Have you ever looked at a business headline and wondered who understands these numbers and makes sense of them? Chances are, a skilled financial analyst does. But the truth is, not every analyst is similar.

If you want to build a financial analyst career path that doesn’t just pay the bills but sets you apart, you require more than spreadsheets and ratios. You need sharp skills, the right mindset, and a method that puts you ahead of the pack.

In this guide, we’ll explain how to become a financial analyst who doesn’t get lost in the crowd, from learning core ideas to earning top-notch finance certifications for analysts, sharpening your investment analysis training, and growing your financial modelling skills.

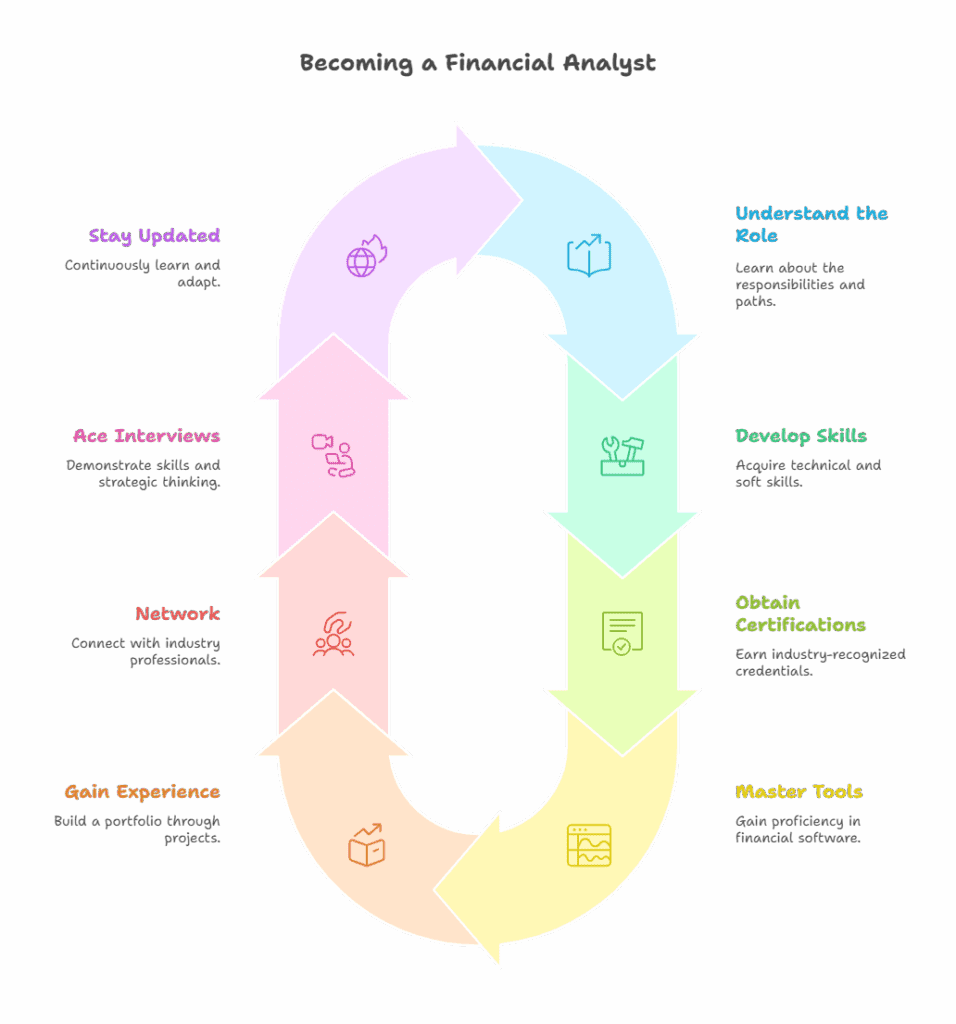

How to Become a Financial Analyst?

Before you plan your future, know what you desire to become.

A financial analyst is more than just a number cruncher. They are financial advisors who look at financial figures, analyse investments, and make wise money moves to enable businesses and clients to achieve their dreams.

Analysts can become corporate finance analysts, investors’ banking analysts, equity researchers, risk managers, or portfolio managers. Whatever they do, they transform raw data into visual, realistic methods of creating growth and reducing risk.

It’s not just about being good with spreadsheets; it’s about becoming the analyst your company or clients trust when the stakes are high.

Why Do Financial Analysts Matter?

Nowadays, businesses rely on more than intuition. Their judgments, budgets, predictions, valuations, and astute investments are all supported by data.

Here’s where you can help. Businesses of all sizes use analysts to identify risks, analyse trends, and direct initiatives that keep the company running. 85 percent of Indian graduates choose industry certifications to secure better jobs and earn higher income, according to the CFA Institute Graduate Outlook Survey 2025.

The problem is that while demand is rising, so is competition.

Step 1: What Does a Financial Analyst Do?

Know the job before applying for it. Upon analysis of financial information, a financial analyst comes up with useful information. This may involve the evaluation of quarterly reports, the development of profit forecasts, the observation of market trends, or the provision of investment guidance.

- Corporate finance (within corporations, to regulate budgets and development strategies)

- Deals, mergers, acquisitions (investment banking)

- Equity research (research of stocks and sectors for investors)

- Risk management (evaluating financial risks and protection of capital)

Being aware of such paths enables you to decide according to your interests and abilities.

Step 2: Find out the Requisite Skills of Financial Analysts

So what do the employers desire? Additional attributes ushered in by the best analysts include a combination of hard & soft skills and technical expertise.

This is what you will have to construct:

- Analytical and Critical thinking

It is not all about calculation; it is about looking at what the numbers tell you. Can you see patterns and draw lines that other people fail to see?

- Communication & Storytelling

The most skilled analysts can present a narrative of complicated data to top management, investors, or customers. Knowledge becomes valueless unless someone can clearly account for their findings.

- Soft Skills

An analyst who can remain flexible stays relevant. Want to know how to become a financial analyst who stands out? Combine all these skills with real-world experience.

Step 3: Top Certifications for Analysts

Here’s a quick look at some famous finance certifications for analysts to help you pick:

| Certification | Focus Area | Global Recognition | Best For | Duration |

| CFA | Investment Analysis & Portfolio Management | Very High Aspiring Equity Analysts | Portfolio Managers | 2-3 Years |

| FRM | Risk Management | High | Risk Analysts, Credit Risk, Market Risk | 1-2 Years |

| CPA | Accounting & Auditing | Very High | Accounting & Finance Professionals | 18 Months – 2 Years |

| CFI | Financial Modelling | Moderate | Entry-Level Analysts, Corporate Finance Roles | 6 Months – 1 Year |

Step 4: Get Practical: Learn Financial Modelling Skills and Tools

Theory is good, practice is better. Companies want you to hit the ground running.

So, master these tools early:

- Excel: The rigor of any analyst. Complex functions, pivot tables, and macros.

- Power BI / Tableau: You want your report to be legible and compelling based on data visualisation.

- Bloomberg Terminal: The go-to of investment analysts, who often swear by it to access real-time financial information.

- Python/R: If you desire an advantage in quantitative positions or big-data finance.

As one can see, investment analysis training modules at Imarticus Learning match these tools with real-life case studies, so you learn through action, not mere window shopping of slide tutorials.

For example, Imarticus Learning’s investment analysis training modules pair these tools with real case studies so you understand by doing, not just watching slides.

Step 5: Gain Real-World Experience

This is where many candidates stall. So, how do you become a financial analyst with no full-time role yet? Internships, part-time analyst roles, or freelance projects build your portfolio and confidence.

Offer to help a startup budget for growth. Build a stock pitch and present it to your network. Volunteer for research work. Each small step makes your resume stronger and shows you’re proactive.

Step 6: Network Like It’s a Skill

You have the skills needed for financial analysts and have obtained your finance certifications, but that is insufficient. Develop a network that makes you visible and informed.

Get acquainted with industry events, meetings of the CFA societies, webinars, and alumni events. Establish a connection with mentors who can track you on the correct path in terms of a career path as a financial analyst. Many analyst roles aren’t even advertised; they’re filled through recommendations.

Step 7: Ace the Interview and Prove You’re Different

Your CV gets you in the door. But your interview shows whether you will stay there.

- Expect technical questions. You should prepare to demonstrate your financial modelling skills, debate on valuation techniques, or critique a company’s financials.

- Model thinking: Describe how you are going to go about your plan. Clarity matters more than speed.

- Be curious. Ask smart questions about the company’s strategy to prove you’re more than a number cruncher; you’re a strategist.

Step 8: Stay Sharp: Finance Never Stops Evolving

The top analysts consider learning a continuous project. Market trends change, new technology alters data gathering, and laws vary.

Take shorter courses such as investing analysis training or high-level computer tool training in Excel. Subscribe to financial news, read market reports, and practice building your models for fun.

How Imarticus Learning Can Help You Stand Out

If you want the roadmap built, the Financial Analysis Prodegree by Imarticus Learning is one of India’s top industry-recognised programmes. It blends theory with hands-on tools to sharpen your financial modelling skills and investment analysis training, all designed with KPMG in India.

What you get:

- 180+ hours of training

- Real-world projects guided by industry experts

- A clear path to top finance certifications for analysts

- Placement support to launch your career faster

Watch this video to learn about the tremendous collaboration between imarticus learning and KPMG

FAQ

Q. What is the job of a financial analyst like?

Most begin as junior or associate analysts and transfer to senior positions or become equity research analysts, corporate strategists, or portfolio managers.

Q. What does a financial analyst need?

High Excel, data analytics, financial model, clear thinking, and good communication capabilities.

Q. What are the best finance qualifications for analysts?

The most well-known throughout the world is the CFA; however, the FRM and FMVA specialisations are awesome as well.

Q. What is the best way to develop financial modelling skills?

Do practical courses, work with real data from a company, and be a learner and not only an observer.

Q. What is the motivation behind the training in investment analysis?

It teaches you to evaluate assets, industry, and market trends, something you will utilise every day in making good suggestions.

Q. How does one begin a career as a financial analyst?

Begin with the courses that are both theoretical and practical, and accumulate a small portfolio of projects.

The Final Words

Numbers are your tool, but approach is your superpower. The analysts who lead tomorrow’s companies don’t just report what happened. They see what’s next and help steer the business in the right direction.

So, polish your financial modelling skills, complete solid investment analysis training, earn respected finance certifications for analysts, and sharpen the skills needed for financial analysts that no spreadsheet can teach.

That’s how to become a financial analyst who doesn’t just get hired but gets noticed.