7 Little Changes That’ll Make A Big Difference: Credit Risk Certification In India

Credit risk certification in India can help you gain better insights into your field. If you are one of those looking for ways to expand their business, this course will undoubtedly benefit your company. This post will discuss some little changes that will make a big difference in credit risk certification in India.

Core competency

The first step to improving credit risk certification in your company is understanding the importance of core competency. It’s important to know what you’re doing and be able to demonstrate that knowledge. For example, you may understand how loan repayment models work and how they apply across various industries or geographies.

Experience

Experience is another crucial part of improving credit risk certification. Suppose you don’t have enough experience under your belt. In addition, having more experienced employees helps ensure that new hires will be able to hit the ground running right away by learning from those who’ve already been through it before them—and not just at their own pace but also yours!

The focus is on the future

If you’re focused on the future, your mind is open to new possibilities and opportunities. You start a business because you have a vision of what it could become in the future. If you’re focused on the present, you’re happy and don’t want to change anything. The past happened—it can’t be changed or undone, so why think about it?

We use credit risk certification in India because it helps us understand our clients’ financial situation and how they’ll act in various situations. This information assists us in making better decisions about whether or not we should lend money to someone.

Growing awareness of credit risk

Credit risk is the risk of loss from a borrower or counterparty’s failure to meet its financial obligations. It’s an essential factor affecting a company’s financial performance, and it needs to get managed effectively.

Demand for qualified candidates

The demand for qualified candidates with credit risk certification is growing, and this is one of the reasons you should consider it a career option. Credit Risk Certification is a must for credit risk professionals, so if you have this certification, it will help you get an edge over other applicants.

Net-working opportunities and experience sharing

Networking is an indispensable aspect of building your network. You can meet people who have the same interest, learn from their experiences, share your own experience with others, find out about new opportunities and build your network.

Networking extends beyond industry events; it’s a great way to connect with like-minded individuals who may not work directly in the financial services sector but have valuable knowledge that could benefit you.

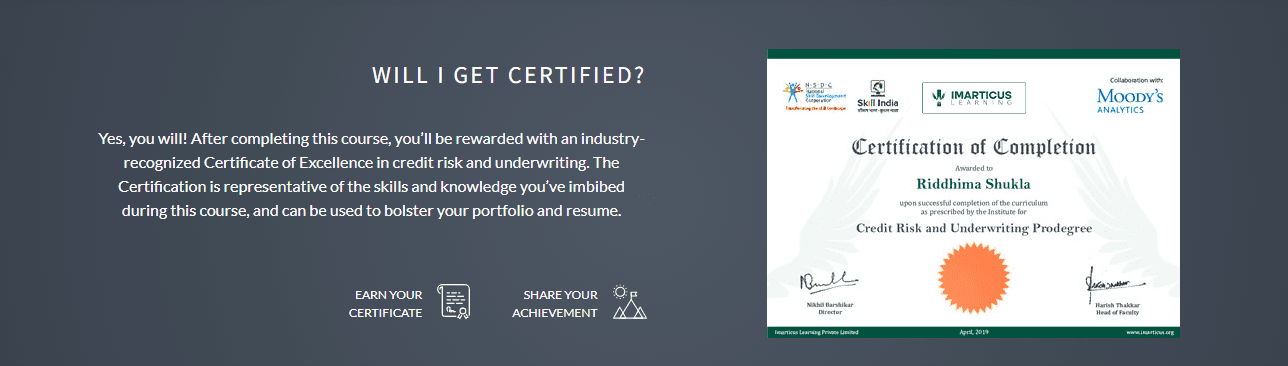

Explore the best credit risk certification in India with Imarticus Learning

This credit risk certification in India teaches students about the lending atmosphere, credit underwriting, and regulatory requirements. It also discusses how modern technology might affect your business.

Course Benefits for Learners

- The career-focused practical curriculum satisfies globally recognized requirements and combines the most recent global trends and best practices.

- The credit risk management courses include 145 hours of live lectures, five case studies, and social learning in the curriculum.

- The credit management courses online are industry-focused, hands-on, and connected with internationally accepted standards. It incorporates the most recent educational innovations from across the world, making it one-of-a-kind!

Related Articles

Everything you need to know to build a career as a credit analyst

Through these

Through these

Credit Risk Analysis is primarily a number-crunching job that needs a strong foundation in finance. If you’re keen to pursue a Credit Analyst Course, you should have a Bachelor’s Degree in finance, accounting, or other related fields such as ratio analysis, statistics, economics, calculus, financial statement analysis, and risk assessment.

Credit Risk Analysis is primarily a number-crunching job that needs a strong foundation in finance. If you’re keen to pursue a Credit Analyst Course, you should have a Bachelor’s Degree in finance, accounting, or other related fields such as ratio analysis, statistics, economics, calculus, financial statement analysis, and risk assessment.