If you are passionate about the Finance industry and have a fine knowledge and interest in the Sensex and nifty, why not make a career in the Capital Market and become a Capital Market Analyst?

A Capital Market Analyst is the one who combines sales, consultation, trade, and banking and balances these to work for the cause. With the market growing vast, there is a rewarding career in the Capital Market Analysis. Today we have professional training in Capital Market that produces highly skilled analysts.

What does a Capital Market Analyst do?

The Analyst can be found working in a various established organization such as Hedge Funds, consulting firms, the investment banking group, and other related firms.

They have a key role in facilitating communication between the company, investment firms, and research organizations. Companies count on them to bring the best possible deal for the clients and investors both. Capital Market Analyst is the supporter of the business that seeks capital investment in their company or the other way around.

The responsibilities of a Capital Market Analyst are:

- Communicating with the investors: They are the first ones who start the communication with the investors and are also responsible to research about them in details.

- Setting or negotiating price: It is the responsibility of the analyst to deal with the pricing and thus they need to be highly persuasive and also adjusting in nature.

- Organizing events: These analyst act as the middleman between the firms and the companies and thus will make efforts and organize events for the frequent meetings.

- Pitching documents: They prepare the pitching documents that contain clear messages with all the details and helps to put forward the case.

- Closing the deals: Last but not least, the analyst’s seals and finalizes the deal and ensures satisfaction on both sides.

Qualifications and Skill required to become a Capital Analyst

It is a field which requires all-round varying knowledge and different skills to be put together to create huge profit for the employers. In today’s contemporary times, a specialist is preferred who have a specific area of focus but some key qualities need to be present in common.

They require prominent knowledge in :

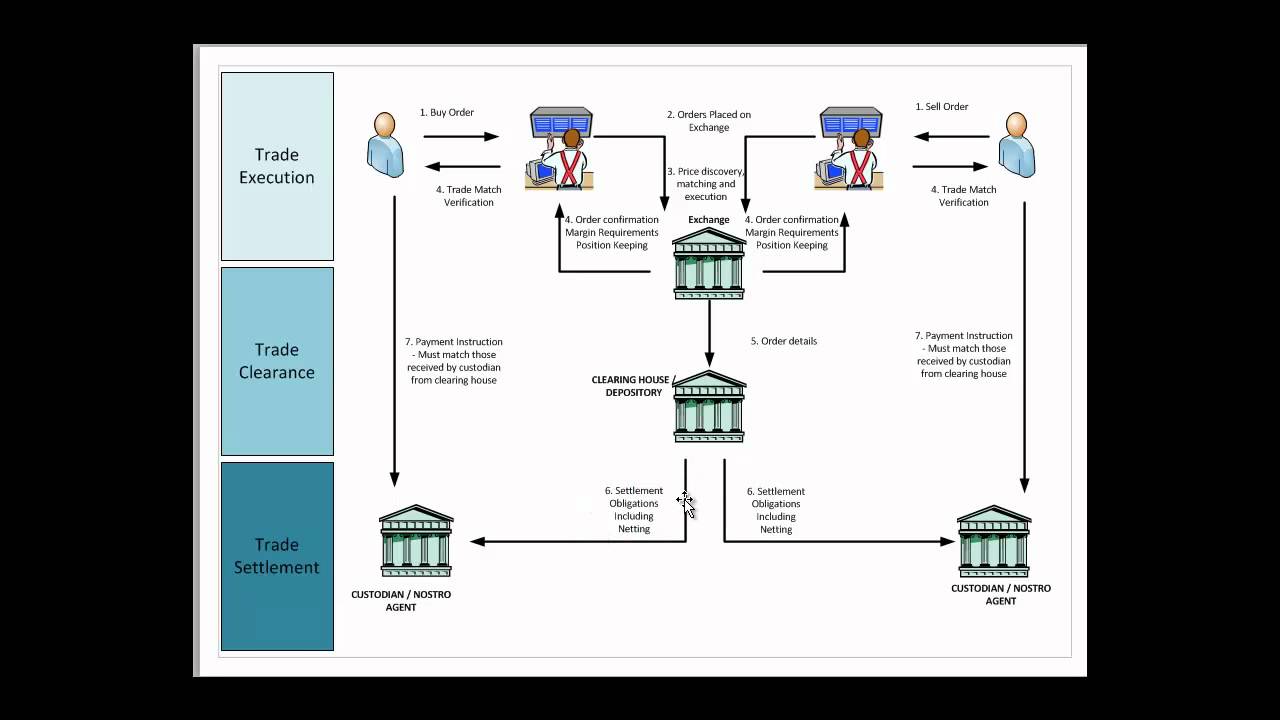

- Trading

- Settlements

- Custody

- Compliance

- Risk

- OTC derivatives

- Finance

- Prime Brokerage

- Knowledge of IT Softwares

To become a Capital Analyst, one will need at least a Bachelor’s Degree in Finance, Business, Statistics or related field. Though there are no hard and fast qualification requirements to train in Capital Analysis, having strong communication skills, negotiation skills, analytical and research skills will surely give an upper hand. Also, if you intend to become a specialist in certain fields such as Healthcare, Tech, Media and Communication, you need to have deep knowledge about the sector.

There are several pioneer institutes in the country that run Capital Market Courses and provide top-notch training in the making of Analyst experts. The capital market tutorial is an easy way to gain basics in this field that will boost up your start. These tutorials are easily available, highly simplified that ensures the technicalities of this field are easily understood.

Share and Derivatives Analysis

Derivatives are among the most powerful financial tools which mainly represents contracts between two parties and derives its value from an underlying asset. The most common types of derivatives are stocks, commodities, market indexes or interest rates.

With shares and derivatives as a fast-growing financial instrument category, it becomes of utmost importance that a company dealing with finance takes measures for Share and Derivative Analysis. Derivative Analysis plays a pivot role in eliminating risks and helps in making successful predictions about the company and its future performances. This analysis indicates how well a firm is doing in the market in comparison to its competitors.

Share and Derivative analysis manifest complete details about the company’s strengths and weaknesses, its business relations, financial performances and all those factors that affect its earnings, dividends and future growth prospects. This analysis tool is being used worldwide to initiate successful trades. The purpose of the analysis is to help make more financially sound investment-related decisions by the investors.

Ways to learn Share and Derivative Analysis

Today, we have access to multiple sources of education that are easily accessible and highly reliable. To learn about Share and Derivative Analysis, a beginner needs to focus on fundamentals and basics of derivatives. There are so many resources and different platforms that can help gain a strong and sound knowledge about how derivative analysis works. Few of the ways we can approach are,

- Read books

- Tutorial videos

- Certified courses

- Resources and guidelines available online and offline

- Blogs and Articles

- Online and Offline Seminars

All the above-mentioned categories are helpful for a beginner to gain knowledge in this field. A word of advice is to make sure the resources are reliable and credible. For more details, you can also contact us through the Live Chat Support system or can even visit one of our training centers based in – Mumbai, Thane, Pune, Chennai, Hyderabad, Delhi, Gurgaon, and Ahmedabad.