A finance career is usually a very lucrative industry and involves working in a finance company or any finance division of a venture. Although the salary grades depend on experience and other allied factors, the average pay scale of a financial analyst varies between Rs. 4 lakh and Rs. 5 lakh. It is also accompanied by bonuses and other company benefits. Hence to start a career in the financial sector, it is essential to opt for an advanced management program in financial services and capital markets.

How to Get Started?

Although starting a career in finance needs determination and hard work, here are the pointers to kick-start it.

- Get Proper Certification And Degrees

It is not a surprise that adequate knowledge concerning a subject is necessary to succeed in a domain. Although it is preferable for commerce, business, or economics students, individuals from other disciplines can also join. To get detailed knowledge about the management of finance, they might need to opt for a PGDM in finance management. This course exposes aspirants to knowledge about investment banking, capital market, and risk and Fintech modules.

Create Networking

Create Networking

Whether it’s from your previous job or current coursework, impactful networking is important. In financial services, it is not only about how much you know about the subject, but it is also about how many people you know.

One of the most effective ways is to request people you already know to introduce you to other people or organizations you are interested in. But, remember to be polite, professional, and curious to learn more.

- Use a Referee

If any contact of yours works in a venture you are willing to apply for, you can ask them for a referral. Many hiring managers are interested in resumes from internal references and might consider you for a position to fill a spot.

- Apply For An Entry Level Position

After completing capital market courses, it is most likely that you will acquire enough knowledge, and accompanied with previous experience, you can get a rewarding career. But also, if you are willing to start from the base, you can go for an entry-level position. These positions are easy to crack and provide a handsome salary to individuals.

- Attend Career Fairs

A career fair is where different companies visit with their representatives and share opportunities with students as per their qualifications. In some cases, they also allow students to leave a copy of their CV to contact them. For people willing to start their careers, this opportunity can be stolen and help them reach higher job roles based on experience and expertise.

- Create a Great Resume

Most individuals don’t emphasize this pointer much when starting a new job role. It is imperative to create a proper CV before applying. Focus on things that actually matter to the job, rather than other irrelevant information. You need to highlight past experiences, education, and certification in your resume. It is also important to note that a resume must be clean and easy to understand. A CV packed with information doesn’t really appeal to the hiring manager; instead, make it tidy, professional, and relevant.

- Seek Assistance From a Mentor

The role of a mentor for starting a career in finance can be noteworthy. They can assist you with all the resources and guide you in making important decisions concerning your job. They can also help you make realistic goals and act as a harbinger in achieving them. Thus, apart from choosing a chaperone, opting for courses related to capital markets and financial services can provide you with the ground to kick your career towards the financial sector.

A financial market is bestowed with myriad opportunities for fresher and experienced candidates. From investment consultant to the budget analyst, the chances for growth are perpetual. Hence, a PGDM in finance management can be a launchpad for candidates to skyrocket their careers in the financial sector.

A financial market is bestowed with myriad opportunities for fresher and experienced candidates. From investment consultant to the budget analyst, the chances for growth are perpetual. Hence, a PGDM in finance management can be a launchpad for candidates to skyrocket their careers in the financial sector.

Credit risk management is a popular part of the banking sector today. You can undertake

Credit risk management is a popular part of the banking sector today. You can undertake

How about traveling to a distant mart for supplies and attend a 20-minute short session? Isn’t it cool how flexible and adaptable these programs are!

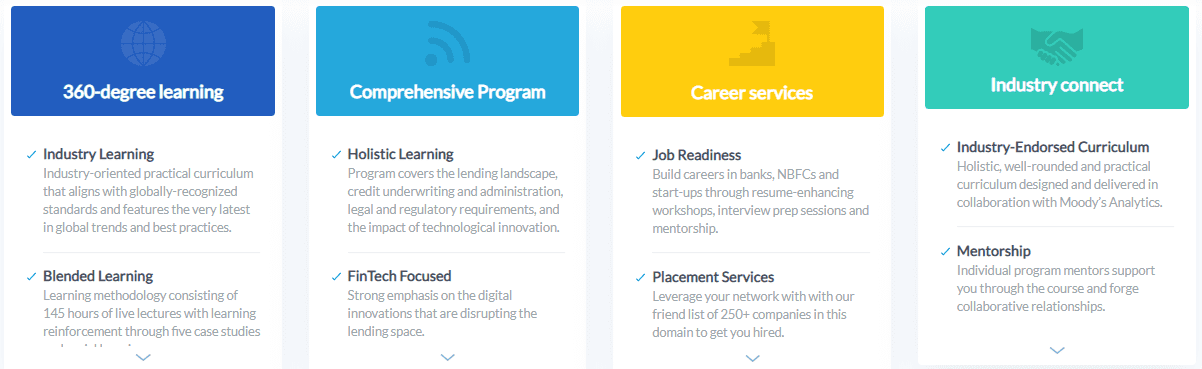

How about traveling to a distant mart for supplies and attend a 20-minute short session? Isn’t it cool how flexible and adaptable these programs are! This program covers every paradigm of cutting-edge New Age management solutions. The curriculum is designed to provide students in-depth exposure to critical elements of the various domains via hands-on training with prominent technologies such as API, Blockchain, Cloud Computing, AI, Machine Learning, RPA, IoT, and Big Data.

This program covers every paradigm of cutting-edge New Age management solutions. The curriculum is designed to provide students in-depth exposure to critical elements of the various domains via hands-on training with prominent technologies such as API, Blockchain, Cloud Computing, AI, Machine Learning, RPA, IoT, and Big Data.