Last Updated on 8 months ago by Imarticus Learning

Pursuing a career in risk management isn’t just about understanding numbers—it’s about preparing for the unexpected, making strategic decisions under pressure & mitigating financial threats before they spiral out of control. One of the most respected certifications in this space is the FRM® (Financial Risk Manager) designation- awarded by the Global Association of Risk Professionals (GARP). If you’re planning to appear… for the FRM exams in 2025 or exploring this credential for career advancement- it’s essential to understand the FRM course structure, exam duration, modules, and evaluation format.

This blog will walk you through the FRM course duration, FRM level 1 and 2 modules, and the FRM exam pattern, giving you a clear picture of what to expect and how to plan your preparation.

What is the FRM Certification?

The FRM certification is a globally recognised qualification for finance professionals specialising in risk assessment & control. It is ideal for those aspiring to work in…risk management, trading, asset management, auditing… or even regulatory compliance roles. Understanding the FRM certification structure is the first step toward earning this credential and unlocking career opportunities across banking, investment firms, hedge funds, & more.

To explore the course directly, you can check the FRM Certification Program by Imarticus Learning which offers a comprehensive curriculum designed for professionals and fresh graduates.

FRM Course Duration: How Long Does it Take?

One of the most common questions aspiring candidates ask is… “How long does it take to complete the FRM certification?”

Here’s a quick look:

| Component | Duration |

| FRM Part I Preparation | 4–5 months |

| FRM Part II Preparation | 4–5 months |

| Total Estimated Duration | 8–9 months (flexible) |

| Mode of Study | Live online sessions + recordings |

The FRM course duration depends on your availability and pace of learning, but most students allocate 200–240 hours for each level.

Overview of FRM Course Structure

The FRM course structure is split into two main parts:

- FRM Level 1: Focuses on tools used to assess financial risk

- FRM Level 2: Emphasises application of risk tools and deep dives into risk types and issues

Let’s break down the FRM syllabus 2025 level-wise.

FRM Level 1 and 2 Modules Explained

Understanding the FRM level 1 and 2 modules is crucial before planning your study timeline. The syllabus is comprehensive and analytical, designed to train candidates in both theory and real-world application.

🔹 FRM Level 1 Modules:

| Module | Weightage |

| Foundations of Risk Management | 20% |

| Quantitative Analysis | 20% |

| Financial Markets and Products | 30% |

| Valuation and Risk Models | 30% |

Level 1 introduces the foundational knowledge and mathematical tools used in risk assessment and financial valuation. These are essential FRM study topics that set the tone for deeper learning in Part II.

🔹 FRM Level 2 Modules:

| Module | Weightage |

| Market Risk Measurement and Management | 20% |

| Credit Risk Measurement and Management | 20% |

| Operational and Integrated Risk Management | 20% |

| Liquidity and Treasury Risk Measurement | 15% |

| Risk Management and Investment Management | 15% |

| Current Issues in Financial Markets | 10% |

The FRM level 1 and 2 modules in Part II focus heavily on application and analysis. These modules align closely with daily tasks risk professionals undertake in leading organisations.

What’s New in the FRM Syllabus 2025?

The FRM syllabus 2025 reflects global developments in risk, regulatory changes, & new tools. Some updates in the latest syllabus include:

- Greater focus on climate risk

- Broader treatment of fintech and digital banking risks

- More advanced techniques in scenario analysis and stress testing

Here’s a glance:

| Topic Area | Updates for 2025 |

| Operational Risk | Integration with enterprise risk frameworks |

| Financial Markets | Emphasis on crypto, DeFi, and ESG regulations |

| Quantitative Methods | Machine learning basics for risk modelling |

These updates make the FRM study topics more dynamic and relevant to current industry challenges.

Understanding the FRM Exam Pattern

The FRM exam pattern is structured to evaluate both theoretical knowledge and real-world application. Here’s how each part is designed:

FRM Part I:

- Format: Computer-based

- Number of Questions: 100

- Type: Multiple Choice Questions (MCQs)

- Duration: 4 hours

- Scoring: No negative marking

FRM Part II:

- Format: Computer-based

- Number of Questions: 80

- Type: Multiple Choice Questions

- Duration: 4 hours

Understanding the FRM exam pattern helps in preparing a smarter strategy for revision and mock tests. For those curious about the exam’s difficulty, this blog on how hard the FRM exam is offers valuable insights.

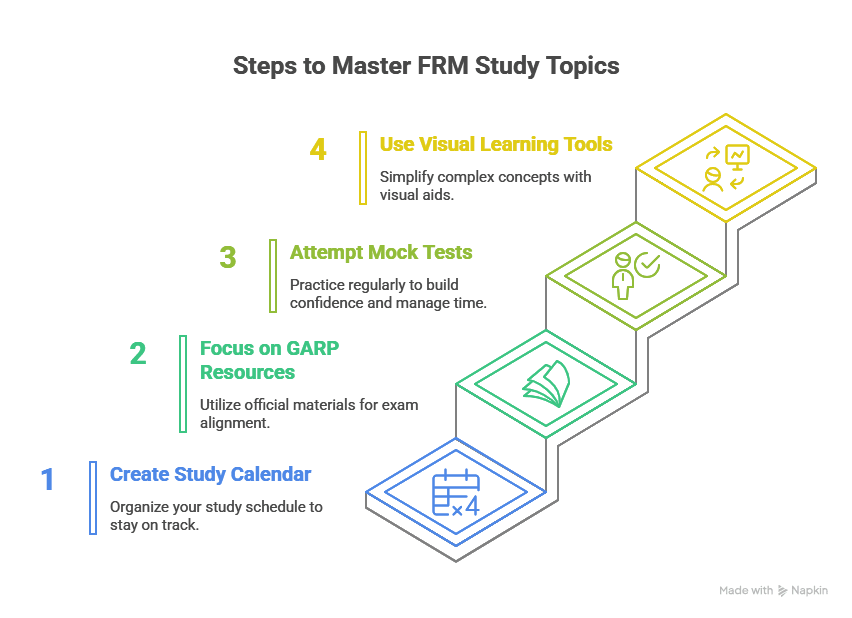

Tips to Master FRM Study Topics

Mastering the FRM study topics requires a blend of strategic planning and regular practice. Here are some preparation strategies:

| Strategy | Benefit |

| Create a study calendar | Keeps your preparation on track |

| Focus on GARP-provided resources | Aligns with the official exam framework |

| Attempt mock tests regularly | Builds exam-day confidence and time management |

| Use visual learning tools | Helps simplify complex quantitative concepts |

You can also explore this video on FRM preparation tips to get guidance from experts.

FRM Certification Structure: How It All Fits Together

Here’s a quick recap of the complete FRM certification structure:

| Stage | Details |

| Part I Exam | Tools and fundamentals |

| Part II Exam | Advanced application and case-based learning |

| Professional Experience | Two years in risk or financial analysis roles |

| Certification Awarded | Upon passing both exams and work experience |

The structured nature of the FRM course structure ensures that you’re not just exam-ready but also job-ready.

Comparing FRM with CFA: Which One Is Right for You?

For many, the decision isn’t whether to do FRM—but whether to choose FRM or CFA. Both are powerful, but they serve different career purposes. If you’re debating between the two, this FRM vs CFA comparison is a helpful guide.

Career Benefits of FRM Certification

Earning the FRM certification has a direct impact on career prospects. Recruiters across banks, consulting firms, and investment institutions value this qualification for its rigour and industry alignment.

Roles that benefit from FRM certification include:

- Risk Manager

- Credit Analyst

- Market Risk Analyst

- Treasury Professional

- Quantitative Risk Analyst

- Regulatory Risk Consultant

Institutes like Imarticus Learning’s FRM program also offer placement support, mentorship, and live industry sessions, making them a reliable partner in your career journey.

FAQs

1. What’s the FRM course duration?

Around 8–9 months… depending on how you pace it.

2. What’s new in the FRM syllabus 2025?

It now includes climate risk, fintech, and updated market topics.

3. How are FRM level 1 and 2 modules different?

Level 1 is theory-focused; Level 2 is more practical & applied.

4. What’s the FRM exam pattern like?

Both parts are 4-hour MCQ-based exams—no negative marking.

5. What are the main FRM study topics?

Risk models, valuation, markets, quant analysis—core stuff!

6. Is the Financial Risk Manager syllabus tough?

It’s detailed but doable with a solid prep plan.

7. How’s the FRM certification structure set up?

Two exams + 2 years of work = you’re certified!

8. Can I manage the FRM course duration with a job?

Yep, it’s totally flexible for working pros.

Final Thoughts

Choosing to pursue the FRM designation is a significant step- in advancing your finance career. The clear & progressive FRM course structure, paired with up-to-date modules & a practical exam format… ensures candidates are equipped for real-world challenges. Whether you’re just starting out or looking to switch roles, understanding the FRM syllabus 2025, preparing for both FRM level 1 and 2 modules, & aligning with the FRM certification structure will put you on the right path.

From the exam pattern to FRM course duration, every element is designed to train you as a well-rounded risk professional. So, plan your calendar, get the right prep resources, and take the leap toward becoming a certified Financial Risk Manager.