Technology is revolutionising the world of investment banking. Fintech, or financial technology, is no longer just a buzzword. It’s the force behind new finance, rapid and smart banking, and easier. In fact, fintech is at the heart itself of how investment banks these days are changing—be it risk models run with the help of AI or transactions on blockchain. Anyone looking to get his toe in the waters of finance must be aware of this revolution.

Whether you are a professional or finance graduate, you are driven to position yourself better with the way fintech is changing the investment banking sector in a bid to secure your future working career better. Imarticus’ Certified Investment Banking Operations Professional CIBOP certification course is particularly meant to do just that—position you better with new finance through a robust industry-based course.

What Is Fintech?

Fintech is the application of sophisticated high-tech technology in the financial sector. There’s electronic payment, blockchain, and robo-advisors; there’s algorithmic trading and artificial intelligence analytics. Within the broad fintech umbrella, there is nothing. For investment banks, fintech has completely transformed the manner in which trades are executed, risk is executed, and customer services are provided.

By 2024, the fintech market will reach more than $310 billion, casting its giant shadow over the financial mainstream services, particularly investment banking.

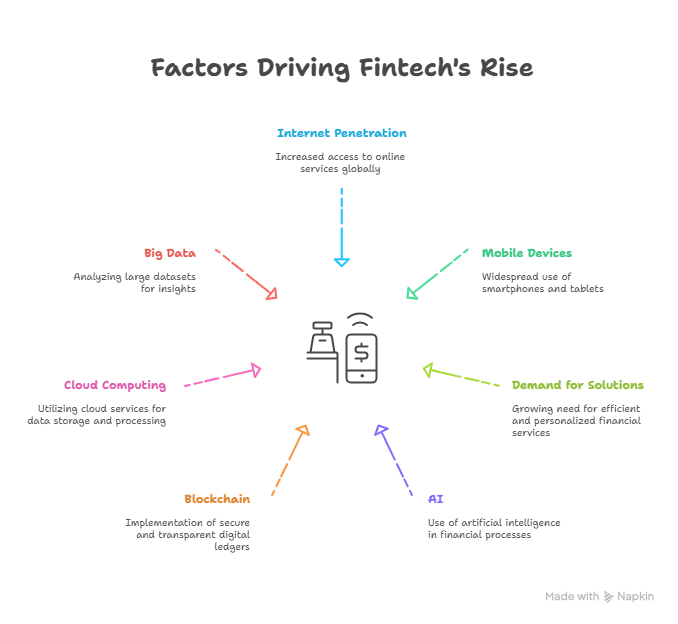

The Rise of Technology in Investment Banking

Investment banking is traditionally spread sheet and man-dependent but is slowly adapting to technologies like:

- Blockchain for real-time settlement

- Cloud Computing for business scalability

- Big Data for client analysis

- Robotic Process Automation (RPA) for operations

This fintech transformation is changing processes, eliminating inefficiencies, and creating new jobs that didn’t even exist a decade ago.

Fact: 90% of investment banks today have fintech solutions installed within operations or will very soon, according to one PwC report.

AI in Investment Banking: Disruption or Revolution?

Artificial Intelligence is likely to be the most powerful banking driver of our era. From algorithmic trading, predictive analysis, and fraud prevention to revolutionizing the face of decision-making.

AI in banking is expected to contribute $1 trillion in added value globally by 2030.

Examples of these include autonomous regulatory oversight, natural language processing of chatbots, and smart contracts. AI isn’t slowing down or taking the jobs—it’s redefining them. Those working today must be machine learning model familiar, data analysis, and decision tree technology-influenced.

Career Opportunities in Digital Banking

The. intersection of finance and fintech has opened up new career paths that combine technical and financial knowledge. Most in-demand fintech career positions today are:

- Investment Banking Associate (with digital tool expertise)

- Wealth Management Analyst (with AI platforms)

- Regulatory Reporting Analyst (with data compliance)

- Risk Management Consultant (with predictive technology implementation)

- Client Onboarding Associate (with automated KYC platforms)

Fintech careers are not only making relevance, but permanence.

Key Skills Required for Fintech Careers

Money and technology require a double-skilled approach. Most important skills are:

- Data Analysis with Excel, SQL, or Python

- Blockchain and Cryptocurrency knowledge

- AI/Machine Learning concepts

- Risk Assessment tools

- Compliance and Ethical Banking software

Decision-making, flexibility, and subject-specific communication are equally important soft skills too.

Resume for Investment Banking Roles in a Tech-Driven Era

If looking for investment banking careers in the current digital-age era, your resume must be technology-aware.

Tips:

- Highlight data tools: Excel, Tableau, SQL

- Call out technology-based projects: AML simulations, Trade Lifecycle, etc.

- Certifications such as the CIBOP to support learning in areas of the profession.

A resume tailored towards problem-solving in real-world situations actually makes an impression.

Interview Tips: Ace Your Fintech Finance Job Interview

Interviewing at an investment bank these days and writing an investment banking interview question, you won’t only be queried on balance sheets and EBITDA. Be ready to explain:

- How AI can automate

- The impact of RPA on middle-office functions

- Algorithmic modeling to mitigate risk

Top Finance Job Interview Tips:

- Be a solutions thinker, not a process thinker.

- Your digital banking solutions answer.

- Emphasise fintech disruption awareness—e.g., neobanking and DeFi.

Why CIBOP by Imarticus Is Future-ready?

Certified Investment Banking Operations Professional (CIBOP™) course is at the top in the highly competitive education industry. Here’s why:

- Job Guarantee: 100% job guarantee for finance graduates with good marks

- Placement Rate: 85% in high-quality banks

- Salary Increases: 60% average salary hike

- Role Readiness: Prepared for 12+ roles in digital finance

- Real-World Projects: Anti-money laundering, ethical banking, compliance simulation

You don’t learn. You do.

More than 1200 batches successfully completed and 50,000+ trained students.

FAQs

Q1: What is the role of fintech in modern investment banking?

A: Fintech enhances the efficiency of the process, enables decision-making based on artificial intelligence, and creates new employment opportunities through automation of standard banking processes.

Q2: Which jobs are available after a fintech investment banking course?

A: Job opportunities offered are Investment Banking Associate, Risk Management Consultant, KYC Analyst, Trade Surveillance Specialist, etc.

Q3: What makes CIBOP different from other certifications?

A: It offers 100% job guarantee, live project experience, and hands-on exposure—along with industry-approved certificates.

Q4: Can non-tech finance graduates enter this field?

A: Yes. Fintech-foundation finance courses such as CIBOP are for beginners and start from the core levels.

Q5: How should I prepare for a fintech-based finance interview?

A: Place emphasis on tech, fintech knowledge, and ability to talk about use cases like AI in trade or RPA in settlement.

Conclusion

Fintech is the future of investment banking—and that future is already here. It’s changing what banks do, how they do it, and whom they hire. In order to stay in business, next-gen professionals must embrace the intersection of finance and technology.

Imarticus Learning’s CIBOP™ program is the ideal place to make that jump. With 7 interview assurances, hand-in-hand exercises, and 1000+ hiring partners, it’s not a course—it’s a career starting point.

It’s time to shake up your resume, skill set, and career path with fintech in finance.