When you hear what is investment banking? Do you envision a million-dollar merger, an IPO launch or look at it as one of the most sought-after careers in finance? Investment banking is more than finance; it’s where strategy, numbers, and leadership intersect. It is quite normal to wonder what exactly investment banking is and why professionals with a certified investment banking operations program are in such high demand.

Investment banking services typically include underwriting new stock and bond issues, facilitating mergers and acquisitions, and acting as financial advisors. Professionals with a certified investment banking operations program play a crucial role in ensuring the smooth and efficient execution of these complex transactions, from managing data and compliance to optimising back-office processes, making them indispensable to the industry’s success.

Investment banking isn’t just a small segment of the financial services industry, but one of the most significant branches that generates profits for businesses. Investment banking is really about helping big businesses and even governments make their biggest money moves. Think of a company that wants to grow into a new market but has no idea how to raise the kind of cash it needs. Or a business that wants to merge with a competitor but doesn’t know where even to start. That’s when these professional comes in.

If you’re drawn to create a career with a strong impact in finance with strategy, leadership and shaping the business, this guide will help you understand investment banking along with its core functions, career paths and everything that you need to know.

👉 Did you know?

According to Business Insights, the global investment banking market size is projected to grow to $183.28 billion by 2032, exhibiting a CAGR of 7.5% during the forecast period.

Here’s a snapshot of what is Investment Banking and its roles and functions.

What is Investment Banking

Investment banking is where strategy meets money on the grandest stage of business, and every move can have ripple effects across industries. It’s the field that helps companies grow beyond imagination by raising funds, advising on mergers, or guiding them through public listings. In simple terms, investment banking acts as the bridge between people who have money to invest and businesses that need that money to expand or transform.

“An investment in knowledge pays the best interest.” – Benjamin Franklin.

Definition of Investment Banking

To answer what is investment banking in precise terms, Investment banking is the part of finance that helps companies raise huge sums, expand into new markets, or merge with others to grow stronger. Investment banking is where ideas turn into empires.

It is a branch of finance that focuses on providing strategic advice and executing complex deals that help corporations, governments, and institutions raise capital, manage large financial transactions, and pursue mergers and acquisitions to drive economic growth.

It acts as an intermediary between investors and organisations. It’s about transforming creative or business potential into large-scale financial success.

When you decide to renovate your home.

Will you just pick the cheapest tiles and paint from a local vendor?

Or will you consider going with a trusted architect and interior designer for the overall aesthetic, durability of materials, how it enhances your home’s functionality, and its eventual appeal to potential buyers?

An investment banking professional’s role is similar in strategic advisory: guiding organisations to look beyond immediate operational costs and assess how a strategic decision – like entering a new market or divesting a business unit – impacts their core competencies, competitive advantage, and long-term sustainable growth.

Difference Between Investment Banking and Commercial Banking

The primary functions and target areas of traditional or commercial banking differ from those of investment banking. The table below gives a brief overview of the factors that differentiate these two banking types.

| Distinguishing Point | Investment Banking | Commercial Banking |

| Capital raising, IPOs, M&A advisory | ✔️ | ❌ |

| Deposits, savings, loans | ❌ | ✔️ |

| Core clients: Corporations & governments | ✔️ | ❌ |

| Core clients: Individuals & SMEs | ❌ | ✔️ |

| Fee-based revenue (advisory, underwriting) | ✔️ | ❌ |

| Interest income–based revenue | ❌ | ✔️ |

| Large-scale deals (multi-million/billion) | ✔️ | ❌ |

| Small/medium loans & transactions | ❌ | ✔️ |

| Global transactions & cross-border focus | ✔️ | ❌ |

| Local/regional focus | ❌ | ✔️ |

| High profit volatility (market-driven) | ✔️ | ❌ |

| Stable recurring income | ❌ | ✔️ |

| Prestige & elite career reputation | ✔️ | ❌ |

| Stable, trusted career reputation | ❌ | ✔️ |

| High entry barriers (elite universities, intense recruitment) | ✔️ | ❌ |

| Moderate entry barriers | ❌ | ✔️ |

| Very high salary uplift | ✔️ | ❌ |

| Moderate salary uplift | ❌ | ✔️ |

| Challenging work-life balance (long hours) | ✔️ | ❌ |

| Balanced work-life hours | ❌ | ✔️ |

| Strong global mobility | ✔️ | ❌ |

| Limited mobility (regional relevance) | ❌ | ✔️ |

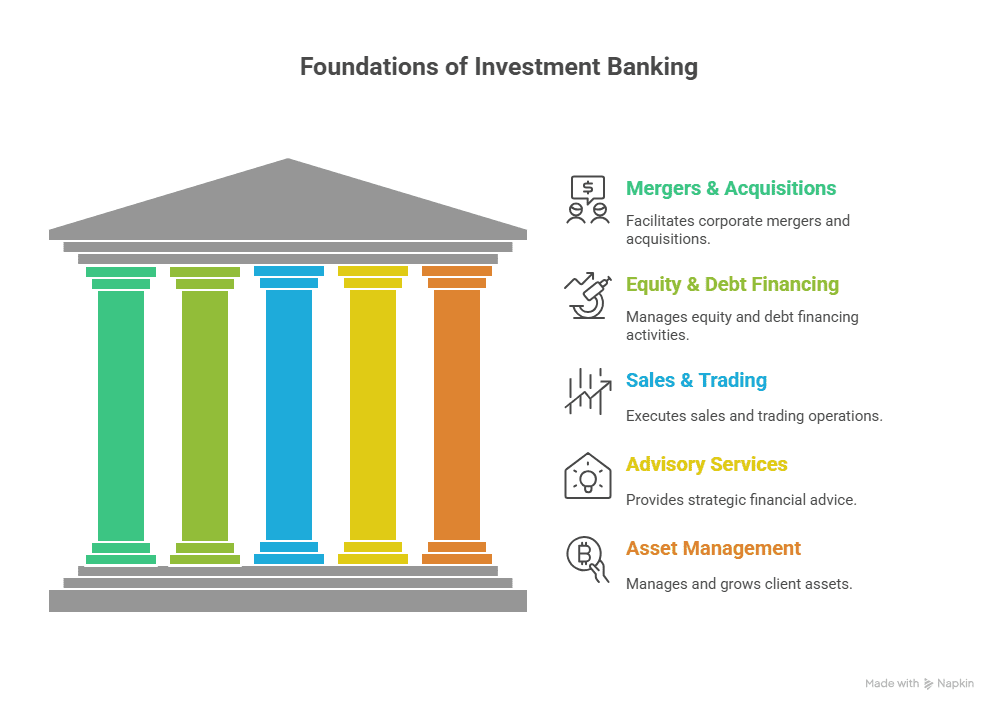

Pillars of Investment Banking

Knowing what is investment banking also means understanding its core pillars. Investment Banking consists of four pillars, which are the foundation of all investment banking operations and functions. These pillars define the purpose of investment banking and its impact.

The four pillars of investment banking are:

| Pillar | Functions |

| Advisory Services | Mergers & Acquisitions, Corporate Advisory, Market Research |

| Underwriting | Underwriting, Capital Raising (Equity & Debt) |

| Sales & Trading | Sales & Trading |

| Asset & Wealth Management | Wealth & Asset Management, Financial Modelling |

👉 Did you know?

Mergers & Acquisitions accounted for about 38% of investment banking revenues in 2025.

Key Functions in Investment Banking

Some of the major functions of Investment Banking are:

- Underwriting: Think of underwriting as a safety net. Underwriting is when a professional helps companies to raise money by guaranteeing the sale of their stocks or bonds.

- Capital Raising (Equity & Debt): Need money to grow? Investment banking professionals design the best funding strategy by balancing and controlling costs for long-term goals. Capital raising involves helping businesses secure funds for growth, either by selling ownership and equity, borrowing money or taking on debt.

- Mergers & Acquisitions (M&A): This handles everything from valuation, negotiation, and deal structuring and acts as a strategic advisor when one company plans to buy or sell a company, or merge with another.

- Corporate Advisory: Big decisions can make or break a company. Corporate specialists advise to help shape the company’s future.

- Sales and Trading: Want to maximise returns and manage risk? Sales and trading professionals connect investors with the right opportunities by buying and selling stocks, bonds, or other securities on their behalf.

- Market Research: Market research is their secret weapon – the insights fuel every deal, helping companies and clients to spot opportunities, analyse industries, companies, and economic trends to support smarter investment decisions.

- Financial Modelling: This builds a numerical roadmap for the company’s future. It involves creating detailed numerical models to predict a company’s future performance.

- Wealth and Asset Management: Wealth and asset managers focus on helping individuals and institutions grow and protect their wealth. These professionals manage portfolios, develop investment strategies, and ensure that clients’ money works for their short and long-term goals.

If your car breaks down, will you panic and just opt for the cheapest and quickest available repair? Or will you consider checking the underlying cause, the reliability of a more comprehensive repair, and whether it’s more cost-effective in the long run than constant breakdowns or buying a new car?

An investment banking professional’s role is similar in restructuring: helping companies in distress look beyond immediate cash flow issues and evaluate the fundamental changes needed, the long-term viability of the business model, and the optimal path to financial health and sustainable operations.

👉 Did you know?

Investment banking helps companies raise capital, restructure, and make strategic decisions far beyond traditional banking services.

The Role of Investment Banking

Part of grasping what is investment banking is seeing the day-to-day impact of investment banking, who structure deals, advise clients, and manage portfolios.

Think of an investment banking professional as the go-to problem solver for big-money decisions who can turn ambition into achievable goals. One moment, they’re crunching numbers to value a company, the next, they’re sitting in a boardroom advising executives on a merger or IPO. They can turn complex financial puzzles into real-world strategies by making sure every deal actually creates an impact. It’s fast, high-stakes, and a little chaotic, but that’s exactly what makes the role exciting.

Core Responsibilities in Investment Banking

Investment banking professionals take multiple responsibilities under high pressure every day, right from financial modelling to client advisory.

Financial Modelling and Valuation

By using financial modelling and valuation, these professionals create company valuations, assess risk, and guide strategic decisions to predict the future of a business.

Deal Structuring

Investment banking professionals design a blueprint to crack every deal. They align their financial expertise with their customers’ vision and help them achieve their goals.

Client Advisory and Relationship Management

Strong relationships are key to cracking any role, and investment banking professionals are no different in this approach. They advise executives, CEOs, and boards, balancing their financial expertise with an understanding of their clients’ vision and goals. It’s as much about trust as it is about numbers and revenue.

👉 Did you know?

With most job roles following a 40-hour work week, Investment banking professionals work up to 100 hours per week.

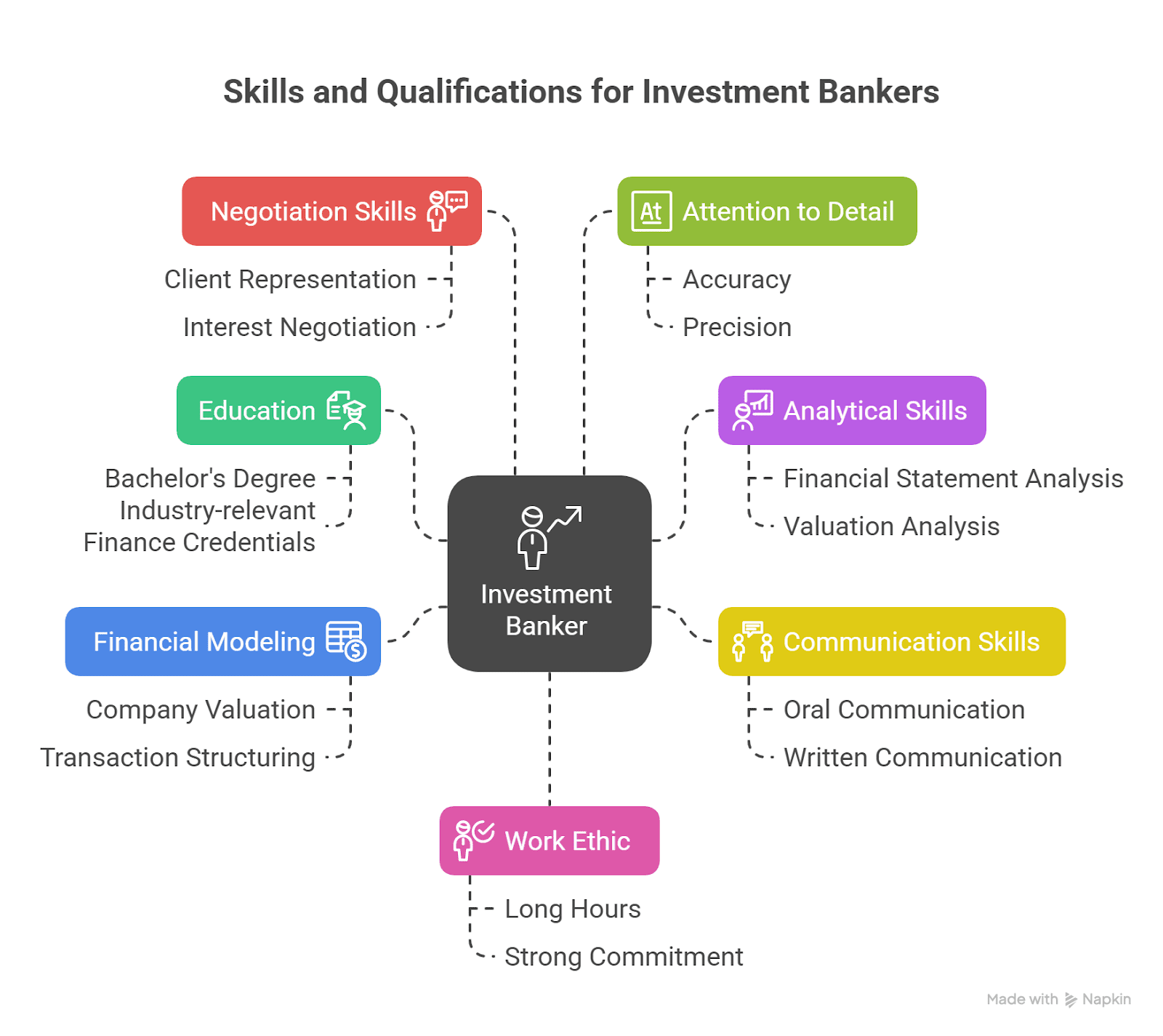

Skills Required to Excel in Investment Banking

As you might already be aware, AI is no longer a bubble or future, but it’s the present and also the most followed latest trend in the market. Just like every fast-paced industry professional, Investment banking professionals now leverage AI skills to analyse data faster, predict trends, and even automate routine tasks, freeing up time for strategic thinking.

Using AI and Technology in Finance won’t replace an investment banking professional, but a professional with the right skillset who understands how to use AI and technology to make conscious decisions that drive business growth is in demand more than ever.

If you ask a seasoned investment banking professional what their job really is, you might hear a story rather than a list. “We’re part analyst, part strategist, part negotiator,” they’ll say, “and every day, we solve financial puzzles that could make or break companies.” The truth is, to excel in investment banking isn’t about memorising formulas or market trends.

So yes, a certification will help you enter the industry, but to sustain and succeed in this field, you need to inculcate the right skillset. With a combination of strong technical and soft skills to navigate complex financial transactions and build client relationships.

To thrive in investment banking, you need more than just knowledge. To really thrive in investment banking, you need to inculcate a dynamic skillset that enables you to lead high-stakes decisions with both precision and judgment. These skills can broadly be divided into two categories: technical skills and soft skills.

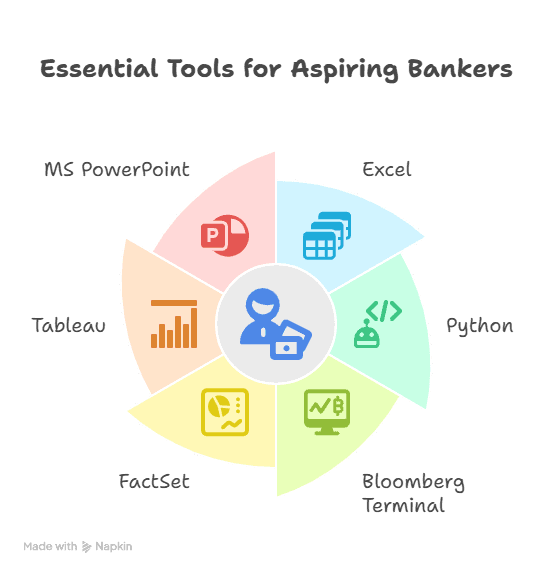

Technical Skills

Every great deal closes with a spreadsheet, but it doesn’t end there. A rock-solid understanding of finance, accounting, and valuation techniques to make sense of complex data is essential.

Visualisation tools like Excel, Microsoft Office, PowerPoint, Word, Power BI, Tableau, blockchain, financial modelling, and analytics are their key tools that allow them to navigate complex deals efficiently.

They are required to use various tools and software for analysis, reporting, presentation and decision-making. And as technology reshapes finance, being fluent in generative AI and analytics has become a non-negotiable skill, not just a nice-to-know.

Simply put, these tools are an investment banker’s compass – helping them evaluate deals, forecast trends, and navigate an ever-changing financial landscape.

Soft Skills

Numbers alone don’t close deals- people do. In addition to handling numbers well and having technical knowledge, professionals require another crucial skill to do their job efficiently.

Great investment bankers are the ones who know how to connect, communicate, and stay composed under pressure. Developing soft skills can simplify complex ideas, listen with intent, and turn tense negotiations into long-term partnerships.

One is expected to have a high-level command of communication, problem-solving, and relationship-building skills. Having soft skills accelerates the way an investment banking professional performs.

The ability to explain complex concepts clearly to customers and work precisely under high pressure is what sets good investment banking professionals apart from great ones.

“Risk comes from not knowing what you’re doing.”

– Warren Buffett.

How Investment Banking Functions

Investment banking functions as a multi-layered ecosystem where every deal involves strategy, compliance, and precise execution. From front-office operations and deal-making to back-office support, the industry runs by ensuring the deals are executed smoothly and strategically.

Investment Banking is similar to a three-tier system. You can think of it as simple as our reflex action. When you touch something hot accidentally, your hand automatically withdraws from that surface. Now, in terms of investment banking, the front-tier is the action that takes place by the hand which you can see, the second or middle-tier is the reflex arc carried out by the sensory neurons and your muscles and the third or back-tier which actually sent the signal to carry out the reflex action which is the spinal cord or the head of your nervous system.

Front Office: Deal-Making and Client Advisory

In this role, the professional works closely with the clients to pitch deals and negotiate terms, which are essential to turn a strategy into reality.

Middle Office: Risk, Compliance, and Strategy

In this role, the professional ensures the deals carried out are safe, compliant, and strategically sound. They analyse risk, monitor regulations, and make sure that the bank’s decisions protect both the client and the company.

Back Office: Operations and Support

The back office acts as the backbone that keeps everything running smoothly, but may not be in the spotlight. From processing transactions and operations to handling documentation and offering support, this team ensures that deals are executed seamlessly without a hitch.

Trends Impacting Investment Banking

Unlike any other commercial banking industry, the Investment Banking industry is a fast-paced industry where the impact of technology is high. The decision-making process is not carried out by pure intent but backed by various financial models that are based on records and future predictions.

Such industries follow the latest trends to ensure that they stay updated according to industry standards to deliver high-quality and valuable services and results. A few trends that have a huge impact on the investment banking industry are:

AI & Technology Integration

- Investment banks are rapidly adopting AI and machine learning for deal origination, risk management, trading algorithms, and client advisory services.

- According to statistical insights, 89% of investment banking positions are projected to require data and tech skills by 2030. This highlights the critical shift towards a tech-savvy workforce.

ESG and Sustainable Finance

- Environmental, social, and governance (ESG), even though they are non-financial factors, now hold the power that is shaping deals like never before. Professionals now help clients align with sustainable practices in corporations and businesses while still driving growth and profitability.

- They use the ESG principles in guiding investment decisions towards adopting sustainable, ethical, responsible and conscious business practices that result in long-term growth.

Fintech & Payments Collaboration

- Investment banks are increasingly partnering with fintech companies to offer innovative solutions, improve client experiences, and expand into areas like digital payments and wealth management.

- Top investment banking firms like JPMorgan Chase have started investing over $2 billion annually in technology as part of their $18 billion total tech budget.

Blockchain & Digital Assets

- Blockchain technology and cryptocurrencies are gaining traction, with banks exploring applications in areas like tokenised securities, digital custody, and faster settlements.

- Top investment banking firms like Morgan Stanley were among the pioneers in adopting blockchain. Goldman Sachs has a dedicated crypto trading desk and offers Bitcoin futures and other crypto-linked products to its clients.

Is Investment Banking Worth It

After exploring what investment banking is and what an investment banking professional does, the next question that strikes the mind is: Is an investment banking career truly worth it?

If you are ambitious about it, enjoy high-stakes equity analysis problem-solving, and want a career that blends finance, strategy, and leadership, investment banking could be the best career choice for you. Its value lies in how much value you can deliver.

If you think of buying a new phone. Will you just look at the price tag? Or you will compare features, durability, and resale value. An investment banking professional’s role is similar: helping organisations look beyond cost and evaluate the long-term value of every decision.

Here’s a list of the top industry categories and companies where these professionals work:

- Elite Investment Banks: Goldman Sachs, JPMorgan Chase, Morgan Stanley, Bank of America Merrill Lynch, Citigroup, Barclays, UBS, Deutsche Bank, and Credit Suisse.

- Global full-service banks: Nomura, Wells Fargo, BNP Paribas, Société Générale, Mitsubishi UFJ Financial Group (MUFG), and many others.

- Indian Investment Banks: SBI Capital Markets, ICICI Securities, Kotak Investment Bank, Axis Capital, HDFC Bank ( Investment Banking Division), and Motilal Oswal Investment Advisors.

- Asset Management: BlackRock, J. P. Morgan Asset Management, Morgan Stanley Investment Management, Standard Chartered Wealth Management, and Aditya Birla Capital.

- Hedge Funds: Citadel, D.E. Shaw, JP Morgan Private Bank, Morgan Stanley Wealth Management, and Tata Alternative Investment Fund – Category 3 by Tata Group.

Benefits of Choosing a Career in Investment Banking

The investment banking market is one of the fastest-growing markets in the financial industry. It was valued at $103.23 billion in 2024 and is projected to reach $183.28 billion by 2032, growing at a Compound Annual Growth Rate (CAGR) of 7.5%.

Choosing a career in Investment Banking offers a dynamic and rewarding career path, not only in India but globally. The investment banking sector is projected to grow to a $30 trillion economy by 2047, which emphasises its role in economic growth.

An investment banking career offers lucrative salaries, higher perks and benefits, with rapid career progression. Investment banking is a launchpad for leadership, strategy, and global business influence.

- Exposure to High-Stakes Deals: Exposure to diverse industries and large corporations to build a highly valued reputation in the financial industry.

- Accelerated Learning and Professional Growth: Continuous Learning & Development of transferable skills in finance, leadership, and negotiation.

- Networking with Industry Leaders: Access to one of the most prestigious professional networks, with the opportunity to directly work with industry leaders.

- Prestige and Influence in the Business World: Career stability and opportunities to work globally and enter into other prestigious roles.

- Higher Earning Potential with Lucrative Packages: Apart from the high base salaries, senior professionals get additional benefits in compensation, such as stock options, perks and other performance-based bonuses.

- Dynamic Work with Strategic Impact: They play a pivotal role in mergers and acquisitions, IPOs (initial public offering) of listed companies, which is dynamic in nature. These decisions help the companies grow exponentially and hold a critical importance in the business dynamics.

An investment banking career not only offers high rewards and rapid progression but also builds a robust foundation, as demonstrated by the successful entrepreneurial transitions of individuals like Falguni Nayar (Nykaa) and Lalit Chaudhary (Infinity Cars), leveraging their strategic acumen and financial expertise to launch and scale diverse ventures.

Challenges of Investment Banking

Just like every coin has two sides, the Investment Banking career has a few setbacks which one should be aware of before making a decision.

- High Work Pressure: They are expected to deliver targets with utmost precision and quality that meets industry standards within strict, short deadlines of time due to the highly demanding nature of their job.

- Long Working Hours: The job is critical and demands time across various markets and time zones, which often leads to a poor work-life balance. And they usually do not have a fixed 9-5 schedule and work beyond the regular working hours.

- Limited Career Security: Investment banking is highly competitive, with high accountability and a fast-paced environment that makes job security questionable. The professional growth highly relies on your performance and skills, which can change based on market conditions.

- Regulations – The number of increased regulations has led to higher compliance costs, which causes regulatory pressures.

- AI – Trusting the reports and outputs generated by AI models has a potential risk due to inaccurate and biased information, which results in increased work to verify AI results.

- Financial Risk – The investment cost in cybersecurity has surged due to increased threats from AI-powered threat detection models and increased financial fraud through phishing, insider threats, man-in-the-middle attacks, and many more.

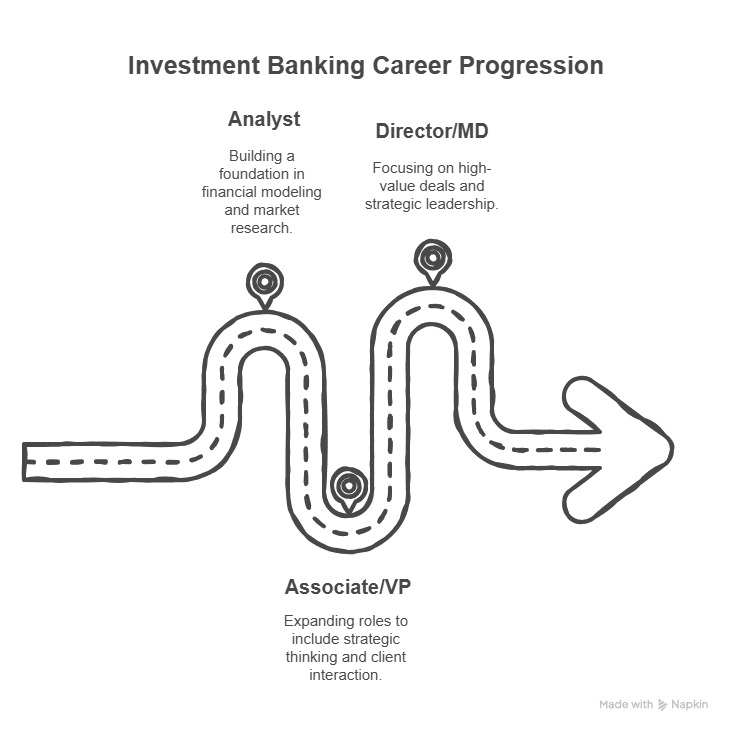

Investment Banking Career Roadmap

The journey from analyst to MD requires mastering both technical skills and strategic leadership over several years.

To reach the Managing Director (MD) stage in investment banking is a demanding journey that requires a significant investment of time, work ethic, continuous learning and upskilling, intellect, and resilience. While the compensation and prestige of this role are high and seem interesting, the path is quite competitive, and the work-life balance is often challenging.

Professionals begin as interns or analysts in an entry-level role, out of which very few progress to reach the top tier with promotions and structured growth. On average, it takes a span of 2-4 years to get a promotion at each level.

The career progression goes from:

- Analyst to Associate in 2 to 3 years,

- Associate with the Vice President (VP) in the next 3 to 4 years.

- Another 3 to 4 years to go from VP to Senior VP or Director roles.

- Professionals who demonstrate exceptional skills and are valued highly by organisations then go from Director to Managing Director in 2 to 3 years.

The picture below shows a brief overview of how you can make a swift career progression as an investment banking professional.

Investment Banking Career Opportunities

If you thought that careers in investment banking are limited to working in Investment Banking companies, then let me clear this misconception.

They are in demand beyond the banking sector in small companies that want to go public, startups that want to scale by raising funds, companies planning for expansions, companies looking for mergers and acquisitions or companies that want to start an initial public offering (IPOs).

Investment Banking careers are versatile and extend beyond investment banks. From analyst to CFO, the career path in investment banking offers diverse opportunities across finance functions and geographies.

- ₹7-16 LPA (base)

- ₹15-50 LPA + total compensation

- ₹ 2.4 – 13 LPA (typical)

- ₹2.4-17 LPA (early-level)

- ₹19 LPA (average)

- ₹30 LPA+ (experienced)

- ₹4.5-72 LPA (early- mid-senior)

- ₹1 crore (experienced)

- ₹24-26 LPA (typical)

- ₹2.8-35 LPA (average range)

Financial Analyst / Associate Roles

- ₹5.7 LPA (analyst)

- ₹15 LPA (senior analyst)

- ₹10.2 LPA+ (associate)

Risk Management & Treasury Roles

- ~₹6.5 LPA (entry)

- ₹34 LPA (senior treasury)

- ₹50 LPA (senior risk management)

Portfolio Management / Fund Management

- ₹20-27 LPA (average)

Executive Roles (CFO, Director, MD)

- CFO – ₹37 LPA (average)

- Director – ₹35 LPA+ (start), ₹ 1 crore+ (experienced)

- MD ₹ 20 – 50 LPA (average)

- Executive Director -₹ 24 LPA – ₹ 1 crore+(based on experience and industry).

If you are passionate about building a dynamic career in the field of Investment Banking, check out this video:

Who Can Build a Career in Investment Banking

Investment banking is not limited to any one academic background. Candidates with bachelor’s degrees in finance, commerce, accounting, business administration, economics, engineering, or even liberal arts can pursue this career if they acquire the right certifications and skills.

Any professional with passion, analytical thinking, and resilience can enter investment banking with the right preparation and training.

Eligibility Criteria

- Bachelor’s Degree from any background related to business administration, economics, finance, accounting, mathematics, engineering or quantitative fields is eligible.

- Three-year degree courses in science, commerce and liberal arts are considered eligible.

- MBA graduates and MS in Finance degree holders are also eligible to apply.

- Analytical and problem-solving skills are essential for pursuing any investment banking course.

Entrance Exams

If you wish to go through the MBA or MS route, you will have to clear the entrance examinations like CAT, GATE, GMAT, or equivalent exams recognised by the top universities and institutions.

Top Investment Banking Certifications

Investment Banking is a vast career, and there are no fixed banking courses or certifications like a regular degree course that lets you step into this industry. You have various options in courses and certifications to become an investment banking professional.

Enrolling in structured courses provides you with both the technical expertise and strategic mindset needed to thrive in investment banking. There are various career paths in the field of investment banking, and choosing the courses and certifications according to your interests opens the door to a dynamic career with high earnings potential.

Certifications like CFA, CMA, and CIBOP are essential to have mastered critical skills needed to demonstrate expertise in finance and credibility for aspiring investment banking professionals. Holding a globally recognised qualification is an indicator to potential employers of what the candidate has to offer for high-stakes finance and investment management roles.

CIBOP

The Certified Investment Banking Operations Professional (CIBOP) course focuses on training candidates with relevant skills and knowledge to master core and industry-relevant topics. It is recognised in India by top-tier banks and global financial institutions.

It helps in building expertise in Securities, Wealth and Asset Management Operations. It is designed to equip you with industry-relevant and transferable skills in financial systems and investment banking operations overseas.

This certification helps you to leverage your earning potential by developing a holistic approach that prepares you for handling challenging situations smoothly in investment banking.

How to Choose the Right Course for Investment Banking

This table will help you decide the right course to break through in your career in investment banking.

| Feature | CIBOP | CFA | CMA |

| Focus on Investment Banking Operations | ✔️ | ❌ | ❌ |

| Focus on Investment Analysis & Portfolio Management | ❌ | ✔️ | ❌ |

| Focus on Management Accounting & Corporate Finance | ❌ | ❌ | ✔️ |

| Duration < 1 year | ✔️ | ❌ | ❌ |

| Classroom & Live Online Training | ✔️ | ❌ | ❌ |

| Self-Study Option Available | ❌ | ✔️ | ✔️ |

| Global Recognition | ❌(mainly India-focused) | ✔️ | ✔️ |

| Placement Assistance / Job Support | ✔️ | ❌ | ❌ |

| Entry Eligibility: Graduate or Professional | ✔️ | ✔️ | ✔️ |

| Average Entry-Level Salary (India) | ₹4–9 LPA | ₹10–30 LPA | ₹8–18 LPA |

| Direct Relevance to Investment Banking Roles | ✔️ | ✔️(mainly analytical/ research roles) | ❌ |

| Ideal for Non-Finance Background Professionals | ✔️ | ❌ | ✔️ |

Learning Partner For Investment Banking Career

Choosing the right learning partner can make all the difference in building a career in investment banking. Imarticus Learning stands out as an approved provider for the top 5 finance certification courses, making it a premier choice for aspirants seeking a career in finance. We offer structured learning, practical exposure, and industry connections.

Imarticus Learning turns ambition into action. You’ll be ready to step into investment banking confidently.

Imarticus offers:

- Industry-Aligned curriculum & practical training.

- Expert-Led Classes & Mentorship.

- Flexible batches to suit your needs.

- Strong industry partnerships for placement assistance.

- Bridging theory & industry with top industry leaders.

FAQs about Investment Banking

Frequently asked questions about Investment Banking careers.

What is an investment banking course?

An investment banking course is a practical training to build domain knowledge and job-relevant skills for a career as an investment banker.

What does investment banking do?

Investment banking carries out all the important functions of capital raising, mergers and acquisitions, underwriting for initial public offering (IPO) launch, corporate advisory and risk management for organisations.

What is the trade life cycle in investment banking?

The trade life cycle in investment banking stands for the end-to-end process of a financial transaction, right from trade initiation to settlement. It consists of a total of 7 steps starting from the sale, trade initiation and execution, trade capture, trade validation and enrichment, trade confirmation, trade settlement and reconciliation.

What is fund accounting in investment banking?

Fund accounting in investment banking is a specialised accounting method used by asset managers for tracking the financial activity of investment funds or asset classes, such as mutual funds, hedge funds, and pension funds. It emphasises accountability, transparency and regulatory compliance for investors by precisely recording income, expenses, assets, and liabilities to ensure accurate Net Asset Value (NAV) calculations, with proper investor capital allocation, and strict adherence to regulatory requirements.

What are the 4 pillars of investment banking?

The 4 pillars of investment banking are capital markets, advisory, trading and brokerage, and asset management. They are also known as the four major branches of investment banking.

What degree is required for investment banking?

What degree is best for investment banking?

There is no best degree for investment banking. There are a few top investment banking courses and certifications that you can pursue, like CFA and CIBOP. Any bachelor’s or master’s degree in the field of commerce, business, finance or related makes you eligible for the investment banking course.

Who earns more, a CA or an investment banker?

An investment banker typically earns higher compensation and additional benefits like stock options and other perks with advanced roles. CA salaries start from ₹6 LPA for freshers and range over ₹1 crore per annum for experienced professionals. On the other hand, investment bankers start at ₹8 LPA and go beyond ₹1 crore per annum.

What is reference data in investment banking?

In investment banking, reference data is used for classification, identification, and description of financial instruments, counterparties and other related entities, to ensure consistency of data across financial transactions and investments.

How do I become an investment banker?

To become an investment banker, you should have the required educational background, pursue a relevant certification, gain soft skills, and practical and technical training through internship experience.

What is an investment banking firm?

An investment banking firm is an organisation or institution that primarily works in the financial services industry to offer strategic advice in mergers and acquisitions, capital raising, underwriting, equity research analysis and similar services.

What is technology investment banking?

Technology investment banking is a specialised area that provides financial advisory and services such as mergers and acquisitions (M&A) and capital raising specifically for companies working in the technology sector, including software, hardware, cloud services, next-generation technologies and internet businesses.

What is client onboarding in investment banking?

Client onboarding is the process of officially onboarding a client into the bank’s digital infrastructure or ecosystem by verifying all the mandatory checks like KYC, account creation and setup, providing essential training if any, following the compliance regulations and building a relationship with the client.

References

- https://www.goldmansachs.com/careers/our-firm/investment-banking

- https://imarticus.org/blog/trade-life-cycle-the-process-of-buying-selling/

- https://www.naukri.com/campus/career-guidance/how-to-become-an-investment-banker

- https://imarticus.org/blog/chartered-accountant-vs-investment-banker-salary/

- https://imarticus.org/blog/what-is-reference-data-in-investment-banking/

- https://www.jpmorgan.com/investment-banking/technology-investment-banking

- https://corporatefinanceinstitute.com/resources/career/10-top-investment-banks-in-the-world/

- https://quintedge.com/investment-banking-companies-in-india/

Kickstart Your Investment Banking Journey

Ultimately, understanding what investment banking truly entails is the first step towards a high-impact, globally recognised career in finance. Investment banking isn’t just another job path. It’s a career passport giving you the confidence to navigate high-stakes deals, the prestige to stand out in the corporate world, and the skills to shape financial strategies that drive real business growth.

So if you’re asking yourself, “Is investment banking really worth it?” the answer lies in your ambition. If you want a conventional finance role, any degree might get you there. But a career in investment banking is highly rewarding and demands discipline, resilience, and strategic thinking.

It offers high compensation and benefits, skill development and accelerated professional growth with global recognition and opportunities to work in top companies worldwide.

With Imarticus Learning’s industry-aligned curriculum, expert mentorship, and strong industry connections, you can transition smoothly into this dynamic field and build a high-impact, future-ready career in investment banking.

![What is the Starting Salary Of An Investment Banker In India[2023-24]?](https://imarticus.org/blog/wp-content/uploads/2020/11/shutterstock_666854833.jpg)