Last updated on August 17th, 2024 at 06:05 am

The question “what is asset management” is a common query among finance professionals and investors. With this article, we aim to break down what is asset management, elucidating its definition, various types, key functions, and the roles and responsibilities involved.

By the end of this article, you’ll have a firm grasp of what asset management entails and its significance in the financial landscape.

What is Asset Management?

Asset management involves the systematic process of developing, operating, maintaining, and selling assets in a cost-effective manner. Thus, a simple answer to “what is asset management“ is the maximisation of the value of an investment over time while minimising risk. This process is managed by asset management companies (AMCs). The functions of AMC oganisations is to utilise their expertise to manage investments on behalf of their clients, including individuals, corporations, and institutions.

To fully grasp what is asset management, it’s essential to understand the various types of assets involved and the methodologies used to manage them. Assets can range from physical assets like real estate and machinery to financial assets such as stocks, bonds, and other securities. Effective asset management requires a blend of strategic planning, detailed financial analysis, and risk management.

Types of Assets

To understand asset management meaning, we must first know about the different types of assets. Assets can be broadly categorized into two types:

- Tangible Assets: These are physical items that hold value, such as real estate, machinery, vehicles, and equipment. Managing these assets involves maintaining them in good condition, ensuring their efficient use, and planning for their eventual replacement or disposal.

- Intangible Assets: These include non-physical items like stocks, bonds, patents, trademarks, and intellectual property. The management of these assets focuses on maximizing their financial performance and protecting their value over time.

How Asset Management Works

What is asset management and the asset management process involves several key steps to understand:

Asset management is the methodology of maximising wealth by the acquisition, maintainence and trading of assets that have the potential to grow in value in the upcoming future and benefit from it. Asset management fundamentally focuses on increasing the ROI of an asset.

The asset management process includes the following steps:

- Asset Identification and Evaluation: Identifying potential investment opportunities and evaluating their expected returns and risks.

- Acquisition: Purchasing the selected assets based on thorough analysis and strategic alignment with investment goals.

- Management and Maintenance: Regularly monitoring and maintaining the assets to ensure they continue to perform optimally. This can involve everything from routine maintenance of physical assets to periodic review and rebalancing of investment portfolios. Not monitoring and maintenance of assets will lead to the depreciation of assets.

- Performance Monitoring: Continuously tracking the performance of assets to ensure they meet expected benchmarks and making adjustments as necessary.

- Disposition: Selling or disposing of assets when they no longer meet the investment criteria or when they have reached their maximum value potential.

Types of Asset Management

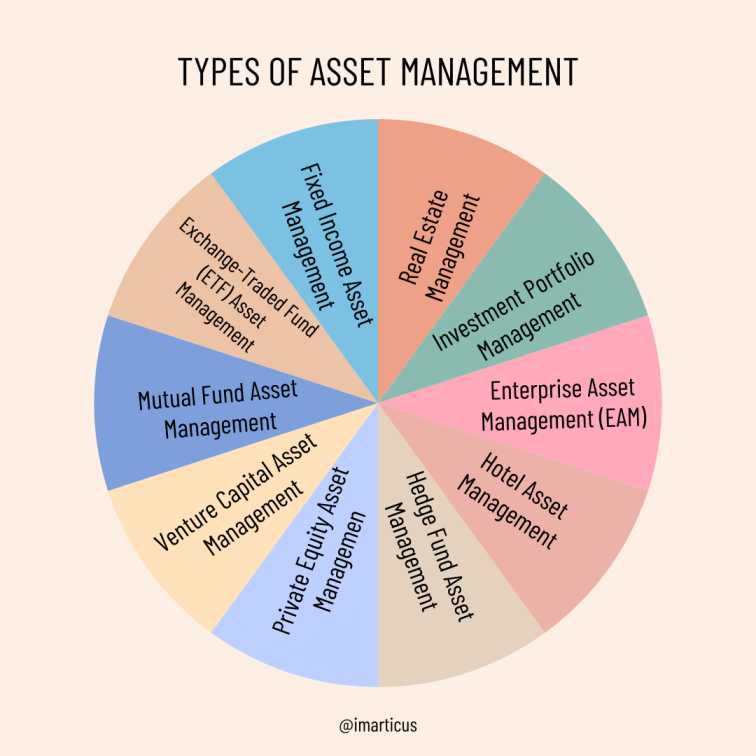

There are as many types of asset management out there as there are types of assets. Here are ten types of asset management as examples:

- Real Estate Management: This might manage a portfolio of rental properties, ensuring they are well-maintained, rented to reliable tenants, and generating a steady income stream. The AMC would also handle the buying and selling of properties to optimize the portfolio’s performance.

- Investment Portfolio Management: This involves managing a collection of financial assets such as stocks, bonds, and mutual funds. The AMC would develop an investment strategy, select appropriate assets, and continuously monitor and adjust the portfolio to achieve the client’s financial goals.

- Enterprise Asset Management (EAM): This refers to managing a company’s physical assets such as machinery, equipment, vehicles, and infrastructure. It involves ensuring optimal performance, reducing downtime, extending the lifecycle of assets, and minimizing costs through effective maintenance and management practices.

- Hotel Asset Management: This niche involves overseeing the financial performance of hotels and resorts, maximizing revenue and profitability through strategic decision-making, operational efficiency, and guest satisfaction.

- Hedge Fund Asset Management: This involves managing complex investment strategies that employ leverage, derivatives, and other sophisticated financial instruments to generate high returns, often with higher risk profiles.

- Private Equity Asset Management: This focuses on investing in private companies not listed on public exchanges, with the goal of acquiring ownership stakes, improving company performance, and ultimately realizing a profit through sale or IPO.

- Venture Capital Asset Management: Similar to private equity, this involves investing in early-stage companies with high growth potential, often in technology or innovation-driven sectors. Venture capital firms provide funding and expertise to help startups scale and achieve success.

- Mutual Fund Asset Management: This involves managing pooled investment vehicles that offer investors exposure to diversified portfolios of stocks, bonds, or other assets. Mutual fund managers make investment decisions on behalf of fund shareholders, aiming to achieve the fund’s stated objectives.

- Exchange-Traded Fund (ETF) Asset Management: Similar to mutual funds, ETFs are traded on stock exchanges and offer investors exposure to diversified portfolios. However, ETFs are passively managed, tracking a specific index or benchmark, which typically results in lower fees compared to actively managed funds.

- Fixed Income Asset Management: This involves managing portfolios of debt securities, such as bonds and treasury bills.

Asset Management Roles and Responsibilities

The roles and responsibilities in what is asset management are diverse and require a range of skills and expertise. Key roles include:

- Asset Managers: They are responsible for developing and implementing strategies to manage assets effectively. This involves conducting research, performing financial analysis, and making investment decisions.

- Analysts: They provide critical support by analyzing market trends, assessing asset performance, and providing data-driven insights to inform investment strategies.

- Operations Managers: These professionals ensure that the day-to-day operations of the assets are running smoothly, including maintenance, tenant relations, and compliance with regulatory requirements.

- Financial Advisors: They work closely with clients to understand their financial goals and develop customized investment plans to achieve those objectives. Closely understanding what is asset management needs for their clients

- Compliance Officers: Ensuring that all asset management activities comply with relevant laws and regulations is crucial. Compliance officers monitor and enforce adherence to these standards.

What is an Asset Management Company (AMC)?

The functions of AMC are multifaceted and designed to deliver maximum value to their clients. These functions include:

- Strategic Planning: Developing long-term strategies to manage and grow the client’s assets.

- Portfolio Management: Selecting and managing a mix of asset classes to achieve the desired investment outcomes.

- Risk Management: Identifying potential risks and implementing measures to mitigate them.

- Performance Reporting: Providing clients with regular updates on the performance of their assets and the overall portfolio.

- Client Advisory Services: Offering personalized advice and recommendations based on the client’s financial situation and goals.

If you were wondering “what is asset management company”, any organisation that offers the above services can be referred to as an AMC.

Types of Asset Management

Understanding what are the types of asset management is crucial for recognizing the breadth of this field. The main types include:

- Real Estate Asset Management: Focuses on managing real estate properties to maximize income and value.

- Financial Asset Management: Involves managing financial securities like stocks, bonds, and mutual funds to achieve investment objectives.

- Infrastructure Asset Management: Deals with managing physical infrastructure assets such as roads, bridges, and utilities.

- Enterprise Asset Management: Focuses on managing the assets of an organization to optimize their usage and performance.

- Digital Asset Management (DAM): Involves managing digital media assets such as photos, videos, and audio files for businesses, ensuring they are easily accessible, organized, and used effectively.Manages software applications and licenses to ensure compliance, optimize usage, and reduce costs.

Conclusion

Asset management involves strategic management of various asset types to maximize value and minimize risk. Understanding the asset management process, the different types of assets, and the roles and responsibilities within the field provides a comprehensive view of how asset management works. Whether it’s through managing real estate portfolios or optimizing financial investments, asset managers play a vital role in helping clients achieve their financial goals. By leveraging their expertise in finance, strategic planning, and risk management, asset management companies ensure that assets are managed effectively and efficiently, contributing to the overall growth and stability of the financial markets.What is asset management is not just about managing assets, it’s about creating value and ensuring the sustainability of those assets over time. With the right knowledge and approach, asset management can significantly enhance the financial well-being of individuals and organizations alike. Enrol in the investment banking course by Imarticus to learn more about asset management and other financial management services.

FAQ’s

Asset management helps companies of all sizes minimise the expense per asset and allows them to make the most out of these assets. Asset management helps organisations avoid costly problems and instances such as asset depreciation, asset damage or duplicate purchases.

This is one of the most common asset management interview questions. Evaluating a new investment involves a two-way approach, understanding the opportunity itself and aligning it with your goals. Research the investment’s risk profile, market potential, and the team behind it. Then, assess how it fits your investment timeline, risk tolerance, and overall financial objectives. It’s like fitting a puzzle piece, the opportunity should complement your bigger financial picture.

Effective asset risk management lies in proactive strategies. Identify all assets, physical and intangible. Analyze past breakdowns and industry trends to predict future risks. Prioritize risks based on potential impact. Ease with preventive maintenance, diversification, or insurance. Regularly monitor performance and update plans as needed.

Staying ahead of market trends is crucial in asset management. Here are your tools to help you stay ahead:

Industry publications: Subscribe to reports and blogs from top asset managers and financial news sources.

Market data providers: Utilize platforms offering real-time data and analysis on economic indicators and asset classes.

Conferences and webinars: Attend industry events to hear expert insights on emerging trends and their impact on investment strategies.

Networking: Connect with other professionals to exchange ideas and stay informed on market developments.