Are you a CFA, CA, CWA, CS, or MBA desirous of a career in the intriguing world of investment banking? Or, a professional employed in the corporate finance/treasury departments of a corporate/bank, or an entrepreneur and manager in the field of financial services and securities markets, seeking that magic dice that pushes you right up the ladder of growth?

Are you looking out to gain competency and mastery over? –

- Using theoretical models of assets to value financial products like equities and derivatives correctly

- How risk plays out in choosing a portfolio

- How international financial markets function

- Adverse selection and moral hazard problems on the informational irregularities within financial markets

- Skills that are necessary to help you manage portfolios according to customer requirements

The Executive Programme in Investment Banking and Capital Services is the best program for you. You fulfill your career aspirations in the finance industry by acquiring the necessary practical knowledge as well as the technical skills essential for a finance professional.

IIM Calcutta, the globally acknowledged business school in the discipline of finance, collaborates with Imarticus, an in-demand skill training and educational organization for executive development, to bring you the IIM Calcutta Investment Banking and Capital Markets Certification course from April 2022.

The program delivers in-depth knowledge of investment banking and global capital markets. The pedagogy is so designed that you get an opportunity to interact with industry leaders and work on a capstone project.

The program delivers in-depth knowledge of investment banking and global capital markets. The pedagogy is so designed that you get an opportunity to interact with industry leaders and work on a capstone project.

The Course Gets you into Readiness as an Executive of the Future

This executive program in investment management hand-holds you through ten subjects with their contents carefully crafted to impart in-demand technical and managerial skills, effective understanding of the subject, and application in practice.

These subjects are Financial Accounting and Analysis, Financial Management and Financial Economics, as foundation modules, and, Debt Capital Markets, Equity Capital Markets, Mergers, Acquisitions and Restructurings, Portfolio Fund Management, Securities Market Research and Valuation, Securities Market Sales and Trading, and Securities Market Regulations, as seven advanced modules.

What’s more? You have two three-day campus immersions at IIM Calcutta, one each towards the beginning and end of the IIM Investment Banking course. Through these three-day immersions, you know about Fintech and Blockchain, Bitcoins and Cryptocurrencies, Financial Risk Management, Sustainability and Impact Financing, etc. from some of the best faculty in the country with diverse experiences.

Not only the knowledge, but you also gather the current global perspectives on different topics as you interact and network with peers and faculty on-campus.

You Develop Competency Skills

The IIM Calcutta Investment Banking Certification course is not only about cramming the subjects but you are also required to work on real-world projects, dissect and study cases, come out with strategies and hone your application skills. Through these, you imbibe an overview of investment banking, capital markets and gain the competencies necessary for you to function as a professional in investment banking and capital markets.

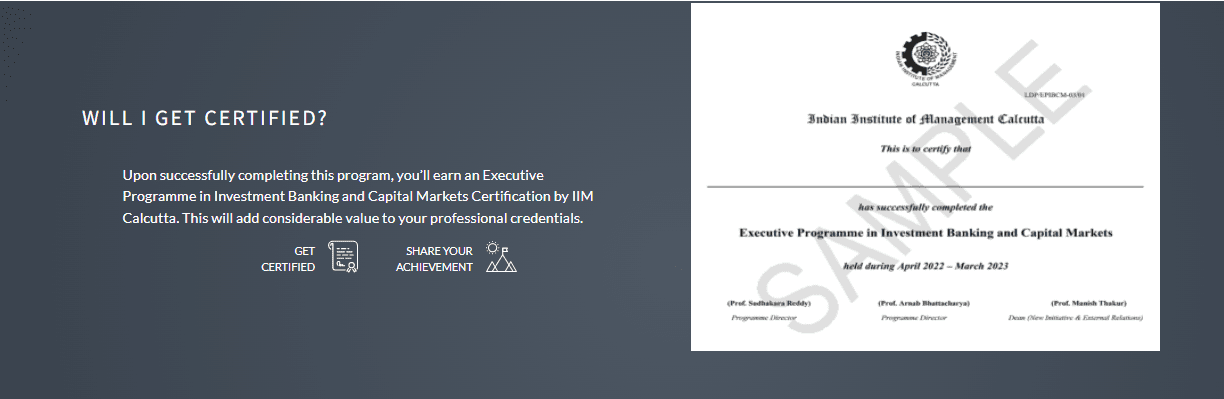

Certificate of EPIBCM From IIM Calcutta is Time-proof

Not only in the near future, but the certificate you get on successful completion of your Executive Programme in Investment Banking and Capital Markets (EPIBCM) is time-proof too. It is testimony to the commitment of one of the topmost institutes of the country of having offered and delivered to you the best possible learning experience for putting your career on the elevated track to growth.

The IIM Calcutta Capital Market course automatically gets you an IIMC Executive Education Alumni status, with access to the institution’s dedicated portal. You keep yourself updated with the latest articles, features, and happenings in your field. You are a future-ready executive, always.