Last updated on March 21st, 2024 at 05:44 am

Last Updated on 2 years ago by Imarticus Learning

Financial analysts are responsible for assessing financial data, financial statement preparation, studying business trends, appraising a business’s financial statements, and potentially meeting with company management to determine the firm’s performance and evaluate the leadership team.

Interviews can be stressful, and preparation makes you confident. So here we’ve put together ten financial analyst interview questions along with potential answers that will help:

Why do you want to be a financial analyst?

Why do you want to be a financial analyst?

Recruiters want to know what attracts you into the job scope of a chartered financial analyst? Tell them elaborately about the real motivation this role puts in you. Avoid generic answers, preferably say you love working with numbers to understand the financial implications of decisions.

Where do you see yourself in five years?

If you’ve done a financial analyst course and are a fresher, saying “dreaming about CFO at Fortune 500 company” isn’t a realistic five-year goal. Instead, be realistic and say, “I would ultimately love to be a CFO, but for now, I want to spend time learning and making an impact.”

Why association with us?

Recruiters want to know what is about their company that attracts you? For example, say that you’ve researched many companies and yours is a perfect fit because you offer various roles for financial analysts.

How do you develop investment recommendations for senior management?

Take this as an opportunity to share how your mind works. Talk about how you get specific recommendations and less about tools and analytical specifics. Strike the perfect balance and talk about what you learned during financial modeling courses, SWOT analysis, ratio analysis, etc., and how it would help with ROI?

How are you meeting tight deadlines?

Recruiters want to know about your performance under pressurized circumstances. Describe an example, a problem you faced, and your role to resolve the challenge with efficiency.

How’ll you deal with a discrepancy in the details of a cash flow statement?

Here you are expected to identify problems and constructively address them. Be smart and say, “I’ll double-check the numbers to ensure the fact of discrepancy. Then, after thinking through the available ramifications and remedies, I would meet with my manager immediately to discuss.” This shows your attention to detail and the positive approach.

How do you suggest handling unhappy internal customers?

Know how financial analyst roles are gatekeeping and may require making unpopular decisions. Let managers know how you can keep the calm and diffuse situation positively. Tell you will listen carefully to concerns and find a real-time solution. Say, “I would also share the conflict with my managers to get their guidance.”

What will you do if the team challenges your opinion?

To answer this, take an opportunity to reflect on how well you play with others. Your description of the example and how you reacted will be necessary. Show your communication and intellectual skills here.

What’s an EBITDA, and what isn’t included in it?

Such questions test your technical knowledge and what you learned through financial modeling courses. So, be prepared for complex questions and establish the fact that you know your stuff!

What tools you’ll use to prepare illustrated reports with graphs, spreadsheets, or charts?

Plan, prepare, and practice! Show the employers that you have a working knowledge of the tools of the trade. The more examples you have ready, the better impression you have.

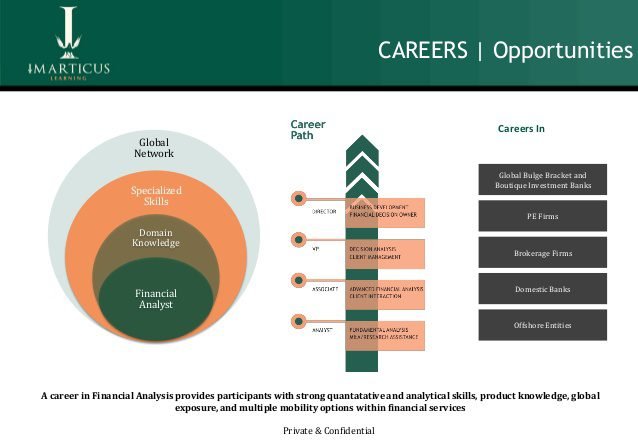

Lastly, to land into better employment roles, make sure you invest time in a financial analyst course.

Imarticus Learning offers a range of courses that help you secure excellent employments. Check out their financial analytics course syllabus here, and enroll in one to gain momentum in new-age careers!

offers a range of courses that help you secure excellent employments. Check out their financial analytics course syllabus here, and enroll in one to gain momentum in new-age careers!

Related Article:

https://imarticus.org/what-is-a-financial-analyst-course/