Fintech is the abbreviation of Financial technology that does the job of collecting and processing data in real-time. Fintech is considered to be a big economic change in this rapidly growing and evolving financial sector. It has changed the way the business sector and various organisations function. Additionally, it has transformed the way financial institutions and banks carry out their Financial Services.

Financial technology courses are considered to be very essential for taking a step ahead if you are looking forward to having a career in fintech. So grab the chance and launch your career towards success.

What is Fintech?

Fintech has been a very popular word in the last few years. In layman’s words, fintech means the design and delivery of financial products and services using various technologies to reduce cost, improve efficiency and generate better-personalized services. As fintech professionals are in great demand, there has been a skill gap in the market. Many education institutions are trying to fill in the skill gap by introducing various financial technology courses so that they can produce more fintech professionals as required by the market demand.

An introduction to the banking and financial industry is an important aspect of the fintech courses. A fintech career seems to be attractive to both professionals and students as they are always up for challenging roles that are not traditional. Fintech courses prepare professionals and students for technologically driven strategic roles in an organisation.

Fintech is revolutionising businesses

Fintech is the latest financial service sector in the 21st century and it is also the future of the world. Financial technology has been at the four front of innovation for many years and financial professionals along with information technology firms have made the innovation of the financial sector very much possible.

It won’t be wrong if we say that technological innovation has taken over the banking and financial sector as well. People are more inclined toward buying things and making payments online rather than traditional payments and purchases. This allows businesses to use the right technology to optimise sales rather than holding on to traditional methods.

Blockchain technology has created a big difference in the banking sector as now money is being transferred on a real-time basis and the transaction for money is created by smart contracts. Fintech has also revolutionised the cyber security department. As the payments are done through various applications, cyber security has also been increased to avoid online fraud as much as possible.

Benefits of Fintech

It is important to note that in today’s world online payments through various applications have taken over the traditional mode of paying through cheques and cash. In the coming years, the world may go completely cashless and all the payments will be made through applications and on an online basis.

In such a scenario, knowing fintech and being aware of the various advantages of fintech can give you an upper hand. Fintech offers numerous advantages that can be stated as follows:

- Fintech helps professionals and business organizations to remain up to date with technology.

- The growth of fintech has reduced the role of banking sectors and hence acts like an eliminator of the middleman.

- Learning fintech makes an individual stand out in a competitive market.

- Fintech courses can be a career transformer for an individual as it is the need of the hour in the financial sector.

Conclusion

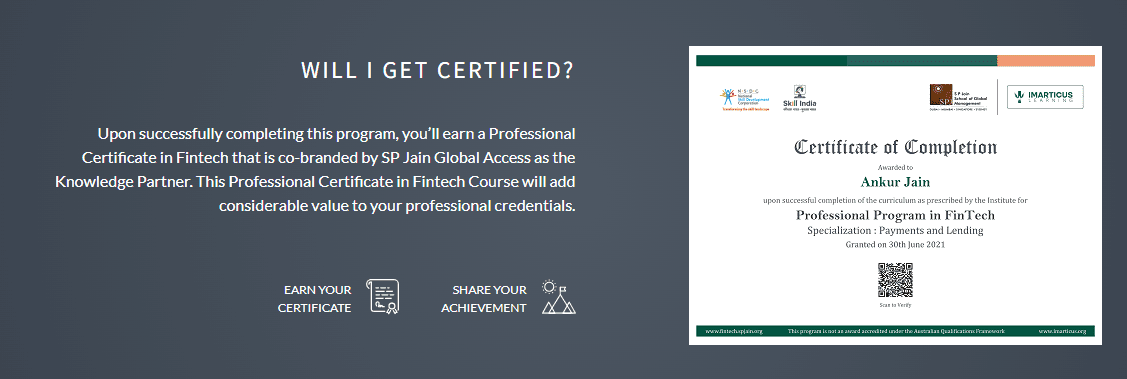

Fintech is the present as well as the future of the world in every possible sense. If you are looking forward to having a fintech career then you are at the right place as Imarticus offers the best fintech courses in India with guaranteed job interview opportunities. These courses are valuable as it provides placements in various organisations and acts as a launchpad for your flourishing career.

You must enroll in our

You must enroll in our