The spurt in the financial domain is instant, recognizing this trend people have started opting for a career in the finance industry. Building a career in such a competitive space where everyone wants a piece of the pie you have to have the added advantage to stand out from the competition. The Financial Analysis subject is best suited for a budding finance enthusiast who is aspiring for a successful career in this field.

Financial Analysis is a complex subject matter that involves different fragments. You have to gather knowledge about a wide range of subjects. Financial reporting analysis, corporate finance, economics, equity, alternative investments, etc. are some of the prominent topics you’ll have to spend your time upon.

The subject matter of financial analysis involves a comprehensive understanding of the company’s fundamentals to do data analysis and project the future trajectory taking into account the different variables that might affect a company’s overall performance in the short as well as the long run.

Where to Find Good Resources?

I am a firm believer of “learning can happen anywhere”, the catch here is that you got to have an open mind and a knack for learning the subject matter. Keeping attention to detail is a must in the case of learning finance.

Before deciding what resources you need to use for building your knowledge base in any domain, you have to figure out the ‘why’. Why do you want to learn financial analysis? The answers could vary from getting a job in a Financial firm to teaching others about the subject. When you have this answer then only you could establish the degree of knowledge that you need to obtain for your pursuit.

Learning is a continuous process and a subject such as finance is always evolving with the economy and the world so there’s no end to learning here. What you knew a year ago might be outdated today so it needs constant catching up.

Today you’ll find countless resources to learn about any topic in finance. The world of social media has made learning easier and much more convenient than traditional means.

The best resources can be found in the form of video channels on youtube, blogs, online courses, educational websites focusing on the finance niche, etc.

If you want to get a good job in the financial industry, getting validation for your knowledge is important, especially in the big corporate houses. You can opt for professional courses like CFA where you’ll get guidance on how to proceed in a structured manner for your financial analyst education. It is a course dedicated to financial Analysis, upon completion of the course and with relevant experience, you’ll get to use the charter title for a financial analyst.

If you break up a Financial Analyst course it contains two fragments one is involved with building your knowledge base in finance and the other is related to upgrading your analysis and presentation skills which include learning Ms excel and PowerPoint.

You can even focus on learning the two fragments in isolation. You can opt for courses that teach Excel and PowerPoint and other courses which help you with building your financial & accounting knowledge.

There are various books on finance by popular authors which teach financial education in a slightly unconventional manner. Some of the good reads are “Richest Man in Babylon”, “One up on wall street”. You can even find the ebook versions for the same on Amazon for a very minimal price if not free.

Conclusion

To learn financial analysis as a subject you need to figure out the details of the subject matter that includes topics from various subjects including economics accounting, financial maths, etc.

It is important to define your goal for learning financial analysis that will give you a direction and will help determine the degree of knowledge you need for your particular endeavor.

Excel is a particularly important course curriculum in

Excel is a particularly important course curriculum in

Why do you want to be a financial analyst?

Why do you want to be a financial analyst?

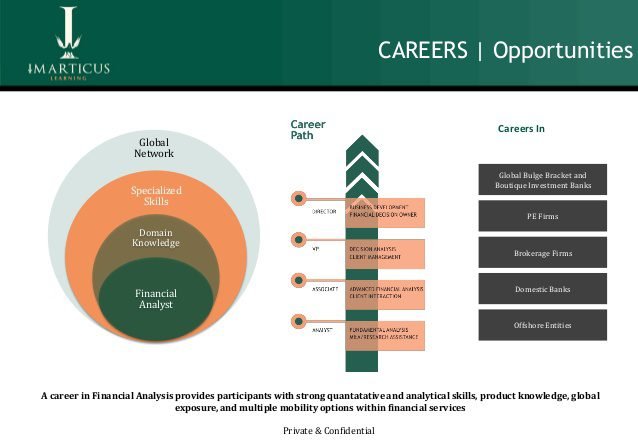

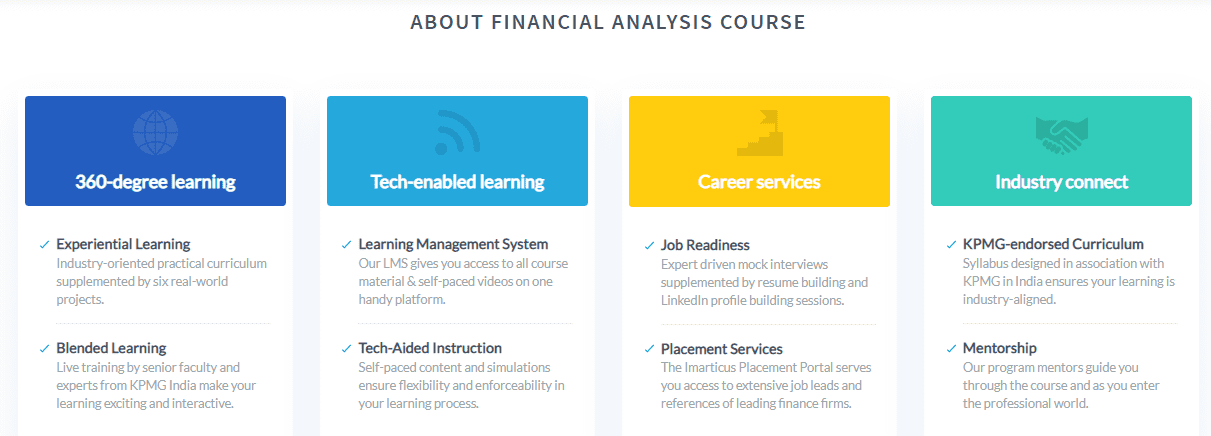

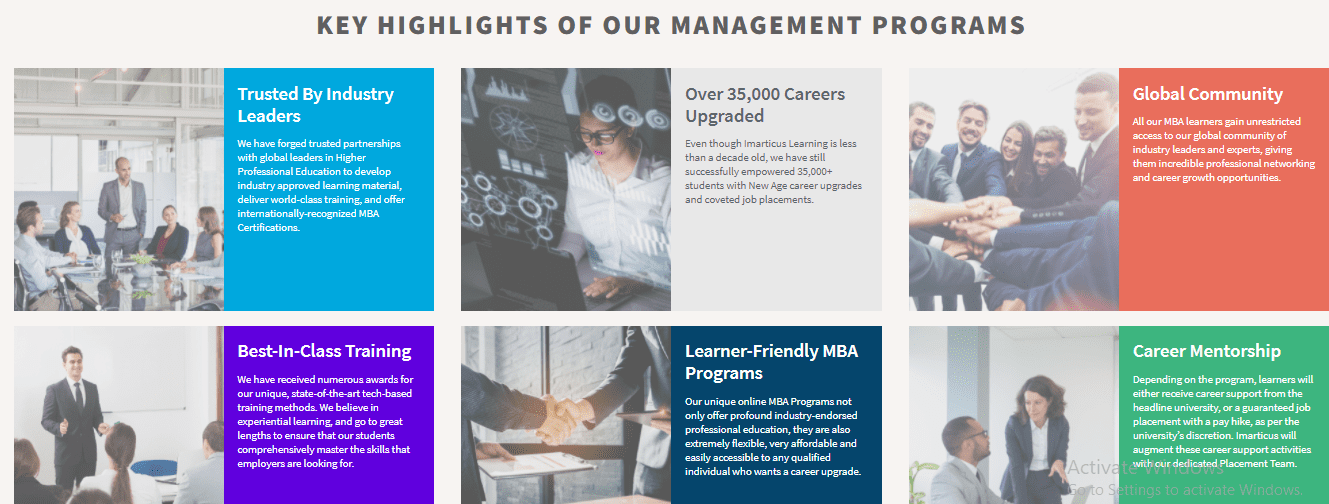

At Imarticus, we empower students with

At Imarticus, we empower students with

A CFA Program teaches and tests the fundamentals of investment tools, valuing assets, portfolio management, and wealth planning. For those wondering how to become a CFA, here’s the process:

A CFA Program teaches and tests the fundamentals of investment tools, valuing assets, portfolio management, and wealth planning. For those wondering how to become a CFA, here’s the process: They offer an extensive learning package, donned with in-depth knowledge on the basics of ratio analysis, SWOT analysis, financial management, and much more. Contact us today for more on Financial modeling Courses!

They offer an extensive learning package, donned with in-depth knowledge on the basics of ratio analysis, SWOT analysis, financial management, and much more. Contact us today for more on Financial modeling Courses!