Cloud computing has taken over most of the digital realm and propelled several industries’ growth, including the Fintech market. With the ever-evolving technological innovations in the financial sector, cloud computing has revamped fintech in unimaginable ways. From enhanced storage solutions to state-of-the-art security systems, fintech solutions have become more accessible and robust thanks to cloud services.

The impact of cloud computing on FinTech is transformative, enabling increased efficiency, scalability, accessibility, and innovation. Therefore, it becomes crucial for finance professionals and aspirants to fully understand cloud computing services and harness their benefits to create an efficient financial market.

What is Cloud Computing?

Cloud computing is accessing and utilising computing resources, such as storage, processing power, and software applications, over the internet. Through a network of servers maintained on the internet, cloud computing enables users to access and utilise these resources remotely rather than depending on local servers or personal PCs.

Cloud computing services are sectioned into three categories: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). The user does not have to worry about maintaining these resources and can reap its benefits, while the Cloud Service Provider (CSP) overlooks the system’s internal workings.

Impact of Cloud Computing on FinTech

The impact of cloud computing in fintech can be summarised in the following points:-

Scalable infrastructure

Cloud computing has enabled Fintech companies to build a scalable, cost-effective infrastructure to manage growing consumer demands easily. By leveraging cloud-based services, the fintech market is optimising its operations and significantly reducing costs as it continues to do away with conventional storage setups and moves into digitisation.

Enhanced security

Cloud services invest heavily in two aspects- storage and security. They implement robust technologies to ensure that sensitive financial information remains protected. As cloud services are accessible publicly, they also take special measures to ensure that one user’s data and information are not exposed to others unless by specific access.

Enhanced accessibility and collaboration

Cloud-based solutions enable FinTech professionals to access data and applications from anywhere, facilitating remote work and collaboration. This accessibility promotes real-time data sharing, seamless integration across platforms, and enhanced collaboration among team members, increasing productivity and efficiency.

Accelerated innovation and time-to-market

Cloud computing services also provide reliable testing and deployment solutions, due to which the fintech sector speeds up its development processes. It provides for faster materialising of ideas, automated debugging solutions, and instant prototype development, furthering innovative fintech solutions in the market.

Advanced analytics and data insights

Cloud computing enables FinTech companies to leverage powerful analytics tools and technologies. By storing and processing vast amounts of financial data in the cloud, firms can gain valuable insights, identify patterns, and make data-driven decisions to improve risk assessment, fraud detection, customer segmentation, and personalised financial services.

Use Cases of Cloud Computing in Fintech

Some use cases of cloud computing in fintech are:-

Agile development and deployment

Fintech companies can capitalise on cloud computing to rapidly develop and deploy cutting-edge financial solutions. They can swiftly create prototypes, conduct testing, and launch new products and features by harnessing cloud resources and services. This expedites time-to-market, fosters a culture of continuous innovation, and nurtures an agile development environment.

Real-time risk management

Cloud-based analytics platforms empower fintech firms to extract valuable insights from real-time financial data. Leveraging these platforms, they can perform intricate data analysis, detect patterns, and make data-driven decisions for effective risk management. This includes proactive fraud detection, precise customer segmentation, and personalised financial services, enhancing overall risk assessment capabilities.

Open banking and API integration

Cloud-based APIs serve as a fundamental facilitator for seamless integration between fintech platforms and external systems, enabling open banking initiatives. By leveraging the power of cloud infrastructure, fintech companies can securely expose their services and data, fostering collaborations, enabling third-party integrations, and creating innovative financial ecosystems that provide enhanced services and convenience to customers.

Conclusion

Cloud computing has successfully made a huge positive impact in the fintech sector with its effective solutions and enhanced technological innovations. As both cloud computing and fintech are ever-evolving markets, their integration is expected to simplify financial services further while simultaneously focusing on eliminating security threats and technical challenges.

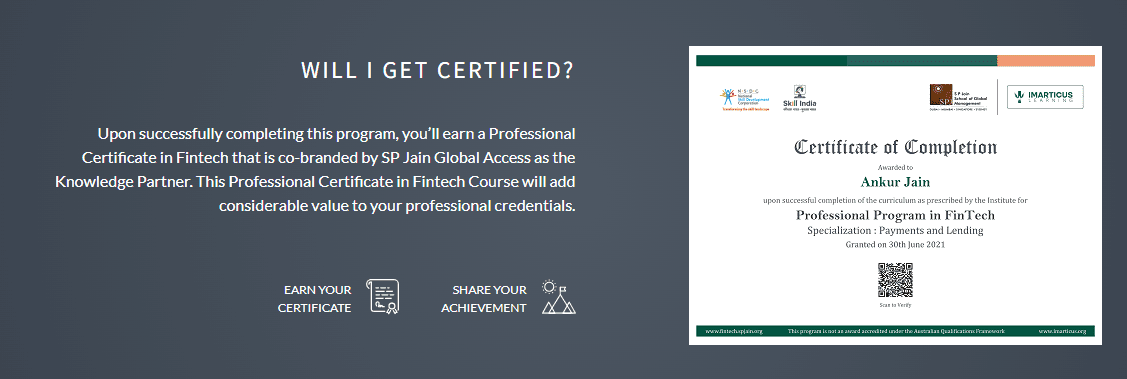

With this competitive business, learners will have all they need by getting certified through our program.

With this competitive business, learners will have all they need by getting certified through our program.