Specialised lending has become the bedrock on which businesses establish ‘tailor-made’ financial solutions, especially in the dynamic world of financial services. Below, we have enfolded the three basic areas: Trade Finance, SME Lending, and Project Finance. These findings help businesses understand the options in specialised lending, journeying one step ahead in their needs and growth opportunities.

Understanding Trade Finance

What is Trade Finance?

Trade finance covers various financial services and products, all of which seek to foster and safeguard the practice of trade. It is also beneficial for goods imported or exported as it enables the necessary support to ensure effective and safe transactions. Risk management and payment guarantees significantly enhance global trade’s reliability and efficiency significantly.

Importance of Trade Finance Solutions

In the contemporary global economy, Trade Finance Solutions are essential components in promoting international trade. These solutions assist firms in mitigating risks, raising cash, and improving processes, reducing barriers to carrying out international business transactions. With the help of Trade Finance, organisations can enter greater markets and compete on the world stage.

Types of Trade Finance Solutions

Trade Finance Solutions in the Market come in the form of letters of credit, trade credit insurance, and factoring, among others. Each solution addresses different aspects of conducting business and international trade. This allows the international businesses to select the most appropriate solution as per their requirements.

Benefits of Trade Finance

There are numerous advantages tied to trade finance. It in turn helps businesses to improve their cash tensions, minimise risks and widen their scope of competition. With Trade Finance, businesses can access funding and take on bigger projects and even enter new geographies without any fear.

SME Lending: Fueling Small and Medium Enterprises

Overview of SME Lending

Every economy has small and medium enterprises as its foundation which is able to offer high level of employment and gross domestic product. SME Lending Trends will also give some alterations to policy due to the special characteristics of these types of businesses in order to provide the growth capital they require.

Current SME Lending Trends

The SME lending landscape is changing day to day. Upcoming SME Lending Trends suggest that choices for flexible and accessible borrowing will increasingly be important in the future. No longer the exclusive preserve of traditional banks, today SME loans can be sourced from alternative lenders.

Alternative Lending Options for SMEs

The transformation trend in financial services has led to the rise of Alternative Lending Options. Small and Medium-sized Enterprises (SMEs) access capital more easily and quickly via Peer-to-peer lending, Crowdfunding, and online lenders. These alternatives also have fewer requirements, facilitating capital acquisition for SMEs.

Benefits of Alternative Lending Options

There are a number of distinctive qualities associated with the Alternative Lending Options as compared with the conventional lending to SMEs. There is a quick turnaround of the application process, which reduces the need for collaterals and the services offered are more individualised. All these advantages make alternative funding appealing to an SME that wishes to grow or even steady its operations.

Project Finance: Supporting Large-Scale Projects

What is Project Finance?

Project finance is a form of financing large infrastructure and industrial projects using long-term financing. These include sponsoring project financing based on cash flows derived from a project where project assets and rights form security.

Importance of Project Finance in Financial Services

Project Finance would be the central pillar of major developments because it allows the sharing of risks and returns amongst various stakeholders in financial services. This is what makes such large developments possible.

Project finance: Its fundamental aspects

There are various aspects related to project finance such as risk management, a study of particulars worked upon and financial modeling in depth. These aspects ensure that the feasibility of the project is established and all possible risks are taken into account.

Corporate and Investment Banking Program

Those interested in mastering Project Finance as well as other modes of corporate finance can join the comprehensive Corporate and Investment Banking Program. This program has many benefits in relation to project finance, facilitating the participants to a much-developed stature fit to execute mega projects.

The Role of Financial Services in Specialised Lending

Enhancing Trade Finance Solutions

The enhancement of Trade Finance Solutions cannot be achieved without a proper financial service provider. They provide various products and services, which facilitate the management of trade finances by businesses. Moreover, financial complexes offer infrastructure and training which allow companies to successfully engage in international business.

Supporting SME Lending Trends

There are many factors influencing the trends in lending to SMEs. One of the crucial elements is the financial services’ melting pot. These organisations are inventing and upgrading their offerings regularly to satisfy the dynamic needs of SMEs. Financial services providers who are aware of developments in demand are in a position to provide solutions whose relevance and efficiency can be guaranteed.

Facilitating Project Finance

Financial services play a very critical role in project finance, as they provide both capital and expert advice to accomplish major projects. Bank institutions take different risks and make appropriate financial planning to ensure that a project will become profitable in the long run.

Conclusion

In the realm of commerce, it is characterised by a great need for capital. The ability to secure different kinds of specialised lending mechanisms such as Trade Finance, SME Lending, and Project Finance allows businesses to be as flexible and safe as they should be. Be it venturing into new markets, developing a small company, or executing an extensive project, these financial services can back up any of these endeavours. Given the resources and the know-how of the business environment, it is easy for the organization to overcome any financial challenges and seek expansion course.

FAQs

- What are the primary types of Trade Finance solutions, and how do they benefit businesses?

Letters of credit, trade credit insurance, factoring, and other types of trade finance solutions are broad protection against risks. They help businesses manage cash flow, reduce uncertainty, and add reliability to international transactions. This facilitates successful entry into new markets and taking on larger projects.

- How do alternative lending options for SMEs differ from traditional bank loans?

Alternative lenders, for their part, such as peer-to-peer lending, crowdfunding, and online lending, are generally more lax in terms of requirements, faster to approve, and more personalised; bank loans, on the other hand, are conventional sources of finance for SMEs that aim for growth capital.

- What makes Project Finance suitable for large-scale infrastructure projects?

Large projects receive financing using project finance since it structures its financing based on the future cash flows the project will generate ahead instead of the sponsoring firms’ assets. This results in better risk sharing among the partners involved and longer financing periods that match the entire cycle of the project.

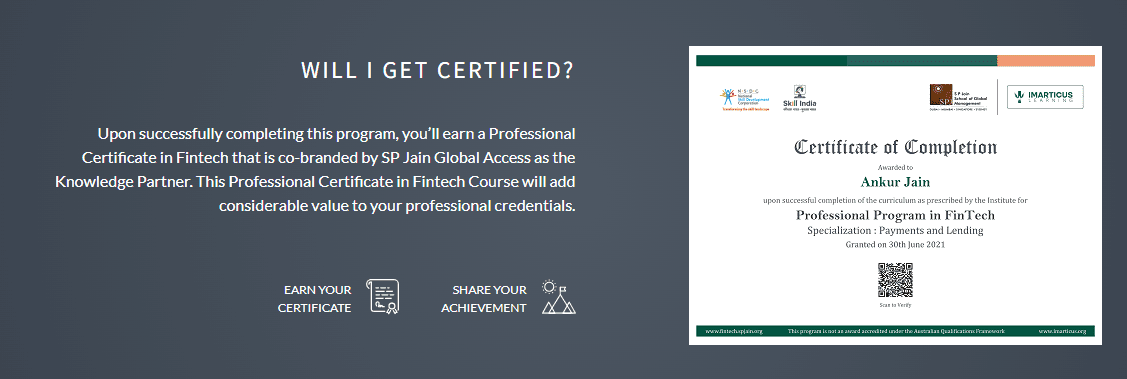

Check Certification Credibility

Check Certification Credibility