Last updated on June 26th, 2024 at 12:45 pm

Trading desks are physical locations of departments within an organisation or a banking institution where securities, like currencies, commodities, bonds, and shares, are traded to ensure liquidity in the market. The purchase or sale of such securities helps facilitate an organisation’s or a client’s trade in the market. It can be considered a money-making activity since it helps increase market liquidity.

Trading desks are highly beneficial to firms. They help the firms analyse transactional costs, formulate favourable trading strategies, and assist in counterparty identification. They also help clients structure their financial products, identify opportunities, and ease entity-investor agreements, increasing the scope of market liquidity. The trading desks earn commissions for the services provided.

This blog discusses how trading desks work in investment banking and how they facilitate market-making activities.

The Working of Trading Desks

Traders with different financial instruments meet in a trading room, also known as a trading floor. A trading floor has multiple trading desks occupied by licensed traders. Each trader deals in specific investments like bonds, currencies, equity, commodities, etc. The desks have service layers facilitating the purchase and sale of securities.

The traders are chosen based on their past performance records. Traders determine the most suitable strike prices for the clients with the help of market makers and electronic trading mechanisms. The trading personnel gathers relevant data from the salesperson, suggests the most suitable trading strategies, receives client orders, and executes the trade per the investors’ goals and objectives.

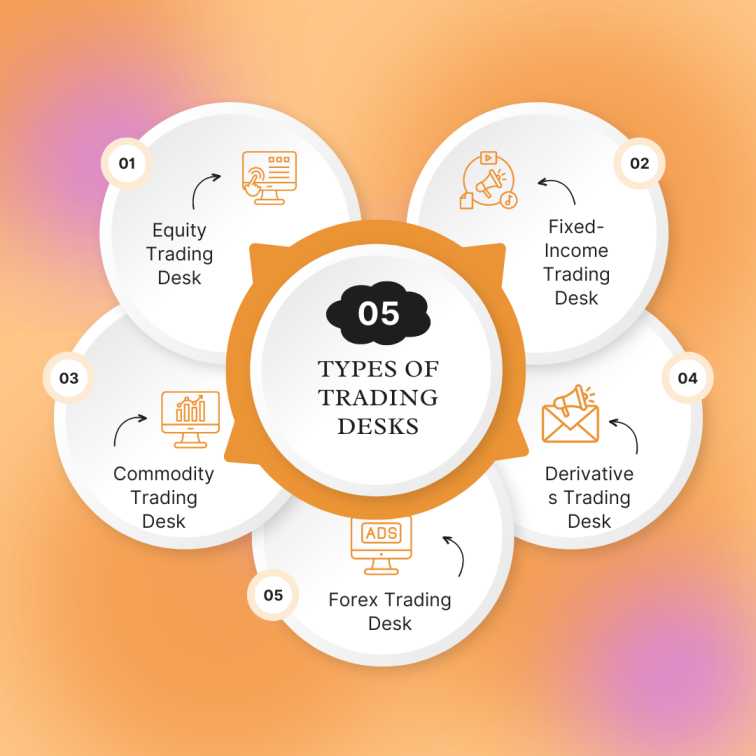

Types of Trading Desks

The different kinds of trading desks are as follows:

- Equity Trading Desk: The equity trading desk facilitates and manages an enormous trading range. The traders working on the sell side of the desk suggest the most suitable options to clients based on information derived from the analysts’ research. The trading desk may be classified into two categories — one, enabling trade for hedge fund clients and the other, offering trade facilities to institutional clients.

- Fixed-Income Trading Desk: Fixed-income securities are bonds with a specific income stream. One such example of a fixed-income security is the US Treasury Bonds. A fixed-income trading desk helps in the execution of trades concerning these securities.

Fixed-income trading desks also trade credit default swaps, derivatives that can act as insurance in case of a bond default. Fixed-income trading desks can be divided further based on the risk associated with the bond being traded.

- Derivatives Trading Desk: This kind of trading desk deals with the trading of derivatives such as options, swaps, forwards, and futures. However, the assets that derivatives trading desks deal in are complicated and can often lead to massive losses or gains.

- Forex Trading Desk: Large-scale investment banks often have a forex trading desk. The traders at the forex trading desk usually have to deal with the spot exchange rates of foreign currencies. They may also have to participate in proprietary trading activities.

- Commodity Trading Desk: This desk deals in commodities like gold, agricultural products, crude oil, etc. The desks can be categorised into soft and hard commodities.

It is entirely at a firm’s discretion to subdivide these categories into smaller parts based on the kind of security being traded.

Benefits of Trading Desks

Listed below are the benefits of trading desks.

- Low cost: Training desks can provide services to multiple customers simultaneously, helping reduce the cost otherwise spent on training, operation, and software. Professional managers are appointed to take training in the different market segments on behalf of the clients. The trading activities are improved through the experts’ technical expertise and valuable insights.

- Advanced technology: The activities are monitored using the latest technology. It helps eliminate the human factor in trading activities and reinforces discipline.

- Skill and expertise in a specific domain: Managers working at trading desks will likely acquire expertise, experience, and knowledge in managing portfolios. It helps hone their efficiency and allows them to identify trading opportunities more proficiently.

- Monitoring brokers’ performance: Trading desks can also help investors track broker-dealers’ performance, helping them identify the best-performing brokers for every security class.

Limitations of Trading Desks

Trading desks have associated drawbacks apart from the benefits too. Trading desk operations often lack transparency with respect to activities like performance evaluation, strategy improvement, analysis, etc.

Also, the services provided by trading desks are not free. Clients have to pay an amount as a commission for trading activities.

Conclusion

Building investment banking skills and expertise is crucial to establishing a career in investment banking. Develop an in-depth knowledge of trading desks and other aspects related to investment banking with Imarticus’ Certified Investment Banking Operations Professional programme.

Ideally suited for finance graduates with 0-3 years of work experience, this investment banking course will take you through the fundamentals, preparing you for roles like market analyst, financial analyst, investment banking associate, and financial market advisor.

Visit Imarticus Learning to learn more about this certification in investment banking.