It is no secret that the world of finance is constantly evolving. To stay ahead of the curve, professionals in the financial services and capital markets industries need to be able to anticipate changes and adapt quickly.

The financial services world is in a time of exciting transformation – full of thrilling possibilities and unpredicted challenges!

In this post, we will look at what the landscape will likely look like in 2023 and explore some of the courses that will be most successful in helping professionals succeed in this field. Stay ahead of the competition – read on!

The Financial Services and Capital Market Landscape in 2023

The financial services and capital markets industries have undergone significant changes in recent years. By 2023, it gets predicted that these changes will be even more pronounced, and the industry will look very different from its present state.

Additionally, the sector needs money to invest in digital and cloud transformation to counter well-funded peers and rivals in the payments, tech, and retail sectors.

However, there is a benefit to capital restraint during a brief recession. Since bank share prices have historically outperformed those of fintech, it might give banks the financial muscle to pursue transformative deals using a combination of cash, stock, or both.

Here are some of the trends that we can expect to witness:

-

Increasing use of technology

Technology is already used in the finance industry to facilitate various processes and transactions, but this trend can become even stronger by 2023. Technologies like blockchain, artificial intelligence, and cloud computing have been used extensively to streamline operations and improve accuracy.

-

Growing need for fintech skills

As technology continues to revolutionize the finance industry, there will be a growing need for professionals with specialized fintech skills. These include technical knowledge of different financial software and understanding how to use it effectively and ethically to maximize its potential.

-

Increasing demand for data-driven decisions

As more sophisticated analytics tools become available, there will be greater demand who can make data-driven decisions. Understanding how to interpret financial data and use it to inform decision-making will become increasingly important as the industry evolves.

-

Greater emphasis on cybersecurity

As more financial transactions move online, there will be an increased need for cybersecurity professionals. Companies must protect their data and assets from cyber threats to remain competitive.

The future of consumer payments

The macroeconomic outlook for 2023 predicts a mixed future for companies participating in consumer payments in the short term. Higher rates should increase banks’ net interest margins for card portfolios.

Still, consumers’ appetite for spending may be affected by ongoing inflation, the depletion of savings, and a potential economic slowdown. Digital payments should also hasten and change the payment experience in several ways.

However, fraud could go where money does. In the long run, it gets anticipated that digital identity will develop as a balancing force to reduce the risk of fraud. Meanwhile, the creation, storage, valuation, and exchange of money through digital currencies could have significant long-term effects on consumer payments.

Nobody can predict the future of financial services and capital markets, but it is safe to say that the environment will be very different from what it is today. Capital markets are constantly evolving, and the companies that survive and thrive will be the ones that can adapt to change.

Whether you are a startup or an established player in this industry, now is the right time to start planning for the future!

Learn Advanced management program in financial services with Imarticus Learning

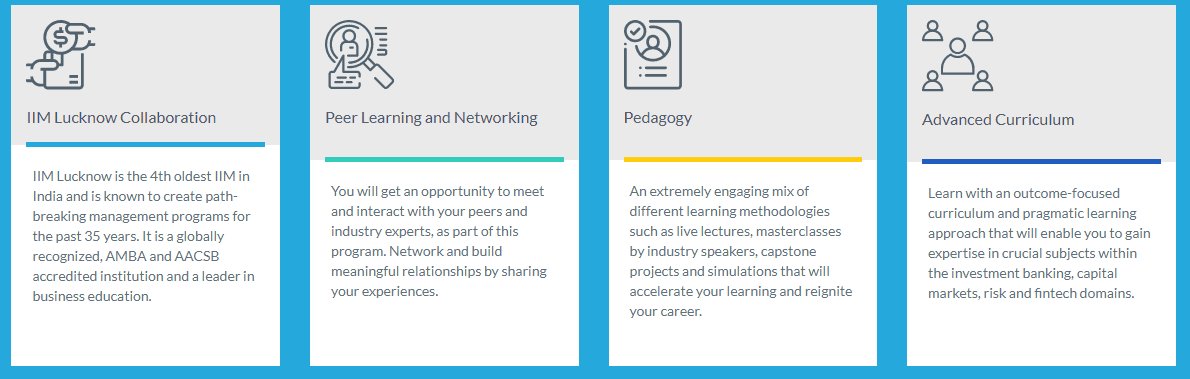

As part of our IIM Lucknow certificate courses, students will learn about careers in investment banking, capital markets, risk management, and fintech. This demanding six-month program was created at IIM Lucknow by the top business school in the world.

Course Benefits For Learners:

- Students can network with peers and business professionals through this financial management course.

- Key concepts like investment banking, capital markets, risk, and fintech will get understood by the students.

- The financial services management certification can teach learners about financial services and capital markets.

Visit our training centers in Mumbai, Thane, Pune, Chennai, Bengaluru, Delhi, Gurgaon, or Ahmedabad, or get in touch via the chat support system.

The course is mainly offered for those with work experience and/or with a

The course is mainly offered for those with work experience and/or with a