Bitcoin is the best example of blockchains succeeding and the beginning of the use of blockchains in all technologies to improve efficiency, accountability, transparency, and productivity at reduced costs for a wide variety of businesses.

Technology today is part and parcel of every business and industry where data is used. Without exceptions and across financial services, global supply chains, healthcare, government, insurance, real estate and banking sectors among many others have benefitted from blockchains. Ways and means to use the Blockchain Certification to transform and disrupt industrial growth and businesses are the subject matter of every innovator on the web.

Let us explore how the blockchain can transform your industry or business model.

1. Transactional transparency:

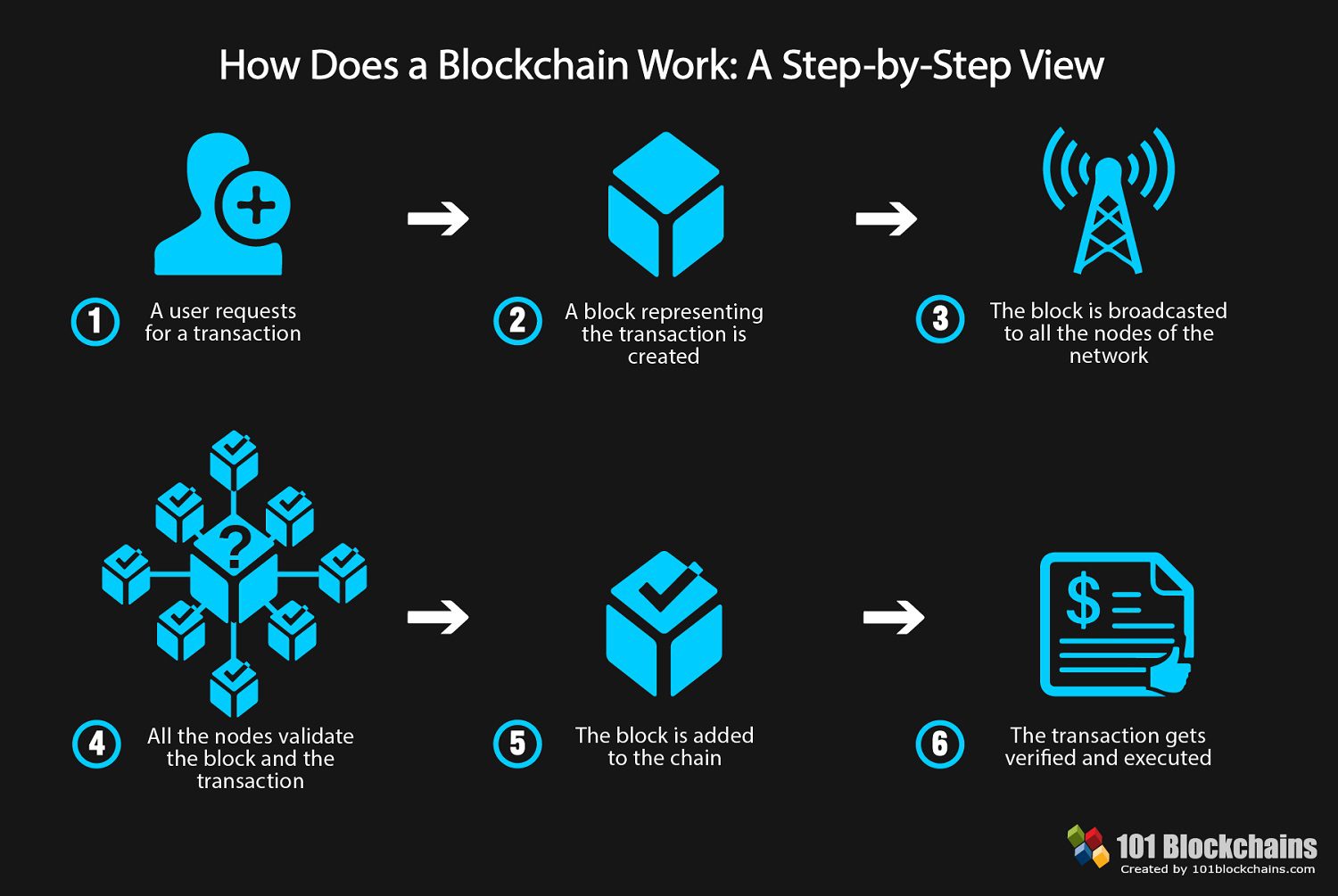

Record keeping and maintaining transactional histories use blockchain distributed ledgers where all network users can verify the recording of the shared documentation. The altering, deleting or tampering of records is near impossible as every block transaction carries a copy of the previous block in unique hashtags and needs verification before being added to the block.

This means duplicity, frauds, altering documents becomes impossible as the sequence has to be changed across millions of network users and needs the consensus of all users on the network to timestamp and record the transaction. The result is a precise, accurate and immutable record shared to permission-enabled users in a transparent and sans intermediary transaction.

2. Verification and top-end security:

Consensual transactions ensure transparent recording. Every transaction is verified, approved, encrypted and linked through cryptographic means to the previous transaction. Publishing for verification in real-time ensures information is stored across every node of the network to make the hacking, data-loss and privacy of the network a 100% fail-proof system.

3. Better record keeping and traceability:

Tracing the source of products in a chain is difficult enough. By recording them on blockchains the logistics, marketing, record-keeping, product lists are all stored on blockchains to ensure finding the source or origin easily in real-time. Imagine how the product deliveries in a food-chain can be tracked to even account for spoilage and refrigeration details!

4. Speed, efficiency, and ease-of-use:

Paper transactions can be completely avoided by recording on blockchains. This also reduces human errors, third-party mediation, ledger keeping, and many such benefits. Sales are quicker and settlements hastened as proven by e-commerce platforms when blockchains are used since the records are stored on blocks shared in real-time across authorized users requiring a single distributed ledger for the entire network of users.

5. Cost reduction:

No intermediaries need be present meaning lesser costs on the recording, verification, and record-keeping. Where cost reduction is a priority blockchain can be relied upon for the trust, accuracy and transparency factors to help with improved efficiency and increased productivity.

A bit on blockchains:

Blockchain technology brings in the important four attributes of immutability, decentralization, transparency, and security.

- User authentication and verification using blockchain technology sans third-party interference.

- The blockchain data structure is contained in the append and causes the data to be immutable, and impossible to delete or alter.

- The data ledgers are cryptography protected and contain hashtag functions from the previous block. This information is verified to complete the cryptography transactional process.

- Ledger consensus and record keeping are enhanced as all data of transactions are contained in the block and are duly verified for maximum trust by the peer network users.

- Blockchain time-stamping ensures a recorded chronological order.

- The ledger is distributed over all blockchain nodes in real-time.

- The peer network has all transactions on the blockchain overall interconnected computers thus decentralizing the system.

- Data is always retrievable and never lost.

- Transparent transactions ensure the viewing parties are verified users and reduce transactional ambiguities.

- The source of the ledger can be tracked at every block of the chain.

- Consensus between the parties ensures duplicity and fraud are removed.

- Smart contracts enable presetting criteria and conditions for automatic recording of transactions.

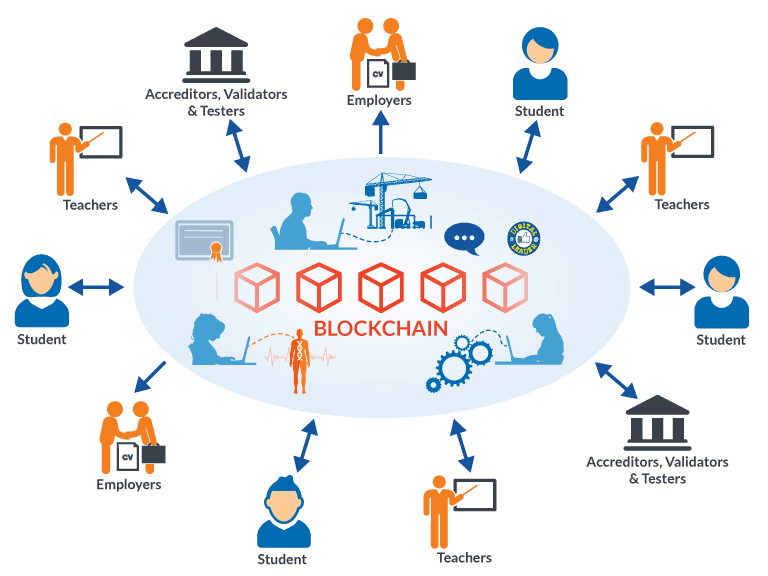

Blockchains are today popular across verticals and industries like banking, agriculture, healthcare, e-commerce, education, mining, property recording, retail, entertainment, media, automobiles, logistics, transport and many more.

Conclusions:

The blockchain technology is being popularly lapped up by governmental agencies, insurance firms, banks, real-estate sectors, for medical record keeping and much more where unauthorized access is limited and verification of users critical. Yes! Blockchains can be applied to all businesses without any problem to reap the very many benefits in improving accountability and efficiency of transactions.

However, to know what and when to do with this technology is an important area best tackled by doing a Blockchain Course at Imarticus Learning. Go ahead and learn it all starting at Imarticus’ course today! For more details, you can even visit one of our training centers based in – Mumbai, Thane, Pune, Chennai, Hyderabad, Banglore, Delhi, Gurgaon, and Ahmedabad.