Capital markets training programs are evolving at a rapid pace. Professionals need to stay with new advancements to keep up with the latest changes and trends.

Here, we will take insights into some of the significant changes that can occur in capital markets training programs over the next few years. Whether you are a professional or just starting in your career, these changes will be sure to impact you!

The current state of capital markets training

Capital markets training programs have come a long way in recent years. In the past, most courses focused on teaching students about the theoretical aspects of financial markets. However, thanks to the global financial crisis, there has been a shift towards programs that focus on practical skills and hands-on learning.

Today, capital markets training programs can give students the tools to succeed in their careers. These programs include a wide range of topics, including investment banking, derivatives trading, and asset management strategies.

Here are some expected changes in capital markets training programs in 2022 include:

- A renewed focus on ethics and compliance

- An increased emphasis on technology training

- More experiential learning opportunities

- Expanded course offerings to meet the requirements of a global workforce

These are just a few of the changes we can expect in capital markets training programs over the next few years.

How will these changes impact capital market training programs?

Technology advancements will continue to drive change in the capital markets industry, impacting how training programs are delivered.

- There will be a greater focus on experiential learning, emphasizing simulations and case studies.

- The use of virtual reality (VR) and augmented reality (AR) can grow, providing learners with a more immersive learning experience.

- Blended learning approaches will continue to gain popularity, with a greater focus on online and self-paced learning.

We can expect to see more gamification in capital markets training programs, as it is an effective way to engage learners and promote learning.

That’s what’s in store for capital markets training programs in 2022!

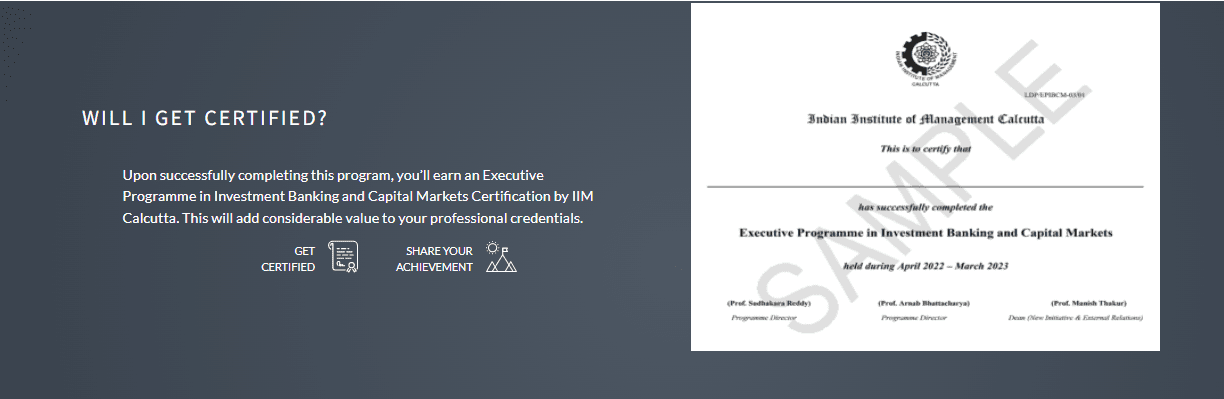

Discover capital market certification with Imarticus Learning

The Financial Services and Capital Markets course gives students a thorough grasp of investment banking and capital markets. Students will also get an advantage over their classmates by studying at IIM Lucknow’s top-tier business school!

Course Benefits For Students:

- Study with an outcome-focused curriculum and hands-on learning approaches to develop expertise in essential domains.

- Learners will have the opportunity to meet and engage with classmates and industry professionals as part of this program.

- This capital markets training program is for mid-level employees who have basic financial skills but want to develop in their careers. Besides, it will provide students with vital skills and information and open possibilities for restarting a career in finance.

chnical skills and effective understanding of investment banking and capital markets as well as their practical application.

chnical skills and effective understanding of investment banking and capital markets as well as their practical application.