Last updated on December 3rd, 2025 at 03:30 pm

Choosing between CMA vs CA is one of the first real crossroads in a finance student’s life. Almost every commerce student reaches this moment, usually with family members telling them to “just do CA” and classmates announcing they are preparing for both. What rarely happens is an honest, grounded conversation about what these qualifications actually do to your career, your thinking style and your professional identity.

Imagine three students at the start of their journey.

→ One loves decoding how companies earn money, how products are priced, and why some businesses stay profitable despite rising costs.

→ Another gets energised by rules, structure, audits, order, and the idea of being legally responsible for certifying financial statements.

→ The third simply wants a stable, respected qualification but has no idea which direction matches their natural strengths.

All three will hear the same advice, yet they are meant for very different paths.

This blog is written for students like them. The goal is not to overwhelm you with generic comparison tables or recycled internet jargon. Instead, you’ll see how each qualification shapes the real world you will step into: the work you’ll do at 24, the skills you’ll fall back on at 30, and the roles you grow into at 35.

By the time you finish reading, you’ll know exactly which path fits your goals, your interests and your future in finance.

What Is CMA and How It Fits Into the CMA vs CA Decision

When students begin comparing CMA vs CA, many of them have only a partial idea of what the CMA qualification truly represents. Before looking at job roles, salaries or industry pathways, it helps to understand the professional identity that someone in Cost and Management Accounting builds. If you have ever searched for what is CMA, you would have noticed that the qualification is designed around how businesses make decisions. It trains you to evaluate costs, measure performance, plan budgets, analyse profitability and guide internal strategies within organisations.

The CMA course prepares you to see the financial engine of a company from the inside. You learn to work closely with operations, supply chain, product teams and leadership. A CMA is constantly asking questions like:

- What drives the cost of producing this product?

- How can the organisation optimise its spending?

- Which activities add value, and which ones drain resources?

- How do budgets align with operational realities?

When you place this understanding within the larger CMA vs CA comparison, it becomes clear that the CMA qualification, offered by the IMA, is not limited to accounting tasks. It positions you as someone who helps shape decisions, improve efficiencies, improve pricing strategies and interpret data in a business-friendly manner. CA focuses more on external responsibilities like audit and compliance, while CMA focuses on internal strategy and performance improvement.

If you’re evaluating whether the CMA US certification is the right path for you, this quick video offers a clear snapshot of the exam’s difficulty, the preparation journey and the real value the credential adds to your career.

The Learning DNA Behind Each Credential

Before comparing outcomes, it helps to look at the academic roots of CA and CMA. Every finance career begins with a worldview shaped by how you learn to interpret numbers, documents, controls and decisions.

CA Curriculum Themes:

- Statutory audit

- Financial reporting

- Corporate and economic laws

- Direct and indirect taxation

- Financial management

- Advanced auditing practices

CMA Curriculum Themes:

- Strategic cost management

- Performance evaluation

- Corporate finance and planning

- Cost audit

- Budgeting and forecasting

- Business analytics fundamentals

The orientation is distinct. CA pushes you to see the organisation from the perspective of controls, legal compliance, structure and reporting obligations. CMA leads you inward into the mechanics of costs, pricing, budgets, performance drivers and strategic decision data. This difference influences how you think as a professional.

The Journey: How Long It Really Takes

Another aspect that students ponder over is the timelines; the CMA course duration becomes a major deciding factor. CMA can typically be completed within 8 to 18 months, depending on your study pace and attempt strategy. CA, on the other hand, follows a longer multi-stage journey with mandatory articleship, often extending to 4 to 5 years from start to finish. This contrast shapes how quickly you can enter full-time roles and begin building industry experience.

Many students ask how long these courses take, but fewer examine why the timelines differ. CA requires mandatory articleship; CMA asks for practical training hours, but structured differently. A simple table can capture the formal timeline expectations.

Duration Snapshot for CMA vs CA

This table captures expected time commitments for both credentials, assuming continuous progression without gaps.

| Qualification | Typical Levels | Training Requirement | Expected Duration* |

| CA (ICAI) | Foundation → Intermediate → Final | ~3 years full-time articleship | 4-5 years |

| CMA (ICMAI) | Foundation → Intermediate → Final | ~15-18 months practical training | 3-4 years |

*Actual duration varies significantly based on attempts, study discipline and training choices.

For instance, during CA articleship, you might spend long days testing controls, verifying invoices, preparing audit schedules or assisting with tax computations. This builds resilience and familiarity with compliance requirements.

CMA training commonly places you inside corporate finance or cost departments where you may prepare budgets, analyse variances, evaluate production costs or measure performance indicators. The day-to-day exposure is different, and students should consider which type of learning environment motivates them.

How Each Qualification Shapes Decision-Making

In my years of mentoring finance students, one pattern stands out repeatedly. CA students start seeing risk, control, compliance and reporting accuracy everywhere. With CMA course subjects, students begin analysing cost drivers, efficiencies, pricing and business performance. Neither mindset is superior; they’re simply different lenses.

Example:

Imagine a company is deciding whether to launch a new product.

A CA-trained mind might consider:

- Tax implications

- Capital structure impact

- Regulatory requirements

- Compliance risks

- Revenue recognition considerations

A CMA-trained mind might consider:

- Contribution margin

- Production cost structure

- Break-even quantity

- Pricing strategies

- Budgetary implications

Overall, CMAs contribute to effective management. Together, both perspectives help the organisation. This is why companies often hire both CAs and CMAs to sit at the strategy table.

Student Workload and Exam Experience

Different learning structures also create different examination experiences. CA exams tend to be lengthier and theory-intensive, particularly in laws, taxation and auditing. CMA exams integrate computational and case-driven assessments.

When students ask, “CA vs CMA, which is tough?”, they often overlook that difficulty depends on their aptitude. CA demands consistent application over a longer training period. The CMA eligibility demands strong quantitative reasoning and the ability to interpret business situations.

Pass-rate statistics vary by attempt but give a broad idea:

- Some CA Final attempts see pass rates under 20%. (Source)

- Certain CMA levels may show higher passing percentages, though still competitive. (Source)

This data often intimidates students. However, high or low pass rates should not influence your choice as much as your natural interest in the work these roles lead to.

While reviewing pass rates helps you understand exam competitiveness, it is equally practical to consider the CMA course fees before planning your timeline. The overall cost typically includes IMA membership, entrance fees and the two-part exam fees, making the financial investment far more predictable than multi-stage programs. For most students, this clarity helps in planning both preparation and budgeting more confidently.

The Culture, Network, and Identity You Build

People often underestimate the cultural environment around qualifications. CA coaching groups tend to be filled with individuals preparing for audit, tax, compliance and financial reporting roles, which shapes discussion, motivation and career ambitions. CMA cohorts, on the other hand, talk more about budgets, product costing, manufacturing processes, MIS dashboards and supply-chain metrics.

A career identity forms long before you qualify. The academic environment nudges you. For example:

- During CA training, you might sit with a senior reviewing ledger proofs and statutory files.

- During CMA training, you may sit with a plant controller analysing raw material variance for the month.

These experiences shape the professional you become.

Recognition, Mobility and Who Values Each Qualification

Competitor articles usually summarise this vaguely, but there is a deeper nuance. Recognition is not only about country listings or equivalences. It’s about ecosystems.

CA recognition thrives in:

- Audit firms (especially big networks)

- Banking and assurance

- Indian corporate compliance environments

- Tax consulting practices

CMA recognition thrives in:

- Manufacturing companies

- FMCG

- Supply chain-heavy industries

- Operational finance

- Cost-focused sectors

- Analytics-oriented finance teams

Many Indian MNCs, including automotive and pharmaceutical companies, have a strong preference for CMA graduates for internal costing roles. Companies that face pricing pressure or volatile supply costs often hire CMAs early in their career cycles.

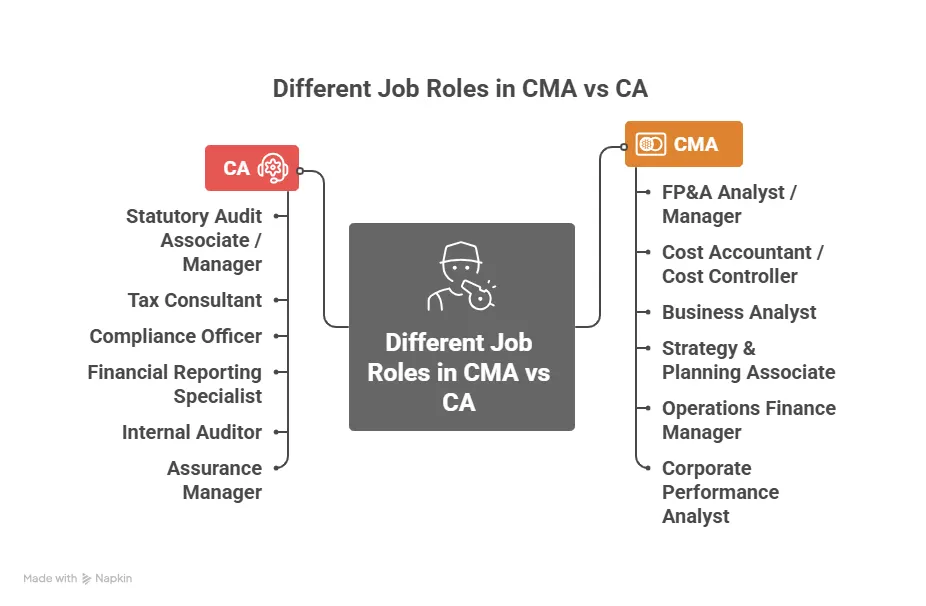

Here is a visual that shows the various job roles each qualification makes you eligible for:

Early Career Exposure: What You Actually Do

Let’s look at two typical early-career tasks:

A CA trainee might:

- Help test fixed-asset controls for a large company

- Assist during the statutory audit

- Support tax computation at year-end

A CMA trainee might:

- Prepare variance reports for a manufacturing line

- Analyse monthly expenses vs budgets for business units

- Assist in preparing product cost sheets

These experiences accumulate over 12–36 months and form your skill set for future roles. When students search “CMA or CA, which is better”, they often need someone to explain this practical difference, not just theoretical differences.

Understanding Career Pathways Through Real Scenarios

To illustrate the career landscape, consider three professionals:

Rahul (CA)

Rahul works at a mid-sized audit firm. His calendar revolves around statutory audits, internal audits, quarterly reporting and tax filings. Over time, he becomes deeply familiar with financial statements, compliance frameworks and regulatory reviews.

Meera (CMA)

Meera works in a manufacturing company. She analyses cost structures, prepares monthly MIS, forecasts budgets, participates in pricing decisions and collaborates with supply-chain teams.

Arjun (Mixed exposure)

Arjun is a CMA who later moved to financial planning and analysis in an MNC. His exposure in performance analytics allowed him to enter global finance teams.

These examples show how roles diverge despite both credentials being finance qualifications.

And if you’re still wondering whether the CMA US certification fits your long-term career goals, this short video gives you a clear, practical breakdown of its real advantages. It highlights the roles CMAs step into, how the qualification strengthens your position in modern corporate finance, and the kind of opportunities it can unlock globally.

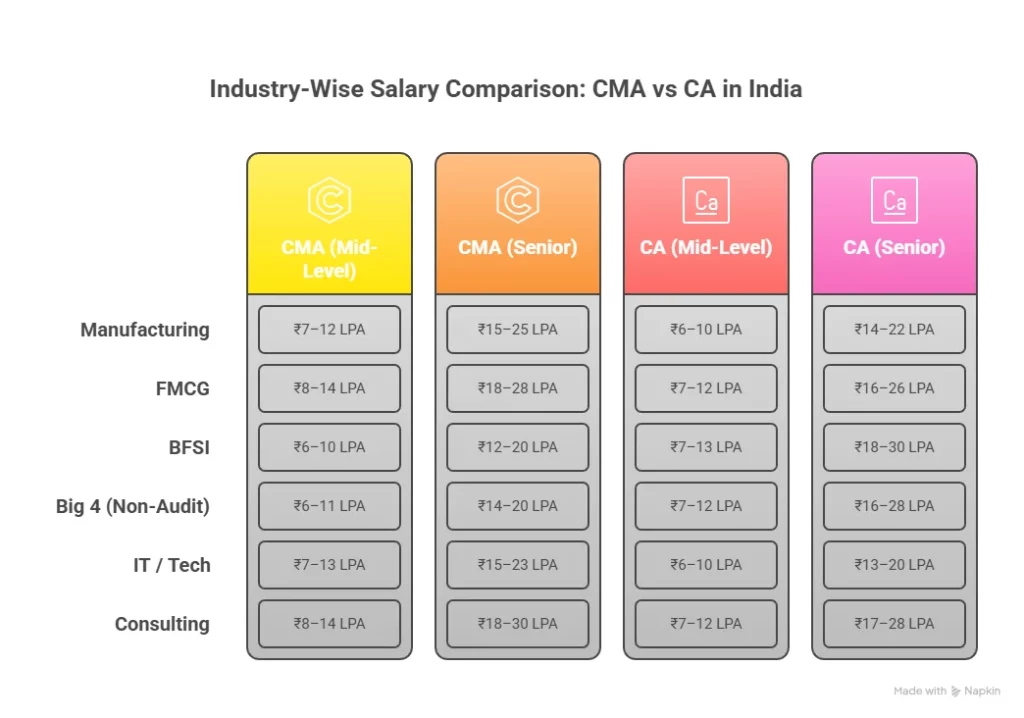

Salary Patterns and What Influences Them

Students researching the difference between CA salary and CMA salary in India often expect a simple number. Salaries in finance depend on multiple variables such as city, industry, role specialisation, business maturity and candidate’s CMA skills.

Salary Overview Table

This table outlines typical salary categories for freshers and early-career professionals.

| Credential | Typical Fresher Salary | 3-5 Year Salary Range | Influencing factors |

| CA | ₹6-11 LPA (avg) | ₹12-20 LPA | Audit vs tax vs industry role, firm size, city, exposure |

| CMA | ₹6-15 LPA (avg) | ₹10-23 LPA | Industry type, costing/FP&A exposure, MNC vs domestic |

Sources: AmbitionBox, 6figr.com

Manufacturing companies sometimes pay early-career CMAs higher than traditional CA roles, especially for plant finance or rapid-scaling firms with tight cost structures. Here is an infographic that lists the salaries of various mid-senior level roles for CMA and CA.

Big Four Opportunities for CMA

A commonly asked question is whether the Big Four hire CMA India graduates. Yes, they do. The hiring usually happens for:

- Advisory

- Risk consulting

- Forensic accounting

- Analytics

- Internal audit

- Process improvement roles

Audit and tax divisions tend to prefer CA candidates, but business advisory roles strongly appreciate CMA graduates.

Public Sector & Government Roles

The question “Is CMA a government job?” comes from a misunderstanding. CMA is a professional qualification, not a government position. However, CMAs are eligible for roles in:

- Public-sector undertakings

- Government-owned manufacturing units

- Defence production departments

- Railways and manufacturing units

- PSUs like BHEL, GAIL, HPCL

To become a GST officer or similar administrative role, one must qualify through the respective government exams. The CMA credential strengthens your understanding of taxation, but does not guarantee entry.

Industry-Specific Roles for CAs and CMAs

Competitor articles often generalise job roles. In reality, each industry uses qualifications differently.

Industries that prefer CA:

- Banking

- Audit firms

- Wealth consulting

- Investment research

- Tax consulting

Industries that prefer CMA:

- Automotive

- FMCG

- Pharma manufacturing

- Steel and cement

- Electronics manufacturing

- Logistics and shipping

- Oil and gas

Operational finance roles demand people who can translate numbers into decisions, which is a CMA strength.

Global Mobility

For CA, mobility is strong in Commonwealth countries and regions with mutual recognition. CMA is recognised globally; mobility rises in corporates, manufacturing economies, supply chain ecosystems and multinational subsidiaries.

When Specialisation Creates Salary Boosts

A fresh CA or CMA may earn modestly, but specialised roles push salaries upward quickly:

- A CA who specialises in transfer pricing often commands higher packages.

- A CMA who becomes an expert in SAP CO, financial modelling, or supply-chain analytics attracts strong corporate interest.

Decision Matrix for Choosing Your Path

This matrix helps students decide based on individual traits and interests.

| Preference | If this defines you | Suitable Path |

| You want roles in manufacturing or FMCG | Focus on product costing and budgets | CMA |

| You enjoy analytics, problem-solving, operations and business decisions | Enjoy working with business units | CMA |

| You want a shorter timeframe before full-time roles | Quick entry into corporate finance | CMA |

| You enjoy audit, regulatory work and structured compliance | Attention to detail, interest in legal frameworks | CA |

| You want to build an audit or tax practice | Entrepreneurship in compliance-rich domains | CA |

| You value public practice and statutory authority | Regulatory privileges | CA |

Use this as a guide, but remember your long-term interest matters more than difficulty or peer pressure.

The Future of Finance and What It Means for CMA vs CA

Companies today expect finance professionals to contribute beyond basic reporting. Technology has shifted the nature of work.

How CA Professionals Fit into the Future

- Compliance complexity keeps rising

- Audit quality standards are increasing

- Risk management is becoming critical

- Forensic and fraud investigation skills are growing in demand

How CMA Professionals Fit into the Future

- Data-driven planning and budgeting

- Real-time cost dashboards

- Analytics in supply chain

- Forecasting and performance measurement

This means both CA and CMA remain relevant, but for different emerging roles.

Understanding the Distinct Career Tracks of CMA and CA

Most students comparing CMA vs CA get overwhelmed because every website lists the same surface-level differences. The reality is that the choice becomes clear only when you compare the actual differentiators that influence your day-to-day career, your earning potential, and how quickly you start working.

Over the years, while mentoring students, I’ve noticed that the decision rarely hinges on syllabus difficulty alone. It comes down to very specific factors:

- How quickly do you want to start earning?

- How much global exposure do you want?

- Whether you prefer corporate finance or statutory audit?

- How flexible do you need your exam schedule to be?

- What type of work energises you daily?

This is why a real, practical comparison needs to look beyond theory. It should reflect how companies hire, how industries evolve, and how the qualification positions you five years into your career, not just the day you receive the certificate.

The grid below highlights those crucial differentiators. The table is designed to be simple, visual and immediately clear to anyone trying to decide between CMA vs CA, regardless of their academic background.

| Crucial Differentiator | CMA | CA |

| Global Recognition & Mobility | ✅ | ❌ |

| Relevance for FP&A, Management Accounting & Strategy | ✅ | ❌ |

| Preferred by MNCs & Global Corporate Roles | ✅ | ❌ |

| Completion Timeline (1–2 Years Possible) | ✅ | ❌ |

| Flexible Exam Windows (Year-Round) | ✅ | ❌ |

| Ideal for Working Professionals / Final-Year Students | ✅ | ❌ |

| High International Salary Potential | ✅ | ❌ |

| Industry-Focused Curriculum (Analytics, Automation, BI) | ✅ | ❌ |

| Lower Exam Stress (Two-Part Modular Format) | ✅ | ❌ |

| Best Fit for Corporate Finance, FP&A & Strategic Roles | ✅ | ❌ |

| Strong Acceptance in the US, Middle East, India-based MNCs | ✅ | ❌ |

| Faster Return on Investment | ✅ | ❌ |

| Deep Indian Tax, Audit & Compliance Expertise | ❌ | ✅ |

| Mandatory Articleship for Practical Training | ❌ | ✅ |

| Strong Demand in Indian Audit, Assurance & Compliance Roles | ❌ | ✅ |

Evaluating the financial outcomes of pursuing the CMA US certification? This quick video gives you a clear look at how earnings compare in India and the USA. It uses real numbers from the 2023 IMA Salary Survey to show what CMAs make at entry, mid and senior levels, and how compensation evolves across regions.

FAQs About CMA vs CA

Students exploring CMA vs CA often have questions that go beyond syllabus details or salary comparisons. This section brings together the most frequently asked questions future finance professionals ask while deciding between the two qualifications. Each answer is designed to give you clarity on career fit, long-term growth and the practical realities of working in these fields.

Which is better, CA or CMA?

When deciding which is better, CA or CMA, understand that both lead to strong finance careers but through different routes. The CA path focuses more on audit, tax, corporate law and assurance, while the CMA path shapes you for cost management, performance analytics and internal corporate finance roles. The right choice depends on whether you enjoy regulatory work or strategic finance.

Can CMA earn 1 crore?

Yes, a CMA can earn 1 crore, especially at senior levels in operational finance, supply chain finance, FP&A and manufacturing leadership roles. These positions often involve handling budgets, pricing, cost strategy and performance reviews. A CMA with cross-functional exposure, global assignments and business partnering skills can definitely reach seven-figure salaries in India or overseas.

Is CMA easy to crack?

Many students wonder if CMA is easy to crack, but success depends on preparation quality, resource planning and mentorship. Compared to CA, the syllabus structure is different, and the timelines are shorter, but that does not make it simple. The CMA vs CA decision should not be based on difficulty but on interest. Students who train with Imarticus Learning often find clarity in concepts and stay disciplined, which increases their ability to clear exams on schedule.

Is CMA losing value?

Industry trends show the opposite. Manufacturing, FMCG, supply chain and cost-intensive sectors are investing more heavily in roles requiring cost and performance analysis. The CMA vs CA debate is less about one losing value and more about industry evolution. As India expands its production capacity and cost-competition sharpens, the demand for CMAs grows steadily.

Do Big 4 hire CMA India?

Yes, Big Four advisory, consulting and risk teams hire CMA India professionals for internal audit, analytics, process improvement, cost analysis and advisory functions. Although audit and tax divisions prefer CA candidates due to regulatory authority, a CMA with strong analytical skills fits well in strategy and advisory teams. Imarticus Learning can strengthen these competencies, making candidates better prepared for interviews and the analytical expectations of Big Four advisory roles.

Is CMA in demand?

CMA is very much in demand, especially in industries that rely on cost optimisation, performance tracking and budgeting. As India invests in manufacturing, domestic production and supply-chain improvements, demand for CMAs continues to rise. In discussions of CMA vs CA career scope, the growing relevance of management accountants in corporate decision-making is one of the strongest indicators of opportunity.

Can CMA become a GST officer?

A CMA can become a GST officer only by qualifying through government recruitment exams, not solely by holding the credential. The CMA vs CA debate is often misunderstood regarding government roles. CMA equips you with strong GST understanding, cost implications and indirect tax fundamentals, which can be advantageous during selection or departmental assessments, but the role still depends on clearing the respective competitive exams.

Can CMA do taxes?

A CMA can handle various tax-related responsibilities within a company, such as GST reconciliation, indirect tax analysis, costing implications and internal tax compliance. In CMA vs CA practice rights, CA has legal authority for statutory audits, while CMA contributes significantly to internal taxation workflows. Students who prepare through Imarticus Learning often build strong conceptual clarity in cost–tax interactions and compliance fundamentals, which helps them contribute more effectively to taxation functions within corporate finance teams.

Is CMA a government job?

CMA is not a government job. It is a professional qualification which enables candidates to apply for finance positions across public-sector undertakings, state enterprises, manufacturing units and government-linked corporations. While the CMA credential strengthens your technical foundation for these roles, actual entry into government positions still depends on standard recruitment exams and selection processes. Students who build strong practical and analytical abilities at Imarticus Learning find themselves better prepared for PSU-level finance responsibilities where cost control, budgeting and performance management skills are highly valued.

Is CMA better than CPA?

In the US, CPA is preferred for public accounting, audit and tax, while CMA is valued in corporate finance, FP&A and strategic roles. Your choice depends on whether you want a statutory authority or a business-focused analysis. Training with Imarticus Learning can help you identify the right fit.

Choosing Your Path Forward

Choosing between two respected pathways like CMA vs CA becomes far easier once you understand how each qualification shapes your skills, long-term opportunities and daily professional life. CA strengthens your command of audit, tax and compliance, while CMA builds your ability to move inside businesses, understand how numbers drive strategy and contribute directly to performance outcomes.

The world of finance is shifting toward analytics, cost intelligence and decision-focused roles, and organisations increasingly value professionals who understand how business engines truly operate. If you found yourself connecting more with strategic finance, budgeting, cost structures or operational insights while reading this blog, the CMA qualification may be the right foundation for your future.

If you are ready to approach finance with a business-first mindset and develop skills that organisations actively seek, begin your CMA Course journey with Imarticus Learning, which can guide you from preparation to placement.