Blockchain: An Overview

A blockchain is a distributed, digital and permanent ledger that helps record transactions and track assets across the entire network of computer systems present on the blockchain.

The technology has added a new aspect to the fintech landscape and offered huge possibilities to the industry of fintech by making crucial changes to business enterprises.

How Is Blockchain Revolutionising The FinTech Industry?

Undoubtedly, blockchain is the backbone technology that is revamping the FinTech industry.

Below mentioned are the ways in which blockchain technology is revamping the fintech industry.

- Creating a digital identity:

Though banks have a strict KYC check, fraudulent accounts are on a constant hike. Here comes the role of blockchain, where users can manage identity data, share data with others without compromising security, and sign documents digitally.

- No third party interferences:

There are chances for things to go wrong in case of multiple parties’ validations. With blockchain technology in place, payments can reach the vendor directly without any halt.

- Protects from fraudulent activities:

Being decentralized in nature, blockchain technology keeps from providing access to other people. It cannot be altered in any way possible, making every record protected.

- Enhances trade accuracy:

The merging of blockchain technology in the financial sector has rescued traders from troublesome counterparty checks. Through blockchain, the risks associated are reduced, and trade accuracy is enhanced.

- Crypto lending:

One of the USPs of blockchain technology, which helps you hold money without the need of a bank. You can hold the crypto money in digital form with a digital wallet after investing in cryptocurrencies.

Challenges Addressed by Blockchain in FinTech Industry

Blockchain has the power to make business operations secure, transparent, efficient, and democratic.

- Trustability:

When users perform any action on the fintech applications, they are unaware of what is happening on the other side, which creates chaos and anxiety about identity theft. On the other hand, blockchain redresses the problem with transparent working.

- High operation costs:

Time is often considered as money in the financial sector. Blockchain technology reduces the high operational costs by cutting down the time involved and reducing the dependency on third parties.

- Slow process:

The involvement of various third parties in the finTech industry delays the overall process, which results in an unstable business economy. This is another challenge addressed by blockchain technology.

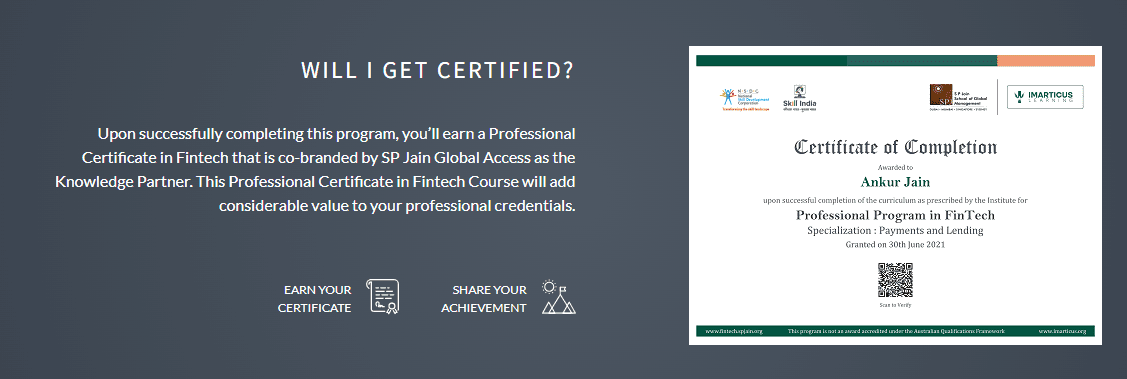

Discover Financial Technology Courses with Imarticus Learning

Our financial technology course helps students:

- Practical application of learnings to real business problems and scenarios.

- Get an in-depth understanding of every critical aspect of FinTech along with hands-on training.

- Stay updated on the latest fintech industry practices by accessing resources powered by research, knowledge, and tech partners such as Rise Mumbai and Automation Anywhere, among others.

- Get full-time fintech career-ready by working on group projects and open bookcase study-based tests that test your fintech knowledge and application in a theoretical decision-maker role.

- Get access to fintech networking webinars, job boards, and events to leverage your fintech learning fully and unlock career opportunities.

Conclusion

Ideal for students with a bachelor’s degree in finance background, this elite Financial Technology Course is bound to take your finTech career to heights you have never imagined!

With the availability of Financial Technology courses online, it has become convenient for learners to gain access to information about each and every element of the FinTech domain.

For any queries, please do not hesitate to Contact Us or drive to one of our training centers in Mumbai, Pune, Thane, Chennai, Bangalore, Delhi, and Gurgaon.

Companies in the commodity industry have started to realize the worth of blockchain experts. They are proactively hiring individuals that have

Companies in the commodity industry have started to realize the worth of blockchain experts. They are proactively hiring individuals that have  Why choose Imarticus’s fintech course?

Why choose Imarticus’s fintech course?