Last updated on August 16th, 2024 at 12:53 pm

Establishing a solid and enduring financial position is crucial when embarking on a company venture. Finances form the structural basis of an economic institution. A sufficient monetary sum and efficient financial strategising, which incorporates the goals of financial management, are crucial to guarantee the long-term survival of a corporation. If a company has consistently practiced effective financial management throughout its existence, it remains advantageous even during the process of dissolution.

Every organisation has a sum of finances to manage and certain processes to balance the same. Thus, a corporation must also have a system to review the business’s financial information in its runtime. Understanding financial management is not just about balancing chequebooks it comprises the goals of financial management, which also include maximising profits, maintaining sufficient cash flow, growing shareholder wealth, and managing risks effectively. Nevertheless, to put it simply, a company that handles its funds expertly sees growth and development.

What is financial management?

Financial management encompasses the strategic organisation, planning, control, and direction of an institution’s or organisation’s financial undertakings. Furthermore, it entails the implementation of management principles onto an organisation’s financial assets and contributes significantly to fiscal management.

The goals of financial management can be broken down into these key objectives:

- Sustaining an adequate financial resource for the organisation

- Ensuring that the organisation’s shareholders receive satisfactory returns on their investments

- Effective and optimal application of funds

- Developing secure and legitimate investment opportunities

Broad areas of finance

Numerous societal segments operate financially and need money. As a result, there are three primary financial subcategories:

- Personal finance – Personal finance is the financial management for an individual or family. This entails examining the financial state and activities of that person to strategy for future demands. Personal finance techniques are frequently influenced by an individual’s income, housing needs, and financial objectives.

Personal financial management, for instance, is applicable to someone who invests and saves money throughout their work in order to prepare for retirement. Financial items such as mortgages, insurance, and credit cards can also be included in personal finance. Personal finance also includes banking, which includes checking and savings accounts as well as any mobile or internet payment services.

- Corporate finance – The financial administration of a business is known as corporate finance. Corporate finance frequently aims to minimise a business’s financial risks while maximising its profit typically, risk management and investment analysis are corporate finance’s main tasks. Trying to manage a budget and choose which projects to finance now and which to invest in later is an example of corporate finance in action.

- Public finance – The financial administration of a government body is known as public finance. It entails the social and fiscal duties of the government, which include monitoring resource allocation, economic stability, income distribution, and the sufficiency of social programs. Taxation, budgeting, spending, and other measures that influence how a government pays for the public services it offers are together referred to as public finance. Managing income taxes is one of the primary responsibilities of public finance management.

Scope of financial management

Having grasped the meaning of financial management, let’s now examine the scope in a career in finance.

Capital Structure – A capital structure is necessary to maintain a balance between various sources of resources. Companies employ a combination of stock and debt to finance their operations. This framework governs business-related financial decisions, such as the short- and long-term debt-equity ratios, and plays an important role in achieving several goals and objectives of financial management such as:

- Optimising the cost of capital

- Maximising shareholder’s wealth

Financial decision – The aspect of financial management deals with how and when the funds from current long or short-term sources should be made available, this is known as capital budgeting and is regarded as one of the goals of financial management. The finance manager is responsible for establishing a capital structure in order to maintain the organisational value, achieving this requires a proper balance between debt and equity to ensure attractive returns for stakeholders. It is important for a company to align with these factors so that the market value per share increases and can be beneficial for everyone.

Financial decisions and fundraising avenues such as stakeholders, banks, public deposits and other financial lenders inspect all the sources carefully and then choose the one with maximum profit and liability. Financial professionals also discover investment strategies and source funds for the sake of the company’s ROI. They carry out capital budgeting and ensure the safety of business, liquidity and profitability through several opportunities.

Profit Management – One of the most important duties of a financial manager is to maximise profits. A business may have both short- and long-term financial success. Financial managers have an obligation to look for ways to increase profits while lowering risks.

Working Capital Management – Working capital is measured by subtracting current assets from current liabilities; Analysing it helps firms use their current assets more efficiently, hold on to appropriate cash flow, and meet their immediate and medium-term company demands.

Efficient working capital management can directly contribute to several key goals of financial management as it can help firms access cash that remains stranded on the balance sheet. Access to capital minimises their dependency on external borrowing and helps them to develop their operation, acquire new firms and invest in technology and procedures that further boost their efficiency.

Objectives of financial management

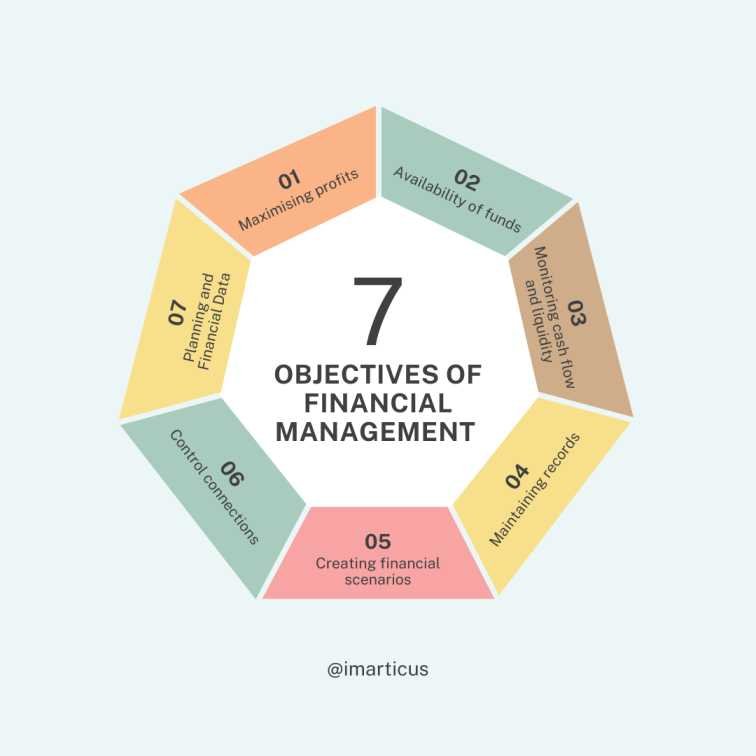

The objectives are nothing but the goals of financial management, and it is for them that we make various decisions. This indicates that the objectives of financial management are the ultimate goals of a certain form, organisation, or even individual endeavor. Therefore, it’s crucial to discuss the goals of financial management they are as follows:

- Maximising profits – Share information on factors that might cause the cost of items supplied to rise, such as growing raw material costs.

- Availability of funds – It serves as a major goal of financial management. The only way for any company organisation to succeed is via disciplined financial management. Thus, it is crucial to confirm that all funds are available and to prepare for the equitable distribution of cash from variable resources.

- Monitoring cash flow and liquidity – Make sure the business has adequate cash on hand to pay its debts

- Maintaining records – Maintaining accurate records of all financial transactions made by a business is another benefit of financial management. It is one of the clauses that ensure the best possible use of the available money and its security.

- Creating financial scenarios – These are based on projections that take a broad range of probable outcomes depending on market circumstances and the existing status of the firm.

- Control connections – interacting with boards of directors and investors in an efficient manner.

- Planning and Financial Data – Giving accurate financial information to lenders, clients, and higher authorities is another important goal of financial management. Additionally, the financial manager has to have a proper strategy in place for handling the finances, including equalisation and use, among other things.

Functions of financial management

Based on the objectives and goals of financial management some function of financial management are as follows:

Calculation of capital requirements – A finance manager must estimate the amount of capital the business will need. This will rely on anticipated expenses and earnings as well as upcoming initiatives and policies of a company.

Planning and Projecting Finances – The longer-term objective of social and non-profit organisations is the betterment of society. Still, the majority of businesses want to increase their return on investment. The company’s present financial situation and its future position are buffered by these earnings. Effective distribution of resources allows the financial management to organise and project the future of the business. It enables them to decide how to use the created earnings, whether an organisation will gain from taking the money out and buying assets or from reinvesting the profits in the business and enhancing marketing plans.

Financial Reporting – The expenses of the organisation must be closely monitored by financial management. They can show the financial status, including specifics about assets, liabilities, cash flow, and expenditures, through financial reports. Periodically, these reports are prepared to guarantee that all funds are in order.

Cash flow maintenance – You know that a good financial manager is at work when a business remains solvent. Among the duties of financial management is making sure the company has enough money on hand for wages, daily costs, and other activities.

The normative goal of financial management

Maximising shareholder wealth concept can be considered as the normative goal of financial management as it serves an important role for evaluating financial decisions. While business may also consider other factors like social responsibility and employee well being for making financial decisions.

Sharpen your management skills

Financial management is a dynamic area that is always growing. In order to be informed about the current trends and practices of financial management, go visit Imarticus Learning blogs for deep information on numerous management issues.

Financial management is a very important skill set for individuals as well as businesses. It includes a wide range of learning based on the objectives, functions and goals of financial management. If you are someone who has a keen interest and wants to enhance your financial knowledge you can enroll in Imarticus Learning Postgraduate Financial Analysis program. Seats are filling fast!

Frequently Asked Question

The basic goal of financial management is to estimate capital costs, establish a capital structure, and set strategies for the purchase and distribution of cash.

The four major financial objectives of organisations are; stability, liquidity, profitability, and efficiency.

The concept of financial management is the strategic activity of developing, controlling, and monitoring all financial resources to fulfill your corporate goals.

Financial management requires critical thinking and risk management. In addition, it is accountable for sustaining earnings and lowering expenditures.