Credit risk is an unavoidable part of any business’s risk management strategy. But what exactly is credit risk, and how can you best manage it? In this blog article, we will explore what credit risk is and how to understand it better. We will discuss the importance of assessing credit risk levels and their potential risks. We will also cover some tips for mitigating credit risk in your business. By the end of this post, you should better understand how to tackle credit risk under your overall risk management strategy.

What Is a Credit Risk under Risk Management?

Credit risk is the probability of loss that a creditor will incur when a debtor fails to make payments on their debt obligations. Creditors use credit risk management to assess and mitigate the risk of losses arising from delinquent or defaulted debtors. There are several credit risks, including counterparty risk, country risk, sovereign risk, and interest rate risk.

Creditors use a variety of methods to manage credit risks, including collateralization, hedging, and diversification. Collateralization involves using assets as security for loans in order to reduce the likelihood of losses in the event of a default. Hedging is a type of financial engineering that aims to minimize exposure to adverse price movements by using derivative contracts. Diversification is another common approach to managing credit risks, which involves spreading out investments across multiple borrowers to minimize the impact of any one borrower defaulting.

What are some prerequisites to becoming a credit risk assessment manager?

If you aspire to be a credit risk assessment manager, here are a few things to know.

Firstly, you should have a degree in risk management, finance, or a related field.

Secondly, you should have several years of experience in credit risk management.

Finally, you should be able to demonstrate strong analytical and problem-solving skills.

What are some factors to consider before becoming a credit risk assessment manager?

When assessing whether or not to become a credit risk assessment manager, there are a few key factors to consider. The first is your experience in finance and credit risk management. It is important to have a strong understanding of financial concepts and models to succeed in this role. Additionally, you should be comfortable working with large amounts of data and have strong analytical skills.

Another important factor is your ability to communicate effectively with internal and external stakeholders. As a credit risk assessment manager, you will be responsible for providing clear and concise reports on the risks associated with lending decisions. Therefore, you must have strong writing and presentation skills.

Finally, you should also be aware of the regulatory environment surrounding credit risk management. It is important to stay up-to-date on regulation changes to ensure compliance within your organization.

How can an investment banking course help you learn about Credit Risk Assessment and the whole industry?

There are many reasons why an investment banking course can help you learn more about credit risk assessment and the industry. For one, an investment banking course will give you a fundamental understanding of how lenders assess credit risk. An investment banking course will also teach you the financial instruments used to manage credit risk. Finally, an investment banking course will give you insights into the inner workings of the credit industry, which can be invaluable when making informed decisions about your finances.

Treading on Learning Journey with Imarticus Learning:

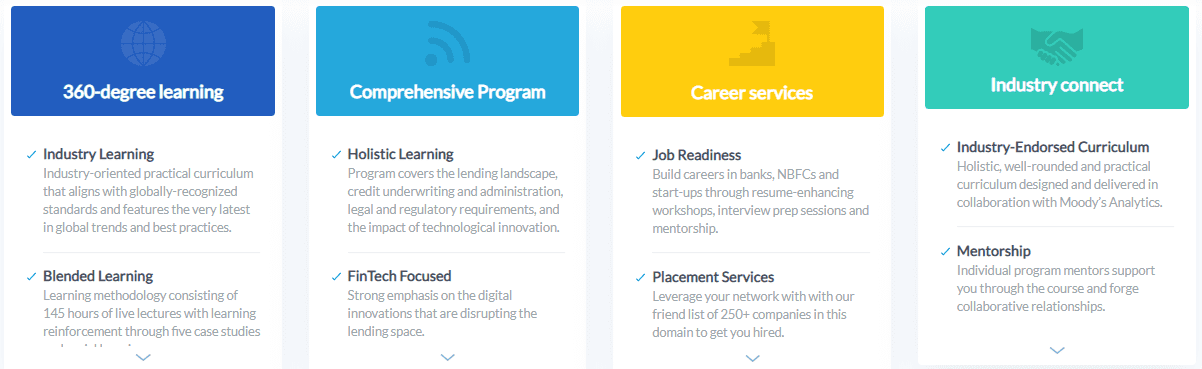

Since you know what a credit risk assessment is, here is a course offered by Imarticus Learning that supports your risk management career goals. Check out the Certified Investment Banking Operations Professional, a course built for those looking to make a career in the field, and investment banking course.

Imarticus Learning offers students an opportunity to build a career with the best programs under its flagship industry-approved program that is best for learners with under three years of experience and comes with a 100% job interview guarantee. This extensive 150-hour program helps you become an investment banking operations expert. The program focuses on the fundamentals of financial markets, trade life cycle, risk management, and regulation and prepares you for a job at a leading company.

Course USPs:

The program comes with a job interview guarantee

Tailored training & offer placement support for unique career goals

Certification from Academy – Euronext Group to enhance your profile

Insights on financial markets, trade life cycle, and risk management.

Expert faculty for robust curriculum using hands-on training

Real-world projects and problem solving

For further details, contact the Live Chat Support system or visit one of our training centers in Mumbai, Thane, Pune, Chennai, Bengaluru, Hyderabad, Delhi, Gurgaon, and Ahmedabad.

A lot of institutions offer a solid

A lot of institutions offer a solid  Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Credit risk management is a popular part of the banking sector today. You can undertake

Credit risk management is a popular part of the banking sector today. You can undertake