In the dog-eat-dog business age, first time right is essential. Elite-class financial analyst training can be your golden ticket to a happy and successful working life in India’s thriving finance industry. With demand for highly skilled practitioners still increasing, and particularly for financial modeling, equity research, and investment analysis, first time right qualifications have never been more crucial.

Why is a Financial Analyst Course is a Game-Changer?

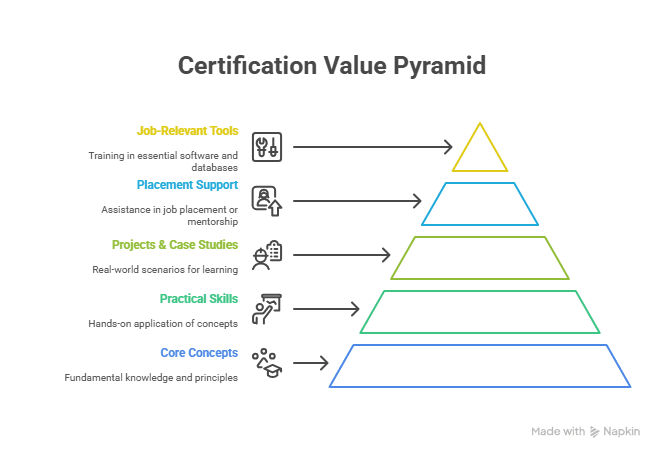

A normal financial analyst course not only equips one with the technical skill and hands-on experience to make entry into traditional finance positions but also goes beyond theory. It allows students to obtain financial modelling qualification, enhance their advanced Excel for finance skills, and acquire investment analysis training skill. With live projects, hands-on simulations, and industry-standard software, contenders are more than well-equipped.

Key Skills Taught in a Financial Analyst Course

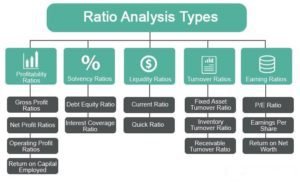

Study for a financial analysis course leads to exposure to core competencies, which are:

- Financial statement analysis – Learn the proper way to read and interpret financial statements.

- Valuation techniques – Learn how to apply DCF, relative valuation, and comparable company analysis.

- Equity research skills – Acquire industry-level research skills.

- Advanced Excel for finance – Use Excel to automate, run complicated formulas, and graph financial data.

- Presentation and story-telling – Get things in front of the reader in a clear, readable form using PowerPoint and data visualisation tools.

These are not optional but essential in being employed in investment banks, asset management firms, and leading MNCs.

Financial Modelling Certification: Why It Matters?

One of the strongest strengths of a master program in financial analyst is having a thorough understanding of financial modelling. It’s a fundamental skill of building models that reflect the finance performance of an organization and is central to M&A deals, equity research, and strategic planning. A financial modelling accreditation can simply boost your profile and lead to senior positions at the outset of your career.

The Power of Investment Analysis Training

Investment analysis training is also an essential part of any best financial analyst course. It equips professionals with the ability to examine profitability and viability of investment concepts using qualitative and quantitative methods. Training encompasses:

- Risk-return analysis

- Sector and industry trend analysis

- Portfolio diversification practices

The outcome? Job-ready and ready to contribute positively on day one.

Finance Course with Placement: Ensuring Career Outcomes

A placement finance program ensures that not just are you qualified but also placed. Having placement guidance and interview assurances, you can start working in firms such as:

- Goldman Sachs

- JP Morgan

- Morgan Stanley

- CitiBank

- UBS

- BNP Paribas

The guarantee of good placement with a good brand provides learners with confidence and encouragement to do well.

Real-world Application Through Equity Research Skills

Equity analysis skill gained from project learning, simulations, and case studies are significant in the finance industry. Based on these skills, you will be capable of:

- Estimating earnings

- Valuing stocks

- Acquiring macroeconomic and sectoral trends

This makes your choices accessible for use by sell-side and buy-side institutions.

Choosing the Right Financial Analyst Course for Career Growth

We need to look for a program that is both academic and industry-oriented. Imarticus Learning’s Postgraduate Financial Analysis Program achieves the same. With a placement record of over 45,000, it delivers anything from investment analysis training to advanced Excel for finance with assured placements.

Why Choose the Postgraduate Financial Analysis Program?

- 100% Job Guarantee: Receive 7 assured interviews with the top finance organizations.

- Flexible Learning: Take a weekday 4-month program or an 8-month weekend program.

- Real-World Simulation Projects: Get placed in situations from M&A, risk management, and wealth advisory.

- Personal Branding & LinkedIn Challenge: Stand out in the current competitive job market.

- Expert-Led Instruction: Learn from real-world professionals.

You are also exposed to tools such as Excel, PowerPoint, and simulation software used by professionals from organizations like:

- Bank of America

- RBS

- Capgemini

- Genpact

Certified Investment Banking Operations Professional: The Ideal Next Step

If you want to move it a notch higher on the ladder, Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP™) program is the best next step. With 0–3 years of experience after finance graduation, it gives you a comprehensive exposure to investment banking operations and has the benefit of 100% job assurance.

Highlights of the CIBOP Programme:

- 85% Placement Rate with up to ₹9 LPA salaries

- 7 Interviews Assured

- 60% Salary Hike

- 1000+ Recruitment Partners

- 1200+ Batches Placed

- 4 LPA Average Package

Real-World Learning Projects Include:

- Money Laundering Schemes

- Trade-Based Money Laundering

- Compliance & Ethical Banking

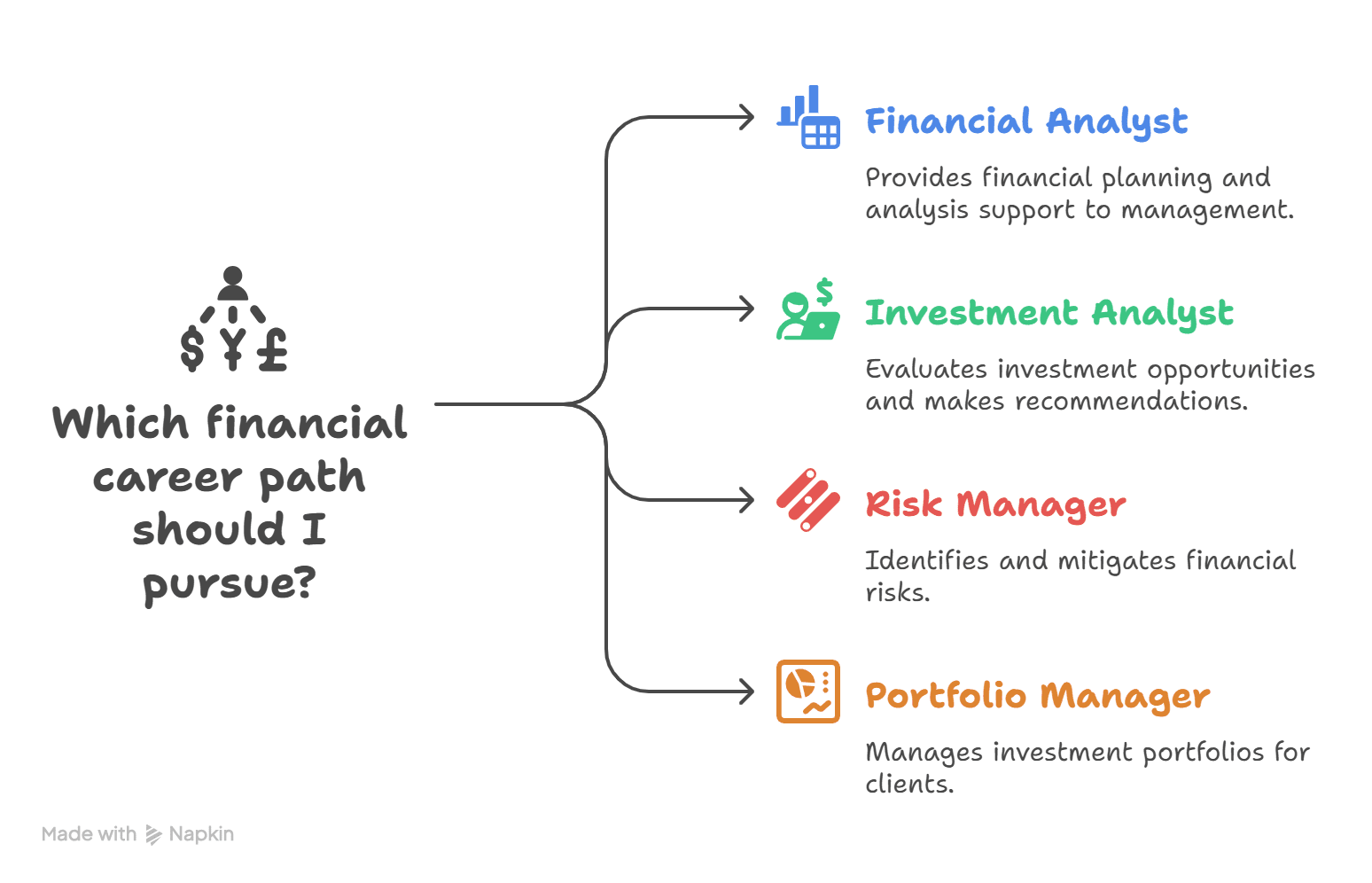

With more than 1000 hiring partners and interview preparation assistance at your fingertips, the CIBOP program prepares you industry-ready as well as profile-ready to upgrade in positions like:

- Investment Banking Associate

- KYC Analyst

- Trade Surveillance Analyst

- Regulatory Reporting Analyst

FAQs

1. What is a financial analyst course, and why is it important?

A financial analyst course provides the necessary tools and skills to analyse financial data, build models, and make strategic recommendations. It is essential for anyone aiming to enter or grow within the finance industry.

2. Which is the best financial analyst course in India with placement?

The Postgraduate Financial Analysis Course by Imarticus Learning has a strong curriculum and 100% placement guarantee, providing 7 sure-shot interviews.

3. What is the difference between financial modelling and financial analysis?

Financial modelling is the building of hypothetical models of actual financial environments, whereas financial analysis is made up of the examination of financial data with the aim of informing business decisions. Both are taught in higher-level financial analyst courses.

4. How do financial modelling certification and investment analysis training help?

They provide assurance of your abilities and increase your appeal to employers through demonstration of your ability to manage real-world finance situations.

5. What are the prerequisites for enrolling in a financial analyst course?

A majority of courses, such as Imarticus’s, are best suited for commerce, finance, or economics graduates with up to three years’ work experience.

6. Are financial analyst courses suitable for career switchers?

Yes. They educate you in skills related to the industry, hence ideal for a career switch to finance.

7. What kind of salary can I expect after completing a financial analyst course?

Initial pay is around ₹4 to ₹5.5 LPA, which can reach very high depending on experience, performance, and college.

Conclusion

Taking up a course in financial analysis is not only an intellectual decision but also a career one. The Indian financial market is growing at a fast rate, and thus there is a demand for professionals who are equipped with analytical skills. Programmes such as Imarticus Learning’s Postgraduate Financial Analysis Programme provide a three-dimensional experience of job guarantee, technical skills, and personality development.

If you are ready to put in the effort and take a leap of faith into investment banking, the CIBOP™ program can be your ticket to a successful and rewarding career. Through full learning, placement assistance, and on-the-job training, it is perfect for career-driven professionals who are ready to reach the pinnacle.

With the right course and the right instruction, a career in finance is not only a possibility—it’s an achievable reality.