Last updated on July 15th, 2024 at 12:30 pm

The function of the Chief Financial Officer (CFO) has evolved over the years, extending past the traditional economic control functions. CFOs have been involved in the company’s overall growth for years now.

As a result, they play an important role in understanding and maintaining the growth within the company. Along with this, with their well-placed strategic planning coming into the picture, it also involves an impressive amount of experience and previous decision-making projects.

This article aims to find a correlation between strategic planning and financial leadership as two important tenets of a Chief Financial Officer’s qualities. While we are on it, let’s look at a plethora of areas where a CFO has to have expertise for a lasting career. Let us also explore how we can take the line of aspiring CFOs forward with a CFO certification.

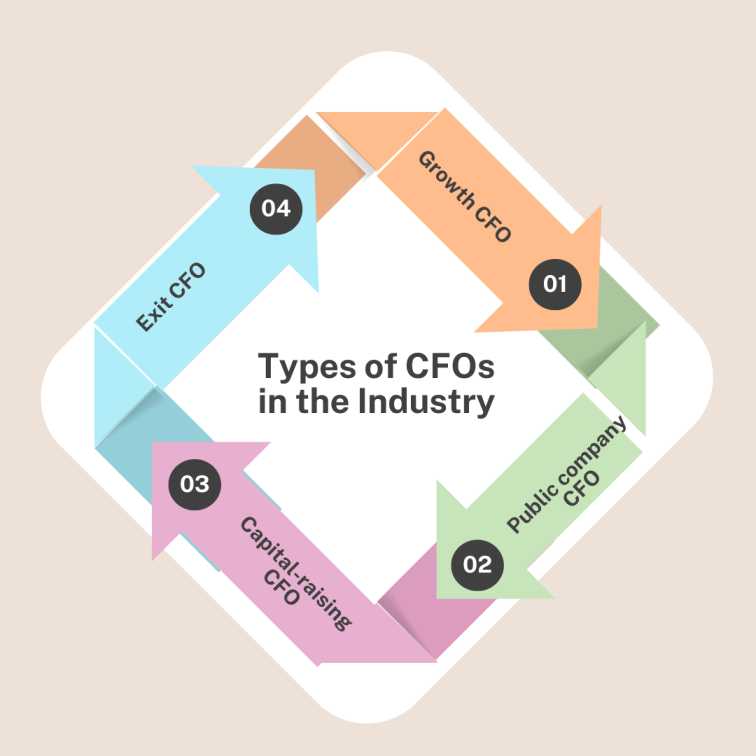

Types of CFOs in the Industry

As an aspiring CFO working in the industry, you must be aware of at least one CFO certification that helps one get to the root of the organisation’s roles. At the same time, it can also help one understand what kind of roles they would like to take on in the professional front. Here are our top picks for the different areas in which CFOs hold an expertise.

Growth CFO

The role of the Growth CFO is to drive growth to the organisation. Unlike in the case of a traditional CFO which focuses solely on financial reporting and management, a growth CFO relies on the company’s resources in making financial decisions.

In doing so, the Growth CFO handles the financial resources and identifies opportunities for business-related expansions. To conclude, the key areas in which growth CFOs work are mergers and acquisitions, investor relations, and fundraising.

Public company CFO

A CFO working for a public company is different from one working in a private firm as it has major responsibilities in their field of work. In a public CFO’s workspace, the officer has relatively more responsibilities to deal with compared to a private firm’s employee.

For instance, CFOs working in the public domain face way more scrutiny compared to their counterparts. They also have to comply with stringent financial reporting and disclosure requirements from time to time. They have to be accountable to a diverse range of stakeholders, including the government, and the general public.

Capital-raising CFO

The capital-raising CFO’s primary duty is to find scope for capital via interested and potential ventures and investors. Often found in spaces like science and technology, the capital-raising CFO looks for potential sources for funding. In this role, they are looking for the cash to make things like expansion, and acquisition happen.

Additionally, they also look after debt refinancing as a way to reduce the overall load acquired in the initial days of the company. In this process, they also assess the advantages and drawbacks associated with every option available at hand. Additionally, a CFO may also be involved in negotiating deals with lenders and investors.

Exit CFO

The exit CFO focuses on the exit strategy of the company. This includes assessing and devising strategies for the growing company at hand. It also includes understanding the price at which the company is valued.

Given the significantly relevant task at hand, it can be harder to make negotiations based on no experience in the market. Hiring someone who can work for M&A as part of their prior experience can hugely impact the process of acquisition. An experienced CFO reduces the overall risk of financial strain and offers several ways to keep the boat afloat.

Qualities of a Successful CFO

For a CFO, it is essential to follow numerous projects and gain experience. In the process, a CFO may face endless obstacles and upcoming issues within the management as well as from external sources. Let’s explore the ideal qualities that CFOs can manifest to understand their skills better.

- Strong financial acumen and expertise – A successful CFO is expected to have a clear and complex understanding of the various financial management tools. In addition, they must have in-hand experience with these tools to automate their work and schedule the best outcome. A CFO certification deals with the intricacies of this job.

Some of these areas include financial analysis, forecasting and budgeting, and risk management. They must also be aware of accounting principles and assess the most favourable choice for their organisation.

- Strategic thinking and vision – A CFO plays a vital role in assessing the vision of the company. They must initiate and maintain morale within the employees of the company. Additionally, a CFO must be qualified to think strategically and regularly develop financial plans and strategies aligning with a company’s overall goals.

- Effective communication and interpersonal skills – Interpersonal and communication skills make the game fairer for every player involved. As a CFO, it is expected of you to have a good hand at communication as it will take you forward with setting goals within the company.

Not only that but it will also be a good skill to have especially when meeting with stakeholders and communicating the company’s intent. Other people include the investors, board members, and lenders.

- Proactive problem-solving abilities – As a CFO, you are determined to find an issue existing as a part of your job. As a part of growth in the company, it is also common. CFOs have to encounter several challenges and obstacles which they must identify and address.

They will also have to devise viable strategies to overcome them first and assign them to the parties involved. This may require extensive critical thinking and problem-solving skills which can also only be made using the best of knowledge and experiences combined.

- Agility in adapting to changing market conditions – CFOs have to be aware of their surroundings and adapt to the changes occurring within the industry. This may require the professional to have a clear understanding of the industry rules and regulations and adjust to the financial environment strategically.

They must also have the ability to mitigate any potential risks and give way to profitable opportunities. When it comes to opportunities in the changing environment, they must welcome them with a strategic leadership approach in mind.

Mergers, Acquisitions, and Strategic Partnerships

Mergers and acquisitions is one aspect that requires a significant amount of knowledge along with actions. Let’s look at how a CFO works with M&A.

- Identifying potential opportunities for growth through M&A – It involves conducting loads of relevant market research before going ahead with any decision. It also includes evaluating industry trends and identifying potential targets aligning with the company’s growth strategy.

- Assessing financial risks and benefits of M&A activities – This assessment includes conducting due diligence, analysing financial statements, and evaluating potential synergies. It can even include determining financial performance, or shareholder value.

Monitoring and Reporting Key Financial Metrics

Managing key financial metrics is a vital part of being on the financial side of things. To understand more, you can opt for a CFO certification that deals with this very aspect of finance. Here are some of the important aspects in which a CFO has a say.

- Implementing an effective financial reporting system – CFOs must ensure that the organisation is functioning robustly with sound financial reporting happening at the blink of an eye. This includes establishing clear financial reporting guidelines and implementing controls to protect the integrity of data.

- Developing key financial performance indicators (KPIs) – CFOs can identify and track the key financial metrics involved in an organisation’s strategic goals. This includes areas like revenue growth, return on investment (ROI), profitability, and cash flow among others.

- Monitoring and analysing financial metrics regularly – A routine check and scrutiny is essential for making sound decisions when it comes to the financial aspect of things. This may include conducting financial reviews, preparing and presenting financial metrics, and identifying patterns in financial data.

Digital Transformation in Finance

As part of the increasingly evolving digital dynamic, CFOs must also be aware of technological developments. As it is a topic that has taken the world by storm with many CFO training courses coming to the fore, it remains a suitable option. Hence, it is only just that a CFO relies on the impact of finance in the transformation of the company.

- Recognising the importance of technology in driving growth – CFOs must maintain a candid nature to digital transformations in the workspace while also working towards ensuring continuous developments. This helps stay put in the competitive sphere while also finding ways to grow in the evolving environment.

- Leveraging digital tools for financial analysis and forecasting – The idea that advanced analytics and AI-powered tools can add to the future of a company is one that a CFO can adapt for their company’s betterment. These tools help CFOs with a deeper analysis of financial data while also enabling more computer-based predictions that impact strategic decision-making.

Sustainable Growth and Corporate Social Responsibility

As a topic that has been fairly emerging for quite some time with companies like Schneider Electric leading the market with 82.7 percent SGR, making a sustainable impact is important. The goal is to give back a percent of what we take in keeping with ethical and sustainable ways.

- Integrating sustainability goals into financial planning and reporting – Companies must include sustainability goals in their financial planning. With this, they ensure that the overall social and environmental impact it has is aligned with traditional measures.

- Evaluating the financial impact of sustainability initiatives – With time, businesses are seeing an increase in financial benefits and cost of implementation with sustainability initiatives. As more citizens come forward to symbiotically benefit from sustainable resources, energy efficiency programs and waste reduction measures also reach the sky.

- Ensuring transparency and accountability in reporting environmental and social impacts – As part of transparency in handling sustainability, companies under the CFO’s guidance are coming together to ensure transparency and gain the customer’s trust. Not only that, but some of the stakeholders also take a high interest in ensuring that companies maintain a high level of standards when it comes to this.

- Aligning growth strategies with sustainable development goals – Under a CFO’s guidance, companies can align their growth strategies with the United Nations’ Sustainable Development Goals (SDGs). These legally approved goals often add to the companies’ social image thereby driving them to long-term profitability.

- Engaging with stakeholders on corporate social responsibility efforts – As discussed before, the stakeholders involved in the company take a huge interest in the internal affairs of the company. Whether it involves the employers, customers, or customers, social responsibility (CSR) is one area that upholds the stakeholders’ values and priorities increasing the overall effect of decisions taken. To understand more, opt for CFO training courses.

Mental health in the CFO sphere

Let’s see how CFOs hold a powerful position in determining the mental repercussions happening in the competitive atmosphere.

- Raising awareness within the company – This can be carried out with the help of educational campaigns and workshops. Alongside this, the CFO can also pave the way for seminars to help employees create initiatives for understanding mental health. Efforts like this could help reduce the stigma surrounding mental health and similar topics.

- Implementing policies and procedures – This involves making guidelines and protocols surrounding mental health including flexible work arrangements, sufficient breaks, and access to mental health resources including support from Human Resources. CFOs get to decide to partner with external organisations and experts in the field of mental health to stay updated on best practices and resources.

- Offering resources and workplace support – To offer resources to the people working is essentially like offering a hand. Companies must provide access to confidential counselling services, along with mandatory employee assistance programs as part of mental health resources. These programs should work towards assisting employees with their mental health thoroughly and on an interval basis.

- Creating a space for open discussions regarding mental health – Encouraging mental health conversations is an integral part of removing stigma from the topic that is mental health. A following advantage is the constant supportive environment in which employees flourish and grow in both their personal and professional spaces.

- Allocating budget for mental health initiatives – Under a CFO’s guidance, a company can set aside a budget specifically meant for mental health initiatives. These include budgets for training programs, mental health resources, seminars, and overall employee well-being initiatives.

- Regularly monitoring the impact of workplace initiatives– As an active CFO, it is a must to be involved in most if not all financial tasks within processes. It is as important for a CFO to understand the effectiveness of the initiatives that they have budgeted, and make necessary adjustments per the effectiveness of the resources.

Case Studies of Leading CFOs and Successful Growth Strategies

While we talk about the life of a CFO, let’s also indulge in the examples of some of the most well-known individuals and companies involved in the process. Note that these are just a handful of examples taken from the huge circle of CFOs globally. CFO training courses can also be a good reference for concrete examples.

Real-world examples of CFOs driving growth

- Netflix – Netflix’s CFO, Spencer Neumann, has been instrumental in Netflix’s growth since 2019. His take on strategic leadership and financial planning has soared the company to heights. Throughout his stint at Netflix, he has managed to take Netflix’s presence to an international level, giving rise to expansion in Latin America, Asia, and Europe.

Neumann has also been involved in negotiating content deals around major studio and production companies, and in the process, securing some of the most high-profile partnerships. An example of this stands in the Marvel Studios agreement with Netflix for exclusive content.

- Apple – CFO Luca Maestri played an intense role in spearheading Apple’s financial growth in recent years. Under his leadership, Apple has achieved a record-breaking revenue of $20.9 billion.

Maestri was mainly responsible for the record-breaking revenue produced thanks to acquisitions of several brands like Beats Electronics and Shazam, which ultimately valued Apple even further. Under Maestri’s position, the company also saw launches of new products like Apple Music and Apple Pay which further diversified Apple’s portfolio.

Examining the financial strategies implemented for growth success

- Through Mergers and Acquisitions, Microsoft acquired LinkedIn for $26.2 billion. This acquisition allowed the former to expand its presence in the professional networking sphere and introduce its products to LinkedIn’s vast user base.

- Initially, Amazon started an online bookstore and diversified it to various sectors like digital streaming with Amazon Prime, and cloud computing with Amazon Web Services. To add to that, it introduced Amazon Echo as its smart home technology. This process of diversification allowed for Amazon’s professional and holistic growth globally.

- Coca-Cola, an all-American beverage venture, successfully expanded over 200 countries with the help of its international expansion strategy. It relied on the former for the primary growth of its market dominance.

Challenges normally encountered

- Currency fluctuations and the reparations – Currency fluctuations and exchange rate risks are, by far, the most intriguing and challenging encounters faced by CFOs. To counter this, CFOs must carefully monitor and manage the impact of both the company’s financial statements and cash flows. This particular area also requires mitigating currency risks and penning viable strategies.

- Changing financial rules and regulations – Another challenge for CFOs is ensuring compliance with complex and evolving financial regulations. Companies must often report according to the Sarbanes-Oxley Act. There must be a need for a strong internal control framework to ensure accuracy and transparency in financial reporting, and all other required processes. In the absence of this, there can be rigorous scrutiny from auditors in all spaces.

What Type of CFO Are You?

Now that we have talked about the various areas in which CFOs can excel at their jobs, it is vital to note that not all CFOs may follow the same path. Additionally, it is also notable that all CFOs may not come with the same personality traits. In possessing their unique characteristics, they may also not follow the same way of doing business. Through our research, we have come across different personality traits and people more inclined to work towards the position of a CFO.

Responder

The “Responder” acts as the first responder in times of qualitative requirements and negotiations. The responder chooses to find business leadership in making quick strategic decisions that strike a balance in the overall state of the company.

Builder

The Builder archetype relies on designing and building different strategies and putting them forth to work in different circumstances. As a builder, you would expect a professional to come forth and make the impossible possible.

Challenger

To put the term into its figurative use would be an understatement seeing that CFOs can sometimes work with challenges in whatever way they deem possible. A CFO who enjoys challenges brings forth new perspectives into the game without a second thought. In short, this type of CFO believes in taking on the challenge head-first and can even be hard to work with because of their aggression.

Transformer

The transformer is someone who, like, a challenger, is willing to take on a whole new responsibility. But how does that make them from a challenger-personality? To a transformer, the workplace may just be a tad too boring to work the traditional way. A mix of options can certainly be brought to the table.

Conclusion

While it is no surprise that financial leadership is the way to go for a CFO’s role, it is also to be noted that strategic thinking plays a clear-cut role in this position. For a CFO to anticipate the worst of the business landscape and still be able to make it through is a quality worth appreciating.

As a CFO, you may often have to look at all sides of the picture while making some crucial decisions. As someone who is also expected to anticipate a set consequence, it can be likely challenging to maintain the posture while also being highly effective on the job.

Want to learn how to mitigate the most challenging of obstacles and make it through the highly competitive atmosphere? Sign up for the Postgraduate Certificate Programme offered by IIM Indore in light of entrepreneurial endeavours. Learn how to find ground in strategy, leadership, and technology combined.

What’s more? You can learn about the revolution currently going on in the industry with the emergence of AI-induced automation. Take the first step today and be one of the many pioneers of new companies coming forward. Opt for CFO training courses today!