Last updated on December 3rd, 2025 at 03:27 pm

Most students begin their finance journey imagining a stable job, a respected title and the satisfaction of becoming the person everyone turns to when the numbers stop making sense. Yet somewhere along the way, two qualifications keep appearing in every conversation: CMA and ACCA. Before you know it, the simple dream of “a good career in finance” becomes a serious dilemma called CMA vs ACCA, and the decision suddenly feels much larger than a course choice. What makes this choice complicated is that both paths open completely different windows into the finance world.

Picture two young professionals on their first week at work. One is working with product managers, analysing why customer acquisition jumped this quarter and preparing a forecast for next month’s goals.

Another is sitting with audit seniors, reviewing IFRS disclosures and helping prepare an internal control report for a multinational client. Both are brilliant. Both are essential. But the kind of thinking they use and the qualifications that got them there are very different.

Considering ACCA?

Get personalized guidance on your ACCA journey—eligibility, exam roadmap, and career outcomes in a 15-minute call with our expert counsellor.

No commitment required • 200+ students counselled this month

Modern companies don’t look for generic finance graduates anymore. They look for people who can either shape decisions or safeguard decisions

The CMA certification leans toward the first, and ACCA leans toward the second. And the real reason students get confused is that no one explains this difference in a way that connects to everyday career reality.

This blog solves that with a detailed look at how each qualification behaves inside real companies, how industries recruit, how salaries grow, how responsibilities evolve and how automation is rewriting entire job families. By the end, you won’t just know the differences, you’ll know which world you want to belong to.

If you’re ready to understand where CMA vs ACCA aligns with your personality, strengths and long-term aspirations, the next sections will give you clarity you can make decisions with.

Understanding the CMA Path in Today’s Job Market

Before understanding the comparison, it helps to get a sense of what is CMA and how it works in the current corporate landscape. The US CMA is built around financial planning, performance analytics, internal decision modelling, variance logic, strategic cost management and organisational planning. These skills are tied closely to roles that sit at the centre of decision-making in most companies.

Students often describe the CMA course as the qualification that teaches them the language of numbers in a way that helps them participate in the business world. The emphasis is practical and scenario-based. Budgets, pricing decisions, operating metrics, forecasting structures and cost controls form the core of the study.

This is the reason CMAs frequently move toward roles where leaders depend on analytical judgment. Some common first-five-year profiles include:

- Business Analyst

- Cost Analyst

- FP&A Associate

- Management Accountant

- Internal Performance Analyst

CMA exams are conducted globally by the IMA and can be completed in a shorter time span because the curriculum is sharply focused. That tempo appeals to students and working professionals who want a qualification that accelerates their entry into decision-centric teams.

Understanding the ACCA Path and Its Relevance Today

As you explore more about what is ACCA, you will see that ACCA has a broader scope and includes financial reporting, audit, taxation, business law, risk, governance principles and financial management. Its strength is depth and coverage. Many students choose ACCA because it offers a wide-angle understanding of how organisations ensure compliance, maintain accurate controls, adopt ethical standards and manage global reporting requirements.

The ACCA curriculum builds strong foundations in:

- IFRS-based reporting

- Audit testing and assurance

- Corporate law principles

- Governance policies

- Financial management theory

Many ACCA candidates lean toward full-spectrum finance roles, multinational reporting teams, audit firms, risk and compliance units, treasury support functions and global accounting positions. Because the qualification spans several layers of organisational functioning, ACCA creates a gradual and systematic learning environment. The following video gives a clear and more holistic understanding of the ACCA course:

1. Why Companies Recruit CMA vs ACCA Profiles for Very Different Reasons

Recruiters often observe that CMA graduates naturally gravitate to teams that participate in daily operational decisions, while ACCA graduates align with the structure and control side of finance. This difference is not a matter of superiority. It is simply two approaches to how organisations process information.

A useful analogy that hiring teams sometimes use is this:

→ CMA professionals support tomorrow’s financial choices by interpreting today’s performance signals.

→ ACCA professionals maintain the accuracy, reliability and governance that allows leaders to trust their numbers.

Both are valuable, but they thrive in separate environments. But, this is the context that makes CMA or ACCA which is better such a common question among students.

2. A Structured Overview of CMA vs ACCA

This table summarises the foundational variables that usually matter to students and working professionals. The intention is not to decide the outcome but to give you a quick snapshot of how the two qualifications are built.

| Area | CMA | ACCA |

| Core Strength | Management accounting, analytics, planning and strategy | Reporting, audit, taxation, governance |

| Exam Body | IMA (USA) | ACCA (UK) |

| Duration | Typically 6-12 months, depending on preparation pace | 2.5-3 years, depending on exemptions and attempt timing |

| Exam Frequency | Multiple windows annually | Four main exam windows yearly |

| Career Focus | FP&A, costing, budgeting, business analytics | Audit, accounting, tax, reporting, risk |

| Skill Orientation | Decision modelling, performance analytics | Compliance, controls, IFRS expertise |

| Completion Structure | Two rigorous papers | Thirteen structured papers (with exemptions possible) |

This overview is only a starting point. The next sections will examine the deeper layers, such as skill relevance in automated environments, how teams internally allocate responsibilities between CMA and ACCA profiles, and what modern hiring patterns reveal.

How Finance Workflows Are Changing and Why This Impacts CMA vs ACCA

As companies enhance their digital ecosystems, finance teams are shifting away from purely bookkeeping functions toward responsibilities that involve analytics, scenario interpretation and strategic storytelling. Automation solves routine accounting tasks, which increases the value of roles that interpret numbers rather than simply record them.

This shift increases the demand for financial planning and analysis roles. According to data from the US Bureau of Labour Statistics, FP&A and management analyst roles are projected to grow steadily through the decade. A similar trend is reflected in the India Skills Report by Wheebox, where analytical finance roles are listed as high-demand categories.

This trend naturally strengthens the position of CMA, when seen from the CMA vs ACCA lens, in environments that operate with high data volumes. At the same time, governance and compliance demands have also risen, particularly in regulated industries. Audit and reporting profiles are essential in sectors such as BFSI, public companies, global shared service units and any enterprise transitioning to IFRS-driven reporting. Similarly, cost and management accounting is a crucial aspect for CMA careers.

This environment ensures that ACCA also retains its relevance, particularly with organisations that operate across borders and require strong reporting frameworks.

- Where CMA Professionals Fit in Organisational Decision Chains

CMA graduates often find themselves working closely with business teams. Their daily interactions may include:

- Reviewing month-end performance metrics.

- Preparing variance reasoning for leadership review meetings.

- Analysing cost structures before pricing revisions.

- Supporting budgeting cycles with scenario options.

- Working on operational efficiency studies.

Their value often lies in their ability to interpret why performance changes occur. Finance managers frequently highlight that CMAs bring the analytical clarity needed for decisions that involve trade-offs.

This is why FP&A teams, manufacturing sectors, IT product companies, consulting teams and shared service centres hire CMA graduates consistently.

- Where ACCA Professionals Fit in the Financial Framework

In the context of the CMA vs ACCA discussion, ACCA graduates often strengthen the organisational backbone:

- Ensuring reporting accuracy through IFRS-aligned processes.

- Supporting internal audit cycles.

- Preparing statutory financial statements.

- Contributing to tax compliance requirements.

- Maintaining internal control integration.

Big Four firms routinely hire ACCA graduates because the training is deeply aligned with the audit mentality. ACCA candidates often understand how to evaluate risk, test controls, validate financial statements and support compliance frameworks.

Salary Progression Trends: A More Grounded Look

Students frequently ask for salary clarity, which is why the CMA vs ACCA salary is one of the most searched comparisons. Below is a realistic look at how salaries typically progress from entry to mid-career in India, using actual observed ranges across major industries.

CMA Salary Progression in India

The following table reflects commonly reported compensation ranges for US CMA professionals across different experience levels.

CMA Salary in India: Typical Ranges

| Experience Level | Typical Roles | Salary Range |

| 0–2 years | Cost Accountant, Junior Analyst, FP&A Trainee | ₹4–7 LPA |

| 2–5 years | Financial Analyst, Senior Analyst, Assistant Manager | ₹7–12 LPA |

| 5–10 years | Finance Manager, FP&A Manager, Commercial Manager | ₹12–20 LPA |

| 10+ years | Senior Finance Leader, Controller, Strategy Lead | ₹20–25+ LPA |

ACCA Salary Progression in India

These tables give a clear snapshot of how compensation typically scales across the first decade for both qualifications. While CMA often delivers faster early-career growth in analytical roles, ACCA provides strong mid-career stability in audit, reporting and compliance environments. Your choice should reflect the kind of financial work you want to build your expertise in.

ACCA Salary in India: Typical Ranges

| Experience Level | Typical Roles | Salary Range |

| 0–2 years | Audit Associate, Junior Accountant, Accounting Trainee | ₹4–8 LPA |

| 2–5 years | Senior Associate, Reporting Analyst, Internal Audit Executive | ₹8–15 LPA |

| 5–7 years | Assistant Manager, Senior Auditor, Reporting Lead | ₹15–25 LPA |

| 7+ years | Audit Manager, Risk Manager, Financial Reporting Manager | ₹20–30+ LPA |

Here is a video that discusses in more depth the respective salaries of these qualifications:

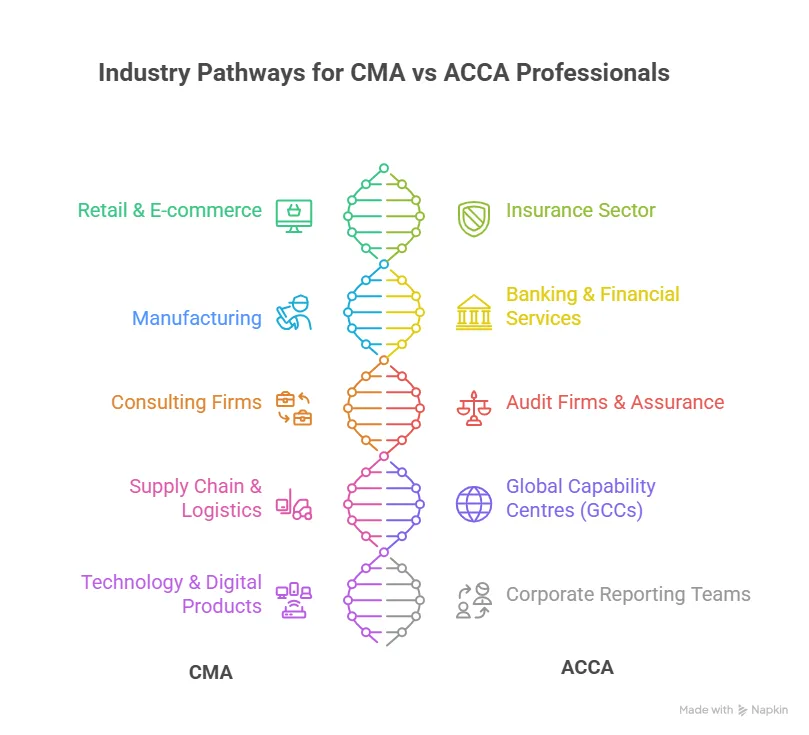

Industry-Specific Momentum for CMA and ACCA

Different industries value CMA and ACCA professionals for very distinct reasons. Understanding where each qualification gains the strongest traction helps students see how demand shifts across sectors for CMA vs ACCA career opportunities. This section highlights the industries where CMA graduates accelerate fastest and the sectors where ACCA professionals build long-term growth, offering clearer direction based on real hiring patterns.

CMA Momentum Sectors

- Manufacturing

- Fast-moving technology companies

- E-commerce operations

- Supply chain-heavy environments

- Consulting teams focused on financial modelling

ACCA Momentum Sectors

- Audit firms

- IFRS-driven reporting companies

- Banking and insurance

- Global capability centres

- Risk and governance units

Understanding these momentum streams helps you determine CMA or ACCA, which is better for your goals, rather than making the decision based on popularity. The following visual sums up the various industries where both these qualifications are in demand:

Skill Depth and Learning Experience in CMA vs ACCA

Every student eventually reaches a point where understanding the difficulty level becomes more important than reading the syllabus outline. Difficulty in professional qualifications rarely comes from the volume of theory alone. It usually comes from the way concepts interact, how quickly you need to apply them, and how consistently you maintain exam discipline across multiple stages.

This section explores the difficulty structure for CMA and ACCA, written for practical clarity instead of the generic explanations found in comparison articles.

- The Difficulty Curve of CMA

CMA examiners often design questions that challenge your ability to choose the most accurate response using a limited time. This creates a particular type of stress, especially for students new to analytical reasoning. The two-part structure of CMA exam papers is known for:

- Calculation-heavy questions.

- Decision-oriented scenarios.

- Time-bound reasoning where small errors change the entire outcome.

Students with backgrounds in mathematics, statistics, commerce, finance or economics often adapt to CMA more comfortably because the mental patterns align with the exam’s expectations. Those who come from non-finance backgrounds can still adapt, but the early weeks may require deliberate practice with numerical logic and cost modelling.

Several survey-style datasets published by coaching institutes and training organisations highlight that many candidates pass the CMA exams with dedicated preparation in as little as six to eight months. This compressed timeframe, when seen in the CMA vs ACCA discussion, appeals strongly to working professionals looking for a single-impact credential.

The CMA difficulty curve often stabilises once students understand cost behaviour, variance structure, working capital cycles and planning frameworks. Most candidates report that the real challenge lies in mastering the interconnections between costing, budgeting and performance metrics, not in individual chapters.

- The Difficulty Curve of ACCA

The ACCA journey consists of multiple exam levels, each with distinct objectives. This creates a different type of difficulty. ACCA requires:

- Long-term consistency.

- The ability to study multiple subjects across different domains.

- Strong writing skills for audit, law and governance papers.

- Technical clarity for IFRS-driven reporting papers.

Even students who are comfortable with accounting concepts often find audit and law papers challenging because they involve conceptual interpretation rather than numerical problem solving.

A noteworthy point shared by many ACCA candidates during their student journeys is that the difficulty spikes occur at transitions, particularly from the Applied Skills level to the Strategic Professional level. This is also why ACCA or CMA, which is tough, is a question with no universal answer. It depends entirely on whether a student prefers analytical decision-making or structured theoretical frameworks.

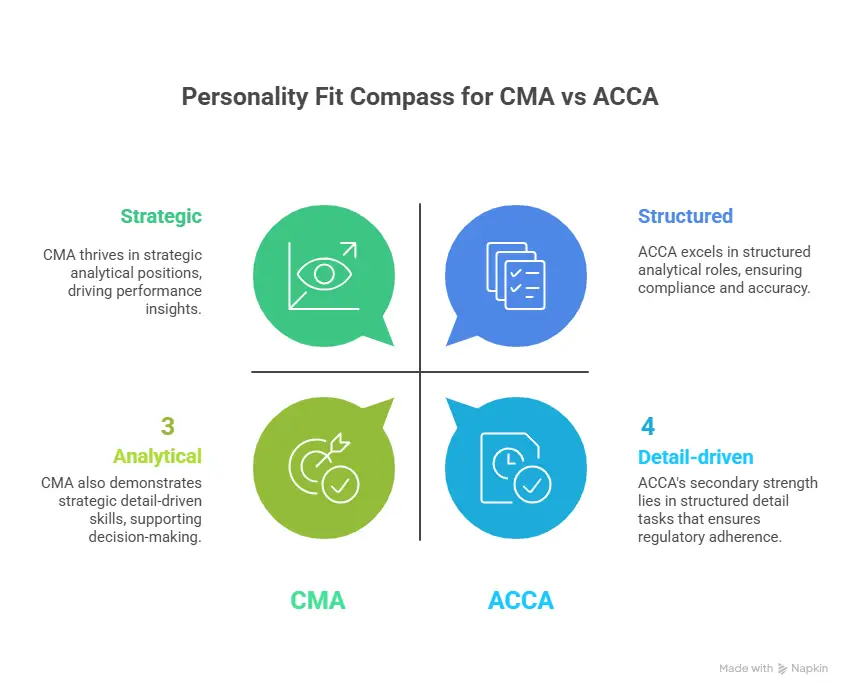

The ACCA duration creates a steady academic environment, which suits learners who appreciate formal structure and ample preparation windows. Because ACCA spans several topics, students who prefer deep conceptual reading and steady revision cycles typically perform well. The infographic below shows the various skills that the CMA and ACCA candidates must possess and how they differ from each other:

A Career Decision Model to Help Students Resolve CMA vs ACCA Confusion

A practical way to approach the CMA vs ACCA decision is to map your interest areas to real job functions instead of relying on formulas or surface-level comparisons. The following model is widely used in career counselling for finance students.

This table is structured to help students identify their natural preferences. Instead of comparing CMA and ACCA directly, it maps your personal strengths to environments where these strengths are most rewarded.

| If You Enjoy | You May Prefer | Why This Alignment Works |

| Analysing patterns, preparing business insights, supporting decisions | CMA | Analytical roles grow faster in organisations with a performance-driven culture |

| Fast-paced learning cycles with focused subjects | CMA | The two-paper structure demands sharp attention but offers quicker completion |

| Working with standards, ensuring compliance, and preparing reports | ACCA | Governance and reporting form the backbone of most global accounting systems |

| Structured long-term study and multi-subject coverage | ACCA | Extended timelines allow deeper understanding of multiple domains |

This model helps resolve the recurring search query CMA or ACCA, which is better, because the answer varies depending on your involvement with problem-solving, structure, numbers or audit thinking. Here is a video to help you gauge the universal appeal of CMA whilst explaining if this course is worth it for your finance career:

1. Why Organisations Often Prefer CMA for Data-Driven Teams

Data-driven companies operate with rapid product cycles, constant metric evaluation and continuous performance improvement. These environments value professionals who understand:

- Cost structures linked to real-time operations.

- Revenue models that change frequently.

- Budget shifts influenced by user behaviour.

- Performance KPIs connected to business strategy.

CMA training prepares graduates for this rhythm. Many FP&A heads in tech-first companies mention that CMA graduates quickly develop the ability to interpret complex financial signals.

This is particularly important in industries such as e-commerce, SaaS platforms, digital marketplaces and operationally intensive organisations where daily performance tracking plays a central role.

2. Why Organisations Prefer ACCA for Structured and Regulated Environments

Regulated industries operate with predictable governance cycles. These include:

- Banking

- Insurance

- Public companies

- Global shared service centres

- Accounting firms

In these environments, structure, documentation, compliance, audit protocols and IFRS accuracy form the centre of daily work. ACCA graduates bring depth in these areas. Their exposure to ethical frameworks, legal structures and reporting standards creates reliability in roles requiring precision and compliance.

This structured environment is also where many students discover career longevity. ACCA graduates often build long-term careers in reporting management, statutory compliance, risk assessment and audit leadership.

Understanding Fees and Return on Investment

Students often compare fees for CMA vs ACCA as a primary metric, but ROI depends more on how quickly a qualification helps you enter skilled roles. This section explains ROI using a simplified model.

Below is a practical look at how CMA and ACCA compare on these dimensions.

1. Fee Structure: CMA vs ACCA

The fee structures below reflect typical numbers (course + exam + membership + study material).

Actual costs vary depending on the institute and student membership discounts.

Typical CMA Fees (India)

| Component | Approx. Cost |

| IMA Entrance + Exam Fees | ₹70,000–₹90,000 |

| Training & Prep Classes | ₹80,000–₹150,000 |

| Total Estimated Cost | ₹1.5–2.3 lakh |

Typical ACCA Fees (India)

| Component | Approx. Cost |

| Registration + Exam Fees (all papers) | ₹2.5–3 lakh |

| Training for 13 Papers (varies by exemptions) | ₹2–3 lakh |

| Total Estimated Cost | ₹4.5–6 lakh |

The CMA course fees are typically less expensive because it has two exam parts, while ACCA has 13 papers (with exemptions available for commerce and related degrees).

2. Duration and Its Impact on ROI

CMA Duration

- 6–12 months for most students

- Fast exam windows

- Shorter learning curve

This shorter timeline for the CMA course duration lets students enter FP&A, costing, and analyst roles sooner, which compresses the payback period of the investment.

ACCA Duration

- 2.5–3 years on average

- Longer learning journey

- Multi-stage exam progression

The ACCA course duration is longer to complete, meaning the financial return comes more gradually, usually once the student moves into mid-level reporting or audit roles.

3. Real ROI Comparison for CMA vs ACCA

CMA ROI

- Typical salary after clearing CMA: ₹6–10 LPA (entry-level)

- Total cost: ₹1.5–2.3 lakh

- Payback period: 8–15 months, depending on role and employer

This is why CMA is often seen as a high-value option for early career acceleration.

ACCA ROI

- Typical salary after clearing ACCA/Affiliate: ₹4–8 LPA

- Total cost: ₹4.5–6 lakh

- Payback period: 18–30 months, depending on exemptions, city and job role

ACCA offers stable long-term growth, but the initial ROI timeline is naturally slower.

Why Many Students Choose CMA First and ACCA Later

A noticeable trend in India is that working professionals complete CMA first and later consider ACCA to enhance their reporting credibility. This is often because:

- CMA delivers momentum early in the career.

- ACCA adds strong technical reporting value later.

- Combining both offers a wide skill portfolio.

This pattern explains why Is CMA worth it after ACCA is a popular question among students exploring multi-credential pathways.

Skill Mapping for CMA and ACCA Careers

Students often benefit from a skill map rather than a simple syllabus comparison for CMA vs ACCA. Skill mapping shows how each qualification trains your thinking and what capabilities employers expect you to demonstrate in interviews.

The table below maps common professional clusters for CMA skills as well as ACCA to the qualification that naturally supports them. It is meant to guide students toward choices that align with their strengths.

| Skill Cluster | CMA Strength | ACCA Strength |

| Decision analytics | Strong | Moderate |

| Financial reporting | Moderate | Strong |

| Costing and performance management | Strong | Limited |

| Global audit understanding | Moderate | Strong |

| Forecasting and budgeting | Strong | Moderate |

| Governance and law knowledge | Limited | Strong |

| IFRS expertise | Moderate | Strong |

| Business partnering | Strong | Moderate |

Understanding these skill alignments helps you plan your first three to five professional years with greater clarity. It also improves your ability to answer interview questions that test practical reasoning.

A Practical Decision Path for Students Choosing Between CMA vs ACCA

If you find yourself still debating CMA vs ACCA after reading the detailed analysis, a structured decision path can simplify your thinking. Use the following steps to gain clarity.

Step 1: Identify Your Core Strengths

If you naturally enjoy analytical tasks, scenario interpretation, pattern understanding and number-based decision logic, the CMA pathway may feel more intuitive.

If you enjoy structured reading, governance, compliance, accounting standards and developing long-term expertise in reporting or audit, ACCA may be a more comfortable path.

Step 2: Think About the Work Environment You Prefer

Dynamic, analytically driven companies often reward CMA graduates quickly.

Structured, compliance-focused organisations often provide strong long-term growth to ACCA professionals.

Step 3: Consider Your Time Horizon

Students who want to accelerate their entry into analytical roles often choose CMA first. Those who want to build a deep foundation across multiple finance domains often prioritise ACCA.

Step 4: Evaluate ROI

Shorter duration and focused structure give CMA a quicker ROI cycle for many students.

Wider subject coverage and cross-border recognition give ACCA a slower but stable ROI arc.

Step 5: Use a Skill Gap Approach

If you already have exposure to accounting, ACCA may deepen your knowledge.

If you lack analytical exposure, CMA helps you develop practical financial reasoning.

This decision path respects your long-term career direction rather than relying on popularity-driven opinions.

Where Imarticus Learning Fits in the CMA Roadmap

Institutes that specialise in practical, analytics-heavy finance training add measurable value to CMA course preparation. Imarticus Learning stands out because its CMA program offers several concrete strengths that matter for success in a certification like CMA.

- Officially recognised prep provider: Imarticus Learning is an authorised prep provider for the global US CMA credential, backed by the fact that they are listed as a Gold Learning Partner of the organising body.

- Real-world case studies built for global standards: Their curriculum includes 23 business case studies aligned with global finance courses, designed and evaluated by professionals, helping bridge academic theory to real corporate scenarios.

- Internship opportunity with a leading global firm: Top performers in the CMA batch get internship opportunities with KPMG in India, giving early exposure to real corporate finance, audit and reporting practices.

- Support across formats (online/live-stream & in-person), enabling flexibility: Whether you are a working professional or a student, you can choose a delivery mode that fits your schedule: live streaming, recordings, mentoring, and easy fee payments.

- Pass protection & outcome-oriented programme structure: Their model promises greater reliability by offering structured guidance, mock exams, and a supportive revision strategy, which helps address the application-based nature of CMA’s exam format (MCQs + essays).

FAQs on CMA vs ACCA

This section brings together the most frequently asked questions by learners and working professionals, with clear explanations that connect directly to real career outcomes. Whether you’re comparing salary potential, difficulty levels, long-term scope or study timelines, these answers are designed to simplify your thinking and give you confidence as you choose your path.

What is the salary of a CMA and an ACCA?

The salary of CMA vs ACCA professionals varies widely across industries, but most companies follow similar growth patterns for early and mid-career roles. Fresh CMA graduates typically earn between ₹6–10 lakh per year in roles like FP&A, costing and business analytics, which grow faster because these teams work closely with performance data and decision-making. Entry-level ACCA professionals generally start around ₹4–7 lakh per year in audit, accounting or reporting roles, especially in Big Four and multinational companies.

Is CMA worth it after ACCA?

Many students explore whether CMA is worth it after ACCA when planning long-term skill expansion. ACCA builds deep reporting and compliance expertise, while CMA strengthens decision analytics, costing and business planning. Working professionals who pursue CMA after completing ACCA often do so because they want to shift into FP&A or performance management roles. Imarticus Learning has helped many ACCA graduates complete their CMA preparation smoothly because the training blends practical casework with analytical reasoning.

Is CMA tougher than ACCA?

CMA challenges students through analytical speed, numerical precision and case-based reasoning, especially under time pressure. ACCA tests consistency, reading depth and the ability to integrate multiple subjects across governance, law, reporting and financial management. Neither qualification is tougher in an absolute sense. The experience depends on your ability to handle analytical thinking or long-term structured study.

Is ACCA closing in 2026?

There is no credible indication that ACCA is closing in 2026. Professional bodies routinely update exam formats, syllabus structures and membership policies, which can create confusion on social media, but ACCA continues to operate globally with strong employer recognition. Organisations across audit, reporting and compliance remain dependent on ACCA talent, and this demand shows no signs of decline.

Can CMA earn 1 crore?

When candidates review earning potential through the context of CMA vs ACCA, both qualifications can lead to high-paying leadership roles with the right career progression. CMA professionals who move into FP&A leadership, controllership or strategic finance roles in large companies often reach senior compensation levels over time. The qualification provides analytical strength, but the earnings depend on the individual’s performance, exposure and the growth pace of their organisation.

Can I clear the CMA in 1 year?

CMA can be completed in one year with disciplined preparation, especially when supported by structured training. The focused two-paper format makes it achievable for students who maintain a consistent study routine. Imarticus Learning’s CMA training programs support candidates through planned study calendars, case simulations and guided practice, which helps students maintain momentum through the exam cycle.

What is the age limit for CMA?

There is no strict upper age limit for CMA, which gives this qualification flexibility for students and working professionals exploring CMA vs ACCA as part of a career transition. CMA is frequently pursued by individuals who want to shift into analytical finance roles or strengthen their decision-making abilities. Many professionals complete CMA even after years of work experience because the curriculum aligns with practical responsibilities in financial planning and performance management.

Can I crack CMA by self-study?

Students sometimes plan to prepare through self-study to manage costs while comparing CMA and ACCA as long-term options. Cracking CMA through self-study is possible, but the effectiveness depends on your ability to understand case-based analytical questions without guided feedback. For students who prefer a guided learning environment, Imarticus Learning provides a blend of conceptual teaching and practice modules that simplify the analytical mindset required for CMA exams.

Key Insights to Carry Ahead

The debate on CMA vs ACCA becomes far simpler when you look beyond the syllabus and focus on how each qualification shapes your long-term growth. CMA accelerates your entry into analytical, decision-oriented roles, while ACCA builds strength in structured reporting and compliance. Both paths have merit, but students who thrive in problem solving, business understanding, financial modelling and performance interpretation often find the CMA journey more aligned with the way modern finance teams operate.

The rapidly expanding demand for FP&A, costing, and strategic planning professionals makes the CMA qualification a strong choice for those seeking faster mobility and meaningful responsibilities early in their careers.

If you feel drawn toward roles that influence decisions rather than simply document them, the CMA pathway may be your next strategic move. And if you want guidance shaped by real industry expectations, exploring a structured CMA course prep with Imarticus Learning is an excellent place to begin.