Every year, thousands of commerce students in India make the same calculation. Three years of BCom, then figure out the rest. It is not a bad plan. It is just an incomplete one. The job market you are graduating into does not reward degrees the way it did a decade ago. A BCom from a good college still matters. But it rarely separates you from the hundred other BCom graduates applying for the same role at the same firm on the same day. So what does?

A qualification that most of your peers do not have. One that tells an employer in Mumbai, or a recruiter in Dubai, that you did not just study commerce. You passed the same professional papers that accountants in London and Singapore cleared. That you understand IFRS, not just Indian accounting standards. That you are, by global definition, ready to work. That is what the ACCA certification actually is. Not a heavier workload. Not a second degree bolted onto the first. It is the same three years, pointed in a smarter direction.

Think about it this way. Two students graduate from the same college, same BCom programme, same results. One spent those three years doing exactly what the syllabus asked. The other spent those same three years doing the syllabus and quietly clearing nine papers of a globally recognised professional qualification. By the time both walk into a campus placement, one has a degree. The other has a degree and a credential that opens doors in 180 countries.

This guide covers everything that actually matters before you make this decision. What BCom with ACCA means in practice, which subjects you study, how the ACCA exemptions work, where the best colleges are across India, including a detailed breakdown for Kerala, Bangalore, Delhi, Chennai, and beyond, what jobs and salaries look like on the other side. By the end of it, you will form a solid sense of judgment on this!

Did You Know?

ACCA has over 252,500 members and 526,000 students across 180 countries. It is the world’s largest professional accounting body by student numbers.

What Is BCom with ACCA

The ‘BCom with ACCA meaning’ is simpler than it sounds. A university formally aligns its Bachelor of Commerce curriculum with the syllabus of the Association of Chartered Certified Accountants, UK. Because there is so much overlap between the two, students who complete their BCom get automatic exemptions from several ACCA papers. Instead of starting ACCA after graduation from scratch, they pick up from where BCom left off.

To understand why this matters, it helps to first understand: what is ACCA as a qualification?

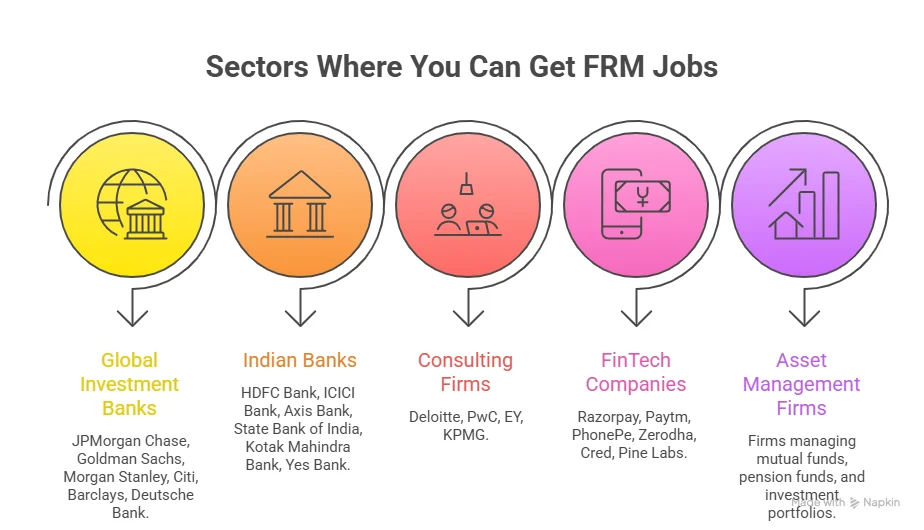

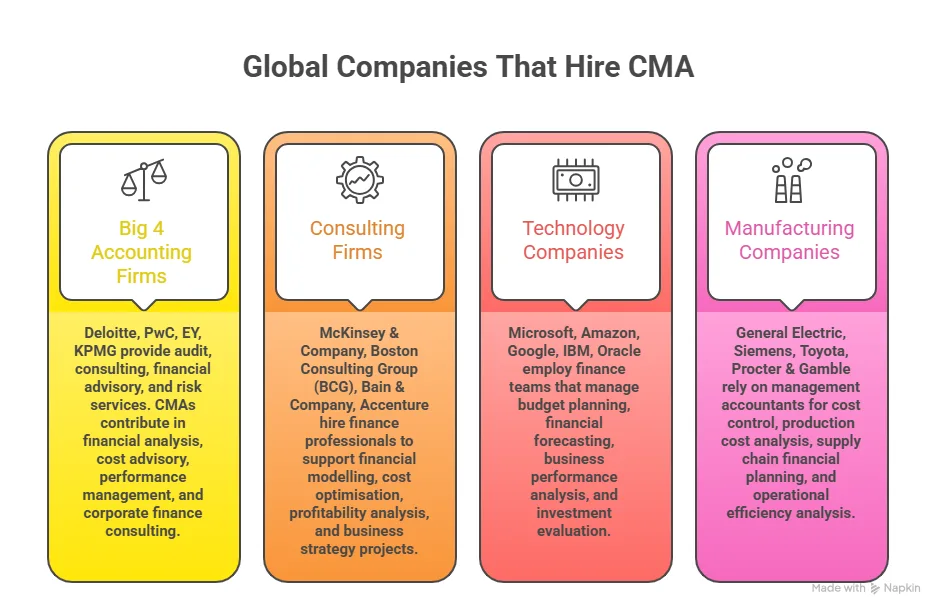

ACCA is not a short certificate course. It is a full professional accounting qualification regulated in the UK, recognised in 180 countries, and held by over 252,500 members globally. The firms that hire ACCA-qualified professionals include Deloitte, PwC, HSBC, Unilever, and hundreds of multinationals that operate in India. When BCom integrates with that, the ACCA scope expands, and the degree stops being just a degree.

Let’s put it plainly: imagine you are building a house. Standalone BCom gives you the foundation. ACCA gives you the full structure, electrical, plumbing and all. BCom with ACCA gives you both at the same time, with the same effort, during the same three years.

What 9 Exemptions Actually Look Like

The number of exemptions a student receives depends on the university’s ACCA Approved Learning Partner status. At the highest level, students receive exemptions from up to 9 of the 13 ACCA papers. That leaves only 4 Strategic Professional papers to complete independently.

- ACCA’s Applied Knowledge level: 3 papers (fully exempted)

- ACCA’s Applied Skills level: 6 papers (fully or partially exempted)

- Remaining to clear independently: Strategic Professional level, 4 papers

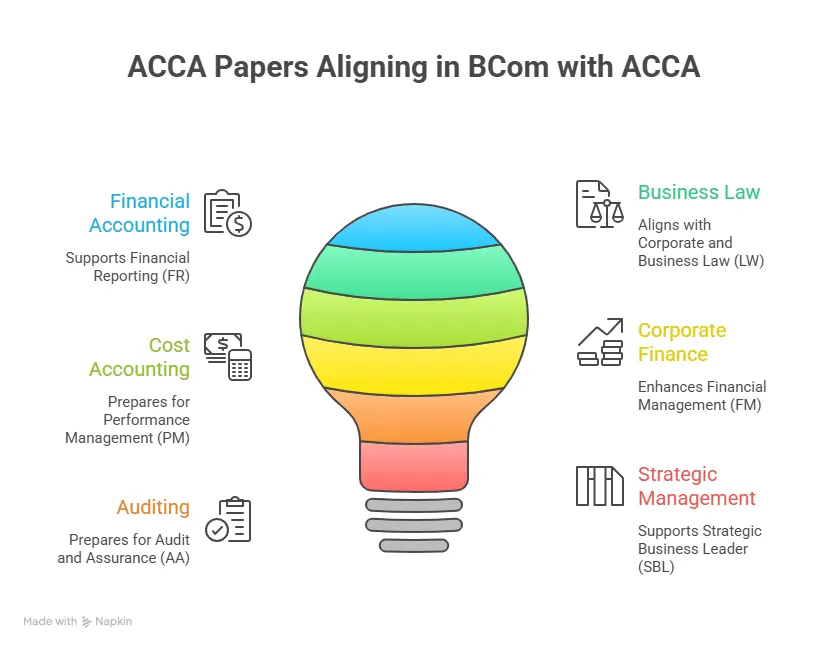

Subjects in BCom with ACCA

Below is a clear look at how the BCom curriculum maps to ACCA papers. This mapping is what makes the exemptions possible.

| ACCA Paper | Paper Name | Aligned BCom Subject |

| F1 | Business and Technology | Organisational Management, Principles of Business |

| F2 | Management Accounting | Cost Accounting, Management Accounting |

| F3 | Financial Accounting | Financial Accounting I and II |

| F4 | Corporate and Business Law | Business Law, Company Law |

| F5 | Performance Management | Advanced Management Accounting |

| F6 | Taxation | Direct Tax, Indirect Tax, GST |

| F7 | Financial Reporting | Advanced Financial Accounting, IFRS |

| F8 | Audit and Assurance | Auditing, Assurance and Risk |

| F9 | Financial Management | Financial Management, Corporate Finance |

Notice that subjects like IFRS-based Financial Reporting and Audit and Assurance are included. These are not standard in a regular BCom. They are what make BCom with ACCA graduates job-ready at a level that standalone BCom graduates often are not.

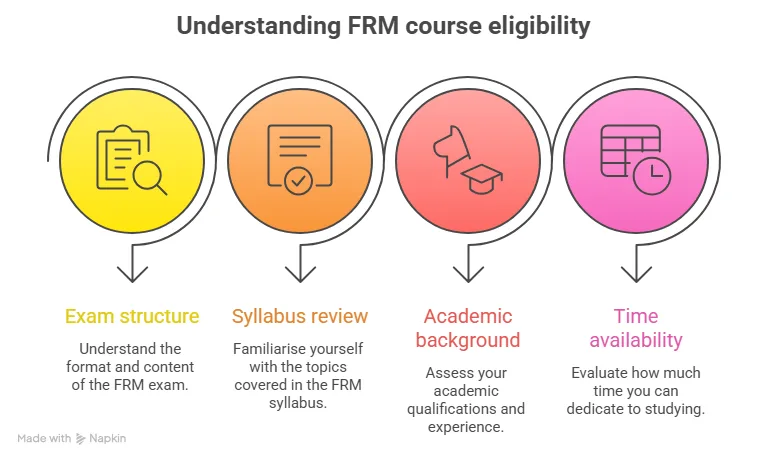

Many students exploring global accounting careers often come across the ACCA qualification, but are not always clear about how it works. The following explanation breaks down the qualification in simple terms, covering what ACCA stands for, how the exams are structured, and how it fits into modern finance and accounting careers.

BCom with ACCA Course Duration

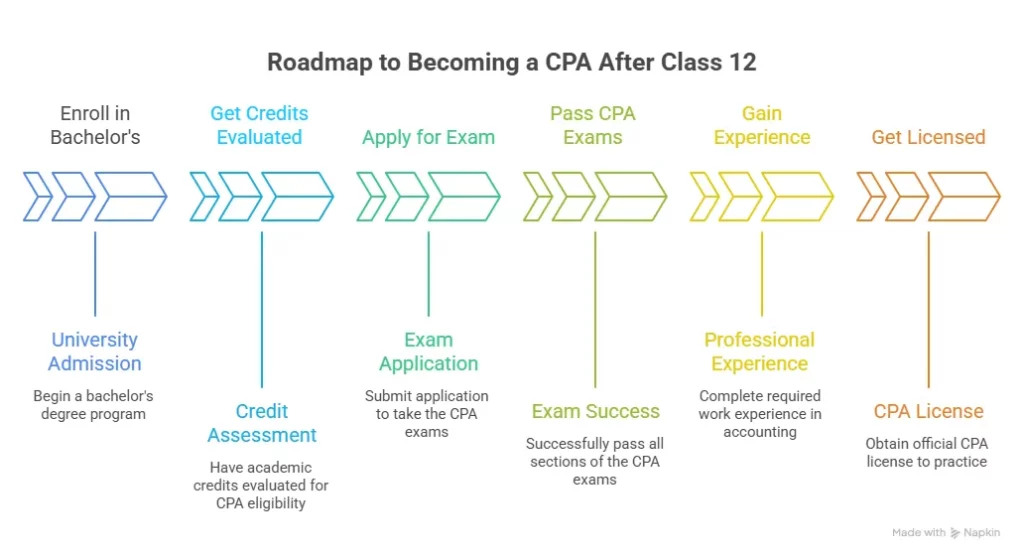

The BCom with ACCA course duration is 3 years for the degree itself. That part is fixed. What varies is how quickly you complete the remaining 4 ACCA Strategic Professional papers.

Most students attempt these papers in the final year of BCom or in the year immediately after graduation. ACCA exams are conducted four times a year, in March, June, September, and December. This flexibility means there is no rigid waiting period after graduation.

| Phase | Duration | What Happens |

| Years 1 to 3 | 3 years | BCom degree + automatic ACCA exemptions for 9 papers |

| Post-graduation or concurrent | 12 to 18 months | Attempt 4 Strategic Professional papers at your own pace |

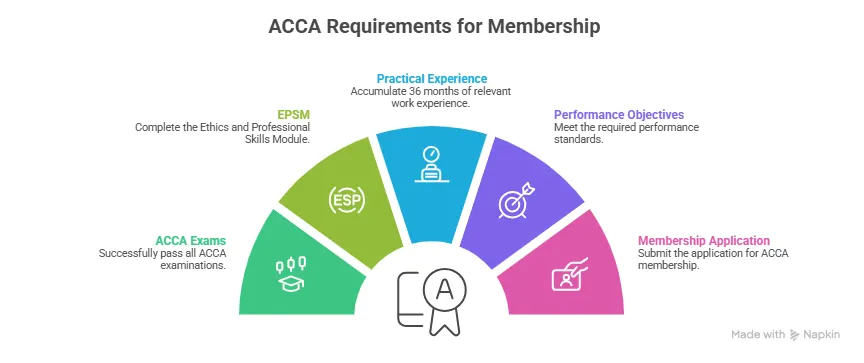

| 3 years of practical experience | Concurrent or post-exam | Required for full ACCA membership; can be done during BCom itself |

| Full ACCA membership | Total: 4 to 5 years from Class 12 | Globally recognised professional accountant status |

The 3-year practical experience requirement is something many guides overlook. ACCA requires members to complete 36 months of relevant work experience. The good news is that internships, part-time accounting roles, and even well-structured BCom project work may count towards this. Starting early matters.

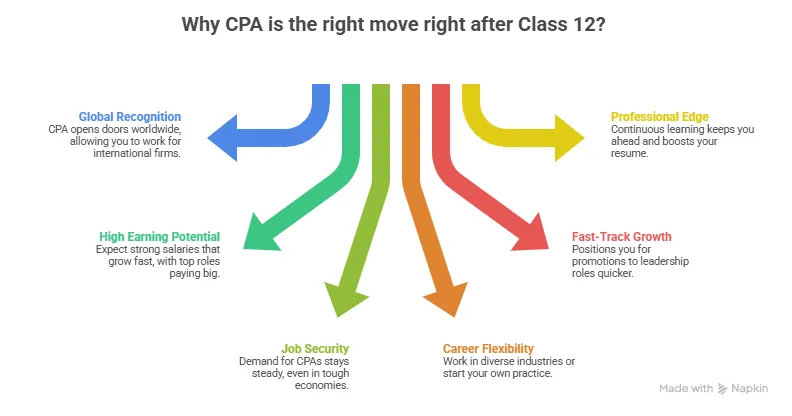

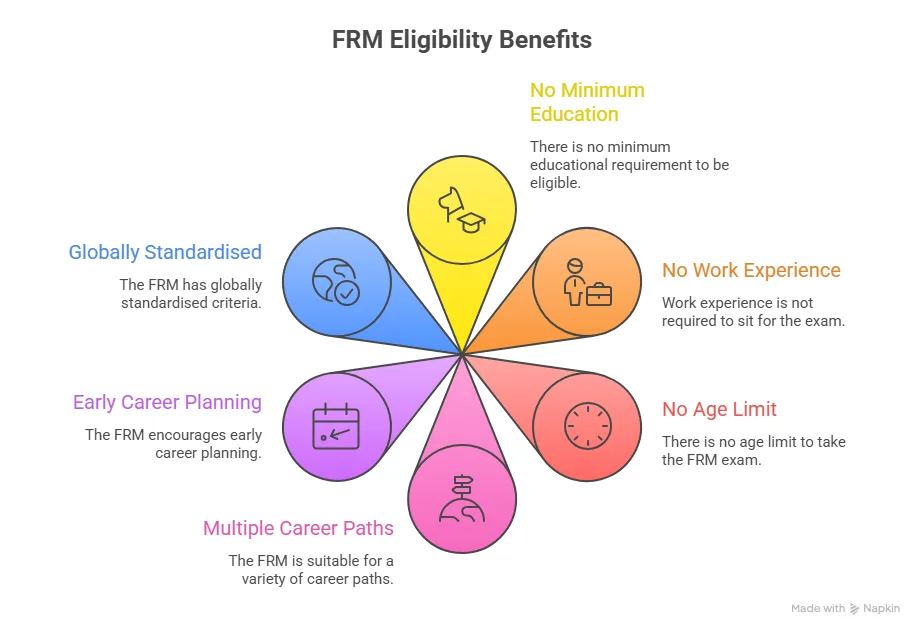

BCom with ACCA Benefits

People often weigh this decision the same way they weigh buying a car with basic features versus one with a comprehensive package. The sticker price is similar, but what you drive out with is vastly different. These are the ACCA benefits that genuinely differentiate BCom with ACCA from a conventional BCom.

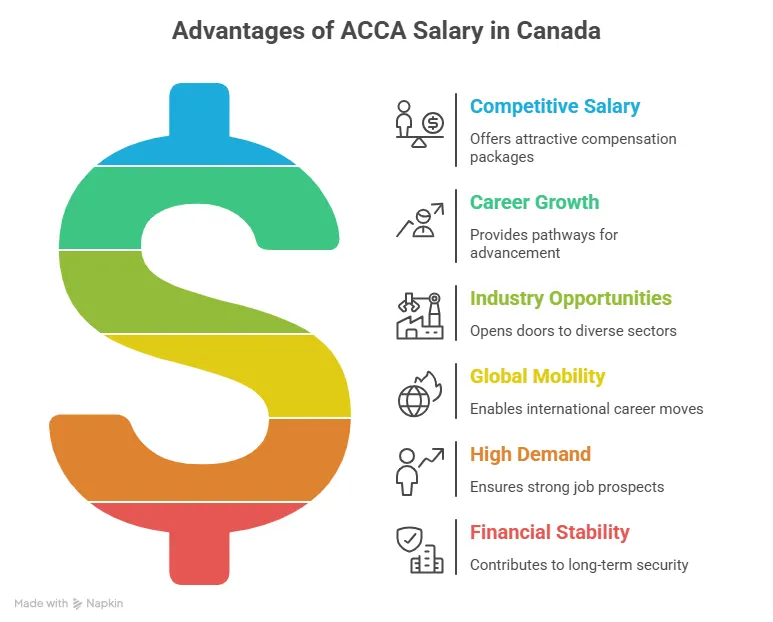

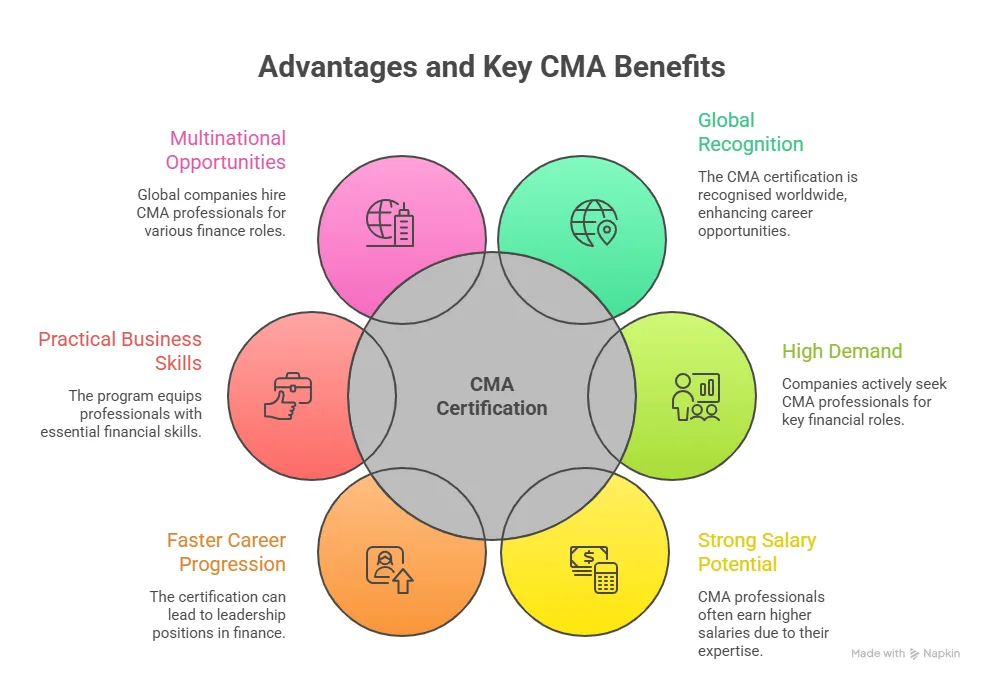

- Global portability: ACCA is recognised in the UK, UAE, Australia, Singapore, Canada, and over 175 other countries. Your qualification does not expire at the Indian border.

- Cost efficiency: Attempting 9 ACCA papers independently costs approximately ₹1.5 to 2 lakhs in registration and exam fees. Integrated programmes absorb most of this cost in the tuition structure.

- Higher starting salaries: The ACCA salary in India for a fresh BCom graduate typically starts at ₹5 to 8 LPA working in a finance role at a multinational firm.

- Big 4 eligibility from day one: Deloitte, PwC, EY, and KPMG actively recruit ACCA-affiliated candidates. A standalone BCom degree rarely opens these doors at the entry level.

- Dual credential, single period of study: You graduate with a UGC-recognised degree and a globally regulated professional qualification. Neither competes with the other.

Also Read: What Makes the ACCA Course Challenging for Most Students?

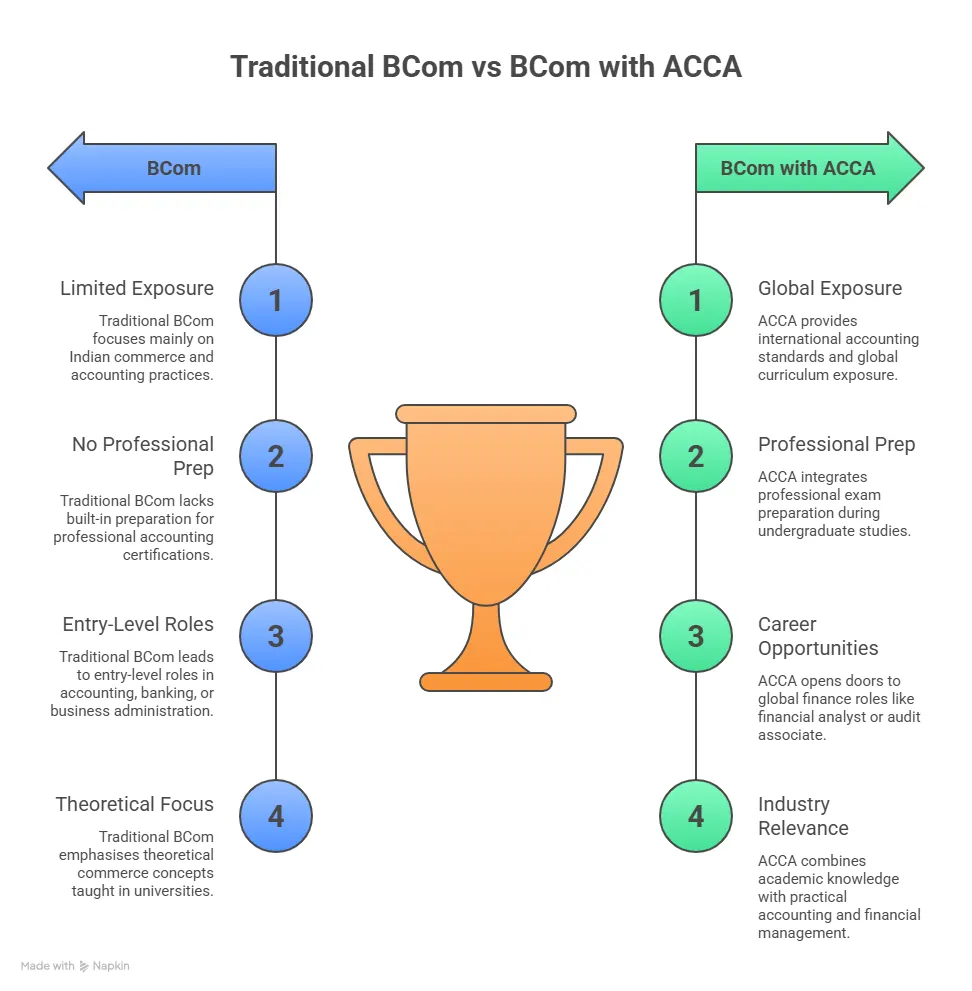

BCom with ACCA vs Traditional BCom

Most students, comparing the two options, think only about difficulty and ACCA course fees. The smarter question is about return. What do you get per rupee invested, and what doors open five years after graduation?

| Factor | BCom with ACCA | Regular BCom |

| ACCA Exemptions | Up to 9 papers | 5 papers (standard standalone) |

| Time to Full ACCA | 1 to 2 years after the degree | 3 to 4 years after the degree |

| Entry Salary Range | ₹5 – 8 LPA | ₹3 – 5 LPA |

| International Career Eligibility | Yes, from Day 1 | Only after the full ACCA qualification |

| Big 4 Firm Recruitment | Eligible as a fresher | Rarely, without additional qualification |

| IFRS and Global Standards Training | Included in the curriculum | Not typically covered |

| Total Cost of ACCA (standalone) | ₹2 – 3 lakhs extra | Saved through integration |

The numbers tell a clear story. The integrated route saves time, money, and the mental overhead of starting a professional qualification from scratch after an already exhausting three-year degree.

Did you know?

The ACCA pass rate for Applied Knowledge papers is approximately 60 to 80%, depending on the paper. This is significantly higher than the ICAI CA Foundation and Intermediate pass rates, which typically hover between 10 and 30%. For students who want a globally credible finance career without the gruelling failure rates of CA, BCom with ACCA is a genuinely strong alternative.

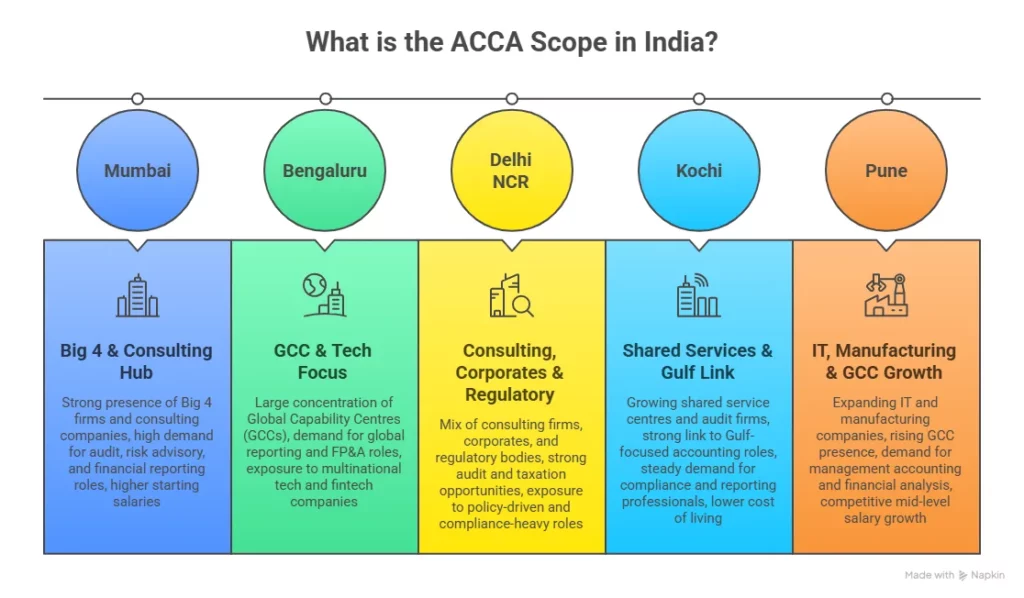

City-wise Guide to BCom with ACCA Colleges in India

Choosing a college for BCom with ACCA is not the same as choosing a college for a regular BCom. The quality of your ACCA integration depends almost entirely on one thing: whether your college holds ACCA Approved Learning Partner status. This is the formal agreement between a university and ACCA UK that guarantees curriculum alignment, faculty training, and examination support. Below is a city-wise breakdown of the strongest BCom with ACCA colleges across India.

BCom with ACCA Colleges in Delhi

Delhi and the NCR region have a growing cluster of BCom with ACCA colleges that blend strong commerce faculties with established ACCA ties.

- Manav Rachna International Institute of Research and Studies (MRIIRS): Offers BCom Hons with ACCA integration and 9-paper exemption. Known for strong industry tie-ups and a dedicated ACCA support cell.

- Amity University, Noida: One of the most established private universities in India, with a BCom programme aligned to ACCA competency frameworks. Campus placements include financial services and majors.

- Sharda University, Greater Noida: Offers BCom with ACCA with a dedicated ACCA prep unit on campus. Useful for students who want structured support for the remaining professional papers.

BCom with ACCA Colleges in Bangalore

Bangalore is where the BCom with ACCA in India story gets particularly interesting. The city is home to over 400 Global Capability Centres, hundreds of MNCs, and all four of the global Big 4 firms.

- Christ University: One of the earliest adopters of ACCA integration in India. Grants up to 9 exemptions. Strong alumni network in finance and audit.

- ISBR Business School: 26 years of operation with placement partners that include JP Morgan, Amazon, and Infosys. A strong pick for students focused on placements alongside qualifications.

- Presidency University: Offers a structured BCom with ACCA programme. NAAC-accredited and centrally located, making it convenient for students across the city.

- Jain University: Known for a commercially oriented BCom curriculum with ACCA add-on tracks. Active industry speaker series and finance club support ACCA learning.

BCom with ACCA in Bangalore also benefits from an active local ACCA community with regular networking events, workshops, and recruitment drives specifically targeting ACCA-affiliated students.

BCom with ACCA Colleges in Chennai and Coimbatore

Tamil Nadu has a deep commerce education culture, and BCom with ACCA in Chennai has grown considerably over the past five years. Chennai’s financial services sector, including domestic banks, insurance companies, and audit firms, actively recruits ACCA-affiliated candidates.

- Loyola College, Chennai: One of the most respected commerce colleges in South India. ACCA-aligned BCom tracks are available. Strong academic culture and alumni network.

- MOP Vaishnav College for Women, Chennai: Has an ACCA-integrated commerce programme with faculty who hold ACCA affiliate status.

BCom with ACCA colleges in Coimbatore are largely affiliated with Bharathiar University. Students here benefit from lower living costs compared to Chennai while still accessing an ACCA-aligned curriculum. Check university-level ALP tie-ups when shortlisting, as these apply across affiliated colleges.

BCom with ACCA Colleges in Hyderabad

Hyderabad’s emergence as a Global Tech and Finance Hub makes it a smart city for BCom with ACCA graduates. BCom with ACCA colleges in Hyderabad include ISBR’s Hyderabad campus and several NAAC-rated commerce institutions connected to Osmania University’s expanded BCom framework. Hyderabad’s placement scene, particularly in GCCs of companies like Microsoft, Google, and Deloitte, rewards ACCA credentials strongly.

BCom with ACCA Colleges in Pune

BCom with ACCA colleges in Pune include NMIMS Pune and several private colleges affiliated with Savitribai Phule Pune University. Pune’s robust manufacturing, IT, and fintech sectors have created consistent demand for candidates with both a commerce degree and an international finance qualification.

BCom with ACCA Colleges in Mangalore

Mangalore has a long history as a banking and commerce hub, given its proximity to major cooperative banks and its strong Tulu Nadu business culture.

BCom with ACCA colleges in Mangalore include institutions under Mangalore University, where ACCA curriculum alignment has been progressively adopted. St Aloysius College and Besant Evening College are worth checking for updated ACCA partnership status.

Students from Mangalore also commonly pursue BCom with ACCA remotely through hybrid programmes offered by institutions in Bangalore.

BCom with ACCA Colleges in Kerala

The state has an unusually high concentration of ACCA-registered students relative to its population. This is partly because Kerala has a strong culture of professional finance education and a large diaspora in ACCA-recognised markets like the UAE, UK, and Bahrain. BCom with ACCA in Kerala is, therefore, not just an academic choice but a strategic career migration tool for many families.

BCom with ACCA Colleges in Ernakulam

Ernakulam, which includes Kochi, is the commercial capital of Kerala and the city with the highest density of ACCA Approved Learning Partners in the state. BCom with ACCA colleges in Ernakulam include institutions like MG University-affiliated commerce colleges in Kakkanad, Aluva, and Edapally, many of which have formal ACCA alignment. Kochi’s growing fintech ecosystem, port-linked finance activity, and presence of global audit firms make it a strong placement market for BCom with ACCA graduates.

BCom with ACCA Colleges in Trivandrum

Trivandrum is home to Kerala’s administrative capital and a growing IT and financial services ecosystem. BCom with ACCA colleges in Trivandrum include colleges affiliated to Kerala University, some of which have adopted ACCA curriculum frameworks in recent years. The state government’s push for professional finance education has supported this growth.

BCom with ACCA Colleges in Thrissur

Thrissur is Kerala’s financial nerve centre in many ways, given its history as the state’s banking capital. BCom with ACCA colleges in Thrissur include cooperative bank-linked commerce colleges and private institutions exploring ACCA integration. Students here often have an advantage in landing audit and finance roles in Kerala’s cooperative banking sector, where ACCA credentials are increasingly valued.

Also Read: Which ACCA Papers Are The Hardest? Pass Rates Explained

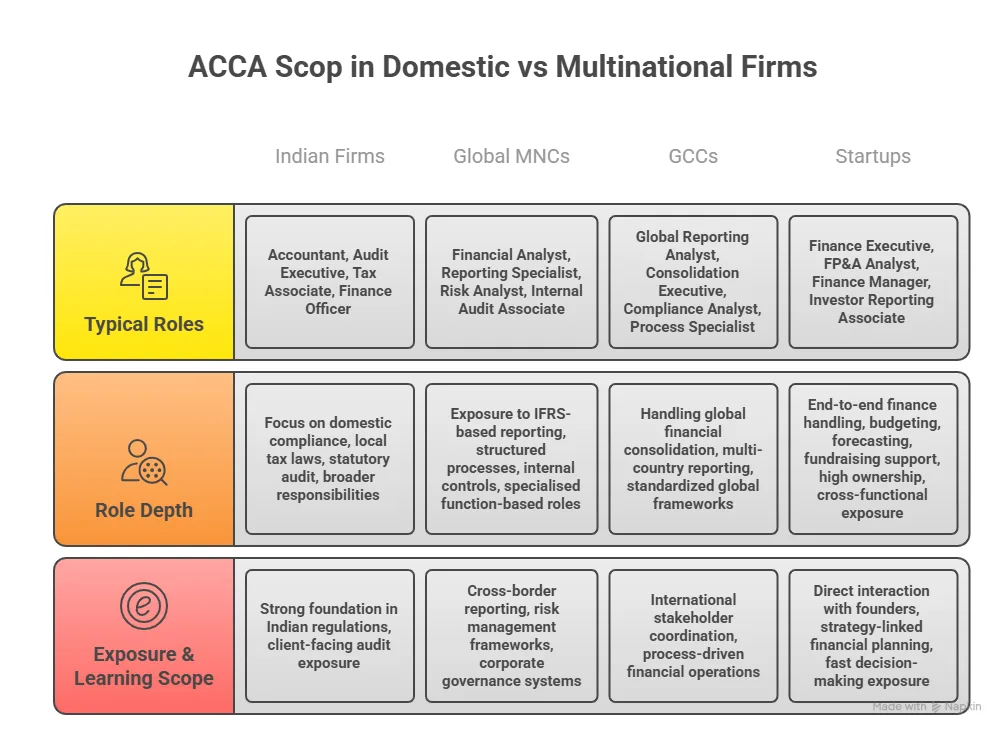

BCom with ACCA or BBA with ACCA

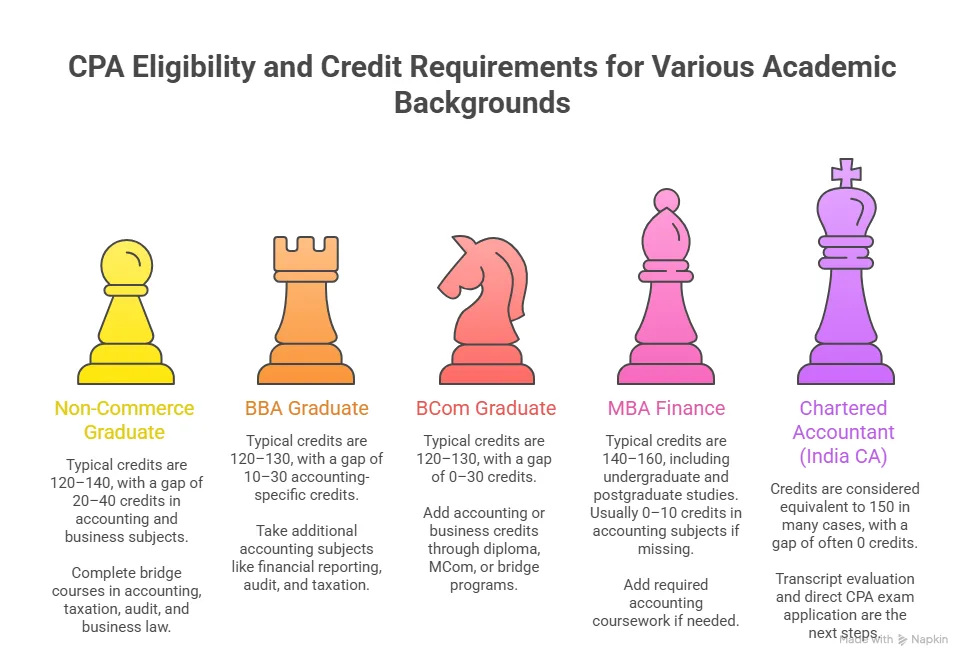

Students who are strong in commerce usually face this question: BCom with ACCA or BBA with ACCA? Both paths lead to the ACCA qualification. But they lead there very differently.

→ BBA is a management-oriented degree. It covers marketing, HR, operations, and strategic management alongside some finance. BBA with ACCA is viable, but the paper overlap is lower, meaning students typically receive only 5 to 6 exemptions rather than 9. The remaining papers require more independent study, more fees, and more time.

→ BCom, on the other hand, is built around accounting, taxation, law, and financial reporting. The overlap with ACCA’s Applied Skills papers is almost exact. If your career goal is accounting, audit and taxation, or global finance, BCom with ACCA is the more efficient route.

If your career goal is business management with a finance add-on, a BBA with ACCA makes sense.

Making the Choice

→ BCom with ACCA: Best for students targeting audit, taxation, financial reporting, Big 4 firms, or international finance roles.

→ BBA with ACCA: Best for students who want business management careers with a credible finance qualification on the side.

→ Bottom line: BCom gives you more ACCA exemptions, lowers your total cost of qualification, and aligns more precisely with ACCA’s core competencies.

Preparing for professional accounting exams requires more than just covering the syllabus. Many students aim to clear ACCA papers in their first attempt, which often comes down to having the right study plan, understanding the exam structure, and practising application-based questions regularly.

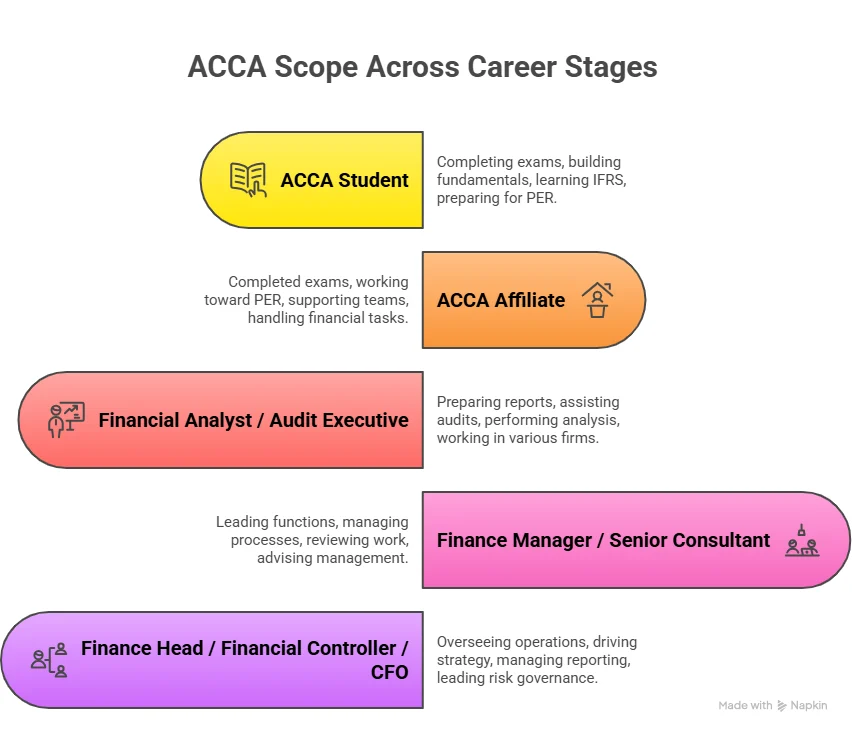

Career Opportunities and BCom with ACCA Jobs

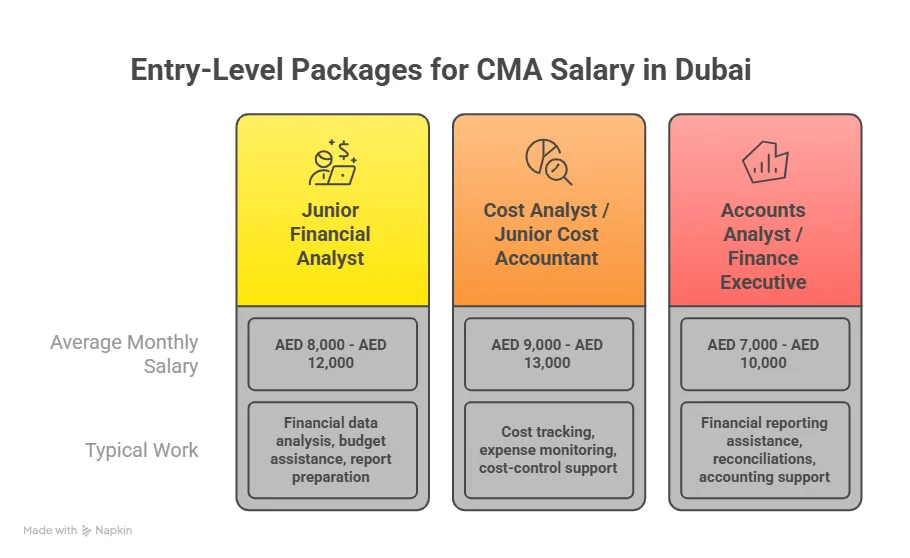

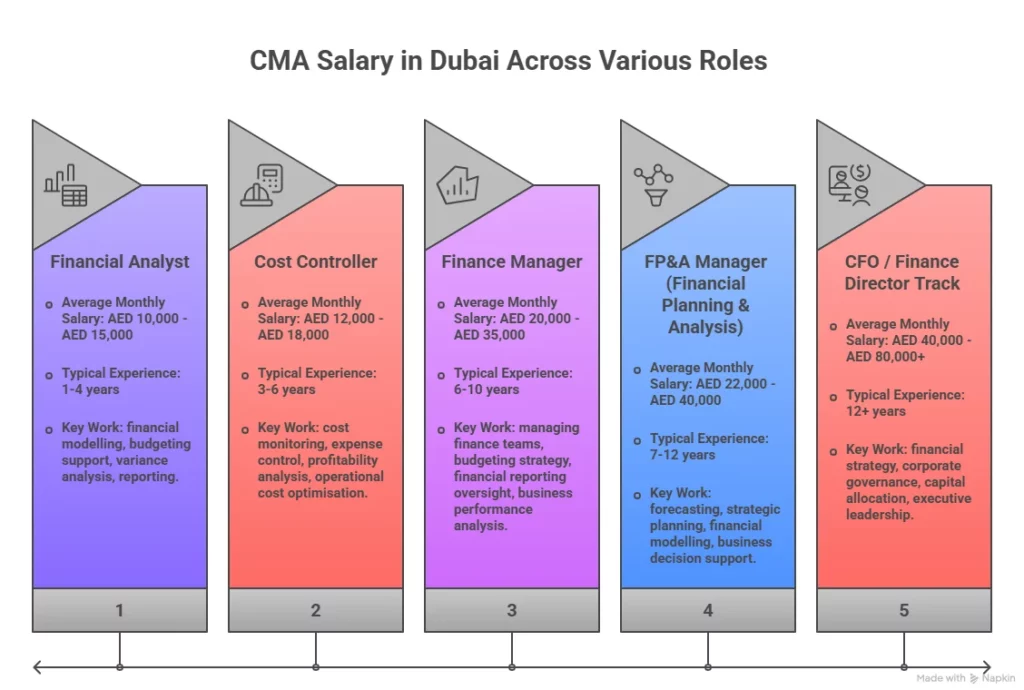

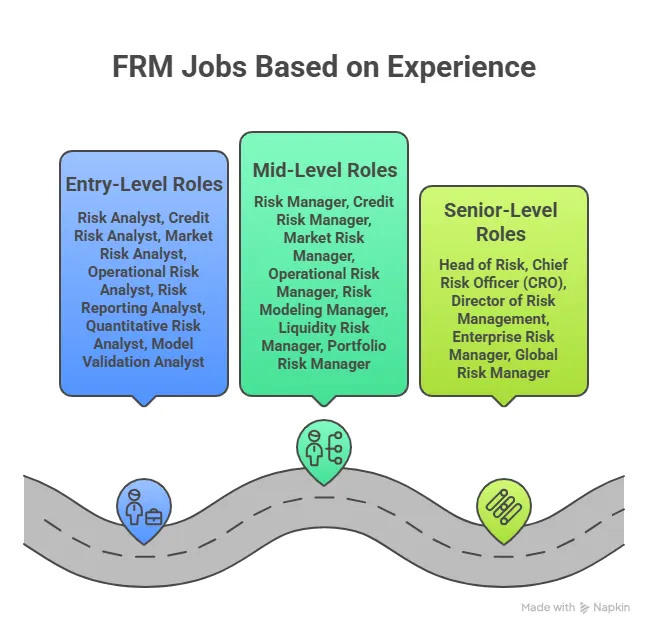

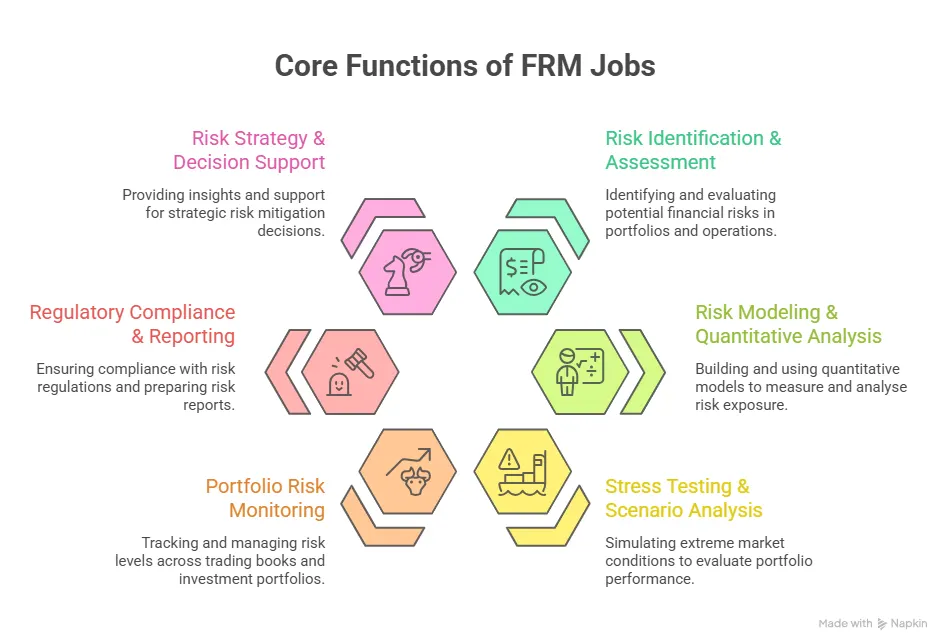

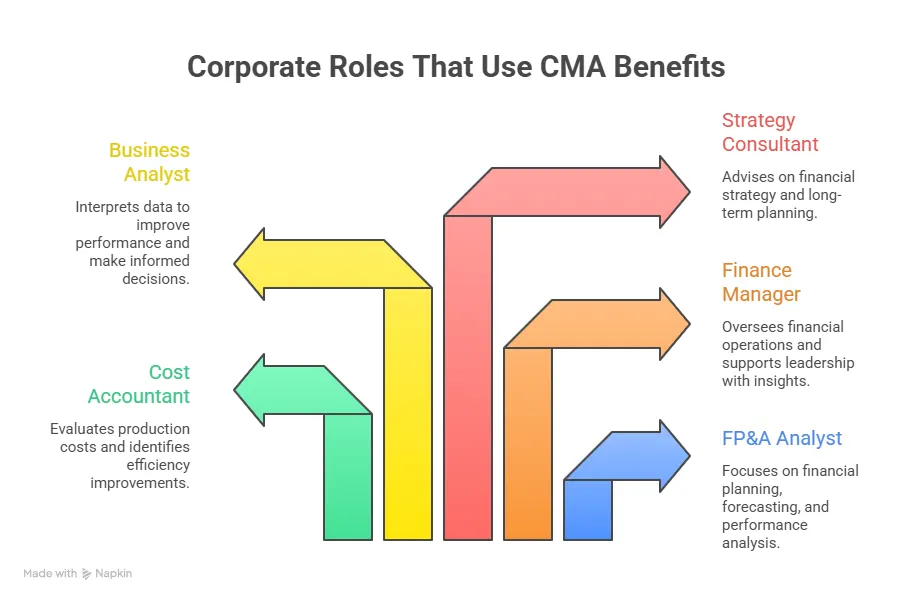

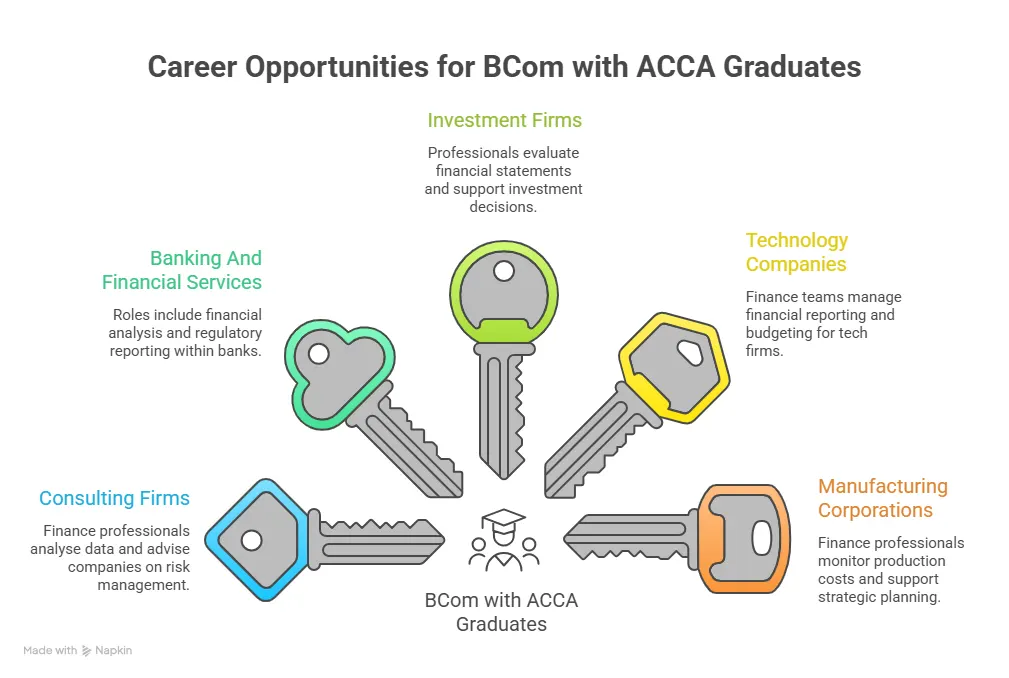

The range of BCom with ACCA jobs is wider than most students expect when they enrol. Because ACCA is a full professional qualification, not just an accounting certificate, it prepares graduates for roles across finance, audit, consulting, compliance, and business strategy. Here is a realistic look at where BCom with ACCA graduates work.

| Job Role | Sector / Employer Type | India Salary (Entry) |

| Audit Associate | Big 4 Firms (EY, PwC, KPMG, Deloitte) | ₹5 – 7 LPA |

| Financial Analyst | MNCs, Investment Banks, GCCs | ₹5 – 8 LPA |

| Tax Consultant | CA Firms, Corporate Tax Teams | ₹4 – 7 LPA |

| Management Accountant | FMCG, Manufacturing, Retail | ₹5 – 9 LPA |

| Internal Auditor | Banks, PSUs, Corporate Governance | ₹5 – 8 LPA |

| Finance Manager | Any sector post-qualification | ₹8 – 12 LPA |

| IFRS Reporting Specialist | Multinationals, listed entities | ₹6 – 10 LPA |

| Risk and Compliance Analyst | Banking, Insurance, Fintech | ₹5 – 8 LPA |

Also Read: Why ACCA Is Your Gateway To Global Finance Careers?

BCom with ACCA Salary in India

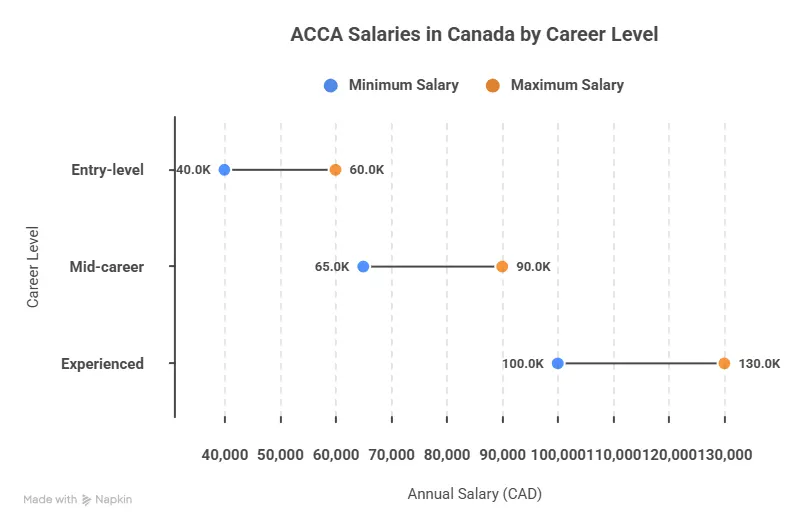

ACCA fresher salary in India growth for BCom with ACCA graduates is not linear. The biggest jumps happen at two milestones: full ACCA membership and the 5-year mark. Here is a realistic progression timeline for a graduate who completes BCom with ACCA and clears all 4 remaining professional papers within 18 months of graduating.

| Career Stage | Years of Experience | Typical Salary Range (India) |

| Entry level (ACCA affiliate) | 0 to 1 year | ₹4 – 8 LPA |

| Junior Finance / Audit Role | 1 to 3 years | ₹7 – 12 LPA |

| Mid-level Analyst or Senior Associate | 3 to 5 years | ₹12 – 20 LPA |

| Manager or ACCA Member | 5 to 8 years | ₹18 – 30 LPA |

| Senior Manager or Director | 8 to 12 years | ₹28 – 50 LPA |

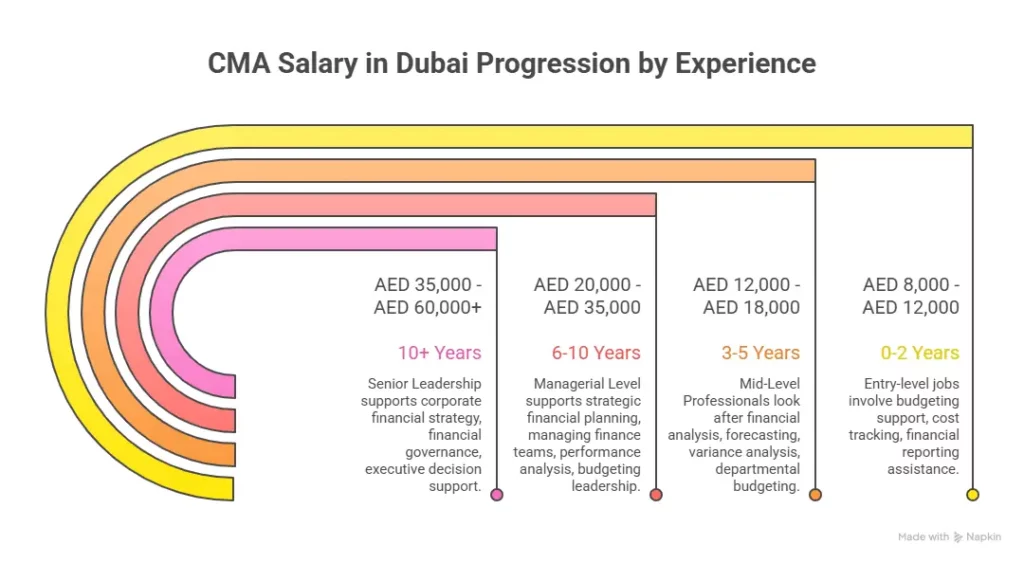

| International roles (UAE, UK, Singapore) | 3 to 7 years | $50,000 – 100,000 annually |

Students who want to build a strong foundation in commerce while also working toward a globally recognised accounting qualification often explore integrated programs that combine both paths. Understanding how a commerce degree aligns with ACCA papers, how the subjects overlap, and how students progress can help clarify why this route is becoming increasingly popular among finance aspirants.

Why Students Preparing for ACCA Choose Imarticus Learning

Not every ACCA prep programme is built the same way. Some give you study material and leave the rest to you. The ACCA Program prep offered by Imarticus Learning is structured differently, and the specifics are worth knowing before you decide.

- Imarticus Learning holds a Gold Status as an ACCA Approved Learning Partner. That is the highest level ACCA gives to any training institution anywhere in the world.

- The programme runs in collaboration with KPMG in India. You work through 23 real business case studies during the course, and KPMG practitioners are the ones who evaluate them.

- When you complete the programme, you walk away with a joint certification from Imarticus Learning and KPMG in India. That sits on your resume well before you are fully ACCA qualified.

- The top three students in each batch get a shot at an internship with KPMG in India. If a Big 4 firm is where you want to start your career, that is about as direct a path as it gets.

- Twelve live sessions every year are conducted by active KPMG professionals, not just faculty. There are also monthly webinars on what is actually happening in global finance right now.

- If you do not clear your ACCA Professional Level exams after going through the programme, Imarticus refunds 50% of your course fee.

- Job assistance includes placement prep, interview practice, and access to the hiring network.

FAQs About BCom with ACCA

Students exploring global accounting pathways often have practical questions before choosing the right academic route. The following answers address some of the most frequently asked questions about BCom with ACCA to help students see how this integrated program works and what they can expect from it.

Can We Do BCom and ACCA Together?

Yes, and that is exactly the point. When your college holds ACCA Approved Learning Partner status, both qualifications run together. Your BCom subjects count as ACCA paper exemptions automatically. By graduation, you have a degree and up to 9 ACCA papers already cleared. Imarticus Learning offers structured pathways that ensure students understand exactly how this integration works before they commit.

What Is the Scope of BCom with ACCA?

Wider than most students expect. Audit, taxation, financial reporting, risk and corporate finance are just the starting points. ACCA is recognised in 180 countries, so the career does not have to stay in India. Big 4 firms, MNCs, banks and global consulting firms all actively recruit for these roles. Imarticus Learning’s placement data shows BCom with ACCA graduates consistently landing roles that standalone BCom graduates are rarely considered for.

Can I Do ACCA After BCom?

Yes, you can. A regular BCom gets you 5 paper exemptions, which means 8 papers still left to clear independently. That adds roughly 2 to 3 years and ₹2 to 3 lakhs in exam fees after graduation. It works, but it is the longer route. If you are already done with BCom, Imarticus Learning has programmes built specifically for post-BCom candidates to get through the remaining papers efficiently.

What is the BCom with ACCA Salary?

Entry-level roles in India start at ₹4 to 8 LPA, with metros like Mumbai and Bangalore typically at the higher end. Mid-level positions with 3 to 5 years of experience move to ₹12 to 20 LPA. Senior roles cross ₹25 LPA and international postings in the UAE or UK push that considerably further. Imarticus Learning’s placement data shows steady salary growth year on year for graduates who clear their professional papers early.

Is BCom with ACCA Easy?

Rigorous, yes. Impossible, no. The first set of ACCA papers has pass rates of 60 to 80%, which is manageable with consistent effort. The Strategic Professional papers are harder, but by then, you have two years of BCom grounding behind you. The students who struggle are usually the ones who treat ACCA as an after-graduation problem rather than something they stayed on top of throughout their degree.

Which College Is Best for BCom with ACCA?

It depends on where you are. Manav Rachna and Amity are solid picks in North India. Christ University and ISBR Business School lead in Bangalore. For Kerala, focus on colleges in Ernakulam and Trivandrum with verified ACCA Approved Learning Partner status. If your college does not offer strong internal ACCA support, Imarticus Learning fills that gap with structured preparation that works alongside any BCom programme.

Which Is Better: BBA or BCom for ACCA?

BCom wins on pure ACCA efficiency. You get up to 9 paper exemptions compared to 5 or 6 with BBA. BCom covers accounting, tax and financial reporting at a depth that BBA simply does not. If the ACCA qualification is the goal, BCom is the more logical starting point.

Is It Better to Study BCom with ACCA or Just BCom?

A regular BCom gets you started. BCom with ACCA gets you further, faster. Same three years, but you graduate with a globally recognised qualification that a standalone BCom simply cannot match. For anyone serious about a finance career, the choice is fairly straightforward.

Starting Strong With BCom With ACCA

Choosing a career path at 17 or 18 is genuinely hard. Nobody hands you a manual. You end up on college comparison websites at midnight, asking seniors who are equally confused, and somehow still feeling like you have missed something important.

Here is what actually cuts through all of that noise. Ask yourself one question. Where do you want to be working at 25? If the honest answer has anything to do with finance, if it involves a reputable firm, a salary that reflects real skill, or the freedom to work beyond India’s borders, then the path you are already reading about is probably the right one. BCom with ACCA does not require a leap of faith. It just requires a decision. The ACCA Course training offered by Imarticus Learning works specifically with BCom students on the Applied Skills and Strategic Professional papers, the ones that sit beyond your exemptions and determine when you cross the finish line.