If you really want to understand the ACCA syllabus, ignore the exam names for a moment and look at what CFOs are hiring for. You’ll notice something interesting: the gaps in global finance teams are not “talent shortages”, they’re judgment shortages.

Companies aren’t struggling to find people who know accounting rules. They’re struggling to find people who can interpret uncertainty, challenge assumptions, and prevent financial mistakes before they turn into reputational damage.

The ACCA syllabus wasn’t built around academic difficulty; it was built around these organisational blind spots.

Every “paper” is essentially a simulation of a failure point inside a real finance function:

- Where performance derails

- Where controls usually crack

- Where reporting gets misread

- Where risks are ignored because someone didn’t know what they were looking at

This is why the ACCA qualification is valuable in the market. Not because it is global, not because it is recognised, but because it trains a professional to think the way high-stakes finance environments actually operate when nobody is watching.

In this blog, you’ll explore subject-level insights, difficulty patterns, the toughest ACCA papers, India-specific exemption logic, pass-rate signals, syllabus updates, and how each subject influences your career trajectory across core finance roles.

What is ACCA?

When people ask what is ACCA, I rarely begin with the usual “globally recognised accounting qualification” line. The real value sits elsewhere. ACCA is a training framework that gradually reshapes how you think about organisations, numbers, accountability, and decision-making. It strengthens the reflexes you rely on when you have limited information and real-world pressure. That mindset shift is the qualification’s core promise.

You’ll notice this the moment you step into the ACCA course. It doesn’t just transfer knowledge. It builds the ability to interpret situations, anticipate risks, question assumptions, and apply concepts in environments that move quickly. Each paper pushes you to unlock a different layer of professional maturity.

Here is a clear, structured way to see it.

How the ACCA Syllabus Shapes Your Professional Identity

The ACCA syllabus does more than organise subjects. If you’re wondering how an ACCA course can propel your career, the answer is this. It gradually builds the professional instincts employers look for: judgment, clarity in financial thinking, ethical consistency and confidence with complex decisions. This section explains how each stage of the syllabus shapes the mindset and identity of a future finance professional.

Understanding these subjects will also help build your ACCA skills and accelerate your career in finance.

The Professional Lens ACCA Builds

- Seeing financial statements as decision-maps, not documents

- Recognising patterns in performance, cost behaviour, and operational stress

- Spotting audit gaps before they become audit findings

- Translating technical regulations into business clarity

- Approaching strategy through cash flows, incentives, and control mechanisms

- Handling ambiguity without losing structure or accuracy

How the ACCA Syllabus Creates This Capability

The syllabus isn’t arranged just for academic progression. It mirrors how careers unfold.

- First, you learn how financial systems work

- Then you learn to measure, analyse, and challenge outcomes

- Finally, you learn to shape direction and strategy

The ACCA subject list strengthens a capability that employers immediately recognise: reporting accuracy, audit judgement, performance interpretation, tax logic, and strategic reasoning.

ACCA Syllabus Overview

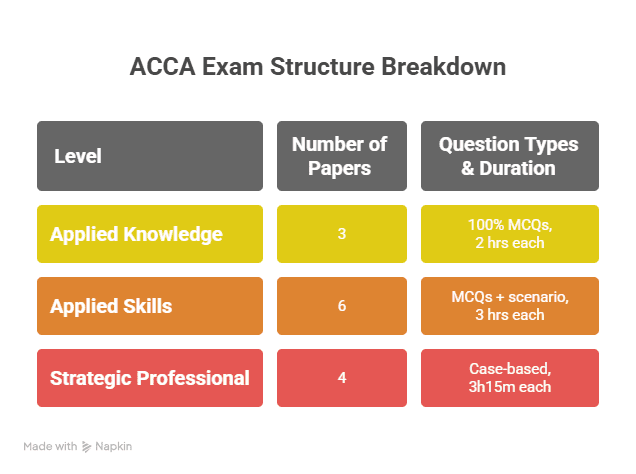

Here we map out the ACCA syllabus in detail: the three levels, all the subjects, and how they connect, because understanding the syllabus architecture is the foundation. We will discuss the 9 ACCA papers and the optional papers too.

ACCA is divided into three levels:

- Applied Knowledge

- BT – Business & Technology

- MA – Management Accounting

- FA – Financial Accounting

- Applied Skills

- LW – Corporate & Business Law

- PM – Performance Management

- TX – Taxation

- FR – Financial Reporting

- AA – Audit & Assurance

- FM – Financial Management

- Strategic Professional

- Essentials: SBL (Strategic Business Leader), SBR (Strategic Business Reporting)

- Options (choose two): AAA (Advanced Audit & Assurance), AFM (Advanced Financial Management), APM (Advanced Performance Management), ATX (Advanced Taxation)

You can get a comprehensive understanding of the ACCA course and syllabus breakdown with this brief overview:

Data-Driven Pass Rates: What the ACCA Syllabus Reveals About Difficulty

Pass rates tell a story that students often miss when navigating the ACCA syllabus. Every exam cycle reflects how candidates worldwide engage with the technical depth, application demands, and analytical pressure of each paper.

Some subjects consistently show lower pass percentages because they require layered reasoning, multi-standard integration, or professional judgement under time constraints. Others fluctuate when syllabus updates shift the focus of examiner expectations.

By examining these numbers objectively and understanding the ACCA eligibility requirements, you gain a realistic view of where the hardest ACCA exam challenges appear, why certain papers routinely emerge as the toughest paper in ACCA, and how preparation strategies should be adjusted.

Recent ACCA Pass Rates by Paper

(Based on June 2025 sitting unless otherwise stated)

| Level | Paper | Pass Rate (June 2025) | Notes on Difficulty |

| Applied Knowledge | BT | 88% | One of the higher pass rates → more conceptual, less application. |

| Applied Knowledge | MA | 64% | Moderate difficulty, some numerical analysis. |

| Applied Knowledge | FA | 68% | Balanced theory + financial facts. |

| Applied Skills | LW | 81% | Relatively manageable legal content. |

| Applied Skills | TX | 54% | Technical and jurisdiction-specific tax legislation. |

| Applied Skills | FR | 50% | IFRS-heavy, mixes calculations + reporting. |

| Applied Skills | PM | 43% | One of the toughest, strong conceptual + decision-making demands. |

| Applied Skills | AA | 44% | Audit standards + interpretation-heavy. |

| Applied Skills | FM | 48% | Financial management + risk + time value of money. |

| Strategic Professional – Essentials | SBL | 51% | Case-based, professional judgement, ethics. |

| Strategic Professional – Essentials | SBR | 49% | IFRS + narrative business reporting. |

| Strategic Professional – Options | AAA | 40% | Very low – advanced audit theory, standards, and application. |

| Strategic Professional – Options | AFM | 46% (approx) | Financial strategy, treasury, risk. |

| Strategic Professional – Options | APM | 40% | High-level performance management, strategic decisions. |

| Strategic Professional – Options | ATX | 49% | Advanced taxation concepts. |

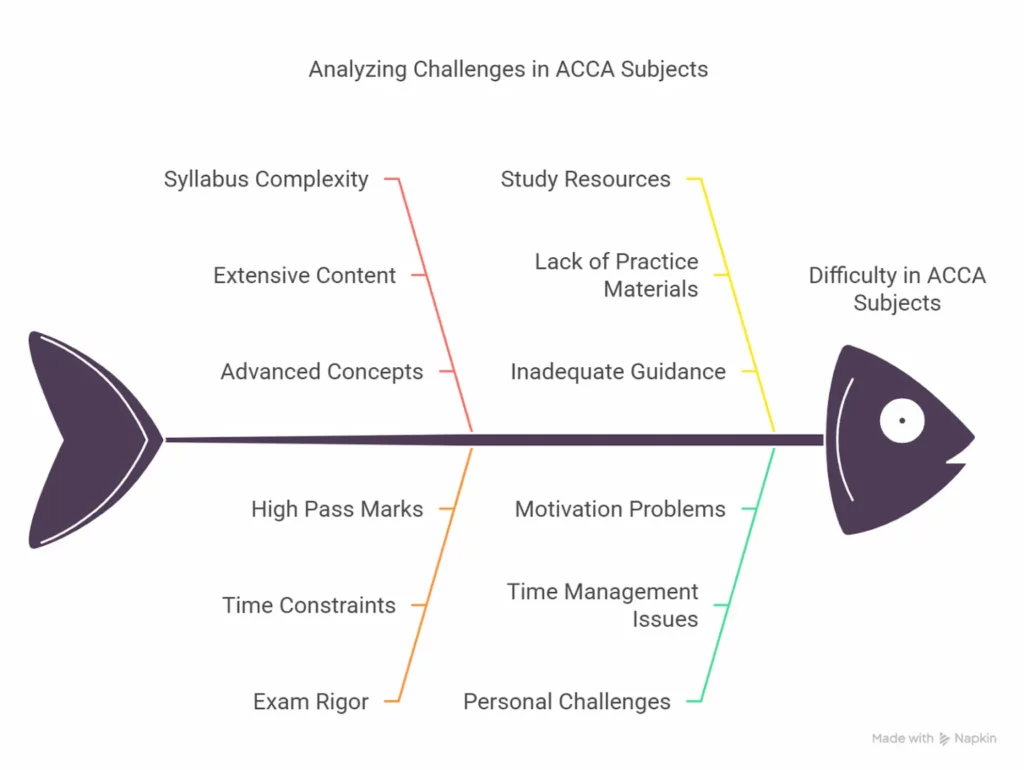

Why Are Some ACCA Subjects Considered the Hardest?

There are a few reasons why certain papers are always the most difficult ACCA papers:

- Syllabus difficulty

- Amount of material to memorise

- Application-type and analytical questions

- Short exam time

- Low pass rates globally

Let’s talk about the papers that are allegedly tough and why.

Most Difficult ACCA Subjects (with Pass Rates)

1. Strategic Business Leader (SBL)

- Level: Strategic Professional

- Global Pass Rate: ~50% (2023)

Why it’s tough:

- Combines content from various subjects

- Requires professional judgment

- Steep emphasis on communication and ethics

- Case-study long format

Expert Advice:

Practice case studies under a time limit. Develop strategic thought and framed answers.

2. Advanced Audit and Assurance (AAA)

- Level: Strategic Professional

- Global Pass Rate: ~32% (2023)

Why it’s tough:

- Need to be familiar with audit standards thoroughly

- Use in complex business scenarios

- Always open-ended and subjective

Expert Tip:

Use concepts rather than memorising. Use actual audit reports to practice.

3. Strategic Business Reporting (SBR)

- Level: Strategic Professional

- Global Pass Rate: ~47% (2023)

Why it’s tough:

- There is widespread IFRS knowledge required

- Analysis-based questions rather than memorising

- Impossible to pass without commercial awareness

Expert Tip:

Use theory to actual financial statements. Do not neglect IFRS updates.

4. Financial Reporting (FR)

- Level: Applied Skills

- Global Pass Rate: ~47% (2023)

Why it’s tough:

- Range of topics with IFRS

- Requires a firm conceptual basis

- Theory and calculations mixed

Expert Tip:

Double-entry mastermind and understand why each standard is there, don’t memorise.

5. Taxation (TX)

- Level: Applied Skills

- Global Pass Rate: ~51% (UK version)

Why it’s tough:

- Technical nature of content

- Tax legislations that vary with every passing of time

- Unresolved calculations against the clock

Expert Tip:

Practice with recent legislation and editions (UK/India/global).

Challenging ACCA Syllabus Topics to Watch Out For

They are generally referred to as the most challenging ACCA syllabus topics for exams:

- Ethics and Corporate Governance (SBL)

- IFRS 15, 16, 9, and 13 (SBR/FR)

- Winding Audit Risk (AAA)

- Tax Planning and International Taxation (TX)

- Business Valuation Techniques (AFM)

Conceptual knowledge of these topics is imperative in order to pass the exam.

Hardest ACCA Papers Based on Syllabus Complexity

Let’s take a look at the following ranked list of the hardest ACCA papers (syllabus-based + pass rate + student feedback):

- AAA (Advanced Audit & Assurance): Advanced standards, deep professional judgment, open-ended scenarios.

- APM (Advanced Performance Management): Strategy + performance, very conceptual, requires strong exam technique.

- PM (Performance Management): High weight of decision-making, costing, and budgeting.

- SBR (Strategic Business Reporting): IFRS-heavy, analysis + narrative.

- SBL (Strategic Business Leader): Integrated case study, ethics, communication.

- FR (Financial Reporting): IFRS + technical accounting + calculations.

- TX (Taxation): Jurisdiction-specific tax law complexity, especially for local variants.

This ranking aligns with real student experience: AAA and APM frequently show among the lowest pass rates, and PM is notoriously difficult because of its mixed quantitative-conceptual nature.

Why These Papers Are So Hard: Syllabus-Level Insight

Here are key reasons why these hardest ACCA exams are particularly challenging, tied to specific parts of the ACCA syllabus:

- AAA: Requires mastery of international audit standards, risk assessment, ethical frameworks, and deep professional judgment. Students must navigate case-based scenarios where there is no single “right answer.”

- APM: The syllabus demands strategic thinking; how to apply performance frameworks, balanced scorecards, variance analysis, and business metrics in complex contexts. It’s not just numbers, but why companies make the decisions they do.

- PM: Topics like standard costing, decision-making under uncertainty, budgeting, and performance measurement. Syllabus depth + time-pressure questions make it tough.

- SBR: Students need to know IFRS standards, interpret statements, perform ratio analysis, and provide narrative answers on financial reporting issues.

- SBL: The case study in SBL covers ethics, leadership, governance, risk management, and strategy. The syllabus requires cross-disciplinary thinking.

- FR: Deep knowledge of IFRS, plus strong technical accounting, consolidation, and adjustments.

- TX: Tax law varies by jurisdiction; ACCA students in different countries must learn local tax legislation + practical computation + planning.

Performance Management (ACCA) Deep Dive: Why It’s So Tricky

Given that performance management is a top concern for many students, it deserves a full breakdown.

Syllabus Topics in PM (Applied Skills)

Here are some of the core syllabus areas in Performance Management:

- Costing techniques: absorption, marginal, activity-based costing

- Budgeting: Master budgets, flexed budgets

- Standard costing: variances (material, labour, overhead)

- Decision-making: make-or-buy, relevant costing, special orders

- Risk and uncertainty: sensitivity analysis, simulation

- Performance measurement: balanced scorecard, key performance indicators (KPIs)

- Divisional performance: ROI, residual income

- Transfer pricing

Each of these topics carries significant exam weight and requires strong conceptual clarity + calculation + decision reasoning.

Why PM Is One of the Hardest ACCA Papers

- Mixed skill demand: It’s not just number crunching; students must analyse, make decisions, and justify them.

- Time pressure: Calculations + reasoning in the same exam makes time management critical.

- Uncertainty: Topics like risk, sensitivity analysis, and simulation introduce ambiguity; the syllabus demands you model scenarios, not just compute fixed numbers.

- Performance measurement: Balanced scorecard, KPIs, performance reports; these are not formulaic but strategic, so students must think like a manager.

- Exam technique: Many students underestimate the narrative part; they do well in computations but lose marks on explanations.

Strategic Tips to Tackle PM (Performance Management ACCA)

- Use real business examples: think of how a company sets KPIs, uses balanced scorecard, or makes budget decisions.

- Practice integrated questions: mix variance + decision-making + performance measurement in mocks.

- Time yourself: in exam conditions, simulate the split between calculation and theory.

- Use examiner reports: ACCA publishes feedback; know where students lose marks most.

ACCA Exemptions: India-Specific Flow & Calculator Logic

Exemptions often shape the starting point of an ACCA journey in India, yet many students misunderstand how the ACCA syllabus connects with their existing qualifications. The exemption structure is designed to recognise prior learning, but it follows a defined logic that considers academic depth, curriculum relevance, and the progression requirements set by ACCA.

Knowing how exemptions work helps you avoid skipping foundational subjects that might be essential for tackling advanced papers later.

How ACCA Exemptions Work

- ACCA grants exemptions based on your prior education (university degree, professional qualification)

- The number of ACCA subjects you need to sit reduces depending on your qualification, especially in the Applied Knowledge and sometimes the Applied Skills levels.

- Exemptions are mapped subject-by-subject: for instance, a commerce graduate might get exemptions for BT, MA, FA (Applied Knowledge), but may still need applied skills papers.

Check the exemptions that you might be eligible for with the ACCA Global Exemptions Calculator.

Example:

- A student with CA Inter may get exemption for 6 papers → only needs to sit 7 ACCA papers → huge saving.

- A B.Com (honours) student may skip the 3 Knowledge papers → 10 to take.

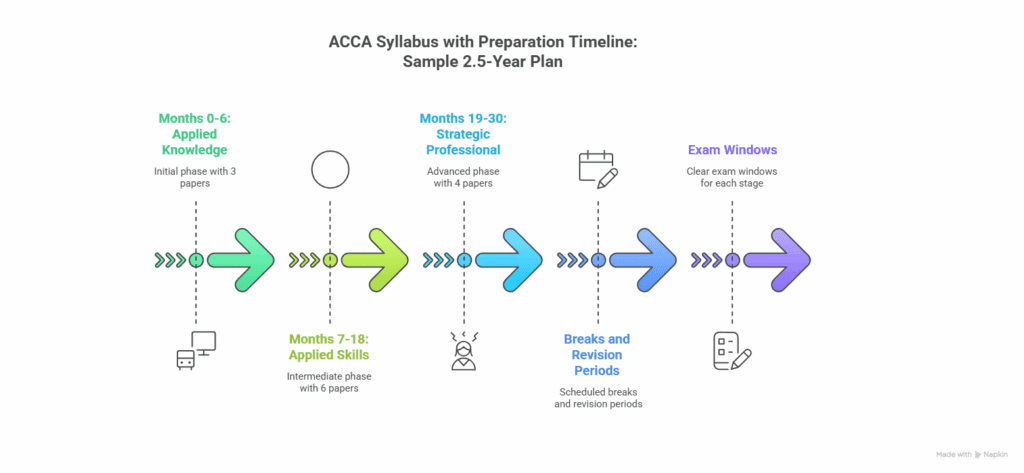

Optimised Exam Sequence Based on Syllabus Difficulty

Choosing which ACCA paper to attempt first can dramatically affect your pass rate. Because some papers are tougher (based on syllabus and pass rates), building a syllabus-driven roadmap is essential.

Here is a recommended exam order for students, based on the ACCA syllabus and difficulty curve:

| Phase | Level | Suggested Papers | Rationale |

| Phase 1 | Applied Knowledge | BT, FA, MA | These are foundation papers. High pass rates, conceptual clarity. Build confidence. |

| Phase 2 | Applied Skills – Easy / Moderate | LW, TX, FR | LW is relatively manageable; TX gives technical but digestible tax; FR gives IFRS exposure without extreme strategic depth. |

| Phase 3 | Applied Skills – Hard | PM, AA, FM | Once you’ve built a base, take on the tough ones. PM challenges conceptual + applied thinking; AA is audit-heavy; FM introduces financial management. |

| Phase 4 | Strategic Professional Essentials | SBL, SBR | By now, you have skills + knowledge. These papers are case-based (SBL) and reporting-based (SBR), but manageable if you prepare well. |

| Phase 5 | Strategic Professional Options | AAA, APM, AFM or ATX (choose two) | Based on your career interests: audit (AAA), performance (APM), treasury (AFM), tax (ATX). Leave the hardest ones (e.g., AAA or APM) for later when you have more exam maturity. |

Strategic benefits of this order:

- Builds confidence early.

- Distribute high-risk papers when you are more experienced.

- Aligns with typical career paths (e.g., if you want audit, pick AAA; if you like performance, pick APM).

- Helps with study planning: you can prepare subject-by-subject in a way that leverages the ACCA syllabus flow.

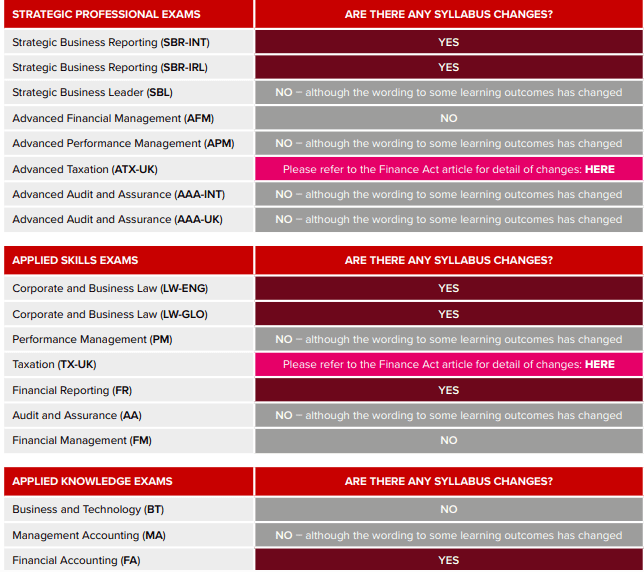

ACCA Syllabus Changes 2024–25 Updates

Staying aligned with the new ACCA program structure requires more than checking what’s taught in each paper. The qualification evolves every year based on global reporting standards, technology shifts, regulatory updates, and employer expectations.

Many students underestimate how the ACCA syllabus revisions influence exam patterns, conceptual depth, and the weightage of application-driven questions. The 2024–25 cycle brings targeted adjustments that strengthen analytical skills, digital readiness, and ethical judgement across multiple ACCA subjects.

Notable Changes (2024–25):

- Certain IFRS updates (if any): Always check ACCA’s official study guides for Strategic Business Reporting (SBR) for any standard updates.

- Shift to more computer-based exams (CBEs): ACCA’s Report on Regulation 2025 confirms a continuation of session-based CBEs.

- Emphasis on professional skills: SBL (Strategic Business Leader) emphasises not just technical but also leadership, ethics, and professional judgment, which reflects ACCA’s evolving syllabus.

- Performance Management: Potential growth in advanced scenario-based questions (e.g., risk + uncertainty).

Why This Matters:

- Students need to know the ACCA syllabus change for 2024–25 need to align their revision with these updates.

- They benefit from knowing exactly which topics have changed, so they don’t study outdated material.

Which ACCA Subjects Are Most Valuable for Jobs

Employers rarely look at ACCA exam results in isolation. They evaluate how well a candidate’s understanding of the ACCA syllabus translates into day-to-day decision-making, analytical depth, and confidence with real business scenarios. Certain ACCA subjects build the exact competencies hiring managers prioritise in finance, audit, taxation, consulting, and corporate strategy roles.

Your ACCA employability depends on these papers that sharpen technical judgment, shape commercial awareness, and train you to interpret information the way organisations actually operate.

Here’s a career-subject mapping table that links ACCA syllabus papers to career paths:

| Career Path | Recommended ACCA Subjects | Why These Subjects Matter |

| Audit / Assurance | AAA, SBL, FR, AA | Audit roles love AAA because of audit standards + judgment; FR for strong financial reporting; SBL for leadership skills. |

| Financial Reporting / Corporate Finance | SBR, FR, AFM, PM | SBR builds deep reporting skills; AFM for financial strategy; PM for management decision-making. |

| Management Consulting / Strategy | SBL, APM, PM | These subjects develop professional judgment, leadership, and strategic performance analysis. |

| Tax Advisory / Compliance | ATX, TX, SBR | Tax papers are directly relevant; combined with reporting and strategic level, you become very attractive for tax advisory. |

| Treasury / Risk Management | AFM, FM | AFM covers advanced financial strategy + risk; FM provides foundational treasury and financial management theory. |

Strategic Tips for Career-Focused Students:

- If your goal is audit, prioritise → AAA + FR in your exam sequence.

- For a finance leadership career, pick → APM + AFM + SBL.

- If you want tax consulting, then → ATX + TX is a powerful combination.

- Use your exam order to align with your career goals: this ensures your ACCA syllabus preparation is not just about passing, but also about building relevant skills.

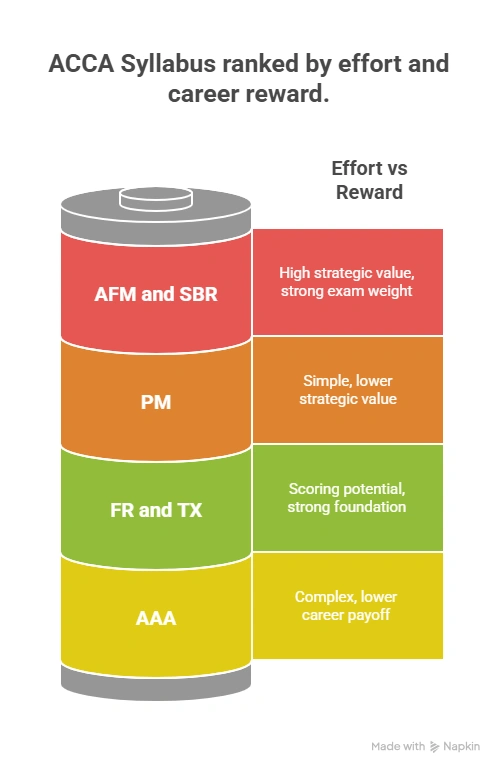

Here is a visual showing the ranking of ACCA papers with respect to their career reward and efforts:

Common Mistakes & Syllabus Pitfalls Students Make

Patterns always emerge when you look closely at examiner reports, marker feedback, and real student performance across multiple exam cycles. Much of the difficulty in the ACCA syllabus doesn’t come from the technical content itself but from the way candidates approach it.

Students often focus heavily on memorising rules instead of understanding why those rules exist, overlook examiner-tested topics because they seem “too basic,” or fail to connect concepts across different ACCA subjects.

Here are specific syllabus-level pitfalls that often slow the progress of ACCA students, especially on difficult papers:

| Syllabus Area / Paper | Common Pitfall | Why It Happens |

| PM (Performance Management) | Focusing only on calculations and ignoring narrative/analysis questions (e.g., decision-making, balanced scorecards) | Students assume PM is purely numerical and don’t practise interpretation-based questions |

| SBL (Strategic Business Leader) | Not practising full case studies under timed conditions | SBL requires integrated thinking; students underestimate the time and structure needed for long case responses |

| SBR / FR (Financial Reporting) | Missing IFRS updates or failing to connect theory with real financial statements | Students rely on rote learning instead of applying standards to real business scenarios |

| AAA (Advanced Audit & Assurance) | Memorising audit standards but failing to apply them to specific case scenarios | AAA is application-heavy; theory alone doesn’t score without contextual analysis |

| TX / ATX (Taxation) | Overlooking nuances in tax laws and avoiding planning/advisory practice | Students focus on rules but not on practical interpretation and structuring tax advice |

| All Papers – Topic Weighting | Studying all topics equally instead of prioritising high-weighted chapters | Misjudgment of examiner trends and a lack of strategic study planning |

| All Papers – Examiner Reports | Ignoring examiner reports despite them highlighting recurring mistakes | Students don’t realise these reports reveal common pitfalls, poor phrasing, and scoring patterns |

Strategy to Avoid These Pitfalls:

- Use examiner report insights to build your study plan

- Practice mixed-type questions (MCQ, scenario, case)

- Time your mocks to simulate exam conditions

- Revise syllabus topic weights; focus more on high-weight, high-risk areas

- Stay up-to-date on IFRS and auditing standards via ACCA updates

Here is an interesting watch if you want to clear the ACCA exam on your first attempt. Yes, even the papers you think are tough:

How to Study Strategically for the ACCA Syllabus (Especially the Hardest Papers)

Here are advanced, mentor-level strategies to maximise success across the ACCA syllabus, especially the hardest ACCA exam papers:

- Syllabus Mapping & Weighting

- Break down the syllabus by topic weight (from ACCA syllabus guides or examiner reports)

- Allocate study time proportionally: high-weight + high-difficulty topics deserve more focus

- Mixed Practice Strategy

- Combine MCQs, case-based questions, and long-form scenario questions in your mocks.

- Use real exam-style mocks under timed conditions.

- Exam Technique over Memorisation

- For tricky papers like AAA or APM, focus on how to apply audit or performance frameworks, not just memorising standards.

- Practice structured answers using PEEL (Point, Explanation, Example, Link) or similar frameworks.

- Use the Exemption Calculator to Plan

- If you have previous qualifications, use (or build) an ACCA exemption calculator logic

- Map out how many papers you can skip → fewer “hardest papers” to tackle

- Leverage Examiner Reports & Feedback

- Read ACCA examiner feedback carefully: these reports often highlight common pitfalls, misinterpretations, and mark-losing patterns.

- Adapt your answers based on real student mistakes reported in previous exams.

- Peer & Mentor Support

- Join study groups focused on performance management, AAA, and APM to collaborate on tough topics.

- Engage with ACCA mentors (like those at Imarticus Learning) who can simulate real-exam strategic thinking.

- Revision & Retake Plan

- For the hardest papers, assume you might need two attempts: set aside revision slots accordingly.

- Use a fail-and-retry mindset: failure in these tough ACCA papers is not uncommon, and strategic reattempts build mastery.

Struggling to design a detailed way to plan your ACCA syllabus and exams? This is just the guide that you’ll find useful.

Why Choose ACCA with Imarticus Learning

Choosing where to pursue your ACCA course can influence how smoothly you navigate the ACCA syllabus, especially when you’re dealing with the toughest papers and long study cycles.

This section outlines why Imarticus Learning’s structure, resources and support ecosystem align well with the actual demands of the ACCA syllabus. The goal is straightforward: to show how the right academic environment can strengthen your preparation without exaggeration or sales language.

Core USPs

- Dual Certification Opportunity: On completing the ACCA course, you also earn a joint certificate (in partnership with KPMG in India) that strengthens your global appeal.

- Money-Back Guarantee: If you do not clear all your ACCA Professional Level exams after following the program, Imarticus will refund 50% of your course fee.

- Gold Status Learning Partner: Imarticus is recognised as a Gold (or “Gold status”) Learning Partner of the global Association of Chartered Certified Accountants (ACCA) body, meaning curriculum, delivery and partner content meet high standards.

- Kaplan-Powered Study Materials: All core course materials (books, question banks, practice papers, live classes) are powered by Kaplan, an ACCA-approved content partner.

- 100% Placement or Internship Guarantee: Even after completing just the first two levels of ACCA with Imarticus, you get an internship/placement guarantee or a refund option.

FAQs: Your ACCA Syllabus Questions Answered

Clarity matters when you’re planning your path through the ACCA syllabus, especially when the stakes include exam timelines, exemptions, pass rates, and long-term career outcomes. These frequently asked questions about the ACCA Syllabus bring a mentor’s perspective to the most practical concerns learners raise, including the toughest paper in ACCA, exam attempts, global rules, costs, future scope, and expected progression.

What are the 13 papers in ACCA?

The ACCA syllabus includes 13 standard papers: 3 at Applied Knowledge (BT, MA, FA), 6 at Applied Skills (LW, PM, TX, FR, AA, FM), and 4 at Strategic Professional (choose 2 of the options: AAA, AFM, APM, ATX, plus the 2 essentials SBL and SBR, making a total 13). Depending on your exemptions, you might not need to sit for all 13.

Is ACCA as tough as CA?

ACCA is challenging, but its difficulty differs from CA. The difficulty is different but not strictly “easier” or “harder.” ACCA’s toughest paper tends to be AAA or APM, which demands high-level professional judgment and strategic thinking. CA exams might emphasise tax, audit, or regulation more aggressively. With disciplined preparation, the ACCA syllabus is manageable. Imarticus Learning helps streamline the journey through structured classes, guided strategies and exam-focused support for the toughest papers.

How many subjects are in ACCA?

ACCA has 13 standard subjects (or papers) in its core qualification syllabus. These 13 cover the three levels (Applied Knowledge, Applied Skills, and Strategic Professional). However, depending on your exemptions, you may not need to sit for every subject, which is where tools like an ACCA exemption calculator come in handy.

What is the 7-year rule for ACCA?

In the ACCA syllabus, the 7-year rule refers to the time limit for completing Strategic Professional papers. Once you pass your first Strategic Professional exam, you have 7 years to pass the rest of your strategic papers; if not, some passed papers may be forfeited, and you’ll have to re-sit them. This makes it important to plan your exam sequence carefully so that the hardest ACCA papers, like AAA or APM, don’t all cluster at the end without time.

Can ACCA earn 1 crore?

Yes, many ACCA professionals go on to earn very high salaries, including compensation packages that can reach or exceed 1 crore INR, especially in senior roles in Big 4 firms, consulting, FP&A or finance leadership. However, achieving that level depends on more than just passing the ACCA syllabus: practical experience, professional network, choice of ACCA subjects (for example, those aligned with high-paying domains like financial management or tax) and career strategy all matter.

Can I finish ACCA in 2 years?

Yes, you can finish the ACCA syllabus in 2 years with exemptions and consistent exam-session planning. Students who clear 3–4 papers per sitting often achieve this timeline. Imarticus Learning supports such fast-track plans with structured coaching, Kaplan materials and guided study schedules built for high-volume exam cycles.

Is ACCA closing in 2026?

No. There is no official announcement by ACCA Global that the ACCA syllabus or qualification is closing in 2026. ACCA continues to run exam sessions, update its syllabus, and support students globally. Any claims about ACCA shutting down in 2026 are likely myths or rumours; always refer to the official ACCA website for up-to-date information.

What is the ACCA pass rate?

The ACCA pass rate depends on the paper and is closely linked to the syllabus’s complexity. For example, in the June 2025 sitting, Performance Management (PM) had a pass rate of 43%, AAA (Advanced Audit & Assurance) was 40%, and SBL was 51%. These pass rates reflect how syllabus topics influence exam difficulty; a lower pass rate often means more challenging syllabus content or exam structure.

How many attempts for ACCA in a year?

Students can attempt ACCA exams in multiple exam sessions per year, depending on the paper. Many Applied Skills and Strategic Professional papers are offered in the standard ACCA sessions throughout the year (March, June, September, December), subject to ACCA’s exam calendar.

What are the 9 papers of ACCA?

The 9 papers of ACCA usually refer to the Applied Knowledge and Applied Skills modules: BT, MA, FA, LW, PM, FR, TX, FM and AA. Students with exemptions often complete only these nine. Imarticus Learning supports this path with structured classes, Kaplan-backed materials and guided exam preparation.

What if I fail an ACCA exam?

Failing an exam is part of many students’ ACCA journey. When you fail, you revisit that particular paper’s syllabus, identify weak topics, and reattempt in the next available session. Because some of the hardest ACCA papers have lower pass rates, it’s common for students to retake them. Imarticus Learning supports the retake strategy by providing mock tests, targeted revision, and expert insight into tough syllabus areas.

How much does ACCA cost in total?

The total cost to complete the ACCA syllabus depends on how many papers you must take (after exemptions), plus tuition, study materials, and exam fees. In India, according to recent reports, the cost to complete all 13 ACCA papers (without exemptions) can be in the range of ₹2,50,000 to ₹3,00,000, which includes registration fees, exam fees, study materials, and coaching support.

Your Next Steps Towards ACCA

Progress through the ACCA syllabus often becomes a personal journey of discipline, clarity, and steadily expanding capability. The exams introduce you to accounting principles, but more importantly, they train you to handle judgment calls, interpret financial realities, and respond to business pressures with structure and precision.

Some papers feel demanding because they simulate the complexity of real workloads. Others require a sharper conceptual foundation or consistent practice. When viewed together, the syllabus doesn’t just certify technical ability. It builds the kind of professional instinct that organisations trust in moments when accuracy, ethics, and resilience matter the most.

For aspirants who want a learning environment shaped by industry mentors, structured guidance, and outcome-driven support, Imarticus Learning offers a path that aligns preparation with long-term career ambition. If you are ready to begin the ACCA course with a framework that strengthens your chances of success at every level, Imarticus is a strong place to start.