Introduction

The salary of a digital marketer relies on factors like experience, location, industry, and business size. Of all these, though, the most influential factor affecting the salary is experience.

With the advent of internet marketing, companies look for experts who are capable of keeping pace with recent developments, making data-driven decisions, and maximising marketing campaigns to their advantage. Whether you are a junior, mid-level, or senior professional, your salary will be based on how effectively you execute strategies, interpret results, and drive business.

In this blog post, we are going to examine how experience defines digital marketing pay scales, the skills needed at every level, and some advice on maximizing your earning potential.

How Experience Defines the Digital Marketing Pay Scale

Experience directly determines the sum of money for which a digital marketer is paid. The longer you’ve been working in the career, the more experience and, therefore, the more hireable you are.

1. Entry-Level Salary of a Digital Marketer (0-2 Years)

You are an entry-level professional if you have just graduated from college or transitioned from another profession to digital marketing. Under this category, you will be doing basic tasks, including:

- Managing social media profiles

- Creating low-budget sponsored ads

- Carrying out keyword research for search engine optimisation

- Preparing content for websites and blogs

- Analysing website metrics and reporting on performance

Here, the emphasis is on familiarising yourself with digital marketing platforms and tools as opposed to applying strategies.

Entry-Level Digital Marketer Salary Expectations

The median entry-level digital marketer salary at this point is:

- India: ₹3-5 LPA

- UK: £20,000-£30,000 per year

- USA: $45,000-$60,000 per year

Determinants of Entry-Level Salaries

- Certifications – Google Ads, Meta Blueprint, and SEO certifications will increase your earning power.

- Practical Experience – Internships, freelance work, and hands-on experience make the candidate more attractive to employers.

- Tools Skills – Google Analytics, SEMrush, Ahrefs, and HubSpot skills are beneficial.

How to Earn More at This Level: Join well-structured courses such as the MyCaptain Digital Marketing Program to acquire industry-specific skills.

2. Mid-Level Digital Marketing Salary (3-7 Years)

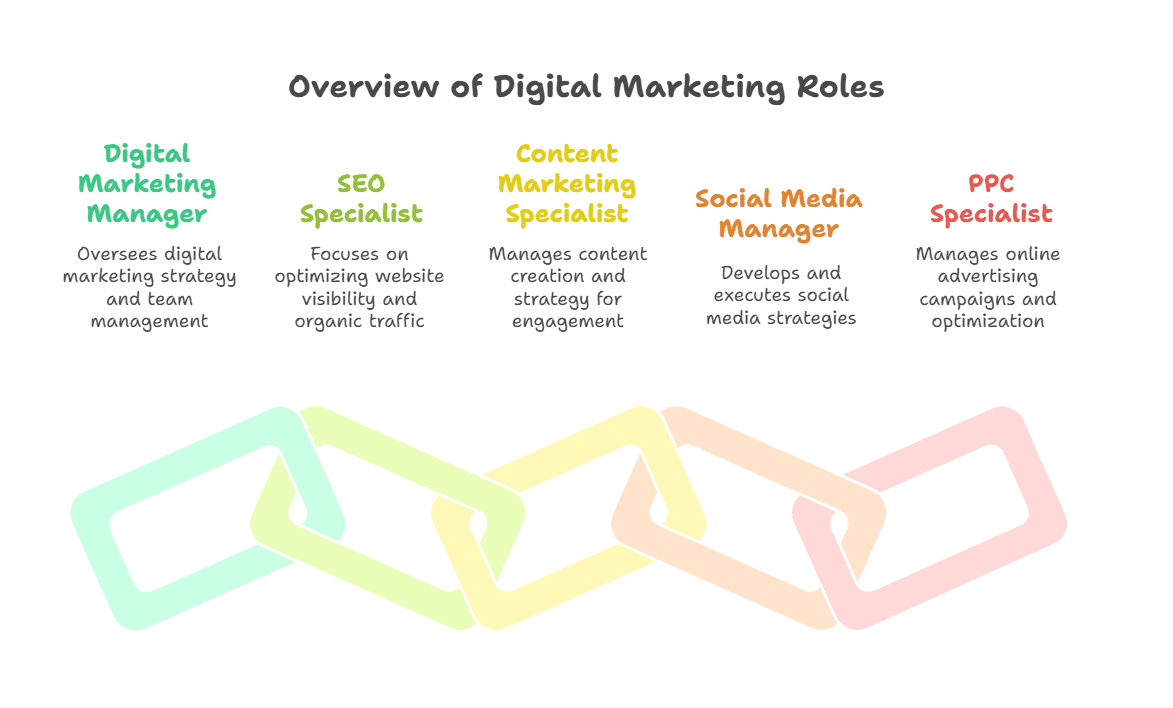

In two years, digital marketers possess strong knowledge of consumer behavior, analytics, and campaign optimisation. This exposure prepares them for senior roles such as:

- SEO Specialist

- PPC Manager

- Email Marketing Manager

- Content Strategist

- Growth Marketer

Here, the professionals need to plan, implement, and optimise campaigns for maximum ROI.

Digital Marketing Salary Range for Mid-Level Professionals

- India: ₹7-15 LPA

- UK: £35,000-£55,000 per annum

- USA: $70,000-$90,000 per annum

Key Factors Affecting Mid-Level Salaries

- Specialisation – PPC, data and automation specialists get better pay cheques.

- Performance Metrics – Increase in conversion, decrease in ad cost, and website ranking increase drive remuneration.

- Management Skills – Mid-level specialists begin managing teams, driving value,.

3. Senior-Level Digital Marketing Salary (8+ Years)

Senior-level marketers transition from execution to strategy, leadership, and business development. They are normally referred to as:

- Digital Marketing Head

- Performance Marketing Director

- Chief Marketing Officer (CMO)

- Here, experts are accountable for:

- Defining the overall direction of marketing

- Spending big advertising budgets

- Leading cross-functional teams

- Integration of AI, automation, and personalisation strategies

Senior Digital Marketer Compensation Trends

- India: ₹20-50 LPA+

- UK: £60,000-£100,000 per annum

- USA: $100,000-$200,000 per annum

Key Factors Impacts on Senior-Level Compensation

- Leadership & Strategy – More experienced business growth practitioners earn more.

- Tech-Savviness – Artificial intelligence marketing, data science, and automation software expertise is needed.

- Networking & Branding – Speakers at conferences, author of popular blogs, and have a large web presence command best-of-the-best pay.

Earning More Money At This Level: Develop a high-level personal brand through writing industry blogs, speaking, and networking with leaders.

Impact of Industry & Location on Salary of Digital Marketer

1. Top Highest Paying Industries for Digital Marketers

All industries do not pay the same digital marketing salaries. Some industries have more budgets, and therefore the hike in pay.

- Highest Industries with the Best Digital Marketing Salary Range

- E-commerce & Retail – Excellent demand for SEO & PPC specialists

- Finance & FinTech – Excellent salary for performance marketers

- IT & SaaS – Ideal for growth hackers and content marketers

2. How Your Location Affects Digital Marketing Salary

- India: Delhi, Mumbai, and Bangalore provide highest pay.

- USA: San Francisco, New York, and Los Angeles provide decent pay.

- UK: London provides highest pay for digital marketing.

Get Paid More: Consider working abroad for higher-paying companies.

Salary Growth Over Time

Here is a table of how years of experience change the range of digital marketing salary in India:

| Experience Level | Job Role | Average Salary (INR) |

| 0-2 Years | Digital Marketing Executive | ₹3-5 LPA |

| 3-5 Years | SEO/PPC/Social Media Manager | ₹7-12 LPA |

| 6-9 Years | Performance Marketing Lead | ₹15-25 LPA |

| 10+ Years | Head of Digital Marketing/CMO | ₹30-50 LPA+ |

10 FAQs on Digital Marketing Salary Trends

1. What is the average digital marketer salary in India?

The average Indian digital marketer’s salary is ₹5-7 LPA depending on experience.

2. What is an entry-level digital marketer’s compensation?

In India, freshers earn ₹3-5 LPA, while in the UK it is £20,000-£30,000.

3. In which industry is the highest digital marketing salary?

The IT, SaaS, and finance industries give the highest.

4. By which means do a digital marketer get a salary hike?

By upskilling in good digital marketing courses, you can get good hikes.

5. Who gets the best-paying job in digital marketing?

CMOs and Heads of Digital Marketing receive the best pay.

6. Is freelancing as well paid as a full-time digital marketing job?

Freelancers receive higher remuneration but with an irregular income.

7. How does geographic location affect the scale of remuneration in digital marketing?

Metro Cities offer higher remuneration than small towns.

8. Does certification impact salary?

Yes, Google, HubSpot, and MyCaptain certification increases salary.

9. What are the most in-demand skills for digital marketers?

SEO, PPC, automation, and AI marketing.

10. Will digital marketers lose their jobs to AI?

No, but it will complement digital marketing techniques.

Conclusion: Key Takeaways

- Experience is the largest single factor in digital marketing salary levels.

- Industry, geography, and skill set affect earning capacity.

- Specialization and ongoing learning result in greater compensation.

Start Your Digital Marketing Career. Join the MyCaptain Digital Marketing Program today to learn high-paying skills and launch your career.