Financial markets are an essential component of the global economy, as they facilitate the efficient allocation of resources and the efficient sharing of risk. This article will provide an overview and cover topics such as the types of markets in India, their significance, and their challenges.

Moreover, the article will include a discussion of the government policies that have been put in place to facilitate the functioning of the financial markets in India.

Introduction

Financial markets refer to the various mechanisms and institutions through which investors can buy and sell financial instruments such as stocks, bonds, commodities, and derivatives. These markets provide a platform for investors to manage their financial portfolios and move the capital from one asset class to another.

India’s markets have grown significantly in recent years, with the country’s stock exchanges, banks, and mutual funds all expanding rapidly. The Indian markets are subject to domestic and international regulations and the influence of global economic and political forces.

Moreover, the Indian mutual fund industry is the fastest-growing in the world and has seen an increase of 5 fold spanning 2012 and 2022. The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) support more than 6,500 listed companies.

How Do Financial Markets Function in The Indian Economy

Financial Markets are India’s primary sources of capital formation, providing funds for economic investments. The role of financial markets can be summarised in the points below.

- Financial markets facilitate efficient capital allocation by providing a platform for investors to purchase and sell financial assets like stocks, bonds, and derivatives.

- These are an essential source of capital for businesses, allowing them to raise funds for growth and expansion.

- These provide a way for governments to raise capital for public investments and to manage their debt.

- These markets enable businesses and individuals to risk by providing a way to hedge against adverse price movements.

- Financial markets advertise the efficient transfer of savings from savers to investors, allowing for economic growth.

- These markets provide a platform for companies to issue and trade securities, facilitating corporate governance and providing information to investors.

- These markets offer pricing information, which helps investors assess the value of assets and make informed decisions.

- These markets promote economic stability by providing liquidity to markets during times of crisis.

- These markets pave the way for investors to diversify their portfolios, reducing the risks associated with investing in a single asset.

Challenges Faced by Indian Financial Markets

One of the most challenging encounters faced by the Indian markets is low levels of financial literacy. It creates an imbalance in the market, leading to the miss-selling of financial products and services. Apart from this, other factors contribute, such as:

- Volatility: The Indian markets are highly volatile, making it difficult for investors to predict future trends.

- Poor Liquidity: Low liquidity in the Indian markets makes it hard for investors to buy and sell shares quickly, leading to price volatility.

- Lack of Transparency: The Indian financial markets lack transparency, making it difficult for investors to make informed decisions.

- Lack of Regulatory Oversight: A potent regulator is needed to protect their investments.

- Poor Infrastructure: Poor infrastructure in the Indian financial markets makes it difficult for investors to access reliable and up-to-date data.

- Taxation: High taxes and complex regulations make investing in the Indian markets costly.

To Sum Up

The financial markets of the Indian economy are significant for the country’s economic development. Providing liquidity to the markets enables companies to finance their operations and investments and improve their productivity. The Indian financial markets are highly regulated by the Securities and Exchange Board of India (SEBI).

This regulatory body ensures that the markets are transparent and secure. It also sets the rules and regulations that govern the conduct of the markets, such as the listing and trading of securities. Moreover, SEBI is responsible for developing the markets, such as introducing new products and services and taking measures to ensure investor protection.

In recent years, the Indian markets have undergone significant changes. They have become more transparent, efficient and well-regulated. It has increased the flow of capital into the Indian economy, allowing businesses to expand and improving economic growth.

In conclusion, the markets in the Indian economy are of great importance for economic development. They are highly regulated, efficient and accessible to a broader range of investors. They facilitate capital formation, enabling companies to finance their operations and investments and improving economic growth. It has made them a crucial part of the Indian economy.

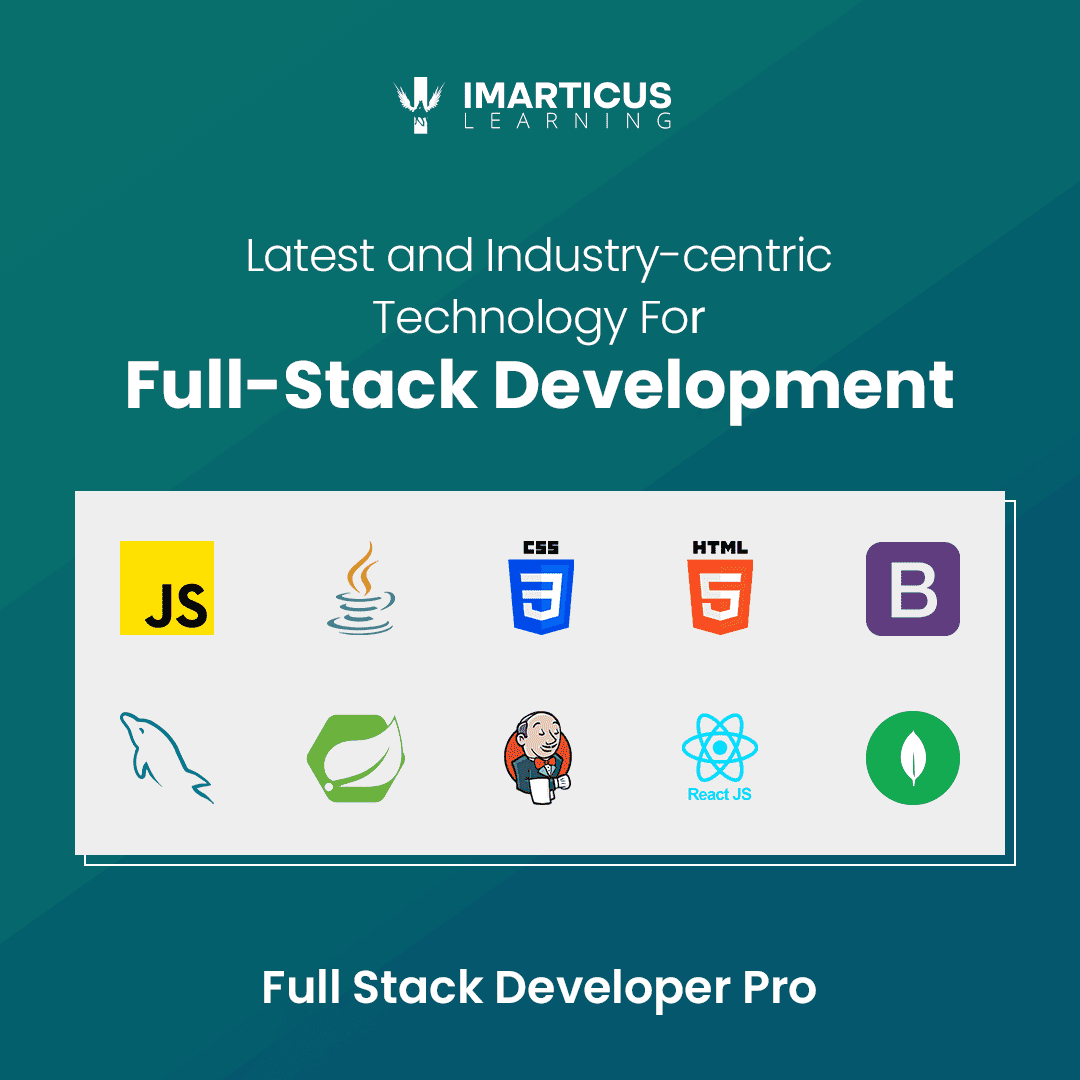

Why Choose An MBA in Fintech

An MBA in Fintech training program is an excellent choice for those looking to develop their financial knowledge and skills. Learn Fintech in one of the highest-grossing courses offered by Imarticus in collaboration with KL University.

By pursuing an MBA in Fintech, you will gain specialised knowledge and skills which will equip you to become a leader in the ever-growing world of finance.

You will gain an understanding of the latest technological advances and how they can be applied to the financial industry. Additionally, as the financial sector is becoming increasingly complex, an MBA in Fintech will give you the skills necessary to stay ahead of the competition.