Chartered Financial Analyst (CFA) is one of the most valued investment and finance professional certifications. The CFA program is complete in the sense that it teaches enormous subjects of finance that give skills and knowledge of high caliber on financial analysis, investment management, and ethics.

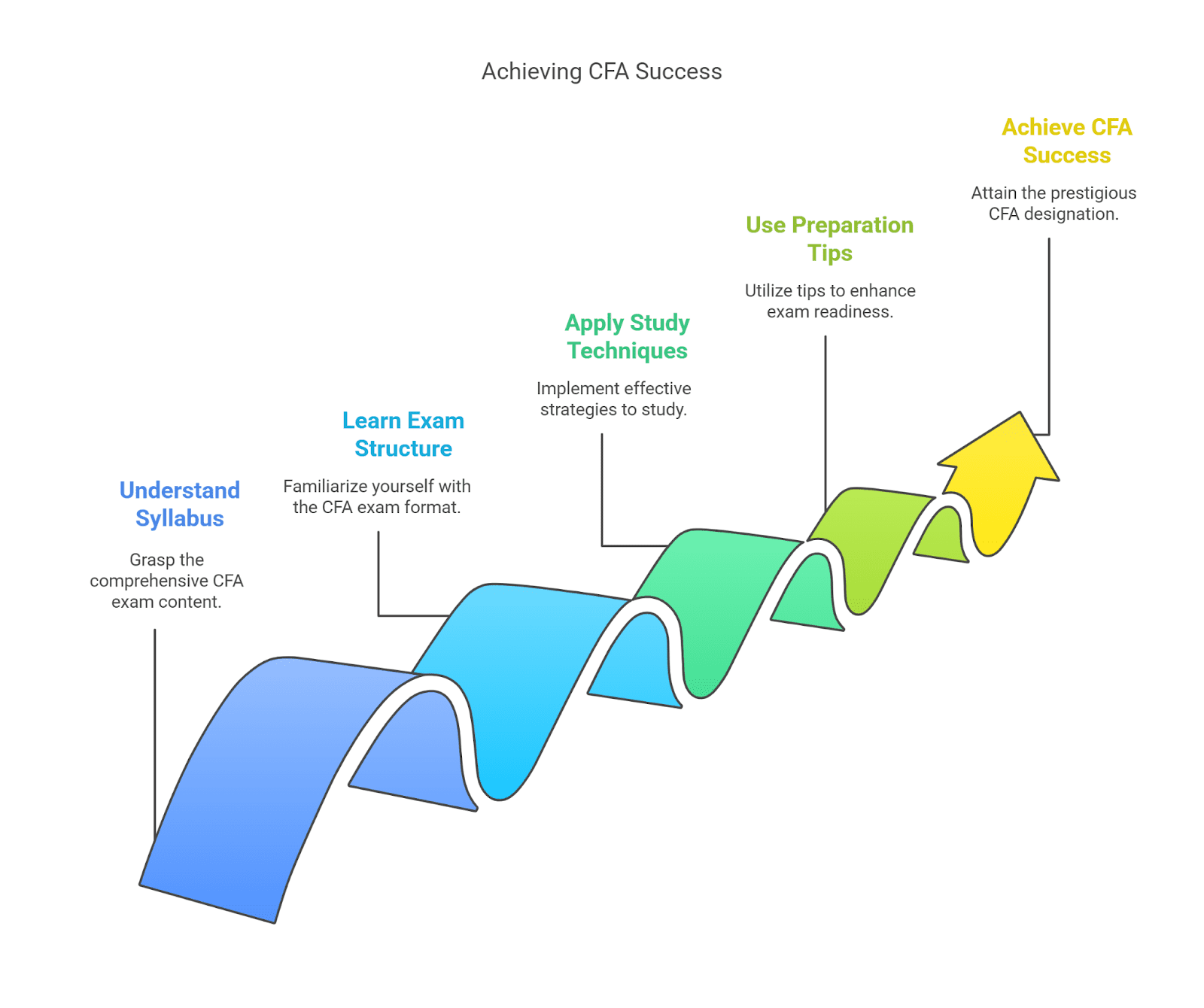

If you are going to appear for the CFA program, knowledge of the pattern of CFA syllabus and a clear idea of how to approach each section with proper study techniques can get you well prepared for the exam. This book gives an integrated overview of the CFA exam syllabus, study guide, and best tips to clear the exam.

Understanding the CFA Syllabus: An Overview

The CFA program comprises three levels – Level I, Level II, and Level III. All three levels are cumulative in nature, as they grow more difficult and deeper in topics.

The CFA syllabus review is planned in a way that it gives a good exposure of investment management in portfolio strategy and financial decision-making. The main study topics are:

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Financial Reporting and Analysis

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management and Wealth Planning

CFA Exam Syllabus Breakdown by Level

The levels of the CFA exam are structured to evaluate various skills. The below is the CFA curriculum breakdown into levels:

CFA Level I Syllabus: The Foundation Stage

The CFA Level I exam is purely based on studying basic concepts and principles of finance. The curriculum is so prepared that it acquaints the candidates with investment products and ethical practices.

Key Topics Covered in CFA Level I:

| Topic | Weightage (%) |

| Ethical and Professional Standards | 15–20% |

| Quantitative Methods | 8–12% |

| Economics | 8–12% |

| Financial Reporting and Analysis | 13–17% |

| Corporate Finance | 8–12% |

| Equity Investments | 10–12% |

| Fixed Income | 10–12% |

| Derivatives | 5–8% |

| Alternative Investments | 5–8% |

| Portfolio Management and Wealth Planning | 5–8% |

Study Strategy:

- Be more cautious with ethics as it is of higher percentage and will reflect your final mark.

- Regularly practice quantitative principles in an effort to create problem-solving.

- Create a clear concept of financial statements and valuation techniques.

CFA Level II Syllabus: Application and Analysis

The CFA Level II exam gets us one step closer to applying concepts to real-world investment situations. Level II examines the candidate’s ability to analyze and interpret sophisticated financial data.

Key Topics Covered in CFA Level II:

| Topic | Weightage (%) |

| Ethical and Professional Standards | 10–15% |

| Quantitative Methods | 5–10% |

| Economics | 5–10% |

| Financial Reporting and Analysis | 10–15% |

| Corporate Finance | 5–10% |

| Equity Investments | 10–15% |

| Fixed Income | 10–15% |

| Derivatives | 5–10% |

| Alternative Investments | 5–10% |

| Portfolio Management and Wealth Planning | 10–15% |

Study Strategy:

- Gain financial modeling skills to work on case studies.

- Use equity and fixed-income security valuation methods.

- Highlight portfolio management skills for investment decision-making.

CFA Level III Syllabus: Portfolio Management & Strategy

The CFA Level III exam is the final and toughest level. It covers portfolio management, asset allocation, and risk management strategies.

Key Topics Covered in CFA Level III:

| Topic | Weightage (%) |

| Ethical and Professional Standards | 10–15% |

| Economics and Capital Markets | 5–10% |

| Fixed Income | 10–15% |

| Equity Investments | 10–15% |

| Derivatives | 5–10% |

| Alternative Investments | 5–10% |

| Portfolio Management & Wealth Planning | 35–40% |

Study Strategy:

- Keep investment concepts technique-oriented as they are the building blocks of Level III.

- Comprehend applying investment concepts in a well-organized essay format (constructed response).

- Ensure focus on asset allocation and risk management strategies.

CFA Study Topics & Strategies for Success

1. Create a CFA Study Plan

- Dedicate 300-350 study hours per level.

- Divide the CFA syllabus into productive study sessions.

- Apply the 80/20 rule: Master high-weightage topics first.

2. Utilize CFA Study Materials Effectively

- Utilise formal CFA Institute curriculum for concept learning.

- Utilise Kaplan Schweser study guides to learn quickly.

- Utilise CFA mock tests and question banks for practice.

3. Master the CFA Exam Content

- The CFA exam is conducted through multiple choice (Level I), item set-based questions (Level II), and constructed response & item sets (Level III).

- Building time management skills to combat tough CFA exam questions.

4. Practice, Practice, and More Practice

- Practice minimum 1,500+ practice problems prior to exam.

- Attempt timed CFA mock exams to simulate exam pressure.

- Work on weak topics on regular intervals and employ problem-solving for concept reinforcement.

5. Join CFA Study Groups and Coaching

- Study with peer study groups for effective recall of concepts.

- Attend CFA coaching courses for expert instruction.

FAQs on the CFA Syllabus

1. What is the structure of the CFA syllabus?

The CFA syllabus has 10 foundation topics, from ethics to asset classes and investment products to portfolio management, distributed over three levels.

2. How many study hours per CFA level do I need to study?

The candidates have traditionally prepared 300-350 study hours per level for best preparation.

3. What CFA topic carries the maximum weightage?

Ethics and Portfolio Management carry high weightages in all three levels.

4. Which are the toughest subjects of CFA syllabus?

Financial Reporting & Analysis, Fixed Income, and Portfolio Management are tough subjects for most of the candidates.

5. Is CFA Level I syllabus tough?

Although having easy subjects in Level I, there should be great analytical ability and ample practice.

6. How to memorize formulas in CFA best?

Flashcards, formula charts, and merciless exercises are utilized for memorizing cumbersome formulas.

7. Is the CFA syllabus annual?

Yes, the CFA Institute updates the syllabus on an annual basis with regard to industry advancements.

8. Am I required to study CFA material linearly?

Yes, study the proposed sequence—start with Ethics and work through to Investments and Portfolio Management.

Conclusion

CFA requires discipline, routine study, and intelligent preparation. By prudent preparation through organized studies, the use of study guides, and round-the-clock practice, candidates find it easy to pass CFA levels.

CFA certification is a milestone in your financial career, with opportunities to earn exposure to senior-level professional jobs and international clients. Your goal to become a financial analyst, investment banker, or portfolio manager will be greatly improved by passing the CFA program. Start your CFA career today and be part of the best finance professionals in the marketplace!