This question always buzzes in the minds of commerce students and working professionals: What is CFA? You might have heard about investment banking, but have you ever wondered what course or qualification is required to become one? The CFA course helps you embark on your career in Investment Banking.

A CFA charterholder is a highly respected qualification by employers worldwide, giving you an edge over top management graduates. A CFA certification is not just a change in designation but a gateway to extraordinary opportunities in the world of finance.

Imagine you’re sitting in an exam hall with aspiring finance professionals. Everyone has the same dream of earning the three golden letters after their name, “CFA”.

The real challenge? Only about one in two candidates actually makes it to the finish line. The road is undoubtedly tough, but every step is absolutely worth it. And in this guide, I’ll walk you through everything you need to know not just to survive, but thrive on your CFA journey.

The CFA journey is challenging. But if you dream of working at Wall Street or Dalal Street with confidence, this certificate could be your golden ticket. The only question is, are you ready to begin your quest?

This guide will demystify your understanding of what is CFA course?

What is CFA?

The Chartered Financial Analyst (CFA) credential is the undisputed gold standard in investment management, equity research, portfolio management, risk analysis — anywhere serious finance happens. It’s not just about numbers or theories: it’s about building a calibre of thinking that separates the average from the exceptional.

Imagine you’re standing among 200,000+ finance professionals worldwide — that’s the current number of CFA charterholders who carry the designation in over 160 countries.

Here’s what makes it real:

- The CFA syllabus consists of three levels. Level I tests your fundamentals. Level II forces you to apply these under pressure. Level III demands judgment — you must think like a portfolio manager, balancing risk, strategy, and ethics.

- In May 2025, only 45% of those who took the Level I Exams passed — a sign of how rigorous the exam really is.

- Level II in that same cycle saw a 54% pass rate, which is still tough, still discriminates the truly prepared.

- Level III isn’t a walk in the park either. In February 2025, just 49% made it through.

And it’s not only about technical knowledge. The CFA Institute weaves ethics, professional conduct, and integrity into every level — not as afterthoughts, but as foundational pillars. When you complete all three exams and fulfil the work experience requirement, you don’t just earn a certificate: you gain a badge that says you’re serious about your craft.

CFA Course: What It Is and Why It Matters

When I first heard about the CFA, I have to admit, it sounded intimidating. Three tough exams, global recognition, and a curriculum that spans everything from portfolio management to ethics. But the more I dug in, the more I realised why it’s considered the gold standard in finance.

What is the full form of CFA?

The full form of CFA is Chartered Financial Analyst, offered by the CFA Institute. It’s one of those credentials that immediately tells people you know your stuff. From what I’ve read, it’s not just about memorising formulas – it’s about learning how to think like someone making real investment decisions, managing risks, and analysing markets at a high level. It is a highly regarded career choice for professionals looking to advance in executive positions.

What exactly is a Chartered Financial Analyst (CFA)?

The CFA is a globally recognised designation in investment management, respected as one of the highest credentials in the world of finance.

The CFA course is ideal for a career path in investment banking, portfolio management, and financial analysis, unlike other professional financial certifications with a focus on management accounting, financial accounting, auditing and taxation.

What exactly does a CFA do?

I’ve seen that CFA charterholders end up doing some pretty impactful work. They’re in investment management, corporate finance, equity research, and portfolio strategy. Essentially, they help companies make big decisions, often with millions of dollars on the line. It’s not an easy path — less than half of candidates pass each level — but that’s exactly why it’s so respected.

A CFA charterholder works in investment management, financial reporting and analysis, corporate finance, equity investment strategies, and economics. CFAs usually work in large financial services and investment banking organisations, where they are required to do extensive research and analysis.

This plays an essential role in guiding companies to make challenging and informed decisions in the complex financial markets.

💡 Imarticus is an authorised preparation provider of the CFA program, which is considered the gold standard of investment certification.

You can even kickstart your CFA journey with industry leaders – Imarticus Learning offers CFA Training in collaboration with KPMG in India, giving aspirants both academic depth and real-world, practical exposure.

Is CFA Worth it in India?

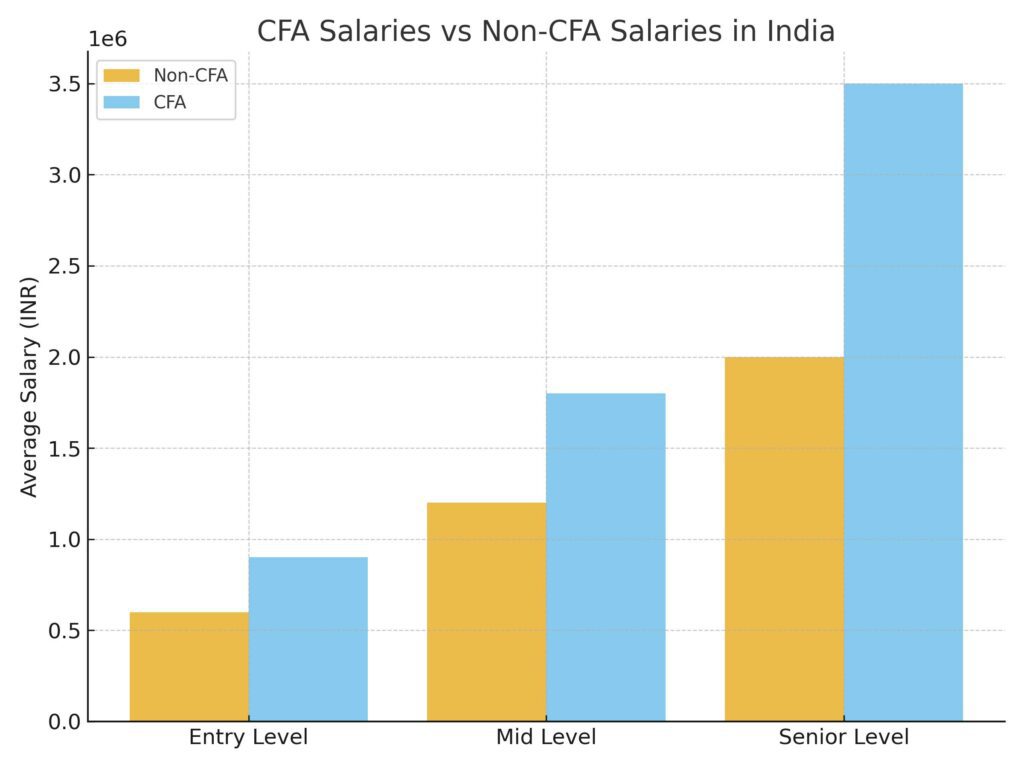

Let’s be real – CFA isn’t an easy ride. The exams are tough, the pass rate is low, and it takes years of effort. So is it worth it if you’re in India? For most people who want to break into finance or grow faster in the industry, yes, it is.

Here’s what makes it worth the grind:

- It gives you a global badge of credibility. Whether you’re applying to firms in Mumbai or Singapore, those three letters carry weight.

- In India, CFAs usually earn more than their non-CFA peers. Freshers may start around ₹8–10 LPA, but with experience, salaries often push past ₹40 LPA in top roles.

- Clearing it shows employers you’ve got discipline and depth. That’s why CFAs are often trusted with serious investment decisions.

- You also get plugged into a community of charterholders worldwide – people you can learn from, network with, and lean on.

Yes, the exams are brutal – less than half the people pass. But that’s what makes the CFA special. It signals that you’ve pushed through something most people can’t, and in finance, that reputation really matters.

Why Pursue the CFA?

You might be wondering, why do thousands of people around the world put themselves through the grind of the CFA exams every year? Because those three letters open doors that very few other qualifications can. The CFA isn’t just another certification; rather, it’s a mark of credibility, trust, and expertise in finance. The designation is globally recognised and respected.

It also signals something deeper to employers: discipline. Passing CFA levels does not just show your smartness, but also consistency, focus, and resilience — the qualities that matter just as much as technical skills in high-stakes finance. Beyond the bookish knowledge, you also join a worldwide network of charterholders — mentors, peers, and industry leaders you can learn from and lean on as your career grows.

In short, you don’t just pursue the CFA for the knowledge — you pursue it for the credibility, the career opportunities, and the community it connects you to.

How Long Does it take to Become a CFA?

It takes 2.5 to 4 years to clear all levels of CFA. This duration can vary depending on preparation time and how quickly you clear the exams.

| Conducted | Preparation Time | |

| CFA Level 1 | Feb, May, Aug, and Nov. | 6-9 months |

| CFA Level 2 | May, Aug, and Nov. | 9-12 months |

| CFA Level 3 | Feb and Aug. | 9-12 months |

On average, candidates spend 300+ study hours per level, and the typical candidate finishes in about 3 years, if they clear all levels in their first attempt.

CFA Attempt Limits

You can take each Level of the CFA Exam a maximum of 6 times, with only two attempts per level each year. There is a waiting period of 6 months to retake the same level.

Interesting Fact – CFA is Not Just for Finance Majors. While most candidates come from finance or economics, people from engineering, IT, and even law backgrounds pursue it to enter the investment world.

The CFA Program Structure: A Deep Dive into the Levels

If you are still doubting what is the CFA program? The CFA curriculum builds candidates with a strong financial and investment foundation.

It includes topics like:

- Ethics,

- Economics,

- Quantitative methods,

- Financial reporting,

- Corporate finance,

- Equity,

- Fixed income,

- Derivatives,

- Alternative investments, and

- Portfolio management.

Overview of CFA Exam Structure & CFA Exam Levels Explained

The CFA Exams build your knowledge, test your expertise and application skills in finance, investment and reporting. The table below explains key points for each Exam Level.

| CFA Level | Stage Name | Focus Areas | Exam Duration & Structure | Question Type | Key Skills Tested |

| CFA Level 1 | Foundation | -10 Core Subjects – Practical Skills Module | – 2 sessions of 2 hrs 15 mins (135 mins) each- Total duration: 4 hrs 30 mins | – 180 Multiple-Choice Questions (MCQs)– No negative marking | – Understanding fundamental concepts- Building core finance knowledge- Interpreting financial statements |

| CFA Level 2 | Asset Valuation & Application | – 10 Core Subjects – Application & Analytical Skills – Mastery in Asset Valuation | – 2 sessions of 2 hrs 12 mins (132 mins) each- Total duration: 4 hrs 24 mins- Each session has 11 item sets | – 22 item sets (Case-based MCQs)– 88 questions in total | – Applying finance theories to scenarios- Analytical & valuation skills- Problem-solving with data sets |

| CFA Level 3 | Portfolio Management & Wealth Planning | – Portfolio construction & risk management- Wealth planning strategies- Advanced investment concepts – Specialisation Pathways | – 2 sessions of 2 hrs 12 mins (132 mins) each- Total duration: 4 hrs 24 mins | – Essay-type questions (Constructed Response)- Some case-based MCQs | – Decision-making like a portfolio manager- Communicating investment rationale- Strategic wealth planning & client advisory |

If you are someone who is pursuing CFA with a full-time job, you can refer to this study plan.

CFA Course Fees

When a commerce or finance graduate decides to pursue CFA, the first thing they Google isn’t the syllabus, but the fees.

Can they afford it?

How much would each level cost in Indian rupees?

Would the investment be worth it?

CFA Course Fees in India

By the time you finish planning about pursuing CFA, you’ll know the CFA fees aren’t just numbers. They are milestones. Each rupee you save, each early registration you make, is part of your journey.

The CFA isn’t just testing your knowledge of finance; it is already teaching you financial discipline. And that lesson, once realised, feels priceless.

- CFA Level 1: ₹60,000

- CFA Level 2: ₹60,000

- CFA Level 3: ₹60,000

At Imarticus Learning, you are given a 100% guarantee to receive a 50% refund of your course fees if you fail the CFA course exams.

Here’s a video to give you a detailed insight into how to clear the CFA Level 1 Exams:

CFA Syllabus

The CFA Syllabus develops a comprehensive skill set and prepares you for the investment and financial world. The Syllabus varies across the 3 levels. You can have a look at the subjects for each level below:

CFA Level 1 Syllabus

CFA Level 1 focuses on core modules, which consist of 10 subjects. It also includes two practical skills modules: Financial Modelling and Python Programming Fundamentals.

| Subject | Weightage |

| Quantitative Methods | 6-9% |

| Economics | 6-9% |

| Portfolio Management | 8-12% |

| Corporate Issuers | 6-9% |

| Financial Statement Analysis | 11-14% |

| Equity Investments | 11-14% |

| Fixed Income | 11-14% |

| Derivatives | 5-8% |

| Alternative Investments | 7-10% |

| Ethical and Professional Standards | 15-20% |

CFA Level 2 Syllabus

CFA Level 2 deepens your expertise on the same core modules with an in-depth focus on practical skills in Analytics, Python, Data Science, AI, and Python programming fundamentals, which is also offered in the Level 1.

CFA Level 3 Syllabus

CFA Level 3 has 6 core subjects with specialisation options and practical modules with case studies to enhance your skills.

| Subject | Weightage |

| Asset Allocation | 15-20% |

| Portfolio Construction | 15-20% |

| Performance Measurement | 5-10% |

| Derivatives and Risk Management | 10-15% |

| Ethical and Professional Standards | 10-15% |

| Specialisation Pathways – Portfolio Management Pathway Private Wealth Pathway Private Markets Pathway | 30-35% |

The Level 3 also has a Practical Skills Module for Portfolio Development and Construction, and a Pathway Specific Module (Due Diligence – Private Markets Pathway / Practical Macro – Portfolio Management Pathway / Managing Private Wealth Clients – Private Wealth Pathway).

Navigating through the CFA Exam: Preparation Strategies & Tips

The CFA journey is beyond clearing the exams. It rewards discipline, consistent preparation, and the ability to stay focused at every stage. Each level teaches you to think through uncertainty and make sound decisions when the answers aren’t obvious. That’s what makes the CFA so much more than a qualification – it’s a true test of character.

This guide can help you with your CFA Certification journey:

Why opting for CFA Training or a dedicated CFA Course-prep can be a Game Changer?

Training isn’t just about someone teaching you the concepts and formulas. It’s about:

- Structured Learning: Access to tailored course material.

- Expert Guidance: Faculty with subject matter expertise.

- Accountability: Doubt-solving sessions and placement opportunities.

- Peer Support: You get access to a dedicated channel with networking opportunities.

- Industry-Relevant Resources: You often get access to industry collaboration events, webinars and live sessions.

Effective Study Strategies

To clear the CFA Exam, you need to follow a strategy and a dedicated routine. On average, candidates spend 300+ hours per level. So, if you are someone who can dedicate time and stay disciplined throughout the journey, you can definitely choose self-study.

Time Management

When you do self-study, you have to decide on your strategy and decide if you will spend your time on a topic with higher weightage or smaller weightage. If you’re a working professional with a 9-5 job, you can split study time by utilising weekdays for reading and concept building, weekends for mocks.

Revision

Revising the concepts learned by applying them and using proven strategies can prepare you for your exams.

Mock Exams

Taking practice tests and mock exams in a timed environment helps you prepare well for the exams and reduces stress.

Requirements to Become a CFA Charterholder

As a final-year B.Com student, when you first hear about CFA, it is quite common to feel excited. But then comes the flood of doubts about whether I am eligible.

Do I need any work experience?

What if I’m still in college?

Will my engineering degree be eligible?

How to become a CFA charterholder in India?

Criteria to enrol in CFA

Like most financial certificate aspirants, the CFA seems like a big dream, but the eligibility rules feel like a maze. To enrol in the CFA course, you need to meet the criteria below:

- Education: Candidates who hold a Bachelor’s degree or who have appeared for their final year exams and are waiting for the results from a recognised University are eligible to appear for the CFA Level 1 Exams.

- Experience: You should have 4000 hours of work experience in the field of investment and decision-making.

- Membership: Register and be a member of the CFA Institute by submitting up to 3 professional reference letters.

Start your CFA Journey with this Roadmap

If you are passionate about earning the most respected credential in investment management. The path to becoming a CFA (Chartered Financial Analyst) charterholder can be daunting.

As an aspirant, you will be overwhelmed with many questions and misconceptions about the CFA journey, like:

How to become a CFA charterholder in India?

How many CFA levels are there, and what’s the syllabus?

How to Study for the CFA Level 1?

CFA isn’t a cakewalk; it’s a demanding course with a series of exams with an utmost difficulty level designed to build an elite class of finance and investment professionals. But the good news is that with a strategic plan and meticulous approach, it’s easy to be a CFA charterholder.

This roadmap is designed to cut through the noise, demystify the process, and guide you step-by-step toward achieving the esteemed CFA Charter.

| Stage | Step | Focus Area | Key Requirements / Outcomes |

| Eligibility | 1. Gain Eligibility | Entry Requirements | Bachelor’s degree (or final year), 4,000 hours of relevant work experience (min. 36 months), a valid passport, and meet professional conduct standards. |

| CFA Level 1 | 2. Enrol & Prepare | Fundamentals | Register with CFA Institute and schedule the Level I exam. Study investment tools, ethics, professional standards, and asset classes. |

| 3. Pass CFA Level 1 | Foundation | Demonstrate solid understanding of basic investment concepts. Establish credibility in the field. | |

| CFA Level 2 | 4. Enrol & Prepare | Asset Valuation & Analysis | Focus on valuation, applied analysis, case studies, and item-set questions. |

| 5. Pass CFA Level 2 | Application | Showcase skills in valuing investments and applying financial data to real-world scenarios. | |

| CFA Level 3 | 6. Enrol & Prepare | Portfolio Management | Study portfolio management, wealth planning, and advanced ethics. Practice essay + item-set questions. |

| 7. Pass CFA Level 3 | Integration | Prove ability to integrate knowledge across all levels and act as an investment decision-maker. | |

| Experience | 8. Fulfil Work Experience | Professional Practice | Accumulate 4,000 hours of qualified work experience in investment decision-making and get professional reference checks. |

| CFA Charter | 9. Become a CFA Charterholder | Achievement | Apply to CFA Institute, earn the CFA Charter, join the elite global network, and commit to ongoing learning & ethics. |

Life as a CFA Charterholder: Career Impact & Beyond

A CFA has deep financial expertise with strong analytical, technical, decision-making and communication skills, making them highly adaptable and valuable in today’s fast-paced financial markets.

When you clear your CFA Level 3 exam, you aren’t just holding a certificate; you are holding a passport. A passport that could take you from Mumbai’s Dalal Street to New York’s Wall Street, and your career from equity research to portfolio management, from analyst to managing director.

But what exactly does that journey look like?

What careers open up?

And how fast can you grow with the three magical letters “CFA” next to your name?

What Job Roles can a CFA pursue?

The CFA charter isn’t just another degree; it’s a professional superpower. Globally recognised and deeply respected among investment circles, it is often considered a competitive alternative to an MBA in finance, signalling a clear message to employers: This person understands money, investment, and wealth management at a world-class level.

That’s why charterholders are found in top firms like:

- JP Morgan

- Goldman Sachs

- BlackRock

- Deloitte

- MSCI, among others

So if you’re still wondering about CFA jobs, CFA professionals have an extensive scope for career advancement and opportunities, and often hold crucial roles like:

- Portfolio Manager,

- Research Analyst,

- Investment Banker,

- Risk Manager, and

- Private Wealth Manager.

CFA Salary (India & Global)

CFAs often enjoy a lucrative earning potential worldwide, with a broad range of career opportunities in the field of investment banking, portfolio optimisation, equities & derivatives, market research, advanced analytics and client advisory services.

CFA Stage 1: The Analyst (Entry Point)

Entry-level CFAs often start their journey as Research Analysts, Risk Analysts, or Investment Banking Associates. Think of this stage as learning to hold the sword where you’re collecting data, analysing trends, and supporting decision-makers.

Job Roles:

- Equity Research Analyst – ₹7 LPA

- Risk Analyst – ₹3-21 LPA

- Credit Analyst -₹6-7 LPA

- Corporate Finance Associate – ₹16 LPA

Salary: Average salaries for CFA Freshers begin at ₹5–10 LPA in India and $70,000-90,000 in the USA.

CFA Stage 2: Strategists

By the time you clear Level 3, your profile transforms. You will no longer be just crunching numbers, but will start making investment calls. Employers trust you with bigger responsibilities.

Job Roles:

- Portfolio Manager – ₹25 LPA

- Fund Manager – ₹16 LPA

- Wealth Manager – ₹7.5 LPA

- Financial Consultant – ₹6.5-24 LPA

- Senior Risk Manager – ₹18-42 LPA

Salary: Average salaries for mid-senior level CFAs range between ₹12–25 LPA in India and $90,000-180,000 in the USA. Few experienced professionals draw higher salaries.

CFA Stage 3: The Leader (Executive Level)

At this stage, experienced CFA charterholders step into leadership roles. They don’t just follow the markets anymore; they lead strategies worth billions by taking important investment decisions, advising institutional investors and high-net-worth clients.

Job Roles:

- Chief Investment Officer – ₹46.5-62.5 LPA

- Managing Director – Investment Banking – ₹70 LPA

- Senior Consultant – Strategy/Advisory – ₹24-25 LPA

- VP/Director – Asset Management – ₹34-38 LPA

Salary: Average salaries for experienced CFAs range between ₹15 LPA – 1 Cr+ annually in India and over $200,000 in the USA.

Still calculating CFA’s ROI? This video explains how you can become a Portfolio Manager with CFA in just 18 months!

CFA vs MBA vs FRM vs CPA

Choosing the best career path can be challenging with multiple options in the market. This comparison will help you get a brief overview of the courses and understand which course is right for you.

| CFA | MBA | FRM | CPA | |

| Focus Areas | Investment Tools, Valuing Asset Classes, Portfolio Management, Wealth Planning | Management, HR, Finance, Marketing, Operations, Analytics, Strategy, IT, Supply Chain Management, Entrepreneurship | Quantitative Analysis, Financial Markets & Products, Valuation & Risk Models, Market Risk, Credit Risk,Operational Risk,Liquidity Risk. | Business Analysis & Reporting, Information Systems & Controls, Tax Compliance & Planning. |

| Fees | ~₹3.4 – 4.5 Lacs | ~₹4 – 30 Lacs+ | ~₹1.5 – 2 Lacs | ~₹3 – 4.5 Lacs |

| Duration | 2.5 – 4 years | 2 years | 1 – 2 years | 12 – 18 months |

| Recognised In | 165+ countries (Global Recognition) | Globally recognised based on University accreditation. | 190+ countries(Global Recognition) | 130+ countries(Global Recognition) |

FAQs about CFA

Here are a few frequently asked questions about CFA.

What is the CFA course?

CFA is a globally recognised certification in investment and financial management.

What does CFA stand for?

CFA stands for Chartered Financial Analyst. A highly reputed certification in investment and financial management with global recognition.

Is the CFA worth it?

CFA is a challenging yet rewarding job role which offers a high earning potential. If you are passionate about numbers, strategy and stock markets, the CFA is an excellent choice to master finance.

How hard is the CFA exam?

The CFA exam has a relatively high difficulty level with a lower pass rate. It requires a disciplined and consistent approach, rigorous practice and a deep understanding of the concepts. The CFA exam isn’t hard if you master the fundamentals.

Can I skip CFA levels?

No, CFA levels cannot be skipped. One needs to give all three levels sequentially.

Do I need a finance background?

Having a background in finance is not mandatory; however, it can be an added advantage if you have prior experience.

What’s the average pass rate?

CFA has a pass rate of below 50% which means only 50 out of 100 candidates clear the exam successfully.

Is CFA better than MBA?

CFAs and MBAs are completely different in nature, which does not make either course better than the other. MBA is a broader course which equips you with business and management skills with a specialisation in the degree. On the other hand, CFA is a specialisation in finance and investment management to deepen your financial knowledge and expertise.

Is CFA tougher than CA?

CA is considered tougher than CFA as it has a relatively lower pass percentage. CA Finals have an average passing rate of 18.75%. CFAs have an average passing rate between 40-50%.

What is a CFA salary?

The salary for CFAs starts from ₹5 LPA and goes higher for professionals with experience.

Begin Your CFA Journey Now

The CFA program is more than just a finance certification – it’s a globally recognised passport with access to a rewarding career in investment, portfolio management, and financial leadership. While the journey demands discipline, time, and effort, the knowledge and credibility it brings are unmatched.

Whether you come from finance, engineering, or even law, the CFA opens doors to opportunities across industries and geographies. If you’re committed to mastering the investment world and building a strong professional edge, the CFA charter is one of the best investments you can make in yourself.

We are India’s first and only approved certification prep provider that offers real-world business case studies, curated resources by top finance institutions like Kaplan Schweser, a dual teaching model, internship opportunities for top performers, and a joint certification that equips you with expert practical skills.

Are you ready to start your CFA journey? We at Imarticus offer the CFA course in association with KPMG in India to create industry-led programs. Bookmark this complete guide and come back whenever you feel lost in the chaos of finance.