Last updated on November 14th, 2025 at 10:07 am

Have you ever dreamed of working with the Big 4, building a global finance career, or even landing opportunities abroad – but felt that without a CA it wasn’t possible? The fact of the matter is that you don’t have to endure 4-5 years of poor pass rates and inflexible exam cycles to achieve that.

With ACCA, you can start right after Class 12 and, in 2-3 years, complete the qualification. You could be working in international roles which are recognised in 180+ countries. If you’re considering how to begin, you may want to explore structured ACCA course that can help you plan your journey more effectively. It is your time to think higher, dream bigger, and a global career can become a reality sooner than you think.

Employers from the Big 4 Accounting Firms (Deloitte, PwC, EY and KPMG) to Fortune 500 companies (JP Morgan and Unilever) are all actively looking for ACCA people because of the depth of their technical knowledge, ethical framework and international harmonisation.

Considering ACCA?

Get personalized guidance on your ACCA journey—eligibility, exam roadmap, and career outcomes in a 15-minute call with our expert counsellor.

No commitment required • 200+ students counselled this month

We have developed this guide to provide a comprehensive overview of ACCA in 2025. We will cover the qualification, the structure, exam level, pass rates, your career scope, salary trends, and comparisons to other global certifications like CPA (US) and CFA.

By the end of this guide, you will be able to answer the question: What is ACCA and how can ACCA boost your career?

What is ACCA?

The Association of Chartered Certified Accountants (ACCA) began in 1904 in London, UK, with the purpose of making accounting a career available to people of all backgrounds – not just the privileged. More than 120 years later, it has evolved into a multinational organisation that:

- Supports 257,900 fully qualified members and 530,100 students.

- Operates across 180+ countries.

- Works with more than 7,600 approved employers.

- Maintains 110 offices and learning centres worldwide (ACCA Global).

The ACCA qualification is considered one of the gold standards in professional accountancy, comparable to the US CPA or the Indian CA, but with a much stronger international scope. Understanding what is ACCA is crucial for anyone aspiring to a global finance career.

Why ACCA Matters in Today’s Finance World?

The financial industry has changed dramatically in the last decade. Accountants are no longer just “number crunchers.” Instead, they are expected to be:

- Strategic decision-makers guiding business growth.

- Technology leaders who can analyse data and implement automation tools.

- Ethical advisors in governance, compliance, and sustainability.

According to the Global Talent Trends 2025 survey by ACCA:

- 52% of professionals think of qualifications like ACCA as an entry point to becoming an entrepreneur.

- 43% of Gen Z professionals work several jobs or side hustles, underscoring a stronger need for flexibility in finance positions.

- 41% expect annual pay increases of over 11%, proving the high earning potential of the profession.

In this context, ACCA-qualified professionals are particularly esteemed because they combine:

- Technical mastery (accounting, taxation, audit, finance).

- Strategic vision (leadership, risk management, business analysis).

- Global recognition (accepted in 180+ countries).

Why Build a Global Accounting Career with ACCA?

In an internationalised world where companies function spanning borders, finance professionals must have skills and qualifications that travel with them. This is where ACCA truly stands out.

International Recognition

ACCA is recognised in 180+ countries, making it one of the most portable qualifications in the finance world. Mutual recognition agreements with CPA Canada, CA ANZ (Australia and New Zealand), and HKICPA give ACCA members added pathways to global credentials.

Global Job Market Demand

According to ACCA Global’s Report:

- 74% of employers believe ACCA prepares professionals for international business challenges.

- 68% of ACCA members work in multinational corporations or roles with cross-border responsibilities.

Career Mobility

Whether you’re in London, Dubai, Mumbai, or Singapore, the ACCA designation signals credibility. It allows professionals to:

- Work in multinational corporations.

- Transition easily between countries.

Take advantage of professional prospects in globally renowned financial hubs such as the United Kingdom, the United Arab Emirates, Singapore & Hong Kong.

Global Advantage in a Globalised Economy

Unlike region-specific qualifications like India’s CA or US CPA, the ACCA qualification equips professionals with:

- A broader and international accounting framework (IFRS standards).

- Increased exposure to international taxation and compliance.

- Skillsets that match the structure and accounts of a multinational organisation.

In short, ACCA is more than a qualification for finance professionals; ACCA is a globalised career license, unlocking your career potential.

Benefits of Pursuing the ACCA Course

There are both tangible & intangible benefits related to choosing ACCA that provide better career prospects than other accounting or accounting-related qualifications/certifications.

Key benefits of ACCA at a glance

| Benefit | Why It Matters |

| Global Recognition | Accepted in 180+ countries, enabling international mobility. |

| Career Opportunities | Opens roles in audit, taxation, consulting, corporate finance, and leadership. |

| Higher Salaries | ACCA professionals in India earn ₹8-10 LPA as freshers, while senior leaders earn ₹30-50 LPA+. |

| Flexible Learning | Exams are available 4 times a year with multiple entry routes and exemptions. |

| Technology & Future-Readiness | Updated syllabus covers AI, data analytics, ESG reporting, and digital finance. |

| Prestige & Credibility | Employers value ACCA as proof of technical competence and ethical grounding. |

| Continuous Learning | Mandatory CPD ensures members remain updated with industry changes. |

| Long-Term Career Growth | ACCA members are 50% more likely to reach senior leadership roles like CFO compared to non-ACCA professionals (source: ACCA Careers Survey 2025). |

The qualification also offers flexibility to branch into entrepreneurship, consulting, or fintech roles.

Work-Life Balance & Flexibility

- With computer-based exams and digital learning resources, the ACCA course can be pursued alongside work or other studies.

- Professionals can complete ACCA in 2-3 years, depending on exemptions, which is faster than becoming a CA.

When you choose ACCA, you are not just earning a certificate but also securing a truly global career, having a high earning capacity, and will always be relevant.

What is ACCA Course Eligibility

One of the reasons ACCA picks up such a varied student population is the wide range of entry criteria. Students, graduates, and working professionals can take it as long as they meet some minimum requirements.

Minimum Admission Requirements

- 12th grade (10+2) with 65% in Accounts/Mathematics and English, and 50% in other subjects.

Warning: If applicants do not meet those minimum marks, they can still start down the Foundations in Accountancy (FIA) road, leading to the ACCA qualification.

Graduate and Postgraduate Students

- B.Com, BBA, or MBA graduates are directly eligible for the main ACCA program.

- Professional qualifications like CA, CMA, and CS can fetch subject exemptions.

International Students

- Must have completed an equivalent of high school (10+2) in their country.

- Proof of English proficiency (like IELTS) may be required in certain regions.

This makes ACCA eligibility fairly broad, making it one of the easiest global accounting qualifications to access in contrast to CA or CPA, which have more rigid entry standards.

Structure of the ACCA Qualification

The ACCA journey is structured into three exam levels, an Ethics module, and a Practical Experience Requirement (PER).

ACCA Qualification Structure (2025)

| Level | Papers / Modules | Focus Area |

| Applied Knowledge | Business & Technology (BT), Management Accounting (MA), Financial Accounting (FA) | Basics of finance and business |

| Applied Skills | Corporate & Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit & Assurance (AA), Financial Management (FM) | Technical and analytical skills |

| Strategic Professional | Essentials: Strategic Business Leader (SBL), Strategic Business Reporting (SBR). Options (choose 2): AFM, APM, ATX, AAA | Advanced strategy, leadership & specialisation |

| Ethics & Professional Skills Module (EPSM) | One compulsory module | Professional ethics, leadership, and communication |

| Practical Experience Requirement (PER) | 36 months of work experience | Real-world application of ACCA skills |

This structured pathway ensures students not only pass exams but also become well-rounded finance leaders. Understanding the ACCA subjects is key to navigating this structure.

Get the Full ACCA Exam Resources Here

What are ACCA PER Requirements?

Apart from clearing exams, ACCA requires candidates to complete Practical Experience Requirements (PER) to become a fully qualified member.

Key PER

- 36 months (3 years) of relevant work experience in finance, accounting, or auditing.

- Work can be done before, during, or after the exams.

- Experience must cover at least 9 performance objectives, out of which 5 are essential (like ethics, professionalism, corporate reporting).

Why PER Matters

- Ensures candidates gain real-world application of ACCA concepts.

- Builds employability—graduates with PER are ready for leadership roles.

- Employers recognise PER as proof of a well-rounded professional.

In short, PER bridges the gap between academic knowledge and workplace competence.

What is ACCA Course Duration?

One of the most significant advantages of ACCA is the flexibility that it offers with regard to completing it. There is the option to run through the content very quickly or to take your time if your personal or professional commitments require that.

Overall Duration of ACCA

For graduates who have received exemptions, ACCA takes on average 2-3 years to complete; for students commencing immediately after Class 12, ACCA typically takes 3-4 years to complete. However, the ACCA completion timeframe varies depending on:

- The number of exemptions awarded (if any).

- How many exams does a candidate attempt per session?

- The ability to balance studies alongside work.

ACCA Syllabus and Exam Structure

The ACCA syllabus is divided into three levels, with 13 exams in total (before exemptions):

| ACCA Level | Number of Papers | Suggested Time to Complete |

| Applied Knowledge | 3 | 6 months |

| Applied Skills | 6 | 12-18 months |

| Strategic Professional | 4 | 12-18 months |

That means a fresh candidate without exemptions will take around 3 to 4 years, while those with a B.Com or CA background may finish in 2 to 2.5 years. The ACCA course duration is a key factor for many.

ACCA Exam Sessions

- ACCA exams are conducted four times a year: March, June, September, and December.

- Students can attempt up to 4 papers per session and a maximum of 8 papers in a year.

- With focused preparation, a motivated student can fast-track the qualification.

ACCA Pathway Examples

| Student Profile | Duration for Exams & Syllabus | Explanation |

| Class 12th Pass | 3-4 years | Starts from Applied Knowledge, no exemptions |

| B.Com Graduate | 2.5-3 years | Gets exemptions in some Applied Knowledge/Skills papers |

| CA Inter / CMA | 1.5-2 years | Major exemptions directly enter the Skills or Strategic level |

Important Note regarding PER: Regardless of how quickly students pass their exams, students are still required to have completed 36 months of Practical Experience Requirement (PER). PER usually runs concurrently with the exams (at least it is designed to), but in some instances, it may prolong how long it takes to finish.

What are ACCA Exemptions?

Exemptions allow students with prior qualifications to skip certain exams, saving time and effort.

Who is Eligible for ACCA Exemptions?

- Commerce Graduates (B.Com, M.Com) – Exempted from some Applied Knowledge/Applied Skills papers.

- CA / CA Inter – Multiple exemptions depending on completion stage.

- CMA, CS, MBA – May receive exemptions for specific subjects.

Important Notes

- Exemptions are not automatic; they must be applied for and approved by ACCA.

- Students still pay a fee per exemption.

- Exemptions do not reduce the PER requirement – work experience is still mandatory.

By using exemptions strategically, students can cut down the ACCA course duration and move faster toward becoming ACCA-qualified.

Candidates can check for applicable exemptions at the ACCA Exemption Calculator.

ACCA Exams: Levels, Subjects & Pass Rates

Understanding recent pass rates offers a perspective on exam difficulty and preparation strategies.

Overall ACCA Exam Stats (June 2025 Sitting)

- 111,639 students registered, with 128,651 exams completed.

- 4,527 candidates achieved affiliate status, completing all ACCA requirements. (ACCA Global)

Pass Rates by Paper (June 2025)

| Level | Paper | Pass Rate % |

| Applied Knowledge | Business & Technology (BT) | 88% |

| Financial Accounting (FA) | 68% | |

| Management Accounting (MA) | 64% | |

| Applied Skills | Corporate & Business Law (LW) | 81% |

| Taxation (TX) | 54% | |

| Financial Reporting (FR) | 50% | |

| Performance Management (PM) | 43% | |

| Financial Management (FM) | 48% | |

| Audit and Assurance (AA) | 44% | |

| Strategic Professional | Strategic Business Leader (SBL) | 51% |

| Strategic Business Reporting (SBR) | 49% | |

| Advanced Audit and Assurance (AAA) | 40% | |

| Advanced Financial Management (AFM) | 46% | |

| Advanced Performance Management (APM) | 40% | |

| Advanced Taxation (ATX) | 49% |

The ACCA Applied Knowledge level sees high pass rates, typically above 60-80%, as its focus is on foundational principles.

The ACCA Strategic Professional level is the most challenging, with pass rates between 40-51%, reflective of the depth and case-study style exams.

The higher-level ACCA exams are tougher because they test not just technical knowledge but also application in real-world business scenarios. This comprehensive understanding of ACCA subjects is vital.

Looking for smart ways to prepare? Explore our best free ACCA resources in this video to kickstart your journey with the right guidance.

Why Students and Professionals Choose ACCA?

ACCA distinguishes itself by bridging academic rigour with practical relevance, offering a framework that resonates with both emerging students and experienced professionals.

For students, it represents a structured pathway into the financial world that prioritises adaptability and future-oriented skills.

For professionals, it provides a means to remain competitive in a marketplace defined by technological change, regulatory evolution, and cross-border business dynamics.

Global Prestige and Recognition

ACCA member status is recognised and respected by employers around the world and is often seen as equivalent to master’s level qualifications, making the professionals very marketable globally. This outlines the answer to what ACCA is in terms of prestige.

Wide Variety of Career Options

Obtaining the ACCA qualification opens many different career paths in auditing, financial management, taxation, corporate finance, risk management and consulting. Employers include Big Four firms, multinational companies, government organisations and start-up ventures.

Competitive Salaries and Promotions

ACCA qualified professionals in India can expect salaries in the range of ₹6 lakh to ₹25 lakh per annum, depending on their experience and job function, along with multi-national experience, garnering even higher salaries at the senior level.

Worldwide, ACCA registered members have significant increases in salary and promotions due to the extensive skills and strategic understanding gained through their qualification. This is a fundamental part of ACCA salary and overall earning potential.

Continuous Professional Development

ACCA places a high focus on lifelong learning with its required CPD (Continuing Professional Development), which equally maintains or expands on the high standards of performance in the ever-changing environment of accounting and finance, and the rapid changes in technology.

Flexibility and Accessibility

Offered every year, the ACCA qualifications allow candidates to choose multiple sittings and also exemptions to build their own learning journey from prior learning qualifications.

With all of your exams being computer-based and the use of technology for your study, ACCA permits you to study and sit your exams anywhere in the world and supports working professionals to develop their careers.

Trends Shaping the Future of ACCA in 2025

The market for ACCAs is driven by these primary global trends:

- Digital Finance Transformation: Analytics, AI and Cloud finance skills are now embedded into the ACCA syllabus.

- Sustainability & ESG Reporting: Companies are required to present sustainability metrics, and ACCA are leading.

- Remote Work & International Careers: ACCA professionals are finding opportunities across borders faster than ever.

- Post-Pandemic Recovery: ACCA professionals are forging their companies’ corporate recovery and restructuring.

How to Start Your ACCA Journey

Deciding to start ACCA is a significant step; however, as you’ll see, the process can be straightforward when broken up into some simple steps. Unlike many professional qualifications, the ACCA offers various entry paths, exemptions and study modes, which makes it a popular choice for students and working professionals.

Step 1: Register on ACCA Global

Your first step is to register as a student on the official ACCA Global website. This will allow you access to the ACCA portal, resources for study, and important updates.

You can register at any time during the year; however, it is best to bring your registration in line with the next exam session.

Step 2: Check the Eligibility

In order to register for ACCA in India, the basic eligibility requirement is a Class 12th qualification with Accounts and Maths with at least 65% in both subjects and at least 50% in other subjects. Many graduates (B.Com, BBA, MBA) or other professionals (CA, CMA, CS) are also eligible, often with exemptions.

If you do not meet these criteria, you also have the option to start with the Foundations in Accountancy (FIA) qualifications that allow you to get into ACCA later on. This qualification covers the important ACCA eligibility criteria.

Step 3: Choose a Learning Partner

You can study ACCA on your own; however, the majority of students study with the help of structured coaching. Enrolling with an Approved Learning Partner (ALP) such as Imarticus Learning ensures you get live online classes, mock tests, mentorship, and exam prep tailored to ACCA’s standards.

It offers ACCA coaching in collaboration with KPMG India, backed by Kaplan content, live classes, and a placement guarantee. This increases your chances of clearing papers on the first attempt.

Step 4: Plan Exam Progression

The ACCA qualification has three levels and 13 exams (before exemptions). Plan how many papers you’ll attempt each session. Many students aim to finish in 2-3 years by giving 2-3 exams per sitting. Working professionals may prefer a slower pace.

Step 5: Complete PER & EPSM Alongside Exams

To become a fully qualified ACCA member, you must complete 36 months of Practical Experience Requirement (PER) and the Ethics and Professional Skills Module (EPSM). It’s recommended to pursue these alongside your exams, so you don’t face delays after finishing the syllabus.

Step 6: Stay Consistent and Network

Consistency is the key to cracking ACCA. Build a study routine, track your progress, and stay updated with exam changes. Engage with ACCA student communities, LinkedIn groups, and forums to exchange resources and experiences. Networking with peers and mentors can also open doors to internships and job opportunities.

By following these steps strategically, you can ensure a smooth ACCA journey and position yourself for a rewarding global career in finance and accounting.

Life After ACCA: Career Paths

For ACCA-qualified professionals, the designation is a launchpad into a spectrum of specialised and leadership-oriented careers. The strength of ACCA lies in its global portability and its integration of finance, strategy, and governance, enabling members to transition seamlessly across industries and geographies.

Graduates often find themselves in roles that extend well beyond traditional accounting, managing cross-border mergers, leading sustainability reporting, steering financial transformation projects, or shaping corporate strategy in multinational firms, to name a few.

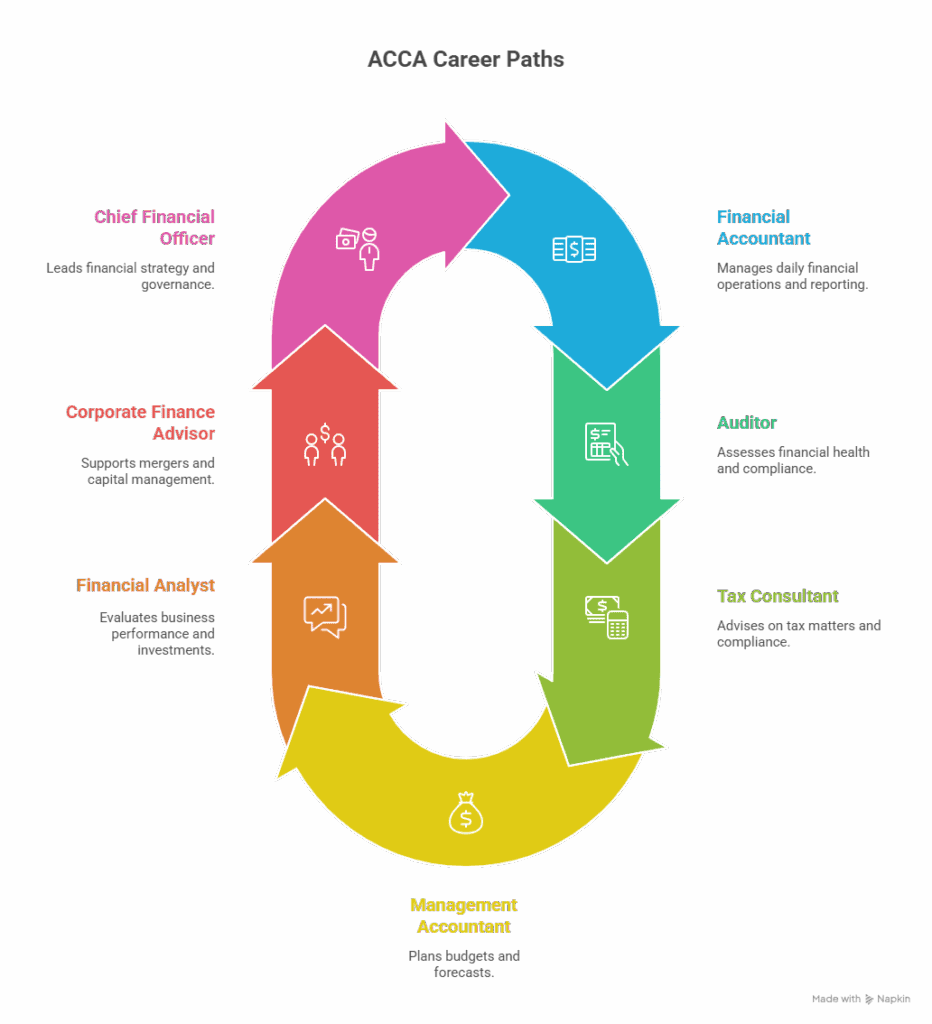

Career Opportunities with ACCA

ACCA members work in a variety of roles, including but not limited to:

- Financial Accountant: Handling daily financial operations, reporting, and compliance.

- Auditor: Conducting audits to assess financial health and compliance.

- Tax Consultant: Advising organisations on tax matters and compliance.

- Management Accountant: Budgeting, forecasting, and financial planning.

- Financial Analyst: Evaluating business performance and investment opportunities.

- Corporate Finance Advisor: Supporting mergers, acquisitions, and capital management.

- Chief Financial Officer (CFO): Leading financial strategy and governance.

Additional growing roles include:

- Forensic Accountant: Investigating financial discrepancies and fraud using data analytics.

- Risk Manager: Identifying and managing financial and operational risks within organisations.

- Internal Auditor: Monitoring internal controls and compliance to improve organisational processes.

- Compliance Officer: Ensuring adherence to statutory regulations and corporate policies.

- Business Consultant: Providing strategic advice on financial management and efficiency improvements.

- Financial Controller: Overseeing the company’s accounting functions and financial reporting.

- Treasury Analyst: Managing company cash flow, investments, and financial risk.

- Sustainability Reporting Specialist: Preparing ESG (Environmental, Social, and Governance) reports aligned with global standards.

Roles in financial technology (FinTech) and digital finance transformation are also growing rapidly, as businesses adopt advanced analytics and automation in financial functions.

Because ACCA is globally recognised, professionals can pursue opportunities across diverse industries—including banking and financial services, consulting, government agencies, multinational corporations, startups, and non-profits—allowing flexibility and upward mobility in their careers worldwide.

Student Testimonial → ACCA learner success stories

Rishabh Rai’s ACCA Journey: Transforming Careers with Imarticus Learning – YouTube

ACCA Scope and Salary in India and Abroad

One of the biggest reasons students choose ACCA is the global career scope it offers. The qualification is recognised in 180+ countries, including the UK, Canada, UAE, Singapore, and Australia, making it a powerful passport to international opportunities.

ACCA Scope in India

In India, demand for ACCA professionals has grown rapidly due to the adoption of IFRS (International Financial Reporting Standards), the entry of multinational companies, and the Big 4 accounting firms’ expansion of their operations.

Top recruiters include EY, PwC, Deloitte, KPMG, BDO, Grant Thornton, Accenture, and TCS. With India’s growing integration into global markets, ACCAs are increasingly hired for roles traditionally reserved for CAs. Understanding what is ACCA in accounting in the Indian context is vital.

ACCA Scope Abroad

Internationally, ACCA members are highly valued for their expertise in accounting, auditing, and financial strategy. Countries like the UK, UAE, Canada, and Singapore actively hire ACCA professionals across banking, consulting, and corporate finance. ACCA is considered a direct route to leadership roles like Finance Manager, CFO, or Partner in global firms.

Average Salaries of ACCA Professionals

One of the biggest advantages of becoming ACCA-qualified is the strong salary potential it offers. From entry-level roles to senior leadership, ACCA professionals enjoy competitive pay in India and abroad, reflecting the global value of the qualification.

Here are a few roles in which you can work after becoming an ACCA:

- Financial Analysts

- India: ₹6-8 LPA

- Abroad: $55,000 – $65,000

- Management Accountant

- India: ₹7-10 LPA

- Abroad: $60,000 – $70,000

- Statutory Auditors

- India: ₹8-12 LPA

- Abroad: $65,000 – $75,000

- Taxation Managers

- India: ₹9-14 LPA

- Abroad: $70,000 – $80,000

- Risk & Compliance Manager

- India: ₹10-15 LPA

- Abroad: $75,000 – $90,000

- Finance Managers

- India: ₹12-18 LPA

- Abroad: $80,000 – $100,000

And for the truly experienced folks at the top, a CFO with over a decade of experience could be looking at well over ₹40 LPA in India – and a fantastic $150,000 – $200,000 abroad!

Note: Salaries vary based on location, employer, and years of experience.

Top Countries Hiring ACCA Professionals

Employers recognise the rigour of ACCA and reward its members with compensation packages that reflect both global credibility and strategic capability.

What sets ACCA apart is the breadth of opportunities: professionals can begin with competitive salaries in analytical and managerial roles, and over time, progress into leadership positions where remuneration scales sharply.

| Country | Average Salary Range (USD) | Popular Roles |

| United Kingdom | $55,000 – $120,000 | Auditor, Tax Consultant, Finance Manager |

| United Arab Emirates | $65,000 – $110,000 | Risk Manager, CFO, Management Accountant |

| Singapore | $60,000 – $115,000 | Financial Analyst, Treasury Manager, Controller |

| Canada | $60,000 – $105,000 | Auditor, Compliance Officer, Finance Manager |

| Australia | $65,000 – $110,000 | Corporate Finance Advisor, Financial Controller |

Key Notes:

- In India, Fresh ACCA affiliates start at ₹6-8 LPA, with senior roles crossing ₹40 LPA.

- Abroad: Salaries are significantly higher, with mid-level managers easily earning $70,000-$100,000 annually.

- Career growth is faster due to ACCA’s global recognition and employer demand.

Clearly, ACCA is not just a certification but a career accelerator, opening high-paying roles both in India and internationally. The ACCA salary overview confirms its lucrative nature.

ACCA vs Other Global Finance Certifications

Many students compare ACCA with CPA (US), CA (India), and CFA. Here’s a quick breakdown:

| Certification | Duration | Recognition | Focus Area | Difficulty | Cost |

| ACCA | 2-3 years | Global (180+ countries) | Accounting, Finance, Strategy | Moderate-High | ₹2.5-3.5 L |

| CPA (US) | 1-1.5 years | US + some global recognised | Accounting, Audit, Tax | High | ₹2-2.5 L |

| CA (India) | 4-5 years | India | Accounting, Audit, Law | Very High | Low |

| CFA | 2-4 years | Global | Investments, Portfolio Management | High | ₹3-4 L |

For those seeking international mobility and career diversity, ACCA stands out.

Watch Video → ACCA vs CMA vs CFA vs CPA vs FRM – Best Global Finance Certification After B.Com?

Why Choose Imarticus Learning for ACCA Training in 2025?

Choosing Imarticus Learning ensures a robust and career-aligned ACCA preparation experience:

Gold Status ACCA Learning Partner

- Imarticus is recognised as a Gold Status Learning Partner by ACCA globally, demonstrating commitment to quality education and an updated curriculum.

Collaboration with KPMG India

- Courses offered in partnership with KPMG India bring industry-relevant insights and practical exposure.

- Curriculum powered by Kaplan, ACCA’s approved content provider, ensures best-in-class learning materials.

- Certification jointly with KPMG India enhances global recognition and credibility.

Exam and Career Support

- Money-back guarantee if you don’t clear all ACCA Professional Level exams exemplifies confidence in results.

- Dedicated placement support includes pre-placement bootcamps, soft skills training, resume building, and assured interviews with top recruiters.

- 100% placement or internship guarantee upon successful completion of early ACCA levels to jumpstart your career with ACCA training.

Flexible Learning Modes

- Live interactive sessions and on-demand classes allow working professionals to balance study and work effortlessly.

- Expert faculty with industry experience ensure practical learning beyond textbooks.

Frequently Asked Questions About ACCA

If you’re considering ACCA, it’s natural to have questions about the course, its benefits, and the career opportunities it can open up. In this section, we’ve answered some of the most frequently asked questions to help you get a clear understanding before you take the next step.

What is ACCA and why is it important?

The Association of Chartered Certified Accountants (ACCA) is a worldwide recognised professional qualification in accounting and finance. Its importance comes from the fact that it is a combination of technical expertise, strategic leadership skills, and global recognition in over 180+ countries. This global recognition makes it one of the most prized potential credentials in the finance world.

Who can pursue ACCA?

Anyone who has completed Class 12 with Accounts and Mathematics is eligible to start ACCA in India. Graduates and working professionals in commerce, finance, or business can also pursue ACCA, often with exemptions from certain papers depending on prior qualifications (like B.Com, CA Inter, or MBA). This covers the ACCA eligibility requirements.

What is the full form of ACCA?

The ACCA full form, the Association of Chartered Certified Accountants (ACCA), has over half a million students around the world. With that, it is one of the most valued qualifications out there in the financial qualification space.

How is the ACCA qualification structured?

The ACCA journey includes:

- Applied Knowledge (3 papers)

- Applied Skills (6 papers)

- Strategic Professional (4 papers – 2 compulsory + 2 optional)

- Ethics & Professional Skills Module (EPSM)

- 36 months of Practical Experience Requirement (PER)

This ensures candidates gain both academic knowledge and practical industry experience. Understanding the ACCA subjects is key here.

How long does it take to complete ACCA?

On average, ACCA takes 2-3 years to complete, depending on exemptions, exam planning, and how quickly a student clears papers. Working professionals often take longer to balance studies with work. This is the typical ACCA course duration.

What is the pass rate for ACCA exams?

Pass rates vary by exam level.

- Applied Knowledge: 60-88% (comparatively higher)

- Applied Skills: 43-54%

- Strategic Professional: 40-51% (most challenging)

These figures highlight the progressive difficulty as students move from fundamentals to advanced strategy.

Is ACCA recognised globally?

Yes. ACCA is recognised in 180+ countries and has mutual recognition agreements with leading accounting bodies like CPA Canada, CA ANZ, and HKICPA. This makes it one of the most internationally portable qualifications compared to region-specific ones like CA (India).

What career opportunities are available after ACCA?

ACCA opens doors to diverse roles such as:

- Financial Accountant

- Auditor / Internal Auditor

- Tax Consultant

- Management Accountant

- Corporate Finance Advisor

- Risk Manager

- CFO or Finance Controller

- ESG & Sustainability Reporting Specialist

Opportunities exist across industries – Big 4 firms, MNCs, banks, startups, and government organisations. This highlights what is ACCA in accounting and its broad applicability.

How much can ACCA professionals earn?

In India (2025):

- Freshers: ₹8-10 LPA

- Mid-level (5–10 yrs): ₹15-24 LPA

- Senior leaders (10+ yrs): ₹30-50 LPA+ (CFO, Controller)

Globally, ACCA professionals in the UK, UAE, and Singapore can earn six-figure salaries depending on role and experience. This is the typical ACCA salary range.

How does ACCA compare to other qualifications like CA, CPA, or CFA?

- ACCA: 2-3 years, global recognition, accounting + finance + strategy, moderate-high difficulty.

- CA (India): 4-5 years, India-focused, very high difficulty.

- CPA (US): 1-1.5 years, US-focused, accounting + audit.

- CFA: 2-4 years, investment & portfolio management.

ACCA is ideal for those seeking international mobility and diverse finance roles.

Why should I choose Imarticus Learning for ACCA preparation?

Imarticus Learning is a Gold Status ACCA Learning Partner, offering:

- Training in collaboration with KPMG India

- Kaplan-powered study materials (official ACCA provider)

- 100% placement or internship guarantee

- Money-back assurance if professional-level exams are not cleared

- Flexible online learning with expert faculty

This ensures industry-aligned preparation and strong career outcomes.

Conclusion

So, what is ACCA? It’s much more than just another professional qualification. It is the international passport into a career in accounting, finance, consulting, and business leadership.

- It equips you with technical knowledge, strategic skills, and global recognition.

- It provides career opportunities with top employers and starting salaries of ₹8-10 LPA in India.

- It prepares you for the future of finance with an emphasis on technology and sustainability.

If you believe you are ready to take the next step, register for the ACCA program at Imarticus Learning, the first and only approved cert prep provider for ACCA, CPA, CFA and CMA in India. With arm’s-length learning from mentors, KPMG-led master classes, and guaranteed placement support, we support your ACCA journey.