MBA, or Master in Business Administration, is one of the most popular courses amongst students looking for postgraduate courses with promising employment prospects. One of the most sought-after MBA courses opted for by students is an MBA in fintech.

Notably, an MBA in fintech covers all the areas that deal with finance and investments. In addition, it builds an understanding of innovative and cutting-edge technologies like artificial intelligence (AI), internet of things (IoT), blockchain, cloud computing and data analytics, along with their application in finance.

The course helps professionals build industry-relevant skills, resulting in more employment opportunities than an MBA degree in any other field. MBA fintech graduates are sought after by well-reputed organisations globally.

Read on to learn more about the jobs and salary prospects after an MBA in fintech.

Career options and job opportunities after MBA in fintech

Candidates after completing MBA in fintech can work and adapt to multiple job roles. They can choose to work in the corporate, banking, or non-banking sectors. MBA fintech specialists are in demand at most organisations for financial management. Both the government and private institutions are open to MBA fintech experts.

The most popular job roles after MBA in fintech include:

Investment Banker

This well-paying job is mainly about making such investments of capital funds that can yield the highest returns. Investment bankers help customers in acquisitions, mergers and raising capital.

Responsibilities of an investment banker

- Selling equity and issuing debt to raise capital

- Conducting intelligent and strategic research to carry out a proper investigation

- Managing multiple equity placements at a time and keeping track of them

- Analysing risks while assisting in corporate restructuring

- Facilitating profitable mergers and acquisitions

Average salary: The average salary of an investment banker is INR 4 lakh per annum.

Financial Analyst

A financial analyst’s primary responsibility is to examine a company’s financial statements. This enables them to keep track of the company’s financial plans and their outcomes. Financial analysts are also responsible for making predictions about the company’s financial health.

Responsibilities of a financial analyst

- Carrying out financial modelling

- Making forecasts about the income and expenditure of the company

- Tracking the economic trends and policies and making financial plans accordingly

Average salary: The average salary of a financial analyst is INR 4.5 lakh per annum.

Financial Advisor

A candidate after pursuing MBA in fintech can become a financial advisor. Every company needs financial advisors who propose ways and policies to improve the overall standing of a company. The role includes financial as well as managerial aspects.

Responsibilities of a financial advisor

- Keenly observing and analysing the financial statements of a company

- Continuously tracking the progress of a task in accordance with plans

- Performing complex tasks like capital budgeting and forecasting

Average salary: The average salary of a financial advisor is INR 2.5 lakh per annum.

Project Manager

Project management is a crucial role that can be performed by an MBA in fintech candidate. A project manager is in charge of looking after the entire course of a project. They are expected to keep an eye on the process, find solutions for ambiguities, and help the project finish.

Responsibilities of a project manager

- Organising and creating project concepts for an organisation

- Monitoring the project throughout its course

- Taking the final call on the plans and policies of the project

- Completing the project in due time while adhering to the client’s requirements

Average salary: The average salary of a project manager is INR 12.5 lakh per annum.

Management Consultant

A management consultant is one of the most crucial personnel in a company. Such a representative supports businesses with organisational management. A management consultant helps maximise business growth and improve overall corporate performance.

Responsibilities of a management consultant

- Advising businesses in increasing financial growth and improving their performance

- Solving managerial difficulties

- Adding value to a company by suggesting effective financial plans

Average salary: The average salary of a management consultant is INR 22.6 lakh per annum.

Private Equity Analyst

Private equity analyst is one of the best job roles available for an MBA in fintech candidate. A private equity analyst is mainly an employee of a public sector undertaking. Such analysts frequently assist PSUs in analysing equity and financial data.

Responsibilities of a private equity analyst

- Conducting ratio analysis and generating results

- Researching and interpreting the functioning of the private sector

- Running valuations and analysing spreadsheets

Average salary: The average salary of a private equity analyst is INR 8 lakh per annum.

Conclusion

Fintech is one of the core foundations of a successful business venture in today’s technology-driven environment. MBA in fintech has a broad scope, given the demand for skilled fintech professionals across industries. Candidates with an MBA in fintech are eligible for prestigious employment opportunities with handsome salary packages.

If you want to become a successful professional with an MBA in fintech, then you can consider enrolling for the MBA in Fintech course by Imarticus and KL University. The course offers a new-age industry-aligned curriculum with hands-on experience in leading technologies like cloud computing, blockchain, AI, machine learning, and IoT.

However, it’s not just about having a degree or being qualified; with the right skillsets, you can have the edge over your competition in this industry.

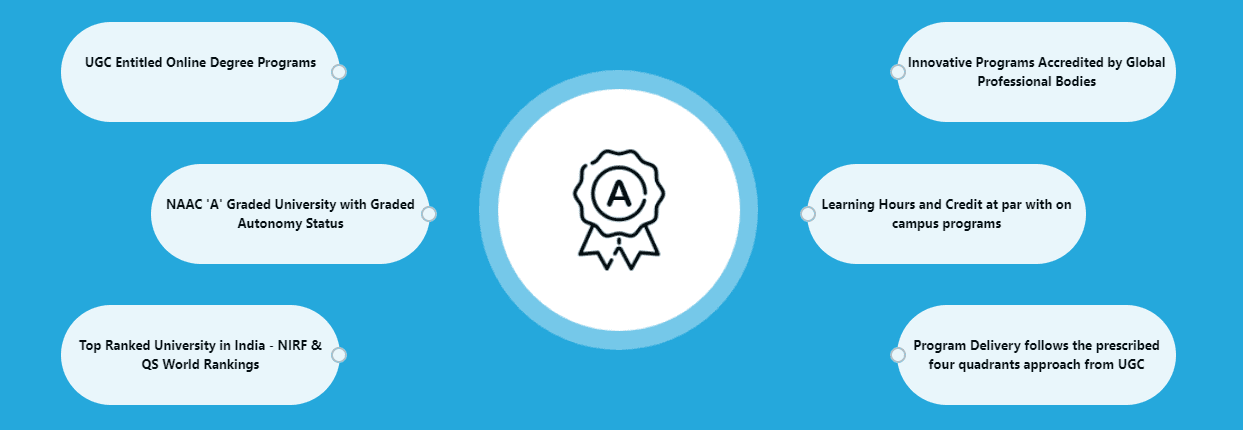

However, it’s not just about having a degree or being qualified; with the right skillsets, you can have the edge over your competition in this industry. Online MBA courses are one of the most coveted advanced degrees as they help you acquire both specific and all-round skills & knowledge required to excel in the industry.

Online MBA courses are one of the most coveted advanced degrees as they help you acquire both specific and all-round skills & knowledge required to excel in the industry.