Why Is Banking and Finance Important?

As the world economy recovers from one of the worst pandemics of our time, a lot of us might be considering a career in banking. While the negative effects of the pandemic were severe, one of the few good effects of it was, the time it gave us to consider all aspects of our lives and decide which direction we want to proceed in the future.

If you have decided to pursue a career in banking and finance in the post-pandemic world, then the question of why banking and finance is so important in modern society must have crossed your mind.

Thus in today’s blog post, we will answer exactly that. Let’s get started.

- The Modern Economy: In order to properly understand why banking and finance are so important on a larger scale to the economy, one of the first aspects you need to understand is how the modern economy works. If you have previously attended a Banking and Finance Courses, you know that the economy we know today can be simplified into two main categories, first, there is credit, and then there is debit.Organizations like banks and financial institutions are the ones who extend the credit, and customers, either direct individuals or companies, take this credit and thus become debited to the institution.The whole cycle of this modern economy is based on lending and taking credit, and thus banks and other financial institutions are very important to keep the wheels turning. Just like how a well functioning economy is important for a country to reach new heights, banks and financial institutions are important to keep the functioning of the economy stable and safe.

- Responsibilities of Banks and Financial Institutions: Now that you have a fair sense of understanding as to why banking and finance is so important for an economy, let us take a look at some of the many responsibilities that banks fulfill on an on-going basis:

- Securing Customers Money: One of the first and most important responsibilities of a bank is to safeguard the investments of its customers. The modern economy is one that is rapidly shifting to a paperless transaction model, and this can only be done through banks.One of the easiest ways of understanding this can be found in how your employer sends your monthly earnings directly to your bank account and how you spend that money every day for various utilities, either through electronic payment or through the use of your debit and credit card.

- Investing Customers Money: While saving and securing a customer’s money is the first and most important responsibility of a bank, the second is to help the customer invest their money and then provide returns on the same.Banks and other financial institutions around the world offer one of the simplest and most convenient ways for customers to invest their hard-earned money, and while it may sound simple and unnecessary to a professional like you (who has undergone a Banking and Finance Courses), millions of people depend on these services each year.

- Providing Loans and Credit Lines: The third most important role of a bank or financial institution is to provide loans and extend a credit line to its customers. No matter how much money a person has saved, there comes a time when each and every one of us needs to take out a loan to facilitate either an emergency spend or to finance our dreams. And the modern economy is designed in such a way that the best loans can only be provided by banks and no one else.

Conclusion

The importance of banks in modern society is huge, and as we continue to progress, their importance will only grow with time. So if you want a future career in the banking industry, make sure you enroll for Online Banking and Finance Courses today.

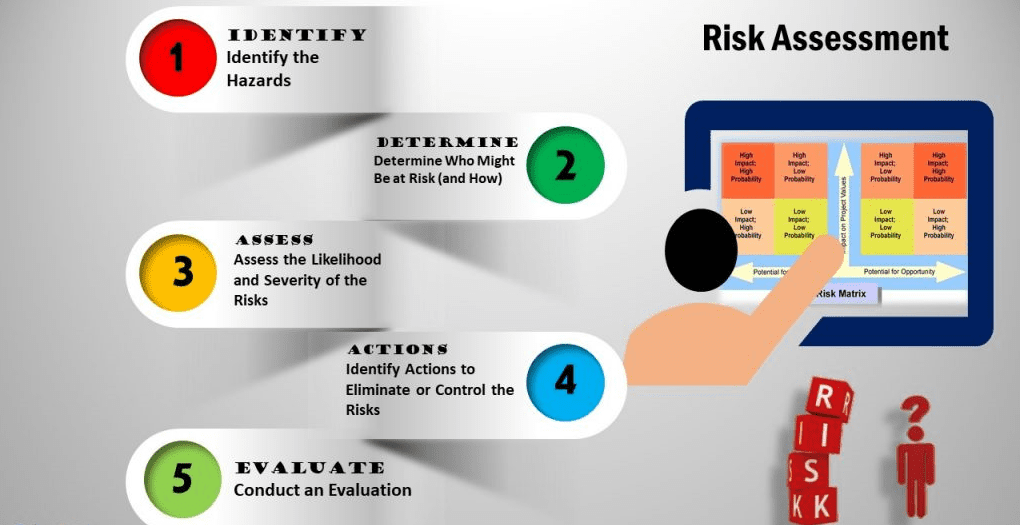

Data is the central part of any trader’s life. It is even more important to store and analyze the information correctly. Traders are increasingly using cloud solutions to store their data and run their models. The processing power of cloud computing allows them to quickly run multiple analyses like risk assessment within a matter of minutes as opposed to hours or even days from conventional means.

Data is the central part of any trader’s life. It is even more important to store and analyze the information correctly. Traders are increasingly using cloud solutions to store their data and run their models. The processing power of cloud computing allows them to quickly run multiple analyses like risk assessment within a matter of minutes as opposed to hours or even days from conventional means. Cloud also allows for better traffic management. Traders can be seen leveraging the cloud to tackle any amount of traffic effectively. Mainly because the cloud is a scalable entity, it can quickly go up and down depending on the actual amount of people using it. Moreover, cloud computing offers a cheaper solution to many problems associated with stock trading.

Cloud also allows for better traffic management. Traders can be seen leveraging the cloud to tackle any amount of traffic effectively. Mainly because the cloud is a scalable entity, it can quickly go up and down depending on the actual amount of people using it. Moreover, cloud computing offers a cheaper solution to many problems associated with stock trading.