Credit risk analyst certification

A person with credit analyst training evaluates an applicant’s ability to repay a loan and recommends that the loan be approved or denied. Let’s look at what to study to become a credit analyst.

Those who train to become credit analysts often find work in banks, lending institutions, credit card companies, investment banks, credit rating agencies, and investment companies. Let’s look at what to study to become a credit analyst.

What a credit analyst does

Let’s start by understanding what the typical tasks of credit analysts are. A credit analyst collects and reviews financial data pertaining to loan applicants, including their payment habits and history, earnings and savings, and spending patterns. Based on this, he or she recommends loan approval or denial.

In detail, these could be some of the day-to-day tasks of a professional that has completed a credit risk analyst course:

- Conduct a thorough analysis of financial statements and evaluate new, modified, refinancing, and annual due diligence credit applications.

- Provide your institution with recommendations linked to credit risk analysis and assessment.

- Maintain credit files and identify discrepancies and variances.

- The present analysis, findings, and recommendations to managers, with emphasis on applicants’ ability to pay.

- Keep up to date with company lending protocols.

- Develop and prepare spreadsheets and models to support credit and loan analysis.

Qualifications and skills

The minimum requirement for this position is usually a degree in finance, accounting, or a related field.

In that sense, the analyst should be familiar with accounting concepts, finance, statistics, ratio analysis, calculus, economics, industry evaluation, and financial statement analysis. Risk analysts in particular are experts in all these concepts and practices.

Some banks and companies provide on-the-job training in credit analysis to candidates who do not have finance-related degrees. In other words, they acquire through work experience what they do not acquire at a university.

However, most analysts are trained at universities, not only obtaining a bachelor’s degree, but also a postgraduate degree. In any case, for financial analysts, experience is crucial. In summary, we can present the skills and requirements for credit analysts as follows:

- Bachelor’s degree in finance, accounting, or other business-related fields.

- Two to five years of solid quantitative experience.

- Strong proficiency in MS Office and computer skills.

- Ability to work under high pressure and effectively manage competing deadlines for projects with varying degrees of supervision.

- Strong attention to detail to be able to notice discrepancies in data.

- Impeccable understanding of financial statements, ratios, and mastery of concepts.

Other skills an analyst may need include:

- Diligence in solving problems and moving projects forward.

- Quantitative analysis skills to review large numbers.

- Written and oral communication skills, to effectively inform decision making and summaries.

- Knowledge of the financial industry and the industry in general in which you plan to work.

- Multitasking and being able to prioritize what is really important according to the project.

- Be able to handle some advanced financial software.

Conclusion

The figure of the risk analyst in companies is relatively new, but today a credit analyst course can be the next best thing for your career. Traditionally, it was not available. However, as companies face uncertain scenarios or complex situations, this profile has become crucial for success.

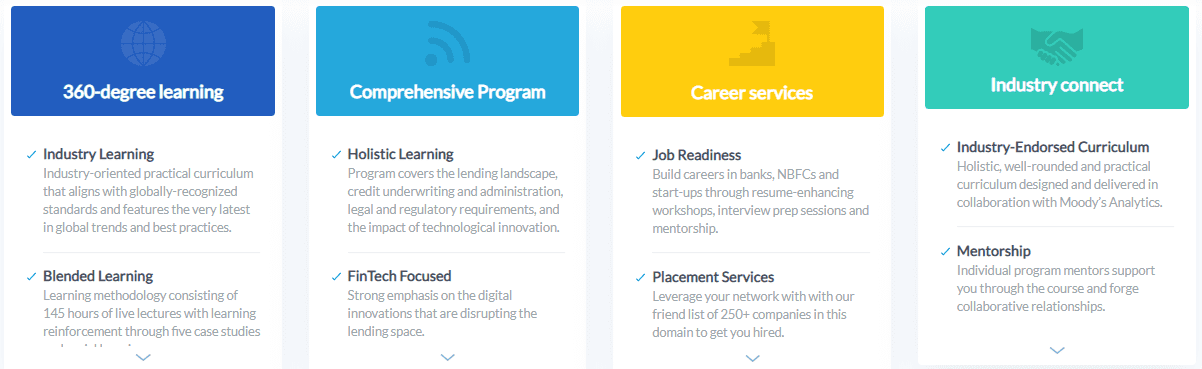

Here at Imarticus, you can enroll in our Credit Risk and Underwriting Prodegree to have access to the best credit risk analyst course.

Credit risk management is a popular part of the banking sector today. You can undertake

Credit risk management is a popular part of the banking sector today. You can undertake