Last updated on October 31st, 2025 at 10:31 am

If you’re reading this, you’re probably asking one of two questions: “Is CPA worth it?” or “How soon will my CPA salary make this whole effort pay off?”

Think about it – what makes certain professionals stand out in finance? How do they gain the credibility to advise on multi-crore budgets, manage risks, or guide companies through complex audits?

This is exactly where specialised training and a CPA certification come into play. It’s what separates someone who simply crunches numbers from a professional who can lead financial strategy, influence major decisions, and command top-tier salaries.

In this blog, we’ll walk through the full map – what is the full form of CPA, real salary ranges in India according to roles and experience, city and industry premiums, how to strategically approach the fresher to leadership pay, and more.

Did you know? Median salary for a new CPA graduate with a bachelor’s degree in the US is $60,834 in 2025, marking an 11% increase over the previous AICPA survey period.

Overview of CPA

You’ve probably heard people talk about accountants, auditors, or finance managers, but not all of them have the same influence or earning potential. Some handle routine bookkeeping, while others are trusted to make strategic decisions that can shape the future of a company. And now, you might wonder who is behind these roles. Well, usually a professional with a CPA is trusted for these kinds of responsibilities.

Sounds like a buzzword, but you are not really sure what is CPA or even what is the full form of CPA. Let me break it down. The full form of CPA is Certified Public Accountant – a US professional accounting license that shows you passed the Uniform CPA Examination and met education & experience requirements.

It’s not a job title but a professional credential that opens roles in audit, tax, finance, risk, and corporate leadership. The AICPA (American Institute of CPAs) is the primary body behind the exam and resources.

What matters for salary is that employers pay for transferable skills (US GAAP/IFRS, tax, audit procedures, financial reporting), and CPAs often command higher pay in cross-border or MNC setups because they can speak both the technical accounting language and global regulatory dialects.

CPA Salary in India

Having a CPA in India can genuinely change the course of your career and open doors to higher earning potential. But it’s important to stay grounded – clearing the CPA exam doesn’t instantly make you a six-figure professional. The salaries you see are tied to the level of responsibility, expertise, and trust that companies place in a CPA. It’s a qualification that allows you to take charge of audits, taxation, financial planning, and strategic decisions that shape a business’s direction.

When you’re just starting, the pay is good – it’s enough to live comfortably and start building some savings. The real growth happens as you gain experience, choose a niche, and step into roles where your work influences major business decisions. That’s when your compensation begins to truly match the value you deliver as a finance professional.

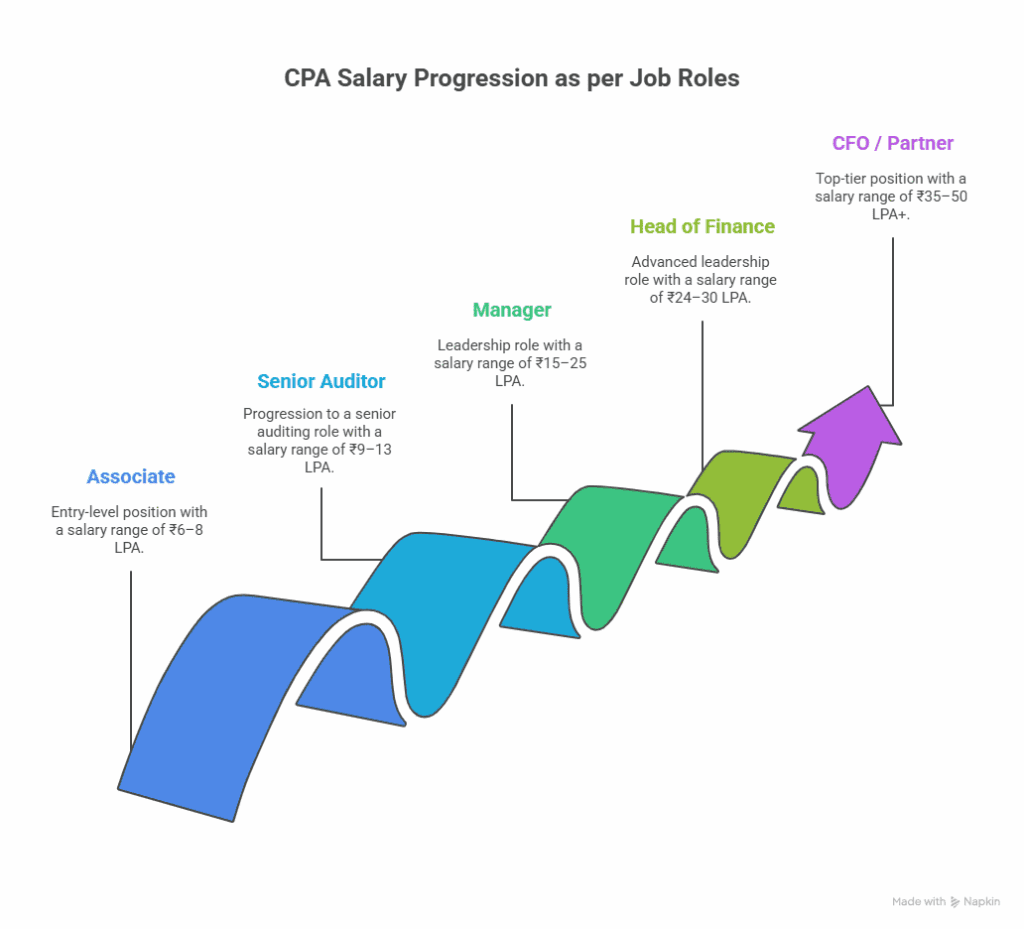

- Average annual CPA salary in India: ~₹6.7–7.2 LPA

- Monthly midpoint (gross): ~₹56,000–60,000 (Annual / 12)

- Fresher range: ₹6–8 LPA (~₹50,000–67,000/month gross)

- Senior / leadership: ₹20–30 LPA+ – CFOs/Partners in Big firms can go much higher

CPA Salary in India by Experience

If you’re looking at a CPA purely through the lens of salary, here’s the truth: it grows steadily, not suddenly. The good part? It’s a growth you can count on. The market in India rewards CPAs who stay curious, take on complex projects, and continuously adapt to changing global standards.

If you’re worried about whether the CPA pays off – it does, but in the most sustainable way possible. Not overnight, but over time, your salary becomes a reflection of the trust your qualification commands.

| Experience Level | Average Annual Salary (INR) |

| Fresher/Entry-Level (0-1 year) | ₹6-9 LPA |

| Early-Career (2-4 years) | ₹6–10 LPA (Total Compensation) |

| Mid-Career (5-10 years) | ₹15–25 LPA |

| Senior/Experienced (10+ years) | ₹24–30 LPA or more (Leadership roles often higher) |

| Big 4 Firms (Entry to Mid-Level) | ₹12–20 LPA |

| Big 4 Firms (Senior/Executive) | ₹20–50+ LPA |

(Source)

The jump between mid and senior – when you take on managerial ownership, client responsibility, or cross-border reporting – can multiply pay by 2x or more. That’s where most CPAs go from “comfortable” to “six-figure in INR” territory.

Salary growth over a CPA’s career

- New hires with master’s degrees saw starting salaries increase roughly 17% to a median $67,750 from the previous survey.

- You can make a Management jump (within 5→10 yrs): the biggest multiplier when the role expands beyond technical work.

CPA Salary by Industry

Not every CPA earns the same, and that’s because industries value accounting expertise differently. A CPA working in financial consulting or investment management often handles high-stakes decisions – so the compensation reflects that. On the other hand, those in manufacturing or public sector roles might enjoy more stability but at a steadier pay scale.

In India, the industry you choose often decides how fast your CPA qualification starts paying off. Technology, BFSI (Banking, Financial Services & Insurance), and consulting firms tend to offer the most aggressive salary growth, especially if you’re handling cross-border compliance or US GAAP reporting.

But ultimately, each sector brings something different to the table – some offer learning, some offer lifestyle, and a few offer both. The table below breaks down how CPA salaries vary across industries, so you can plan your career not just around your skills, but around where those skills are valued most.

| Industry | Average Range |

| Big-4 / Audit firms | ₹6–20 LPA (entry → manager) |

| MNC Finance / Corporate FP&A | ₹8–25 LPA |

| Consulting / Advisory | ₹10–30+ LPA |

| Tech (product firms) | ₹8–22 LPA |

| Banking / BFSI | ₹9–28 LPA |

| Public sector / NGOs | ₹4–10 LPA |

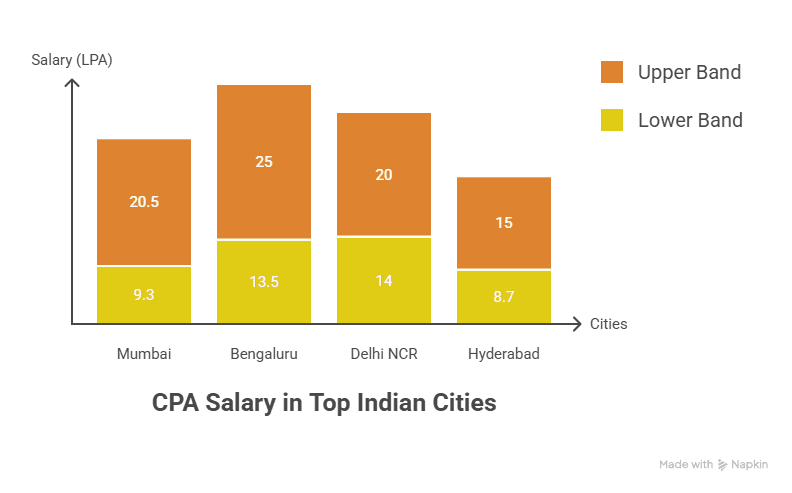

CPA Salary by Cities

Understanding how CPA salaries vary by city can help you make informed decisions about career opportunities and relocation. Here’s a snapshot of average salaries for Certified Public Accountants (CPAs) in key Indian cities:

- Mumbai: ₹9.3-20.5 LPA (Avg. ₹1,24,167 per month)

- Delhi NCR: ₹14-20 LPA (Avg. ₹1,41,667 per month)

- Bangalore: ₹13.5-25 LPA, (Avg. ₹1,60,417 per month)

- Hyderabad: ₹8.7-15 LPA, (Avg. ₹98,750 per month)

- Chennai: ₹9.5-15 LPA, (Avg. ₹1,02,083 per month)

- Kolkata: ₹3.8-12 LPA, (Avg. ₹65,833 per month)

- Ahmedabad: ₹5.5-13 LPA (Avg. ₹77,083 per month)

Consulting and MNC corporate roles generally pay more because the work requires both technical and commercial acumen; Big-4 gives a strong early-career pay and learning curve, while senior Big-4 partners and ex-partners move to CFO/Controller roles with very high pay.

Key Takeaway→ Metro cities like Mumbai and Bengaluru top the charts due to the concentration of MNCs and finance centres.

Factors Impacting CPA Salary

A CPA’s paycheck doesn’t just depend on clearing the exam; it’s shaped by where you work, what you specialise in, how much experience you’ve gathered, and even how you position yourself in the market.

Two people with the same qualifications can have completely different salary stories. One might be working at a Big 4 firm in Mumbai handling multinational audits, while another could be consulting for startups remotely from Pune – both valid, both valuable, but with very different pay scales.

Understanding these factors early helps you make smarter career choices – from the industry you enter to the city you move to, to the niche you build expertise in.

Top factors:

- Experience & Role Scope – early promotion to manager or specialist roles (tax/transfer pricing/forensic) multiplies pay faster than years alone.

Mentor tip: Seek role expansions that add client-facing responsibility or people management within 3–5 years. - Industry – consulting/big-4/MNCs pay premiums. Tech companies with finance teams also pay well for US GAAP know-how.

Mentor tip: Move laterally to BFSI or tech if you want steep salary growth. - City / Cost-of-doing-business – Mumbai, Bangalore, Delhi & Hyderabad command premiums (10–20%).

Mentor tip: If you’re remote and earning from US firms, location is secondary – skill is king. - Skill Specialisation – IFRS conversions, US GAAP, international tax, and forensic accounting attract better pay.

Mentor tip: Add a niche certificate (forensic, valuation) to your stack. - Employer Reputation (Big-4 / MNC vs domestic) – Big-4 lifts brand & learning; MNCs may pay more for control roles.

Mentor Tip: If you want global mobility or cross-border exposure, Big 4 experience makes you a plug-and-play fit for multinational teams.

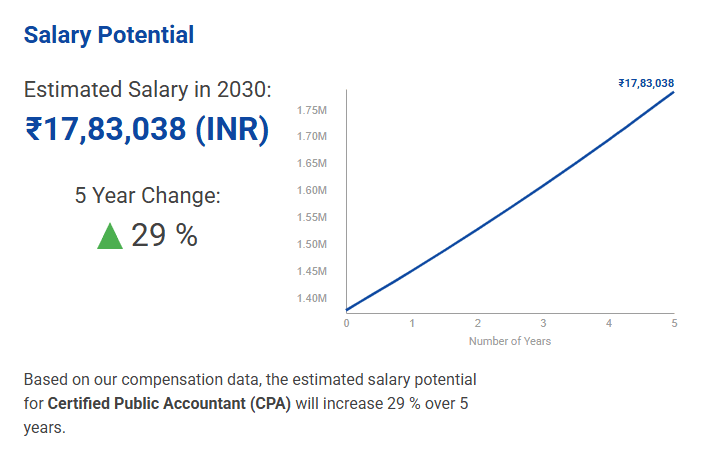

Once you understand what impacts a CPA’s earning power: experience, specialisation, and the trust you build in the market, the growth curve starts to make perfect sense. Below is a projection for the CPA Salary by 2030.

What impacts CPA salary the most?

- Specialisation (tax, IFRS, transfer pricing): +20–40% pay uplift.

- City: Mumbai/Bengaluru/Delhi pays ~10–20% more.

- Scope of Responsibilities: client-facing + managerial = faster increases.

CPA vs CMA vs CA – The Salary and ROI comparison

If you’re trying to decide between the CPA, CMA, and CA certifications, you’re not alone. A lot of people reach this stage and wonder which one will actually help them grow their careers meaningfully.

The CPA is your ticket to global opportunities. It’s respected everywhere and can get you into roles in audit, taxation, or corporate finance that pay really well.

The CMA is more about understanding the business side of numbers, like planning, budgeting, and helping companies make smart financial moves. It’s a great choice if you enjoy strategy and want to grow in corporate roles.

The CA has deep roots in India and still carries huge respect here, especially if you’re interested in audit, tax, or compliance. This comparison highlights the earning potential for each qualification, helping you make an informed career choice.

| Differentiator / Feature | CPA | CMA | CA |

| Global Recognition | ✅ | ✅ | ❌ |

| Average Global Starting Salary | ✅ | ✅ | ❌ |

| Mid-Career Salary Growth | ✅ | ✅ | ✅ |

| Top-Tier Salary Potential (10+ years) | ✅ | ✅ | ✅ |

| ROI (Cost-to-Earning Ratio) | ✅ | ✅ | ❌ |

| Duration to Qualify (Shorter) | ✅ | ✅ | ❌ |

| Recognition by MNCs & Global Firms | ✅ | ✅ | ❌ |

| Ease of Global Mobility | ✅ | ✅ | ❌ |

| Alignment with US/IFRS Standards | ✅ | ✅ | ❌ |

| Demand in Big 4 Firms | ✅ | ✅ | ✅ |

CPA Salary Comparison with CA

The comparison below breaks down how salaries differ between CPAs and CAs across experience levels and roles, helping you see where each qualification truly shines – whether your goal is stability at home or a global finance career.

| Level | CPA average | CA average | Notes |

| Entry(0–2 yrs) | 6–8 | 5–6 | CPA often edges CA at entry where US-focused roles exist. |

| Mid(5–10 yrs) | 11–14 | 9–12 | CPA shows a premium in MNC roles. |

| Senior(10+ yrs) | 20–35+ | 15–25 | CPA senior managers/CFOs often command global packages. |

The “better” path depends on your desired market: if you want early domestic accounting roles in India only, CA is excellent. If you’re targeting MNCs, US reporting, or the US job market, a CPA increases global mobility and may improve salary upside.

Key Takeaway→ CPA offers global portability and often higher pay in MNC roles; CA is excellent for India-specific tax/audit depth. Choose based on target geography & role.

CPA Salaries In India vs the USA

If you benchmark against the US, the nominal numbers differ hugely due to currency and living costs.

Headline numbers:

- US average CPA salary: ~$80k–120k+ depending on source and role.

What that means for India-based CPAs working for US firms: If you secure a remote role paid in USD, your INR salary (after conversion) can look dramatically higher – but remember taxation and benefits differ.

This video walks you through pay scales shift between India, the US, and other major markets – and what really drives those differences beyond just currency. It’s a quick, insightful watch that brings the numbers to life.

Executive CPA Salary in India and the US

When CPAs step into top executive roles, the pay gap between India and the US really starts to show – and it’s not just about the currency difference. It’s about the scale of work, the level of responsibility, and how each market values senior finance professionals.

In India, executive-level CPAs earn well above the average mid- or senior-level salary, especially if they’re working with multinational companies or global consulting firms. In the US, those same roles come with even higher compensation – not only because of the cost of living, but because these positions often shape major business and financial strategies.

The table below gives you a clearer picture of what executive CPAs typically earn in both countries. It’s not just about comparing numbers – it’s about understanding what drives those differences: experience, industry, and the size of the company you work for all play a big part in how far your CPA can take you.

| Country | Role/Experience Level | Average Annual Salary |

| India | Experienced CPAs/Senior Roles (Finance Controller, Director, CFO) | ₹20–50 LPA |

| India | Corporate Controller | ₹35–60+ LPA |

| India | Tax Director | ₹40–70+ LPA |

| India | Chief Financial Officer (CFO) | Upwards of ₹30 LPA, with top roles over ₹1 Crore+ |

| US | Experienced CPAs/Executives | $120,000 and above |

| US | Senior Manager/Director | $121,500–192,000 |

| US | Experienced (20+ years) | Average $150,000 |

Fresher CPA Salary in India and the US

Starting as a CPA, your salary reflects not just your qualification, but also the market you’re stepping into. In India, fresh CPAs earn a good starting pay that grows as they gain experience and take on bigger responsibilities. In the US, starting salaries are generally higher, thanks to the larger scale and cost of living differences.

The table below gives a quick snapshot of what is the CPA salary typically in India and the US. It’s a handy way to get a sense of what to expect as you begin your career and start planning your next steps.

| Country | Experience Level | Average Annual Salary |

| India | Fresher/Entry-Level | ₹6–8.5 LPA |

| India | Fresher/Entry-Level (Metro Cities) | Up to ₹13.8 LPA |

| US | Fresher/Entry-Level | $55,000–75,000 |

Average CPA Salary by Country

CPA salaries can be very different depending on where you are in the world. A lot of that comes down to the economy, industry demand, and the cost of living. In India, CPAs get a strong start and plenty of room to grow. But in places like the US, Canada, or Australia, salaries are usually higher, and the work often comes with more international exposure.

The table below gives you an easy snapshot of average CPA salaries by country. It’s a good way to see not just the numbers, but also the kinds of opportunities your qualification could open up for you.

| Country | Average Annual Salary |

| United States of America (USA) | $90,000–99,000 |

| Australia | $113,035 |

| Canada | $100,291 |

| India | ₹9,12,663 |

| Japan | ¥7,755,349 |

| United Arab Emirates (UAE) | AED 180,000 |

| Ireland | €50,000 |

Understanding How CPA Salary Increases Over Time

Your CPA license is the key, but how fast you unlock its full earning potential depends on the moves you make. From choosing the right industry and city to specialising in high-demand niches, small tactical decisions can multiply your pay faster than just waiting for yearly increments.

In this section, we’ll share some approaches that can help you understand how can your CPA salaries grow over time, with smarter choices that translate directly into higher compensation and career growth.

- Build a niche: Master one high-demand niche (transfer pricing, international tax, forensic). Market it on LinkedIn and include niche keywords.

- Ask for higher-responsibility projects: Volunteer for cross-border reporting or client-facing tasks – responsibility beats tenure.

- Get secondment experience: Temporary placements in MNC finance teams or overseas secondments boost pay and resume.

- Consider lateral moves: Moving companies often yield higher jumps than annual increments.

- Upskill with tech: SQL, Power BI, or automation tools increase bargaining power.

FAQs about CPA Salary

If you’ve made it this far, you probably still have a few questions buzzing in your head about CPA salary – how it grows, what affects it, and whether it’s really worth the effort. This section clears up the most common questions students and professionals ask about CPA salaries.

Who earns more, CA or CPA?

Both credentials are valuable. Generally, a CPA working in MNCs or roles requiring US GAAP/IFRS knowledge can earn a higher CPA salary in global-facing roles, whereas a CA may have stronger domestic opportunities in Indian tax and statutory audit. By seniority (10+ yrs), many CPAs who move into leadership roles or global finance positions will often see higher compensation than their CA counterparts, but individual outcomes depend on role, industry, and negotiation.

What is the highest CPA salary?

The top CPA salary varies widely. In India, senior CPAs who reach the C-suite (CFO, Finance Head, etc.) or become partners in large firms can earn ₹40–50 LPA and beyond, while global packages for senior finance executives can be higher. In the US, senior CPAs in finance leadership roles often average well into six figures (USD), and specialised roles or Big-4 partners report significantly higher pay.

Is CPA better than an MBA?

Better” depends on goals. A CPA is specialised, technical, and highly valued for accounting/audit/tax work; an MBA is generalist, leadership- and strategy-focused. If you want deep finance & reporting expertise and technical credibility, a CPA can be a higher ROI. If you want broad business leadership and a strong management network, an MBA might be the way to go. Some professionals do both to maximise skills and pay.

Am I eligible for CPA?

Your eligibility depends on the various state boards and the specific requirements (e.g. education credits, residency). Most candidates require 120–150 credit hours with accounting and business subjects. Check the AICPA/state board guidance for your exact pathway.

Is CPA a good career option?

Yes. CPAs are in global demand as the designation signals competence and opens doors in audit, tax, corporate finance, and advisory. In India, as businesses find their global footing, the demand for CPAs with international reporting skills will continue to grow.

Is CPA in demand in India?

Yes, CPA is very much in demand in India, particularly among MNCs, US-facing finance teams, consulting firms, and companies doing cross-border reporting. The demand is strongest in major finance hubs like Mumbai and Bengaluru.

Is CPA more difficult than CA?

Both are challenging but different. CA tests India-specific tax, law and audit frameworks extensively. CPA focuses on US exam content and state credentialing rules; difficulty depends on background, study approach, and exam readiness. Many Indian candidates find the CPA exam manageable with structured prep because it’s modular and exam-focused.

What is the fees of CPA course in India?

Fees usually vary: application stages like exam registration, board fees, and coaching combined fall in the range of ₹2–4 lakhs, depending on the coaching provider and your selected state board. Always check the latest fee schedules from the state board and coaching providers.

Which companies hire CPA in India?

Common employers include Big-4 firms, MNCs (Amazon, IBM, JP Morgan), tech product companies, consultancies, and banks, essentially any firm with international reporting or US filing requirements.

Your Next Steps

The true value of the CPA isn’t just in the paychecks – it’s in the kind of professional you become along the way. Salary is a milestone, not the destination. What the CPA does is refine how you think about money, business, and trust. It turns you from someone who records numbers into someone who interprets them – who helps companies make decisions that ripple through balance sheets, markets, and lives.

It’s a credential that demands discipline, but it also builds perspective. A CPA learns early that growth doesn’t come from chasing higher salaries alone, but from earning influence – the ability to walk into a boardroom and be trusted with financial truths. Some CPAs climb fast in multinational firms; others carve their niche in startups or consulting. But across every path, the thread remains the same: the ones who keep learning, keep rising.

Think of it like compounding interest – small, consistent efforts in learning, networking, and specialisation quietly multiply into exponential career returns. Your CPA license is the principal; how you invest it defines your yield.

If you’re ready to take that step – to not just earn more, but become more – the CPA Program in collaboration with KPMG in India offers the structure, mentorship, and global credibility to help you get there. With a money-back guarantee if you don’t clear your exams, live and on-demand sessions that adapt to your schedule, and projects that make you apply what you learn, it’s built for professionals who are serious about building a global finance career.

Because careers don’t just happen; they’re built with intention, skill, and the right guidance.