Dubai is built for professionals who come prepared. The city rewards ambition at a scale that is difficult to find elsewhere, and for CMA-certified finance professionals, the opportunity is particularly well-timed. The CMA salary in Dubai sits at the intersection of a zero-tax income structure, a rapidly diversifying economy, and a job market that is actively expanding across banking, technology, healthcare, and real estate.

The market is also layered in a way that works in a prepared candidate’s favour. Dubai is not a single employer pool with a single pay scale. The DIFC houses global banks and asset managers that benchmark compensation internationally. Free zones host regional headquarters of multinationals across technology, energy, and manufacturing. Mainland companies range from large conglomerates to fast-growing businesses actively building their finance functions.

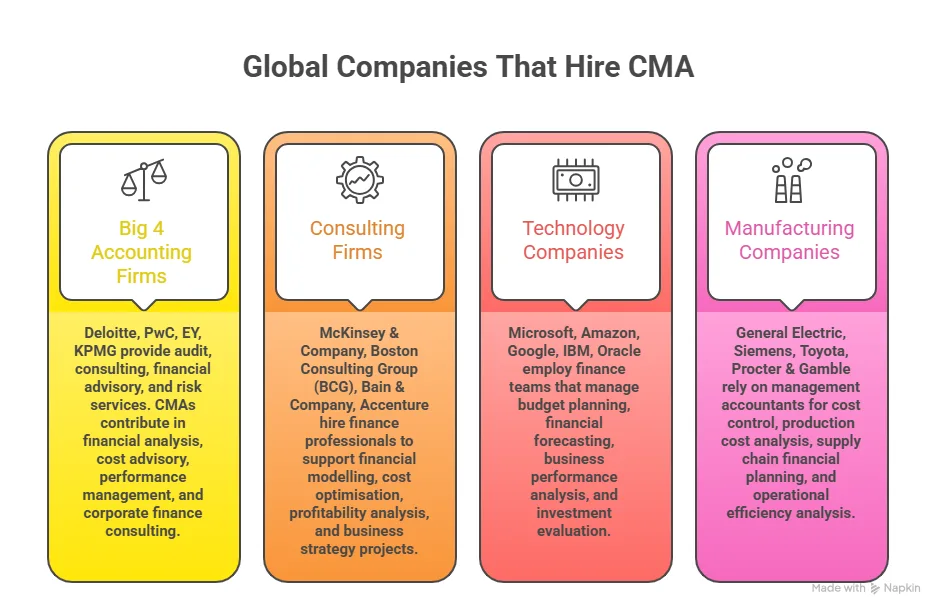

Dubai’s economy is also diversifying at speed. The UAE’s Economic Vision 2031 is an active redirection of capital away from oil dependency and toward finance, technology, healthcare, and logistics. Every one of those sectors needs management accountants. Not bookkeepers. Not auditors. Professionals who can plan, forecast, and connect cost behaviour to business decisions. That is what the US CMA certification trains for, and it is why CMA jobs in Dubai salary keeps growing year on year.

This guide moves through all of it with current data and the kind of context that makes numbers actually useful. Monthly figures in AED, INR conversions that reflect real purchasing power, sector-by-sector and role-by-role breakdowns, and the skill premiums that consistently separate the higher earners from the average. The CMA salary in Dubai is not just a number worth knowing. It is a career decision worth making with full information.

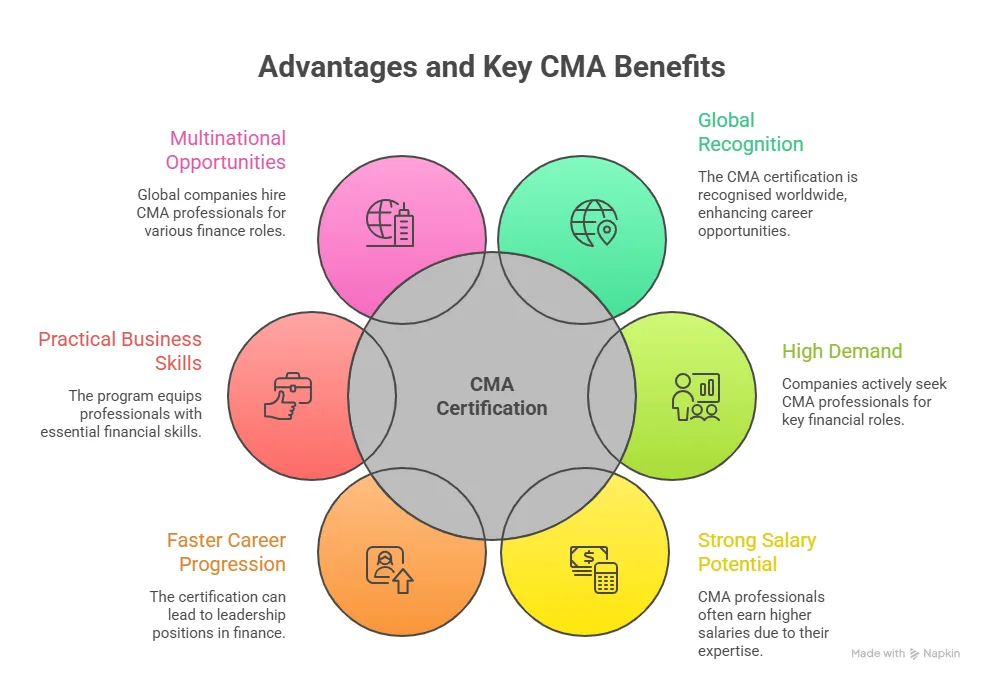

Did You Know? According to IMA’s 2023 Global Salary Survey, CMA-certified professionals in the Middle East earn approximately 15 to 20% more than non-certified peers in comparable roles. That premium is not a one-time benefit. It compounds across every salary negotiation over a career.

What Is CMA and How It Shapes Earning Potential in Dubai

To understand the CMA salary in Dubai, you need a clear picture of what the credential actually represents. The what is CMA question is more relevant here than in most markets, because Dubai’s employers are very specific about what they are paying for when they hire a certified management accountant.

The US CMA, awarded by the Institute of Management Accountants, is a globally recognised certification in management accounting and financial strategy. It is not a general accounting credential. It is designed to train professionals who work inside businesses, close to planning and decision-making, rather than externally reporting on them.

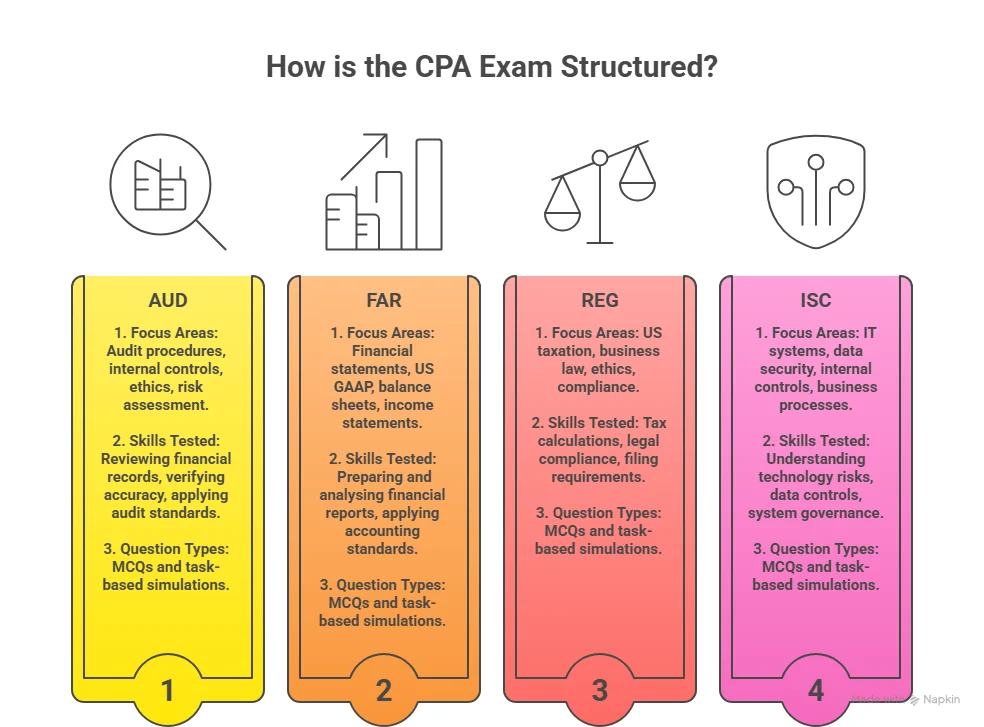

The certification is structured around two exam parts that together cover the full spectrum of skills Dubai’s finance employers need most.

| CMA Exam Part | Core Areas Covered |

| Part 1 | Financial planning, performance analysis, cost management, and internal controls |

| Part 2 | Strategic financial management, decision analysis, risk management, and investment decisions |

Beyond the exam structure, here is what the CMA credential signals to a Dubai employer at a practical level:

- The professional understands how budgets are built and how variances are interpreted

- They can support pricing, capacity, and investment decisions with financial analysis

- They are trained to connect cost data to business strategy, not just to financial statements

- They are equipped to work across industries and geographies under international reporting standards

This is why the CMA USA salary in Dubai sits consistently higher than non-certified finance roles. Employers are not paying for the certificate. They are paying for the judgment it represents.

Dubai’s corporate environment runs on IFRS, manages cross-border capital, and expects finance professionals to advise as much as they report. The CMA syllabus maps directly onto that environment, which is why the credential holds such strong relevance in the Gulf market specifically.

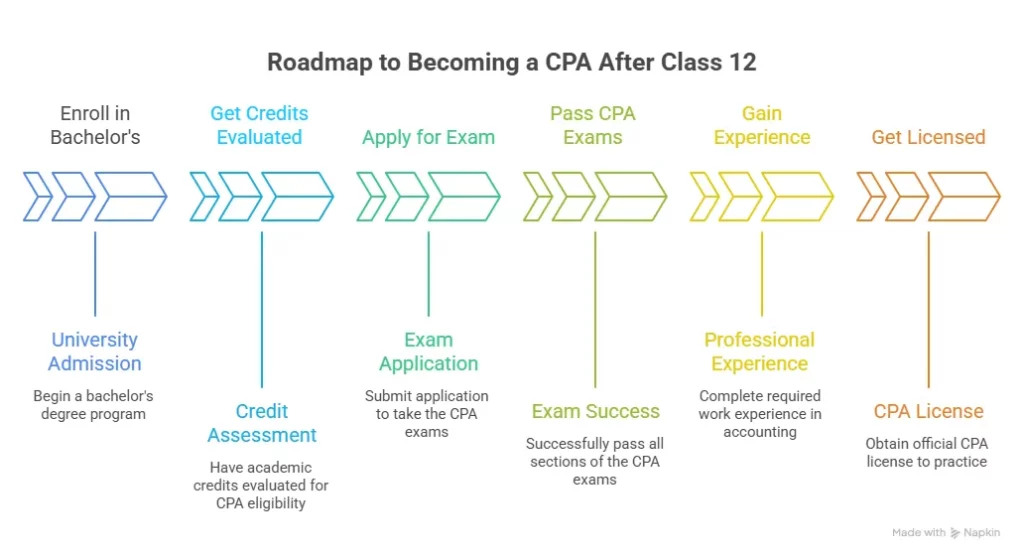

Many candidates researching the CMA salary in Dubai eventually ask themselves whether clearing the CMA exam is actually within reach. The qualification covers financial planning, strategic decision-making, and performance analysis across two exam parts, and the preparation effort required is a fair question before committing to the path.

What Is The CMA Salary in Dubai Per Month?

Annual CMA salary figures are useful for comparisons. Monthly figures are useful for life. Rent in Dubai is quoted monthly. Utility bills arrive monthly. Savings goals are tracked monthly. This is why understanding the CMA salary in Dubai per month is far more practical than any annual headline number.

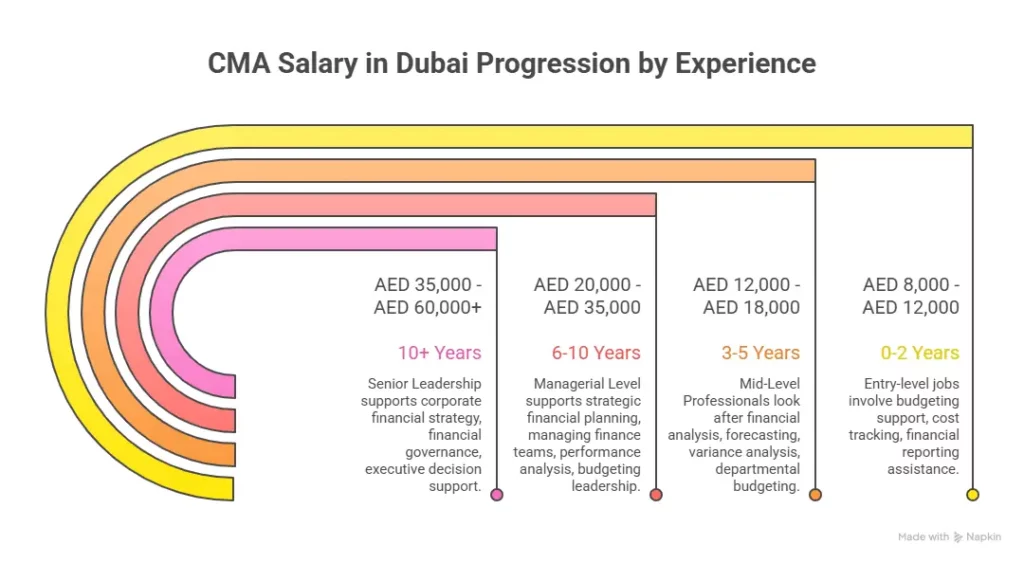

| Career Stage | Experience | Monthly AED | Annual AED |

| Fresher | 0 to 2 years | AED 9,000 to 14,000 | AED 108,000 to 168,000 |

| Early Mid-Level | 3 to 5 years | AED 14,000 to 20,000 | AED 168,000 to 240,000 |

| Mid to Senior | 6 to 9 years | AED 22,000 to 32,000 | AED 264,000 to 384,000 |

| Senior Leadership | 10 years and above | AED 38,000 to 65,000+ | AED 456,000 to 780,000+ |

Sources: IMA Middle East Salary Survey 2023, Gulf Talent Finance Report 2025

Many Dubai employers also supplement the base CMA monthly salary in Dubai with housing allowances, annual flights home, and health insurance. For expatriate professionals, this adds AED 2,000 to AED 5,000 in effective monthly value on top of the stated base salary.

Also Read: How to Choose the Best CMA Review Course for Your Preparation?

How Much Can Freshers Earn with a CMA Salary in Dubai?

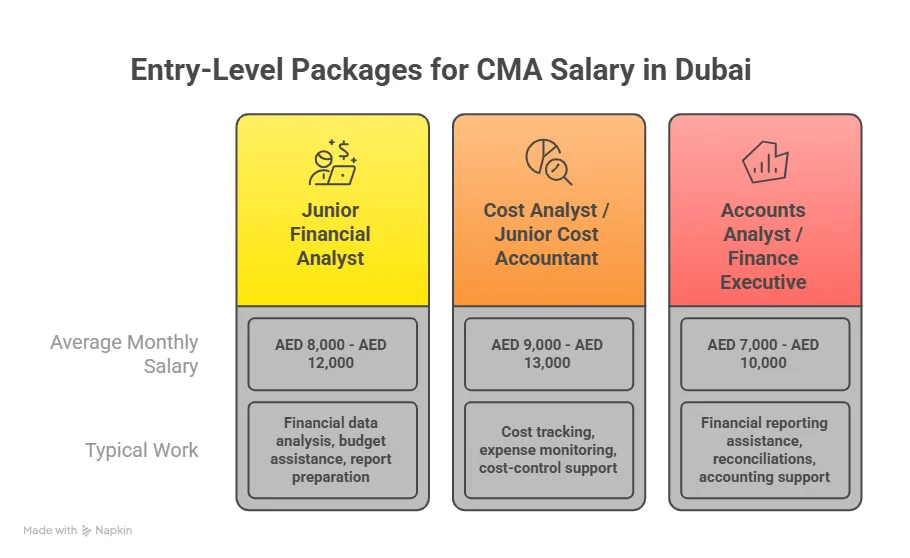

The first job in Dubai sets the trajectory for everything that follows. Industry, employer type, and the role’s proximity to planning work all shape how quickly the CMA USA fresher’s salary in Dubai grows from its starting point.

What pushes a fresher toward the higher end of that AED 9,000 to 14,000 range is largely preparation depth. Dubai employers hiring at the entry level are not just checking for certification. They are evaluating how quickly someone can become useful. Freshers who arrive with ERP system familiarity, practical understanding of cost structures, and clear communication skills in English routinely attract better opening offers.

The table below maps common entry-level CMA jobs in Dubai to their monthly AED ranges and INR equivalents.

| Entry-Level Role | Monthly AED | Annual AED | Annual INR Equivalent |

| Cost Accountant | AED 9,000 to 11,000 | AED 108,000 to 132,000 | ₹24 – 30 LPA |

| Junior Financial Analyst | AED 10,000 to 12,500 | AED 120,000 to 150,000 | ₹27 – 34 LPA |

| Management Reporting Associate | AED 10,500 to 13,000 | AED 126,000 to 156,000 | ₹29L – 36 LPA |

| Budgeting and Planning Analyst | AED 11,000 to 14,000 | AED 132,000 to 168,000 | ₹30 – 40 LPA |

The CMA fresher’s salary in Dubai in dirham is also shaped by employer category. A multinational regional office in a Dubai free zone will typically offer more than a mainland SME. A DIFC-licensed financial firm will offer more than either. Knowing which category of employer to target is as valuable as the certification itself.

How Pay Evolves Past the Five-Year Mark

The first five years of a CMA career in Dubai build technical competence and market credibility. Year six onwards is where compensation compounds noticeably. The shift is structural. Employers stop assigning tasks and start assigning ownership, and Dubai’s finance market prices that responsibility accordingly.

Here is what that transition looks like in practice:

- The role shifts from executing financial tasks to owning the planning cycle and performance narrative presented to leadership.

- Variable pay becomes a meaningful part of the package, with annual bonuses ranging from 10 to 30% of base salary at larger firms.

- Banking and private equity roles introduce profit participation structures that push total compensation well above the stated base figure.

- A finance manager on an AED 28,000 monthly base can effectively take home the equivalent of AED 35,000 once bonuses are annualised across the year.

- Professionals who reach senior levels fastest tend to make at least one lateral industry move before year eight.

Also Read: How the Certified Management Accountant Course Will Make You a Valuable Asset?

Industries-wise Pay for CMA Professionals in Dubai

Dubai is not one economy. It is several running in parallel. Banking, energy, real estate, healthcare, logistics, and technology all operate simultaneously. Each sector pays CMA professionals differently. The US CMA salary in Dubai varies more by industry than by most other single factors, including years of experience.

The table below shows sector-wise CMA USA salaries in Dubai ranges. These reflect current hiring benchmarks for mid-career professionals with four to seven years of experience.

| Industry | Annual Salary Range (AED) | Growth Trajectory |

| Banking and Financial Services | AED 250,000 to 400,000 | High |

| Oil, Gas and Energy | AED 220,000 to 350,000 | High |

| Real Estate and Construction | AED 200,000 to 320,000 | Medium to High |

| Healthcare and Pharma | AED 180,000 to 300,000 | Fast Growing |

| Technology and SaaS | AED 200,000 to 310,000 | Fast Growing |

| Retail and FMCG | AED 160,000 to 270,000 | Medium |

| Hospitality and Tourism | AED 150,000 to 260,000 | Stable |

(Sources: Gulf Talent Finance Market Report 2025, Bayt Salary Survey UAE 2024)

Banking and financial services sit at the top for a reason. The complexity of financial work in Dubai’s banking sector, covering regulatory reporting, capital allocation, and multi-currency treasury management, demands professionals who handle both technical precision and strategic judgment. The CMA job salary in Dubai in this sector reflects that demand directly.

Also Read: Who Can Apply for CMA? Complete Eligibility Criteria Explained?

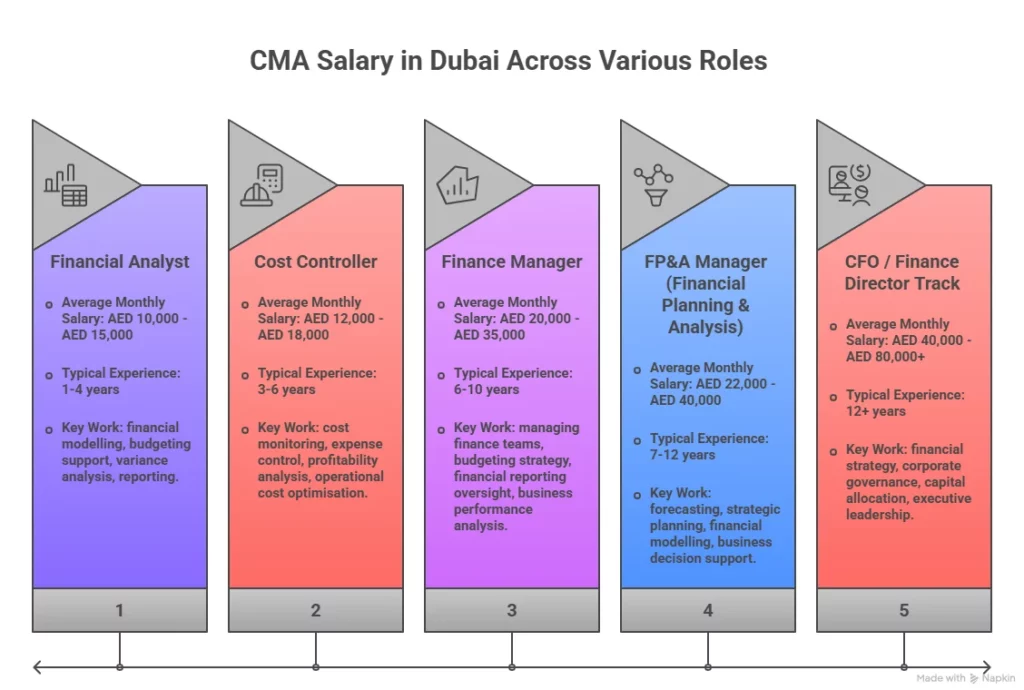

Role-Wise Breakdown for CMA Salary in Dubai

The CMA jobs salary in Dubai shifts considerably depending on what a professional does each day. Two people with the same years of experience can sit on opposite ends of the pay range if one manages cost reporting and the other drives the annual planning cycle.

Below is a role-wise view of the present CMA salary in Dubai, reflecting what employers currently pay across common finance positions held by CMA professionals.

| Role | Monthly AED | Annual AED |

| Cost Accountant | AED 9,000 to 13,000 | AED 108,000 to 156,000 |

| Financial Analyst | AED 12,000 to 18,000 | AED 144,000 to 216,000 |

| FP&A Manager | AED 18,000 to 26,000 | AED 216,000 to 312,000 |

| Finance Manager | AED 22,000 to 32,000 | AED 264,000 to 384,000 |

| Financial Controller | AED 28,000 to 42,000 | AED 336,000 to 504,000 |

| Head of Finance or CFO | AED 42,000 to 70,000+ | AED 504,000 to 840,000+ |

Sources: LinkedIn Salary Insights UAE, IMA Middle East Survey 2023

FP&A and Controller tracks consistently produce the strongest CMA accountant salary in Dubai outcomes. Both roles place the professional at the intersection of financial data and business decisions. Dubai employers spend their compensation budget most generously where finance directly influences outcomes.

Also Read: What Are The Benefits of Becoming a Certified Management Accountant?

DIFC, Free Zone, and Mainland: How Location Inside Dubai Shapes Your Pay

Two CMA professionals with identical qualifications and experience can receive offers that differ by AED 8,000 to 10,000 per month simply because one is joining a DIFC-licensed firm and the other is joining a mainland company three kilometres away.

- Dubai International Financial Centre (DIFC): Global banks, asset management companies, private equity firms, and audit firm headquarters operate here under a separate regulatory framework. Compensation structures in the DIFC often include performance bonuses and structured annual reviews.

- Free Zones (DMCC, JAFZA, Dubai Silicon Oasis, Dubai Internet City): Regional headquarters of multinational manufacturers, technology companies, and commodities traders populate these zones. The CMA USA salary structure in Dubai within free zones is competitive and internationally benchmarked.

- Mainland Dubai: The widest range exists here. Large family conglomerates and established mainland corporations pay well. Smaller mainland firms are more variable. A CMA evaluating a mainland offer needs to assess the employer’s scale, governance maturity, and finance team structure before accepting the package at face value to get the most CMA benefits.

A finance professional who targets DIFC or free zone employers deliberately, rather than applying broadly, improves their salary outcome before any negotiation begins.

Did You Know? The Dubai International Financial Centre houses over 4,500 registered companies, including more than 60 of the world’s top 100 banks. CMAs working within DIFC-licensed entities typically earn 15 to 25% above the city-wide average for equivalent roles.

The INR Equivalent of CMA Salary in Dubai

For Indian finance professionals, the Dubai decision often crystallises when the INR conversion is applied. The CMA course salary in Dubai, translated into rupees, produces figures that are difficult to match in India at equivalent career stages. The zero-tax structure makes the comparison even starker.

Exchange rate used: AED 1 equals approximately Rs. 23, based on RBI reference rate data.

| Career Stage | Monthly AED | Annual AED | Annual INR |

| Fresher | AED 9,000 to 14,000 | AED 108K to 168K | ₹25 – 39 LPA |

| Mid-Level | AED 14,000 to 22,000 | AED 168K to 264K | ₹40 – 60 LPA |

| Senior | AED 22,000 to 35,000 | AED 264K to 420K | ₹60 – 90+ LPA |

| Leadership | AED 42,000 to 70,000+ | AED 504K to 840K+ | ₹1 Cr+ per annum |

Sources: IMA Global Salary Survey 2023, Naukri Salary Insights India 2024, RBI Reference Rates

Consider a simple example. Someone earning AED 11,000 per month in Dubai keeps the full Rs. 30.4 lakhs annually. In India, earning Rs. 30 lakhs gross means paying roughly Rs. 6 to 7 lakhs in taxes. The Dubai fresher and a high-earning Indian professional are taking home nearly the same amount, but one is just starting.

Before mapping out a timeline toward the CMA salary in Dubai, one decision shapes everything that follows: which part to attempt first and how to sequence the preparation. Understanding how the syllabus is divided, where each part sits on the difficulty curve, helps candidates move through the certification efficiently and enter the Dubai job market without unnecessary delays.

Skills That Lift the CMA Salary in Dubai Above Market Average

Certification creates the floor. Skills determine the ceiling. The CMA average salary in Dubai at any experience level has a wide enough range that what a professional brings beyond the credential makes a genuine difference in where they land within it.

Dubai’s finance employers are specific about what they pay extra for. These capabilities consistently show up in higher-paying job descriptions across banking, technology, and energy sectors:

- Financial Modelling and Scenario Analysis: Professionals who build forward-looking models for investment decisions, cost restructuring, or expansion feasibility are valuable across every sector. This skill is especially rewarded in private equity-adjacent roles, real estate, and fast-growing tech companies.

- ERP System Proficiency: SAP S/4HANA, Oracle Fusion, and Microsoft Dynamics are used widely across Dubai’s large employers. A CMA who can extract, reconcile, and present ERP-generated data without relying on IT support shortens the onboarding curve. Employers pay for that speed.

- IFRS Application Knowledge: Dubai’s corporate sector reports under IFRS. CMAs who combine management accounting skills with a strong working knowledge of IFRS 15, IFRS 16, and IFRS 9 are especially valued in controller and reporting roles.

- Power BI and Data Visualisation: FP&A and finance business partner roles in Dubai increasingly expect candidates to present financial insights in executive-ready dashboards. Professionals who can translate a month-end close into a clear visual story for leadership reduce friction and add visible value immediately.

- Arabic Language Familiarity: Not a requirement in most firms, but a genuine differentiator in mainland and family office settings. Some employers in retail, hospitality, and government-linked entities factor this into the US CMA salary and jobs in Dubai evaluation.

For professionals targeting the CMA salary in Dubai, the certification is only as valuable as the speed at which it is earned. Knowing exactly how to approach Part 1 and Part 2 with a structured study plan, which topics carry the most weight, and where most first-attempt candidates lose marks, gives a measurable advantage before the process even begins.

Why Choose Imarticus Learning for Your CMA Journey

Reaching the upper tiers of CMA salary in Dubai begins with the quality of preparation, not just the fact of certification. The distance between passing the exams and being genuinely role-ready determines how quickly professionals earn well, and how much.

Imarticus Learning’s CMA Course preparation is structured around that transition:

- As a Gold Learning Partner of IMA USA, Imarticus holds formal recognition from the same body that awards the US CMA certification, the qualification that Dubai employers look for when hiring.

- The curriculum co-developed with KPMG in India is built around real business scenarios. Candidates learn how cost structures behave in actual organisations, not just in textbook frameworks.

- Internship exposure with KPMG in India for top-performing students offers early experience in how global professional services firms operate, a meaningful signal for Dubai-based employers evaluating candidates.

- AI-powered 24×7 tutor access and mock question banks allow candidates to prepare consistently, regardless of location or schedule.

- Monthly live sessions with industry practitioners keep preparation aligned with how finance roles are actually evolving in markets like Dubai and the wider GCC.

- A pre-placement bootcamp and soft skills programme ensures candidates can articulate their value clearly in interviews, which matters in Dubai’s competitive hiring environment.

- A money-back guarantee removes the financial risk from committing to structured preparation.

FAQs on CMA Salary in Dubai

Deciding to pursue a CMA career in Dubai raises practical questions that go well beyond salary tables and conversion figures. The answers below address the most frequently asked questions that candidates genuinely want to know before committing to the certification.

What Is the Salary of a CMA in Dubai?

The CMA salary in Dubai ranges from AED 9,000 per month for freshers to over AED 65,000 for senior leadership roles. Mid-career professionals with four to eight years of experience typically earn between AED 16,000 and AED 28,000 monthly, all tax-free.

In Which Country Is CMA Highly Paid?

The UAE consistently ranks among the highest-paying markets for US CMA professionals due to zero income tax. While the USA offers higher gross figures, the CMA salary in Dubai often delivers higher net income. Singapore and Qatar also offer strong packages.

Is CMA Worth It in Dubai?

Absolutely. The CMA salary in Dubai at the fresher level is already three to five times higher than equivalent Indian roles in real take-home terms. Across mid and senior levels, the gap widens further. Imarticus Learning’s CMA programme prepares candidates specifically for this market transition.

Can a CMA Fresher Get a Job in Dubai?

Yes. The CMA USA fresher’s salary in Dubai is well established across banking, real estate, and technology sectors. Employers actively hire fresh CMAs for cost accounting and FP&A roles. Structured preparation through Imarticus Learning strengthens interview performance and practical readiness significantly.

Could I Get CMA Jobs in Dubai?

Dubai consistently has openings for CMA-qualified professionals at every level. Active job portals like LinkedIn, Bayt, and GulfTalent list CMA-relevant roles regularly. Targeting FP&A and finance manager tracks, rather than general accounting roles, creates stronger long-term salary trajectories.

What Are the Career Prospects for a CMA in Dubai?

Career prospects are strong and growing. A CMA entering Dubai at a fresher level can realistically reach the finance manager level within seven to nine years, crossing AED 25,000 monthly. The DIFC environment opens further doors globally. Imarticus Learning prepares candidates for this full trajectory.

What Is the Starting Salary of a US-Certified CMA in Dubai?

The CMA USA starting salary in Dubai ranges from AED 9,000 to AED 14,000 per month. Candidates with ERP experience and practical internship exposure consistently reach the upper end. In INR terms, this translates to approximately Rs. 24.8 to Rs. 38.6 lakhs annually, fully tax-free.

Is CMA a Good Career Option?

The CMA salary in Dubai across career stages reflects consistent demand, a clear growth ladder, and global recognition. The US CMA is valued across the UAE, USA, Singapore, Canada, and Australia. Imarticus Learning’s CMA course offers IMA Gold Partner preparation to help candidates build their careers efficiently.

Where the CMA Salary in Dubai Takes You Next

Dubai rewards preparation more visibly than most markets. Zero taxation, a diversifying economy, consistent demand for planning-oriented finance talent, and internationally benchmarked salaries create an environment where a well-prepared CMA professional builds real financial momentum quickly.

The numbers across this guide are not aspirational estimates. They reflect what employers are actively paying right now. A fresher entering at AED 9,000 to 14,000. A mid-career professional at AED 22,000 to 32,000. A controller or finance head at AED 42,000 and above. Each stage is reachable and follows logically from the one before it.

The CMA salary in Dubai grows fastest when role depth and skill depth move together. Professionals who arrive well-prepared, target the right employers, and build planning-heavy careers consistently reach the upper tiers faster than the average timeline suggests. The CMA Program preparation at Imarticus Learning is built for exactly that kind of professional. Preparation is designed to shorten the distance between certification and real responsibility. That distance is where salary differences are made.