7 little changes that will make a big difference: Credit risk certification in India

Objective: A high growth career in Credit Risk

Financial markets provide some of the most rewarding careers across sectors. One such area in which careers are being made is the huge lending industry. In the lending industry, credit risk management expertise provides a plethora of job profiles such as operational risk manager, risk analysis researcher, enterprise risk management lead, credit analysis associate, and insurance underwriting, among other high growth profiles.

However, it is not so easy to get an entry into this industry, and if you are already in credit risk management, job mobility and promotions are a huge problem.

The effective way of making a career in credit risk

There are many ways to get into these roles or pursue a promotion in them. Going for one of the reputed credit management courses can help you reach this goal. Credit risk certification that is recognized by the industry can solve some key problems and make it possible to attain the goal of having a thriving career in credit risk management. Pursuing the best credit risk certification in India can make all the difference to your work profile.

7 ways in which a credit risk certification makes a difference

Here are 7 key ways in which a credit risk certification makes a comprehensive difference for you in your career goals:

-

Strategic overview of the lending landscape.

Going through one of the reputed credit risk management courses will enable a credit analysis professional to get a strategic view of the lending industry. For an ambitious professional, who sees himself rising up the corporate ladder, it is necessary to develop a strategic perspective. Having a broad view of the market is what is expected of key decision-makers.

-

Fintech opportunities

Several major fintech companies have come up in recent years. They have created massive job opportunities and provide an option to those who are looking to switch job profiles. One of the best ways to catch the attention of recruiters is to have a certification that shows knowledge of the area in which one is seeking a role.

-

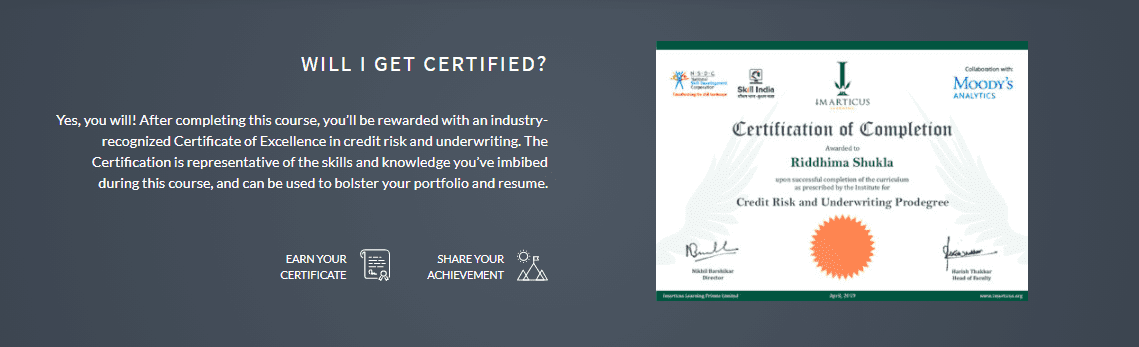

Valued certification

When a credit risk certification comes with a tie-up with a global institution like Moody’s Analytics, it has demonstrated value in the job market. It also enhances prospects within one’s current organization. A certification communicates knowledge and intent to employers all over the world. Moody’s is a globally renowned financial institution.

-

Comprehensive curriculum

A self-learner can be lacking in confidence because of having missed out on working in some key aspects of the industry. For example, someone in sales could feel intimidated by due diligence. But going for certification takes a professional through a comprehensive curriculum where the fundamentals of each key segment are taught.

-

Live interactions with experts

Undergoing a course gives the opportunity to interact with experts and go deeply into every section one is truly interested in. It is a proven method of learning wherein a participant gets an outlet to express his doubts and get them cleared. These are also opportunities to get mentors for one’s career.

-

Upskilling for digital technology

Joining one of the credit risk management courses online fulfills the dual role of providing skills in the credit risk domain, as well as in digital technology. If you have been off academics for a long time, you would be feeling the need to reorient yourself to fit into a digital-first world. Credit risk management courses by modern institutions such as Imarticus teach you tools relevant to the technology-driven lending industry.

-

Learning at an affordable duration

There are many credible educational programs to go through, but these are usually of 1-2 years duration. While they carry legitimacy in the industry, this is a huge investment in both time and money. Credit risk management courses online give your knowledge legitimacy in a much shorter duration.

Conclusion: Credit Risk Certification is the definite solution

Credit management courses online can create tremendous value for any finance professional who wishes to join the segment. There are many reasons, such as the collaboration with Moody’s Analytics, that makes this one of the best credit risk certifications in India.

Imaritcus brings deep learning, relevant today, to all their courses. This makes the engagement meaningful and transformative for their participants. The credit risk certification course, Imarticus offers is readily accepted by the industry.

Within a short duration, it reorients the participant, provides learning of fundamentals, and makes a professional savvy in the technology era – features that would be it the best credit risk certification in India. Getting a certificate through the institute includes placement assistance and contacts to navigate into the industry.

What Else do I Get When I Take a CRU-PRO Degree?

What Else do I Get When I Take a CRU-PRO Degree?

The course will help you leverage current data and maintain the scorecard model. Here are some ways in which you can improve the credit risk process.

The course will help you leverage current data and maintain the scorecard model. Here are some ways in which you can improve the credit risk process. Learn Credit Risk and Underwriting

Learn Credit Risk and Underwriting