Think about the last time you trusted a number without checking it twice. It could be your bank balance, a tax bill, or a company’s profit in the news. Behind those numbers sits a professional who makes sure everything adds up the right way. That professional is a certified public accountant.

Now imagine you are the person who signs off on those numbers. You understand global accounting rules. You work with teams across time zones. You handle data that guides big business decisions. This is the space you enter when you learn the CPA certification.

You may be at a very early stage right now. You could be in school and wondering how to become a CPA after 12th grade. You could be in college, trying to figure out the next step after your degree. You might even be working already and thinking about how to become a CPA in India without taking a career break. Each of these starting points is valid. The route is flexible, and that is what makes it practical.

If you have ever looked at a job description in finance and seen the words US GAAP, audit, taxation, or compliance, you have already seen where CPAs work. They do not just record numbers. They explain what those numbers mean. They check if companies follow the rules. They help firms plan better. In simple terms, they turn data into decisions.

When you start exploring how to become a CPA, you will notice that the process is structured and logical. There are clear steps. You complete your education. You meet credit requirements. You pass the CPA exam. You gain work experience. You apply for a license. Each step builds on the one before it. There are no hidden rules or unclear stages.

As you read this guide, you will see each step explained in a clear way. You will understand the eligibility rules, the exam pattern, the timeline, and the career options. By the end, you will have a complete picture of how to become a certified public accountant and what it takes to build a global finance career with this credential.

Did you know?

The CPA credential is recognised in over 150 countries through global mobility, and it is one of the most structured global finance exams.

What Is A Certified Public Accountant

You will keep seeing the term CPA across job roles, finance news, and global companies. So it is important to clearly understand what is CPA before you go deeper into how to become a CPA.

A CPA is a licensed finance professional who works with accounts, audit, taxes, and financial reporting. The license is issued by a US state board. It is recognised by companies that follow US accounting rules.

In simple words, a CPA is the person who checks if financial numbers are correct and complete. If a company says it made a profit, a CPA checks if that profit is calculated in the right way. If a business files taxes, a CPA ensures the rules are followed.

Here is a quick view of what a CPA handles in daily work.

| Work Area | What It Means In Simple Terms |

| Financial Reports | Preparing and checking company numbers |

| Audit | Checking if the numbers are accurate |

| Tax | Filing and planning taxes |

| Compliance | Making sure rules are followed |

| Advisory | Helping businesses make better financial decisions |

The certified public accountant certification is used across industries. CPAs work in audit firms, banks, tech companies, consulting firms, and global capability centres in India.

A certified public accountant holds a state license in the United States. This license proves great skill in accounting, audit, tax, and regulation. The certified public accountant certification is governed by the AICPA and administered with support from NASBA.

Also Read: Top 5 Reasons to Join a US CPA Course Today

How To Become A CPA Step By Step

Most guides list steps. Few discuss why each step matters for the CPA course explained. Let us walk through the full journey with clarity.

Step 1: Meet Education Requirements

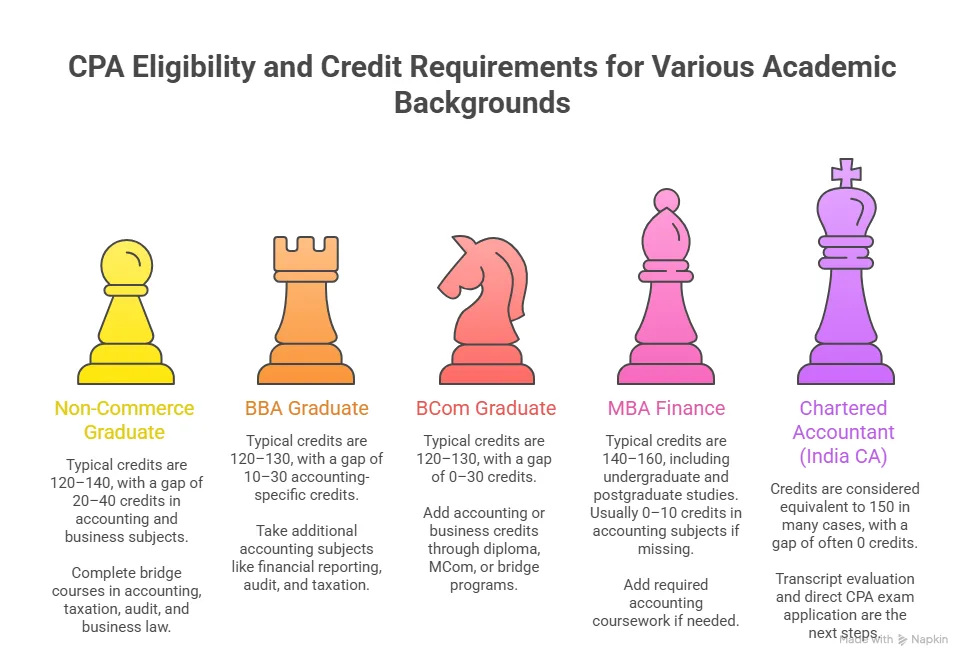

So, you want to know how to become a CPA? You must complete 120 to 150 credit hours. Most states require 150 credits for licensure.

That usually means:

- A bachelor’s degree

- Extra coursework in accounting

- Specific subjects like auditing and taxation

US CPA eligibility varies by state. Some states allow exam eligibility at 120 credits and a license at 150.

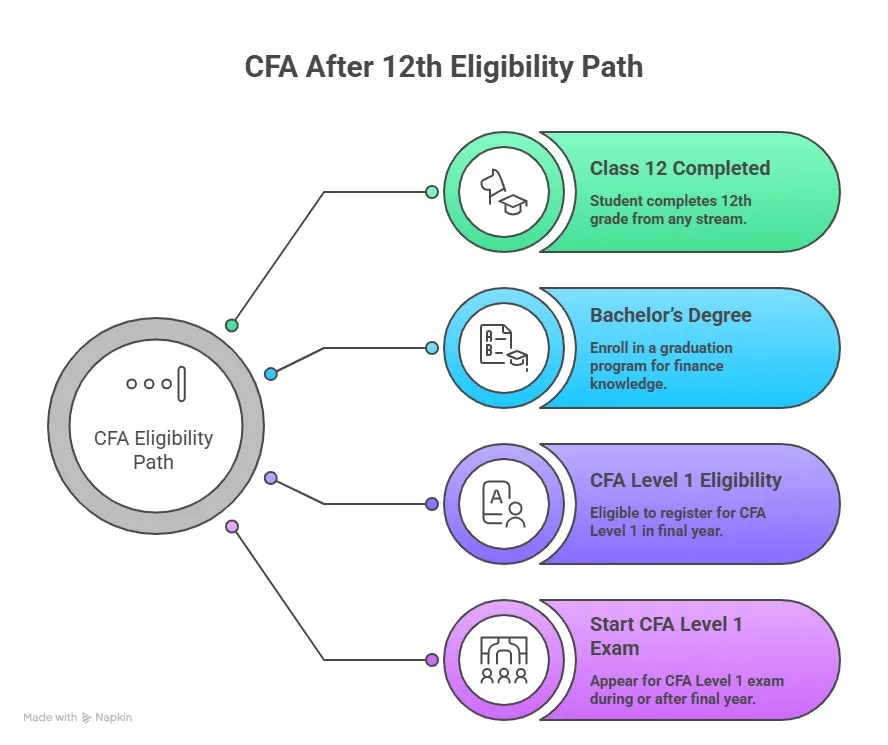

If you are exploring how to become a CPA after 12th, the path starts with graduation. You cannot skip this stage. A commerce degree helps, but is not mandatory in every case.

If you are asking how to become a CPA without a degree in accounting, you can still qualify. You may need bridge courses in accounting and business law. Many candidates from engineering or finance backgrounds take this route.

Step 2: Choose A State Board

The United States has 55 jurisdictions. Each has its own rules. When planning how to become a CPA in the USA, selecting the right state is key. Some states accept international candidates more easily.

Popular states for international students include:

- Alaska

- Guam

- Montana

- Colorado

Each state defines US CPA eligibility based on credit hours and subject mix. You must review the requirements carefully through NASBA.

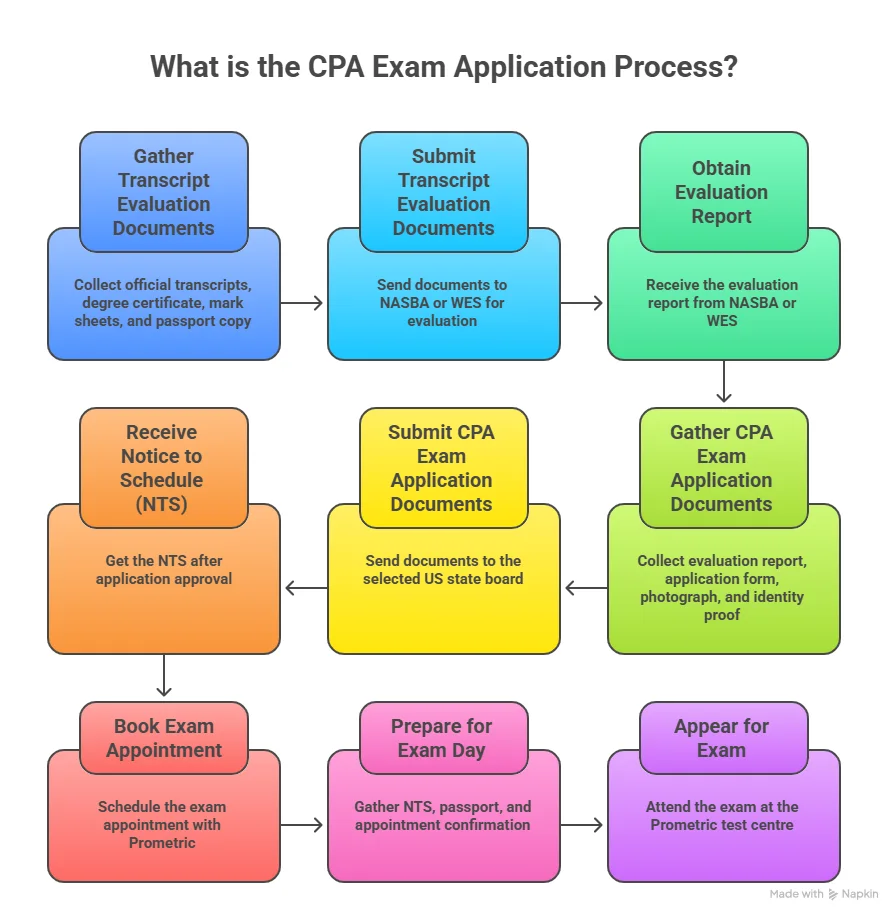

Step 3: Apply For The CPA Exam

After meeting the US CPA eligibility requirements, you submit transcripts for evaluation. International students often use NIES for credential evaluation.

Once approved, you receive a Notice To Schedule. You then book exam slots at Prometric centres. If you are researching how to become a US CPA from India, testing is now available in India at selected centres. This reduces travel costs.

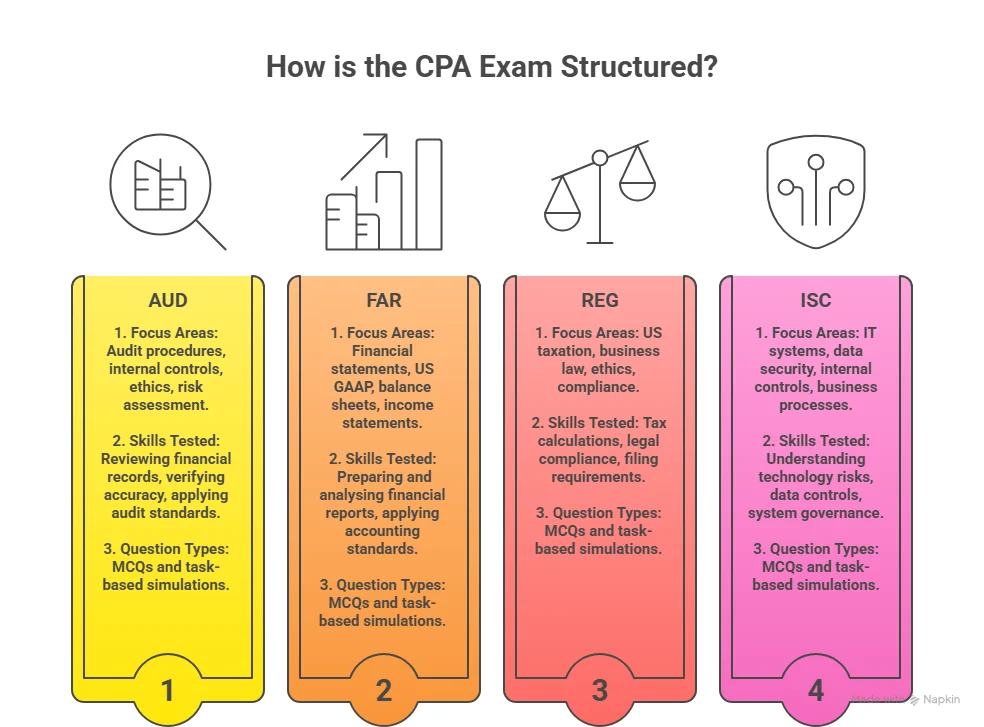

Step 4: Pass All Four Exam Sections

The CPA exam has four parts:

| Section | Focus Area |

| AUD | Auditing And Attestation |

| FAR | Financial Accounting And Reporting |

| REG | Regulation And Tax |

| BAR or TCP or ISC | Discipline Section |

Each section is scored on a scale of 0 to 99. You need 75 to pass. According to AICPA data, average pass rates range between 45% and 60%, depending on the section. This is why many ask, ‘How long does it take to become a CPA?’ Passing requires focused study. Most candidates clear all four sections within 12 to 18 months.

Step 5: Gain Work Experience

After passing exams, most states require 1 to 2 years of supervised experience under a licensed CPA. If you want to know how to become a CPA certified fully, this step completes the journey. Without work experience, you cannot receive a license in many states.

Experience may include:

- Audit

- Tax

- Advisory

- Financial reporting

Step 6: Apply for a License

After the exam and experience, you apply for a license from the state board. Now you can call yourself a certified public accountant officially. If you are planning ‘how to become a CPA member of AICPA?’, you can then apply for membership and networking access.

Also Read: How CPA is Your Your Ultimate Launchpad to a Global Accounting and Finance Career?

How To Become a CPA In India

Many Indian students search for how to become a CPA in India. The process remains US-based. The difference lies in evaluation and logistics.

To understand how to become a CPA in India, consider three realities:

- You must meet the US CPA eligibility requirements

- You can write exams in India

- You receive a US license

If you are wondering how to become a CPA after 12th in India, the answer is simple. Complete graduation first. Then pursue the CPA pathway.

For CA students exploring CPA after CA, many credits overlap. This can speed up eligibility.

For MBA graduates asking how to become a CPA with an MBA, your credits may satisfy business requirements. You may need additional accounting courses.

Also Read: What is the Role of a CPA in Tax Planning?

How Long Does it Take to Become A CPA?

The time for the CPA course duration depends on your background. Below is a realistic timeline:

| Stage | Approximate Time |

| Graduation | 3 to 4 years |

| Extra Credits | 6 to 12 months |

| Exam Preparation | 12 to 18 months |

| Work Experience | 1 year |

So, how many years does it take to become a CPA in total?

→ For a fresh 12th pass student, the journey may take 4 to 6 years.

→ For CA holders planning, ‘how to become a CPA after CA?’, it may take 1 to 2 years.

→ For professionals asking how long to become a CPA while working full-time, it depends on the number of study hours per week. Many working candidates clear within 18 months.

Work Experience Requirement Explained

After passing exams, you need work experience. This is required for license approval. Most states require 1 to 2 years of work under a licensed CPA. This experience can be in audit, tax, or accounting roles. Many students work in Big 4 firms or MNCs during this phase.

CPA License And Membership

After exams and experience, you apply for the license. This step completes how to become a CPA member. Once licensed, you can use the CPA title and sign audit reports. You also need to complete continuing professional education each year to keep your license active.

How to Select the Right State Board For CPA?

Choosing the right state board is an important step in becoming a CPA. Each state has its own rules for education and experience. Common states for Indian students include:

- Alaska

- Montana

- Guam

- Colorado

These states have flexible education requirements. They accept international credit more easily. Always check the US CPA eligibility rules for each state before applying.

Also Read: How Indian Professionals are Conquering the US CPA Exam?

CPA Course Fees And Total Investment

Money matters for every student. When you search for how much does it costs to become a CPA, you will find different numbers. The total cost depends on your state board, exam fees, coaching, and evaluation charges.

Before we look at the table, it helps to see the cost as a bundle. It is not a single fee. It is a group of smaller payments made over time.

| Cost Component | Average Cost | Approx Cost (INR) |

| Evaluation Fees | $200 to $300 | ₹16,000 – 25,000 |

| Exam Fees (4 papers) | $1000 to $1200 | ₹83,000 – 1,00,000 |

| Application Fees | $150 to $300 | ₹12,000 – 25,000 |

| Coaching | $1200 to $2500 | ₹1,00,000 – 2,10,000 |

| License Fees | $100 to $500 | ₹8,000 – 42,000 |

These are average values based on data from NASBA and state boards. You can check detailed fee ranges on the NASBA official fee page. When students ask how much it costs to become a CPA in India, the total usually falls between ₹2.5 lakh and ₹4.5 lakh. This depends on your coaching and currency rates.

Did You Know?

The CPA exam fees were updated in 2024 and may change slightly each year. Always check current fee charts on NASBA or the state board site.

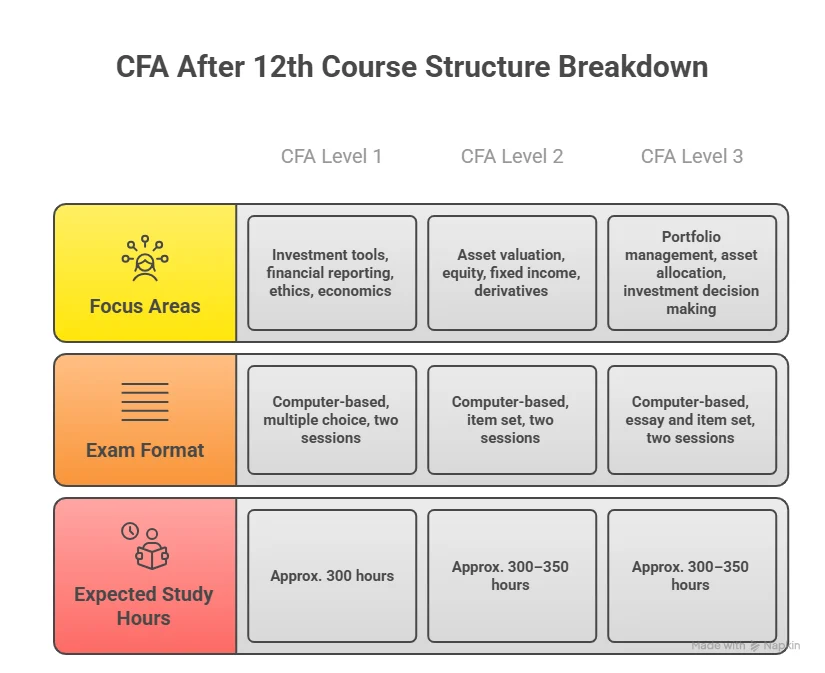

CPA Subjects And What You Will Study

Many students worry about the syllabus. The CPA course details are focused and practical. It tests real work skills. Think of it like learning to manage a business. You learn how to read financial data, check audits, and understand tax rules.

Core CPA Subjects

- Financial accounting and reporting

- Audit and assurance

- Regulation and taxation

- Business analysis and information systems

Each subject in the CPA syllabus is linked to real job tasks. For example, FAR teaches how companies report profits. AUD teaches how to check if those reports are correct.

Students who search for how to become a CPA accountant often want to work in audit or finance roles. These subjects prepare you for that path.

Also Read: How to Pass the US CPA Exam in First Attempt?

Career Scope and Job Roles After CPA

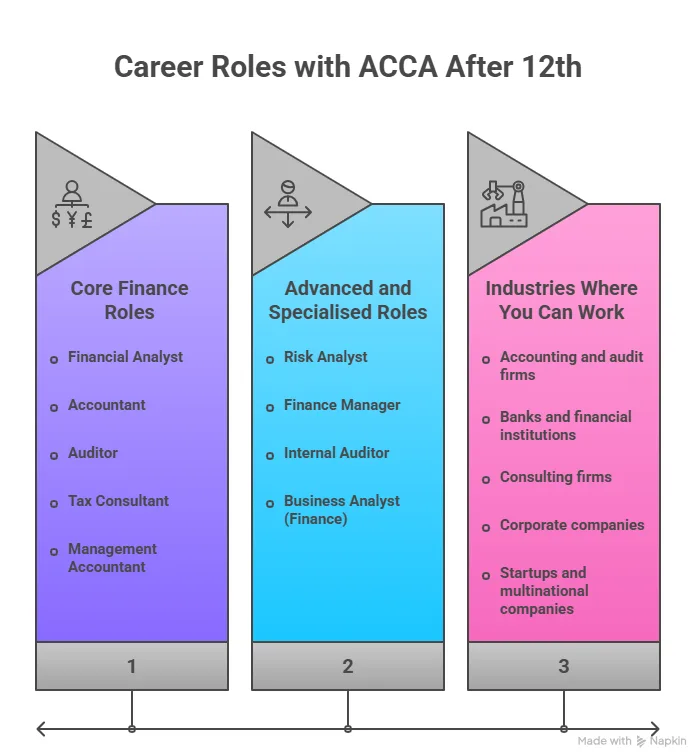

The CPA certification opens multiple career paths. With the diverse scope of CPA, you are not limited to one role. Here are common job roles for a certified public accountant:

- Auditor

- Tax consultant

- Financial analyst

- Risk and compliance manager

- Internal audit specialist

- Business consultant

Many CPAs also move into leadership roles after a few years.

| Job Role | What You Do | Where You Work |

| Auditor | Review financial statements and verify the accuracy of records | Audit firms, Big 4, consulting firms |

| Tax Consultant | Plan and file taxes, ensure compliance with tax laws | Tax advisory firms, consulting firms, corporates |

| Financial Analyst | Analyse financial data and support business decisions | Banks, MNCs, investment firms |

| Risk and Compliance Manager | Monitor financial risks and ensure regulatory compliance | Banks, fintech firms, and large corporations |

| Internal Audit Specialist | Evaluate internal controls and improve business processes | Corporations, manufacturing firms, IT companies |

| Business Consultant | Advise companies on financial strategy and efficiency | Consulting firms, advisory firms |

| Financial Controller | Manage financial reporting, budgeting, and performance tracking | MNCs, large corporates |

| Finance Manager | Oversee finance operations, planning, and reporting | Startups, corporates, global capability centres |

CPA Salary In India And Abroad

The CPA qualification has strong earning potential. The CPA salary in India varies based on experience and role. Before we look at numbers, think of CPA as a global badge. It helps you work with US clients even if you live in India.

| Role | Average Salary In India | Average Salary In USA |

| Entry Level CPA | ₹6 – 9 LPA | $55,000 to $65,000 |

| Mid-Level CPA | ₹10 – 18 LPA | $70,000 to $90,000 |

| Senior CPA | ₹20 LPA+ | $100,000+ |

Many firms in India hire CPAs for US accounting roles. This is why searches like how to become a CPA in the USA and how to become a US CPA from India are increasing.

The CPA qualification can be a strong foundation for moving into senior finance leadership roles over time. This section looks at how professionals progress from core accounting and audit functions into strategic roles, and how the journey can eventually lead to positions such as finance head or CFO in global organisations.

CPA Vs CA Vs ACCA Quick Comparison

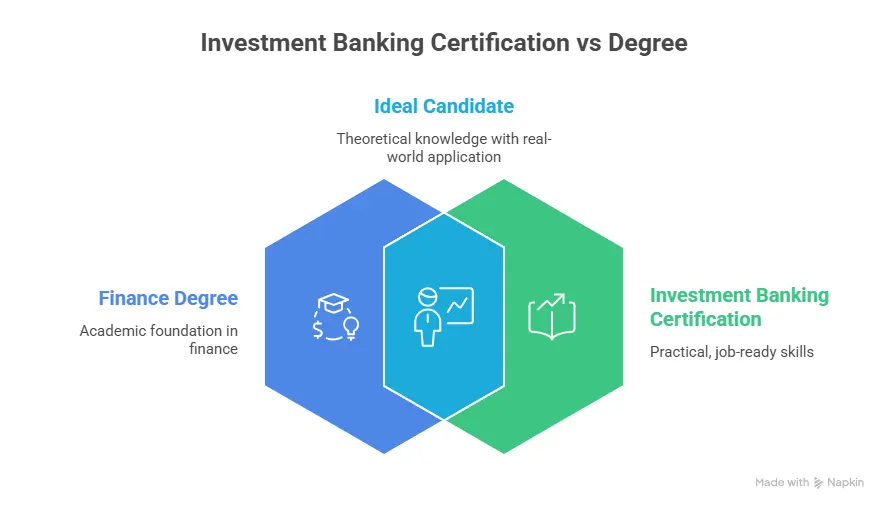

Students often compare CPA with other finance courses, like CPA vs CMA. This helps them choose the right path. Before the table below, think of this as choosing between three different roads that lead to finance careers.

| Feature | CPA | CA | ACCA |

| Region | USA | India | Global |

| Global Recognition | ✅ | ❌ | ✅ |

| Duration | 1 to 2 years | 4 to 5 years | 2 to 3 years |

| Faster Completion | ✅ | ❌ | ❌ |

| Focus | US GAAP, audit | Indian laws | IFRS, global finance |

| International Mobility | ✅ | ❌ | ✅ |

| Exams | 4 papers | Multiple levels | 13 papers |

| Easier Exam Structure | ✅ | ❌ | ❌ |

| Demand In India | Growing fast | Very high | High |

| Demand In Global Firms | ✅ | ❌ | ✅ |

| Flexibility of Career Roles | ✅ | ❌ | ✅ |

Students who search how do I become a certified public accountant often compare CPA with CA before deciding.

Choosing between CPA and CA often comes down to where you want to work and the kind of roles you see yourself in. This video breaks down how the two qualifications differ in terms of global recognition, exam structure, career scope, and long-term opportunities so you can make a clear and informed decision.

Alternate Routes And Flexible Entry Paths to CPA

Many students think there is only one route to the CPA. That is not true. There are flexible ways to enter the program based on your background.

Some students start early. Others switch careers later. Both can succeed.

If you are exploring how to become a certified public accountant from a non-commerce background, you can build the required credits with short accounting courses. These courses cover basic accounting, taxation, and auditing.

Students also search, ‘how to become a CPA?’ without a degree in accounting. This path needs extra coursework. It is like adding extra subjects to complete your degree. It takes time, but it is achievable.

For working professionals, the path of, ‘how to become a CPA online?’ is useful. Online prep helps you study after work hours and manage your schedule.

Also Read: How Your CPA Income Grows Over the Years?

CPA Study Tools And Learning Resources

Today, there are many tools available to prepare for the CPA exams. These tools make the journey easier.

Popular resources include:

- Video lectures

- Test banks

- Practice simulations

- Flashcards

- Mock exams

- CPA study material

In addition to CPA books, many learners prefer structured programs from Imarticus Learning because they combine lectures, practice, and mentorship in one place.

Common Mistakes To Avoid During CPA Preparation

Many students face delays in their CPA exam prep because of simple mistakes. Before you read the list, think of this like common mistakes in a fitness routine. Skipping sessions or not tracking progress slows results.

Mistakes To Avoid

- Not checking eligibility early

- Choosing the wrong state board

- Ignoring mock exams

- Not tracking weak topics

- Delaying application deadlines

Avoiding these mistakes can reduce your timeline and help you complete the CPA faster.

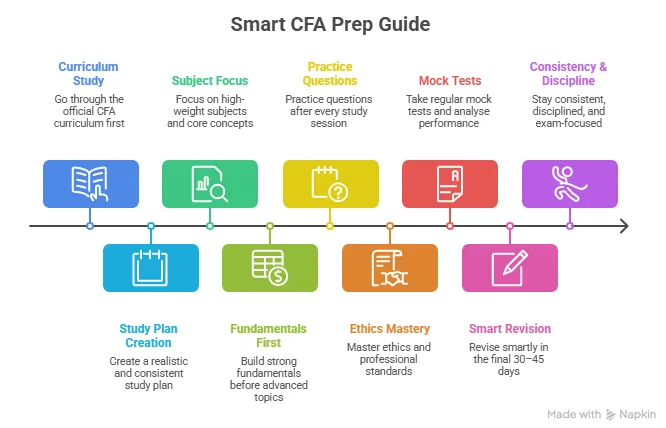

Clearing the CPA exam takes more than just studying long hours. It requires a clear plan, consistent practice, and the right exam strategy. This section brings together practical tips on how to structure your preparation, manage each paper, and approach practice tests so you can improve accuracy and confidence before exam day.

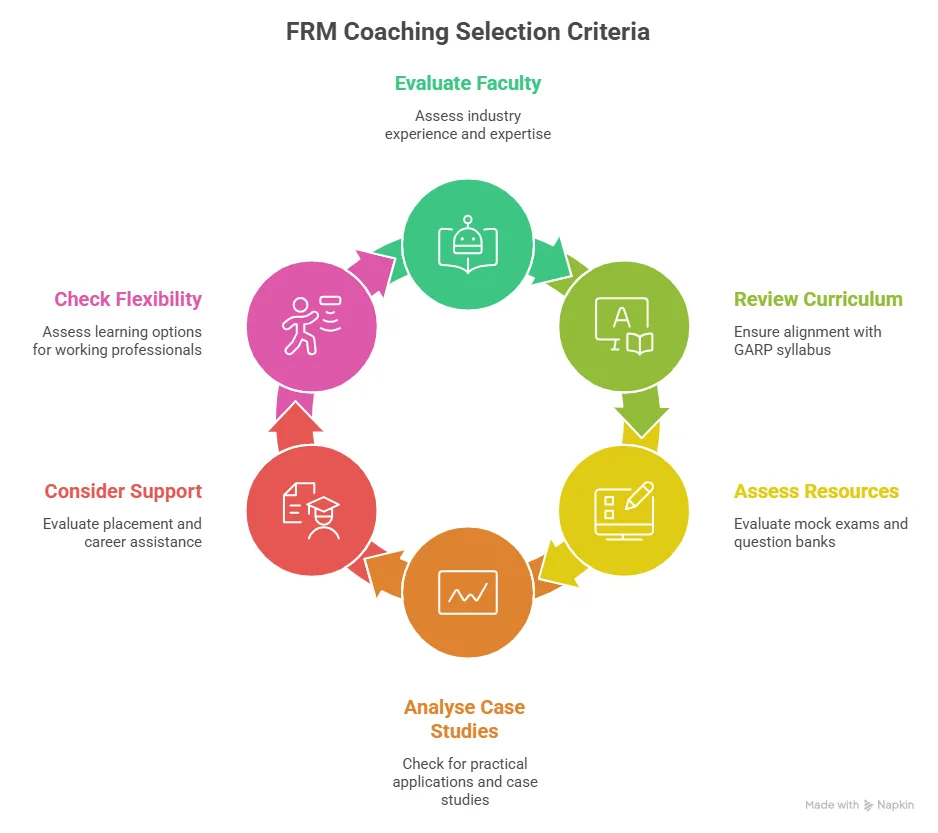

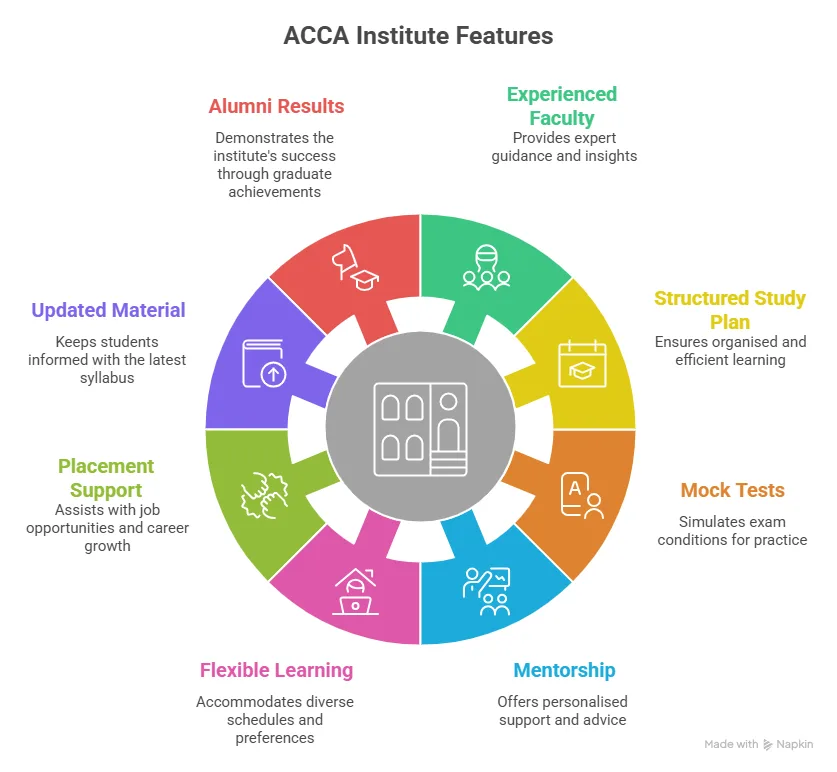

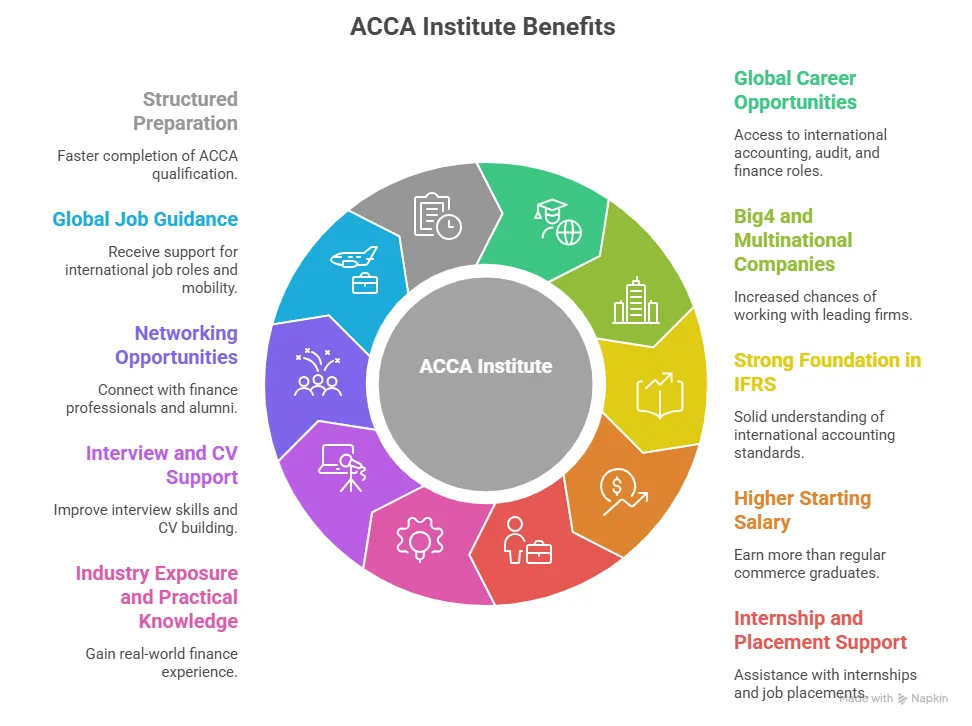

Why Study CPA With Imarticus Learning

Choosing the right preparation partner can shape your entire CPA journey. The path of ‘how to become a CPA?’ needs clarity, structure, and consistent support. A guided program helps you stay on track, manage your time better, and prepare with confidence for all four sections of the exam.

Imarticus Learning offers a structured CPA Program prep, designed to support learners from eligibility to exam readiness and career preparation. The program focuses on practical learning, global accounting standards, and career readiness so that you are not only exam-ready but also job-ready.

Here are the key highlights of the CPA program with Imarticus Learning:

- Industry collaboration with KPMG in India for practical case studies and learning exposure

- Expert-led live classes taught by US CPA qualified instructors and industry professionals

- Trusted study material from Surgent with books, practice questions, and mock exams

- Structured roadmap to complete all four CPA exam sections in 12 to 18 months

- Placement bootcamp with resume building, interview training, and career support for roles in Big 4 and top MNCs

- Real-world case studies aligned with global accounting practices to build job-ready skills

- One-to-one mentoring support from CPA, CA, and ACCA qualified experts

- Access to global career opportunities with a credential recognised across 150+ countries

The program is designed to support learners at every stage of ‘how to become a CPA in India?’ and ‘how to become a US CPA from India?’ With structured guidance, practical learning, and career-focused support, you move closer to completing your CPA journey with clarity and confidence.

FAQs On How To Become A CPA

Before you begin the journey of how to become a CPA, it is natural to have practical questions about eligibility, timelines, costs, and exam requirements. The answers below address the most frequently asked questions students have, so you can move ahead with clarity and confidence.

How Do I Start A CPA?

To begin the process of how to become a CPA, you first check your education and credit requirements. After that, you choose a US state board and evaluate your transcripts. Then you register for the CPA exam and begin your preparation. Many students start with structured programs from Imarticus Learning to get a clear study plan and regular practice support.

How Do I Apply For CPA?

The application step in how to become a CPA involves selecting a state board and submitting your academic transcripts for evaluation. Once your eligibility is approved, you receive a Notice to Schedule and book your exam at a Prometric centre. Many students use guidance from Imarticus Learning to complete the application process correctly and avoid delays.

How Many Years Is A CPA Course?

When you plan how to become a CPA, the course duration depends on your background. Most candidates complete exams within one year and finish their experience in another year. In total, it usually takes one and a half to two years to complete the full CPA journey.

What Is The Eligibility To Become A CPA?

Eligibility is a key step in ‘how to become a CPA’. You need a bachelor’s degree and a specific number of credit hours in accounting and business subjects. You must also pass all four exam sections and complete the required work experience before applying for the license.

How Much Does CPA Cost In India?

When planning how to become a CPA, the total cost in India usually ranges from ₹2.5 lakh to ₹4.5 lakh. This includes exam fees, evaluation charges, coaching, and license fees. Many students manage this investment with flexible payment plans offered by Imarticus Learning.

Can I Complete CPA In 1 Year?

It is possible to complete the exam part of how to become a CPA within one year if you follow a strict study schedule and clear all four papers quickly. However, the full certification, including work experience, may take longer depending on your job role and state requirements.

What Is The CPA Exam Pass Rate?

The CPA exam pass rate is usually between 45 to 55% for each section. While planning how to become a CPA, it is important to prepare well and take mock tests regularly to improve your chances of clearing each paper on the first attempt.

Do All CPAs Start As Accountants?

Many people who explore how to become a CPA begin in accounting or audit roles, but it is not compulsory. CPAs can start in finance, consulting, or analysis roles and later move into specialised areas based on their interest and experience.

Begin Your CPA Journey With A Clear Plan

You now have a clear map of how to become a CPA from start to finish. You have seen the education path, the exam structure, the timeline, the cost, and the career scope. Each step is simple when you take it one at a time. The journey is not rushed. It is steady and planned.

If you are still at the stage of how to become a CPA after 12th, focus on building a strong base with the right degree and subjects. If you are a graduate thinking about how to become a CPA in India or how to become a US CPA from India, your next move is to check your eligibility and choose the right state board. If you already have a CA or MBA, you are already closer to the finish line and can move faster toward certification.

The CPA path rewards clarity and consistency. A few hours of focused study each day can help you clear each section with confidence. A clear plan can help you manage work, study, and life without stress. Over time, each paper you clear brings you closer to the Certified Public Accountant certification and the global career that comes with it. Many students prefer a guided route so they do not have to figure out everything on their own. Structured programs with mentors, mock tests, and progress tracking can make the process smoother. The CPA Course prep offered by Imarticus Learning can support you with a well-designed study plan and regular practice to keep you on track.