In today's business world, change is a constant. Dynamic economic environment and the ever-evolving fintech landscape are the two primary forces driving this transformation.

The dynamic economic environment encompasses global factors, trends, and market conditions influencing economic activities. It involves complex interactions between governments, businesses, consumers, and global markets. Economic dynamics include shifts in growth, consumer behaviour, policy changes, and responses to events like financial crises.

In contrast, the fintech landscape is the realm of financial technology, where innovation shapes traditional financial services. Fintech companies use technologies like AI, blockchain, mobile apps, and data analytics to enhance financial processes, introducing disruptive solutions that challenge traditional finance.

Understanding this relationship is vital in today's fast-paced business landscape, where adaptation and innovation are essential. It involves responding to economic shifts and harnessing fintech advancements to navigate challenges and seize opportunities effectively.

Learning about fintech is essential for any CFO in today’s time. This is why fintech solutions and concepts are always covered in solid CFO certification programs. Read on to learn more about how fintech has impacted the dynamic business environment.

The Fintech Revolution: A Game Changer in Finance

What Is Fintech?

Fintech is a blend of "financial technology," containing various digital tools and solutions that enhance, simplify, digitise, or revolutionise traditional financial services.

Fintech includes software, algorithms, and applications designed for both computers and mobile devices. In some instances, it also involves physical devices, such as internet-connected piggy banks.

Fintech platforms make everyday tasks like depositing checks, transferring money between accounts, settling bills, or seeking financial assistance more convenient. Moreover, they facilitate complex concepts like peer-to-peer lending and cryptocurrency exchanges.

Key Fintech Innovations

Blockchain - Unleashing digital potential

Blockchain, a technology powering cryptocurrencies like Bitcoin, extends far beyond digital coins. Its transformative capabilities are yet to be fully tapped. Innovative developments in blockchain are on the horizon, promising groundbreaking changes in various fields.

Sensors and the Internet of Things (IoT) - Data revolution

IoT is reshaping financial services by introducing sensors that collect unprecedented data. These sensors have become ubiquitous, offering valuable insights. Harvard University research highlights the potential of affordable sensors to monitor everything from household devices to critical equipment, revolutionising remote operations.

Mobile payments and digital banking - Neobanks on the rise

Traditional banking faces disruption from neobanks, digital-first institutions accessible via mobile apps. Customers can open accounts effortlessly, enjoy user-friendly interfaces, and access comprehensive banking features, from savings accounts to loans and easy payments. Neobanks like Monzo and Starling Bank are gaining traction globally.

Robotic process automation (RPA) - Efficiency unleashed

RPA employs digital robots to automate repetitive tasks, freeing up resources and enhancing accuracy. Unlike AI, RPA doesn't require human-like cognitive abilities. It's a cost-effective way for fintech companies to streamline back-office functions, enabling human teams to focus on innovation.

Open banking - Empowering customers

Open banking allows banks to integrate third-party APIs, enabling customers to share financial data with service providers. It enhances user experiences, simplifying tasks such as bill payments and offering personalised services based on transaction history.

Cybersecurity advancements

Fintech companies lead in innovative cybersecurity solutions. In an era of evolving hacking techniques, fintech continuously improves data protection. Technologies like blockchain, multi-cloud storage, secure access service edge (SASE), and decentralisation enhance security.

Challenges like fraud management, KYC, AML, and passwordless authentication are a focus.

Virtual cards for online transactions

Virtual cards, based on VISA or Mastercard, replace physical cards online. They feature a card number, CVV code, and expiration date—no plastic involved. Some also merge loyalty programs and support fiat-crypto transactions. Virtual cards act as backup payment methods when physical cards fail or are misplaced.

Why Fintech Matters

The rapid growth of fintech and the resulting increase in competition have compelled organisations to rethink their operations. It includes everything from quick response to evolving needs to the fundamental design of their structures for success. The old models relied on linear, labour-intensive processes. In contrast, contemporary technology-driven models need more excellent connectivity, automation, and real-time data utilisation.

What stands out in successful fintech firms is their unwavering commitment to the customer. They prioritise designing for the desired outcome rather than fixating on specific processes they believe will lead to it.

This healthy competitive spirit has dramatically benefited the digital customer experience. More and more organisations are now dedicated to enhancing their services, making them faster, user-friendly, inclusive, and attuned to individual requirements.

Risks and Challenges of Fintech

Protecting data has become a massive concern in the digital world, including mobile banking, payment apps, and the broader fintech landscape.

Unlike traditional banking with its physical security measures like guards, CCTVs, and vaults, virtual security poses subtler but equally significant threats. These vulnerabilities not only jeopardise users' finances but also put their data at risk.

Navigating government regulations

The financial sector ranks among the most heavily regulated industries, subject to constant government oversight. Even when employing conventional fintech software that doesn't incorporate cutting-edge technologies like blockchain, regulatory compliance remains a constant factor.

Mobile and tech expertise shortcomings

In the fintech industry, some financial institutions need help to provide convenient mobile banking services. Attempts to replicate websites on mobile apps fall short of modern user expectations.

In today's digital world, users seek seamless and user-friendly mobile experiences that fully leverage device capabilities.

Fintech apps often miss out on features like NFC functionality, geolocation services, fingerprint authentication, and more due to a need for more expertise in mobile app development.

Blockchain integration challenges

Many fintech applications integrate blockchain technology, which offers enhanced security and transparency in transactions. However, the integration of blockchain remains a formidable challenge for numerous financial organisations. While it can significantly boost trustworthiness by enabling comprehensive transaction tracking and prevention of unauthorised changes, implementation hurdles persist.

Traditional vs. fintech dynamics

The fintech sector is often seen as disruptive, challenging the traditional banking system. However, it must contend with the scepticism of traditional banks and government institutions, which remain cautious about embracing new technologies.

Effective customer acquisition marketing

Fintech organisations often grapple with defining their niche, identifying target audiences, and formulating effective marketing strategies. In a landscape where traditional banking services still dominate, fintech companies face an uphill battle in reaching and winning over customers.

The Future of Fintech

Looking ahead in the fintech landscape, regardless of whether fintech firms choose to transition into chartered institutions or maintain their current status, bolstering their potential for success hinges on the establishment of robust risk management mechanisms.

With regulatory scrutiny on the rise and the imperative to ensure ethical and fair treatment of customers, a fintech company that adheres to compliance standards may find itself more appealing to the public.

This difference could pave the way for expanding market share and revenue streams.

Furthermore, it could instil a sense of trust among various stakeholders, including:

- Customers: Those who engage with the company's services will appreciate the assurance of ethical practices and protection of their interests.

- Board and management: The company's leadership and decision-makers will find confidence in the transparency and risk management frameworks in place, aiding in strategic planning.

- Analysts: This includes rating agencies and equity analysts who highly value transparent operations and robust risk management as indicators of financial health and sustainability.

- Regulatory authorities: Regulatory bodies with a keen interest in the conduct of financial entities may view compliant fintech companies favourably and reduce scrutiny.

Navigating the Intersection: How Economics Impacts Fintech

Navigating the intersection of economics and fintech is essential as it sheds light on the profound influence of economic factors on the financial technology sector.

The Economics of Fintech

The economics of fintech delve into the intricate relationship between financial technology and economic factors, highlighting several vital aspects:

Consumer behaviour

Fintech companies prioritise understanding consumer economics to shape their strategies. Behavioural economics guides the creation of user-friendly interfaces, promotes savings, and encourages responsible financial behaviour.

By aligning products with consumer preferences and financial objectives, fintech firms cater to the evolving needs of their user base.

Financial inclusion

Fintech's role in fostering financial inclusion is influenced by economic factors such as income disparities and access to financial services. Fintech effectively narrows these gaps by delivering services to underserved or unbanked populations by leveraging technology.

Through cost-effective transaction solutions, fintech firms empower more individuals to participate in the formal financial system.

Competition and market dynamics

Competition is a driving force in economics, and fintech excels at shaking up traditional financial markets. It introduces fresh players and innovative products, spurring established financial institutions to adapt and innovate.

The heightened competition results in improved services and a broader array of choices for consumers, ultimately enhancing the quality of financial products.

Regulatory and Policy Economics

Regulatory and policy economics is a significant discipline that evaluates how government regulations and policies impact various sectors.

Within the context of fintech, this field plays a crucial role in shaping the industry. Some key considerations include:

Monetary policy

Fintech operates within the orbit of the central bank's monetary policies, including its decisions on interest rates and money supply management. These policies wield considerable influence over borrowing expenses, investment patterns, and inflation rates.

Consequently, they cast ripples across the fintech domain, shaping consumer behaviours and industry dynamics.

Data privacy and security

The economic consequences of data privacy regulations come to the forefront. Fintech enterprises are compelled to allocate resources toward robust data management practices in compliance with legal mandates. The objective is to uphold consumer trust by safeguarding sensitive information.

Any data breaches have far-reaching economic impacts, affecting both businesses and individuals whose data is compromised.

Regulatory frameworks

Fintech regulations pivot on economic considerations. Governments and regulatory bodies grapple with the delicate equilibrium between fostering innovation and preserving the bedrock of stability, consumer safeguards, and systemic risk management.

Regulatory decisions are meticulously weighed for their economic implications, intended to foster the expansion of fintech while upholding the integrity of the financial system.

Global Economic Trends

Global economic trends serve as crucial barometers of the world's economic well-being and trajectory. These prevailing trends hold far-reaching implications, touching upon diverse facets of society, ranging from corporate entities and governmental bodies to individual citizens. Some notable trends are:

Economic cycles

Fintech adaptation is moulded by economic cycles, including periods of growth and economic downturns. In times of recession, fintech services offering savings or investment benefits may see increased adoption. Conversely, during economic upswings, consumer expenditure on fintech products tends to rise.

Globalisation

Fintech thrives in a globally interconnected environment facilitated by economic globalisation that fosters cross-border financial transactions and investments. However, global economic fluctuations and geopolitical tensions can impact fintech firms' expansion strategies, trade relationships, and efforts to comply with varying regulations.

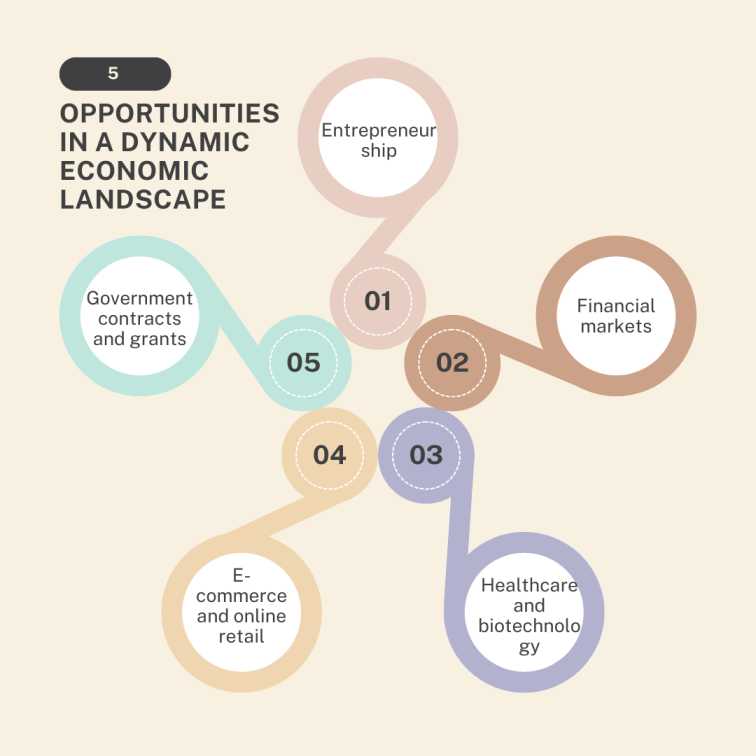

Opportunities in a Dynamic Economic Landscape

In a dynamic economic landscape characterised by rapid changes and uncertainties, there are numerous opportunities for individuals, businesses, and investors who are adaptable and forward-thinking.

Some of these opportunities include:

Entrepreneurship

Starting a business or pursuing entrepreneurial ventures can be a lucrative path in a dynamic economy. Entrepreneurs who identify gaps in the market, offer unique solutions and adapt quickly to changing consumer preferences thrive.

With access to online resources and funding options like crowdfunding, entrepreneurship is more accessible than ever.

Financial markets

Dynamic economic environments provide opportunities in financial markets. Stock markets, cryptocurrencies, and commodities offer the potential for investors to profit from market fluctuations. Diversifying portfolios and staying informed about market trends can be advantageous.

Healthcare and biotechnology

The healthcare and biotechnology sectors continue to expand, with opportunities in pharmaceuticals, telemedicine, health tech, and medical research. Ageing populations and health crises create a growing demand for innovative healthcare solutions.

E-commerce and online retail

The growth of e-commerce presents opportunities for online retailers and digital marketing professionals. As consumer preferences shift towards online shopping, businesses that provide convenient and personalised online experiences can thrive.

Government contracts and grants

Government initiatives and grants in areas like renewable energy, infrastructure development, and healthcare can create opportunities for businesses to partner with or secure contracts from government agencies.

Challenges Faced by Fintech in the Shifting Business World

In the ever-changing landscape of the business world, fintech companies encounter several notable challenges. These challenges encompass:

Regulatory compliance

Fintech companies face the challenge of navigating intricate and constantly changing regulatory structures. Adhering to financial regulations and safeguarding data privacy is indispensable, but it can demand significant resources and unwavering vigilance.

Cybersecurity threats

With the increased reliance on digital platforms, fintech companies are prime targets for cyberattacks. Protecting customer data and financial assets from breaches and fraud is a constant challenge.

Consumer trust

Building and maintaining trust is vital in financial services. Fintech companies must work diligently to establish credibility, especially when competing with established banks and financial institutions.

Data privacy concerns

The collection and use of vast amounts of customer data raise privacy concerns. Fintech firms must strike a balance between utilising data for service improvement and safeguarding individual privacy.

Access to funding

Securing funding, especially for startups, can be challenging. Investors may be cautious in uncertain economic environments.

Partnerships with traditional institutions

Collaborating with traditional financial institutions can be challenging due to differences in cultures, systems, and regulatory environments.

Global economic trends

Global fintech firms are exposed to geopolitical tensions, exchange rate fluctuations, and global economic uncertainties that can impact their operations and growth strategies.

Fraud prevention

As fintech companies expand, they become more vulnerable to various types of financial fraud. Developing robust fraud prevention measures is essential.

Monetary policy impact

Changes in monetary policy, such as interest rate adjustments, can affect fintech firms' borrowing costs, investment strategies, and profitability.

Strategies for Success in the Dynamic Economic and Fintech Landscape

Succeeding in the ever-evolving economic and fintech landscape demands a strategic mindset that prioritises innovation and flexibility. Some essential strategies for achieving success are as follows:

1. Continuous learning and adaptation

Embrace a culture of lifelong learning. Regularly update your knowledge of industry trends, emerging technologies, and regulatory changes. Attend conferences, webinars, and workshops to stay informed. Be open to adapting your business model or career path based on the evolving landscape.

2. Agile business models

Fintech companies should adopt agile methodologies to enhance flexibility. It means being able to pivot quickly in response to market feedback and changing customer needs. Agile development allows for iterative improvements to products and services, ensuring they remain relevant.

3. Customer-centric approach

Place the customer at the centre of your business strategy. Invest in understanding their preferences, pain points, and behaviours. Offer personalised solutions and prioritise excellent customer service. Tailor your products or services to meet the specific needs of your target audience.

4. Security and privacy

Prioritise cybersecurity and data privacy. Develop robust security measures to protect customer data and financial assets. Regularly update and test your security protocols to stay ahead of potential threats. Ensuring data privacy builds trust with customers and regulatory bodies.

5. Diversification

Diversify your offerings or investments to spread risk. A well-diversified portfolio can help mitigate the impact of economic uncertainties or market downturns. Explore different product lines or investment opportunities to reduce dependence on a single revenue stream.

6. Risk management

Develop comprehensive risk management strategies that address operational, financial, and regulatory risks. Conduct stress testing and scenario planning to identify vulnerabilities and establish mitigation plans. Effective risk management ensures business continuity and resilience.

7. Networking and industry involvement

Actively engage with the fintech ecosystem. Attend industry events, join professional associations, and build a robust professional network. Collaborative efforts and partnerships with other fintech startups, investors, regulatory bodies, and academia can lead to innovative solutions and growth opportunities.

8. Financial prudence

Maintain financial discipline, especially during economic uncertainty. Careful financial planning and cash flow management are essential to weather economic downturns. Maintain a financial cushion to cover unexpected expenses.

The Future Outlook: Economic Dynamics and Fintech Innovations

Looking ahead, the future outlook for economic dynamics and fintech innovations promises a landscape characterised by ongoing transformation and advancement. Here's what to expect in the future:

- Regulatory evolution: Regulators will adapt to the changing fintech landscape, with fintech companies employing regtech to meet compliance requirements.

- Digital payments: Digital payments and cryptocurrencies will gain momentum, offering convenient and secure alternatives to cash.

- Risk management: Fintech will assist businesses in understanding and mitigating economic and operational risks.

- Sustainable finance: ESG considerations will drive investments in environmentally responsible initiatives and ethical projects.

- Cross-industry collaboration: Fintech will foster collaborations across sectors, offering integrated services and solutions.

- Personalisation: Fintech will leverage behavioural insights for personalised financial products and services.

- Cybersecurity: Fintech will invest in robust cybersecurity measures and adhere to data privacy regulations.

- Global expansion: Fintech will expand globally, catering to diverse markets while ensuring regulatory compliance and cross-border transactions.

Conclusion

As the financial landscape continues to evolve, the role of CFOs becomes increasingly critical. Staying ahead in this dynamic environment requires continuous learning and upskilling. That's where Imarticus Learning’s IIM Indore's Postgraduate Certificate Programme for Emerging CFOs comes into play.

Our CFO certification program equips finance professionals with the knowledge and skills needed to excel in today's financial world. With a focus on real-world applications and industry-relevant insights, our CFO training courses prepare you to navigate the complexities of financial leadership confidently.

Take the next step in your finance career by enrolling in our CFO certification program and unlock new opportunities in the ever-changing financial landscape.

Visit Imarticus Learning today to learn more about our CFO training courses.