and futures. Businesses can lessen the negative effects of currency fluctuations on their bottom line by hedging against them.

- Diversification: Diversifying revenue streams across multiple currencies and markets can help spread exchange rate risks. By operating in different regions with varying currency exposures, businesses can reduce their reliance on any single currency and mitigate the impact of adverse exchange rate movements.

- Natural Hedging: To reduce exchange rate risks, natural hedging entails matching revenues and expenses in the same currency. An enterprise that produces income in euros and spends money in euros, for instance, would be automatically protected against changes in the euro-dollar exchange rate.

Exchange Rate Risks for Investors

For investors with international portfolios, exchange rate risks can affect the returns and diversification benefits of their investments. Fluctuations in exchange rates can amplify or dampen investment returns, depending on whether the investor’s home currency strengthens or weakens relative to foreign currencies. Moreover, currency volatility can introduce additional uncertainty and complexity into investment decisions, requiring careful consideration of risk management strategies.

Mitigating Exchange Rate Risks for Investors

Investors can employ several strategies to manage exchange rate risks and protect their investment portfolios:

- Currency Hedging: Financial instruments such as currency forwards and options are used to hedge against fluctuations in exchange rates. By hedging the currency exposure of their foreign assets, investors can mitigate the detrimental effects of volatile currency markets on the returns on their portfolio.

- Diversification: By adjusting exposure to various asset classes, countries, and currencies, exchange rate risk can be dispersed throughout an investment portfolio. Investors can lessen their exposure to any one currency and increase the resilience of their portfolio by holding a mix of assets denominated in various currencies.

The fundamental ideas of the currencies and economies in which they invest should be the focus of investors. Long-term factors that affect exchange rates include inflation rates, monetary policies, prospects for economic growth, and geopolitical stability.

Strategic Financial Planning in a Volatile Market

Financial markets are becoming more and more volatile and uncertain in today’s fast-paced, globally connected world. Chief Financial Officers (CFOs) are essential in guiding their companies toward sustainable growth and profitability by navigating these obstacles as stewards of the financial health of their organisations. This article explores the tactics CFOs use for strategic financial planning in order to prosper during erratic market conditions.

Embracing Agility and Flexibility

In a volatile market environment, traditional financial planning approaches may prove insufficient. CFOs must embrace agility and flexibility, adapting their strategies in response to changing market dynamics. This requires a proactive approach to scenario planning, stress testing, and sensitivity analysis to assess the potential impact of various market scenarios on the organisation’s financial performance. By anticipating and preparing for different outcomes, CFOs can position their companies to respond swiftly to market disruptions and capitalise on emerging opportunities.

Risk Management and Mitigation

In volatile markets, strategic financial planning relies heavily on effective risk management. Risks that CFOs have to be aware of, evaluate, and take steps to reduce include credit, liquidity, market, and operational risks. To guard against unfavorable market fluctuations, this entails putting strong risk management frameworks into place, setting risk appetite thresholds, and using hedging techniques. By taking a proactive stance on risk management, CFOs can safeguard their companies’ financial stability and resilience in the face of market turbulence.

Capital Allocation and Investment Prioritisation

It is even more important to allocate capital wisely when the market is unstable. CFOs have to assess investment opportunities with great care, balancing possible profits with related risks. This calls for a methodical approach to investment prioritisation, concentrating funds on initiatives that have the best chance of generating value and yielding returns that are risk-adjusted. CFOs should also think about other financing choices, like debt issuance or equity fundraising, in order to improve the capital structure and financial flexibility of the company.

CFOs must take a proactive, flexible, and strategic approach to risk management and financial planning in order to navigate volatile markets. Through the adoption of agile practices, prudent risk management, optimal capital allocation, cost-efficiency initiatives, and open and honest communication, CFOs can equip their organisations for sustained prosperity and resilience amidst market fluctuations. CFOs are essential to their organisations’ success because they protect financial stability and create value, helping them navigate through difficult times and seize chances for expansion and success.

Capital Budgeting Strategies for International Expansion

Companies seeking to expand internationally will encounter both opportunities and challenges as they look to enter new markets and foster growth. For CFOs, these kinds of projects’ long-term viability depends on strategic capital budgeting.

First and foremost, extensive market research is required to ascertain whether expanding internationally is feasible. CFOs must take into account factors like market size, growth potential, the competitive landscape, and the regulatory environment in order to make well-informed investment decisions.

Second, risk assessment and mitigation are crucial components of capital budgeting for international expansion. CFOs must evaluate geopolitical risks, currency volatility, regulatory compliance, and cultural quirks in order to anticipate future challenges and develop mitigation strategies.

Thirdly, a phased approach to investing allows for careful capital allocation and risk management. CFOs may decide to experiment with joint ventures or pilot projects before investing significant resources in expansion projects.

Managing Risk in Cross-Border Investing

While international business endeavors offer stimulating opportunities for growth and development, they also entail inherent risks that must be appropriately addressed. Effective risk management is necessary to safeguard investments and ensure the success of international business endeavors.

Strong legal and contractual frameworks are essential components of a risk management strategy. Clear contractual agreements define rights and obligations and lower legal risk. They frequently also contain exit strategies and dispute resolution protocols. Purchasing the appropriate insurance protection, such as political risk insurance or foreign exchange risk insurance, can also provide financial security against unforeseen events.

In order to reduce risks to operations and reputation, strong alliances and partnerships can be formed with regional stakeholders. Local partners can increase the venture’s chances of success and reduce the risks associated with operating in foreign business environments by providing their networks, cultural insights, and market knowledge.

Effective risk management is crucial for navigating the challenges of doing business internationally. By developing strategic alliances, putting in place robust legal frameworks, implementing proactive risk monitoring systems, and performing extensive due diligence, businesses can reduce risks and improve their chances of success in international markets.

Building and Sustaining Strategies Partnership with Financial Institutions

Building and sustaining strategic partnerships with financial institutions is essential for businesses seeking to access capital, manage financial risks, and drive growth. These partnerships offer valuable opportunities for collaboration, innovation, and mutual benefit

Businesses must first find financial institutions that share their values and strategic objectives in order to form effective partnerships. Selecting the correct partners is essential for long-term success, whether they are banks, investment firms, or fintech companies.

Building strong partnerships requires establishing credibility and trust. Companies should exhibit their dependability, sound financial standing, and dedication to common objectives. Transparency and open communication promote understanding amongst parties and set the stage for successful teamwork.

Moreover, companies can enhance the partnership by utilising their distinct advantages and skills. Showcasing their value to financial institutions increases their attractiveness, whether it is through industry experience, technological innovation, or access to new markets. Businesses need to concentrate on maintaining their partnerships by continuing to work together and support one another. In order to guarantee goal alignment and promote creativity, regular communication, feedback loops, and collaborative strategic planning sessions are necessary.

Sustainable Finance and Corporate Social Responsibility Globally

Sustainable finance and corporate social responsibility (CSR) have emerged as critical imperatives for businesses seeking to create long-term value while addressing environmental, social, and governance (ESG) challenges. As stewards of financial stewardship, Chief Financial Officers (CFOs) play a pivotal role in driving sustainable finance and CSR initiatives on a global scale.

Enhanced Risk Management

Sustainable finance and CSR efforts contribute to enhanced risk management by addressing environmental and social risks that could impact financial performance. CFOs are implementing robust risk assessment frameworks to identify and mitigate ESG-related risks, safeguarding the company’s reputation and long-term viability.

Stakeholder Engagement and Transparency

CFOs are fostering stakeholder engagement and transparency by disclosing ESG performance metrics and financial impacts. By communicating effectively with investors, customers, employees, and regulators, CFOs build trust, enhance brand reputation, and attract investment capital.

CFOs are driving sustainable finance and CSR initiatives on a global scale by integrating ESG considerations into financial decision-making, strategically investing in sustainable initiatives, enhancing risk management, and fostering stakeholder engagement and transparency. By prioritising sustainability and corporate social responsibility, CFOs are not only creating value for their organisations but also contributing to a more sustainable and equitable future.

The Role of CFO in Driving Corporate Strategy in a Global Context

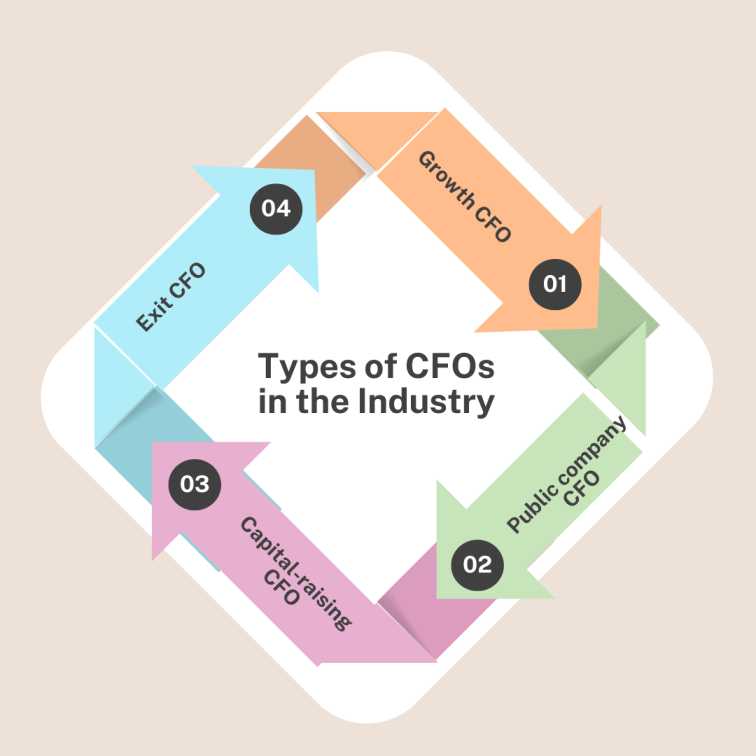

It is impossible to overestimate the importance of the CFO in guiding business strategy in a global setting. CFOs have a major impact on the direction that multinational firms take because they are guardians of their financial well-being and the creators of their strategic vision.

CFOs have to navigate intricate economic landscapes, unpredictable geopolitical situations, and quickly changing market dynamics in today’s interconnected world. To lead their companies toward sustainable growth and profitability, they need to have a thorough awareness of global economic trends, currency fluctuations, and regulatory environments.

Modern CFOs perform strategic roles alongside the CEO and board, offering critical insights and analysis to support strategic decision-making. They go beyond traditional financial responsibilities. They are essential to risk management, capital allocation, and investment prioritisation because they make sure that resources are used effectively and efficiently to maximise shareholder value.

In addition, CFOs are innovators and change agents who use data analytics and technology to improve operational excellence and boost strategic flexibility. In an increasingly cutthroat global marketplace, CFOs can minimise risks, maximise performance, and find new growth opportunities by utilising financial intelligence and emerging technologies.

Conclusion

The CFO’s responsibilities go beyond financial stewardship to include wider duties in stakeholder engagement, corporate governance, and sustainability. As advocates for transparency and accountability, CFOs play a vital role in fostering trust and credibility with investors, regulators, and the broader community. In essence, the modern CFO is a strategic leader, driving corporate strategy with a global mindset and a holistic approach to value creation.

By embracing innovation, collaboration, and continuous learning, CFOs can navigate the complexities of the global economy and position their organisations for long-term success in an ever-changing world. A solid CFO course can help you do just that as a future CFO.

If you wish to become a CFO with mastery in strategic corporate finance and global economics, you can enrol in the Chief Financial Officer Programme by Imarticus and ISB. This CFO certification course can help you become an effective CFO and financial leader with the help of the right skills and knowledge.