Table of Contents

Investment banking is one of those careers people talk about long before they truly understand it. The term sounds powerful. The lifestyle sounds intense. The roles sound prestigious. Yet when someone asks what actually happens inside an investment bank, the answers often turn vague.

That gap between perception and reality is where most confusion begins.

Some people imagine investment banking as a single job. Others assume it only involves stock markets or long hours. Many believe you either make it to the top or you do not belong there at all. None of these ideas explain how the industry really works or why Investment Banking Roles are structured the way they are.

When I explain investment banking certification to someone outside finance, I keep the language plain. Investment banking exists to solve large money problems. When a company wants to raise capital, buy another business, or restructure debt, it turns to an investment bank. That is the simplest investment banking definition.

At its core, investment banking exists because large financial decisions need structure. When money runs into hundreds or thousands of crores, intuition is not enough. Companies need valuation. Investors need confidence. Regulators need transparency. Someone has to connect all of this without letting errors slip through. That someone is not a single person. It is a system. And that system is built on clearly defined Investment Banking Roles.

This blog is built around that idea. Instead of treating investment banking as a single destination, it looks at how different roles operate inside the system. How decisions flow from one team to another. Why front office, operations, and risk exist as separate functions. And how careers grow when people understand where they fit.

Investment Banking Basics That Define Every Role

Before going deeper into Investment Banking Roles, it helps to pause and clearly understand what is investment banking is and how it functions in practice. Many people jump straight to job titles without knowing the system those roles operate in. That often leads to confusion later.

In simple terms, investment banking is a service that helps large organisations make high-value financial decisions. These decisions usually involve raising capital, restructuring ownership, or looking at financial risk management. Investment banks do not invest their own money in the way individuals do. They design, advise, and execute transactions for clients.

Imagine a popular food brand that wants to expand across India. The owners need funds. They do not want a simple loan. They want long-term investors. An investment bank studies the company. It checks revenues. It checks costs. It estimates future growth. Then it decides how much the company is worth. After that, it helps sell shares to investors through an IPO.

This is what the work of investment banking is in action. The bank does not just sell shares. It designs the entire transaction. Pricing. Timing. Marketing. Compliance. This example also explains what is meant by investment banking. It is advisory plus execution.

What Actually Comes Under Investment Banking

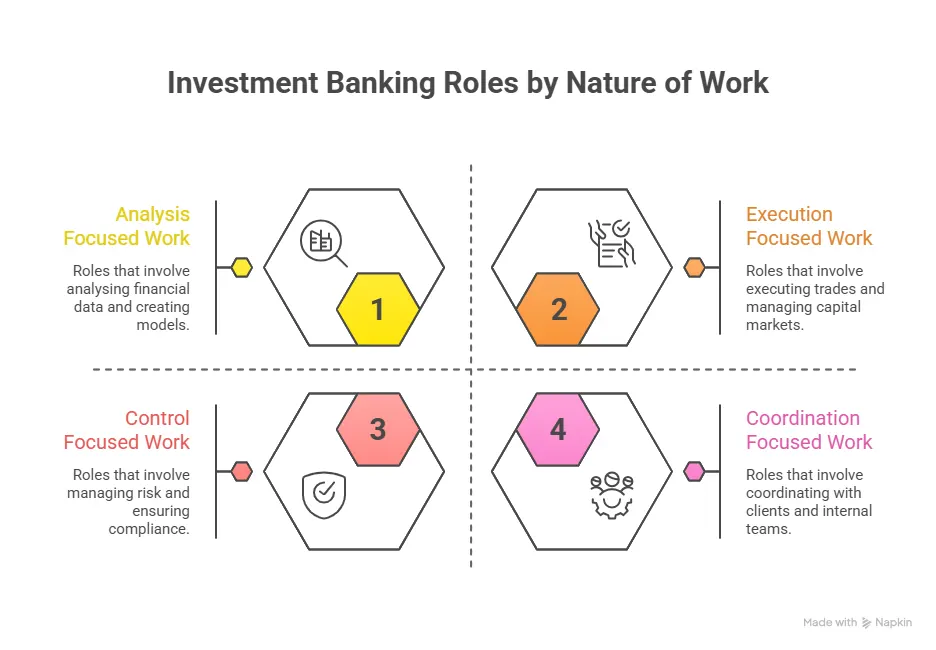

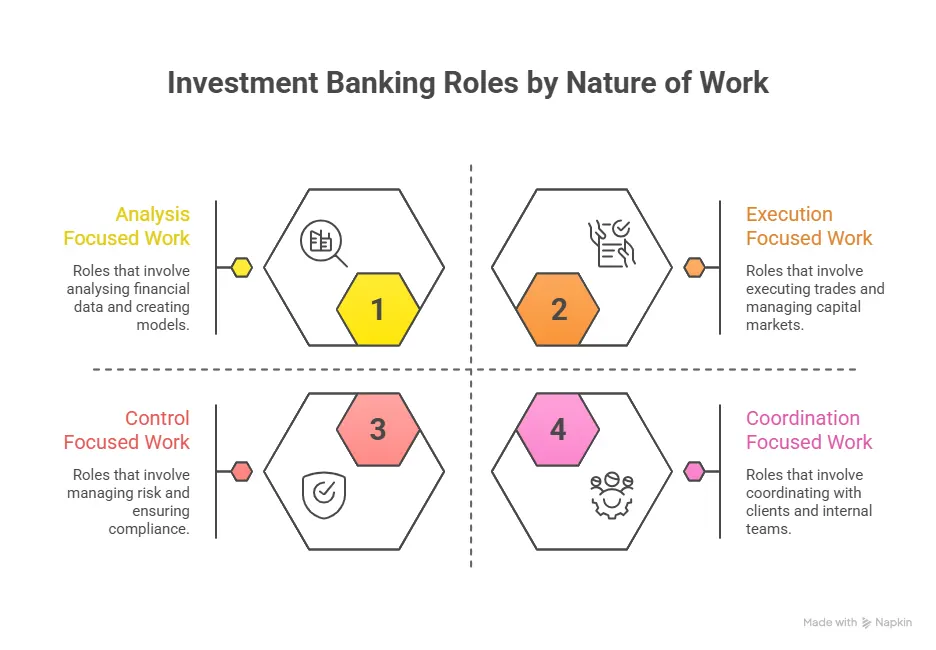

Investment banking is not a single activity. It is a combination of advisory work, execution, and control. Each part later translates into specific Investment Banking Roles.

Some common real-world situations include:

- A company issuing shares to raise funds for expansion

- A business acquiring a competitor

- A government issuing bonds to fund infrastructure

- A firm restructuring debt to reduce financial stress

Each situation needs analysis, planning, compliance, and execution. This layered structure is why investment banking creates many different roles rather than one generic job.

Core Functions of Investment Banking

The easiest way to understand investment banking is by looking at its core functions. These functions explain why roles are divided across teams.

Key functions include:

- Capital raising through equity and debt

- Advisory services for mergers and acquisitions

- Risk assessment and structuring

- Transaction execution and settlement

These functions together explain the investment banking meaning in practical terms. Every role discussed later in the blog exists to support one or more of these functions.

How Functions Translate Into Investment Banking Roles

Each function requires a different type of skill. That is where Investment Banking Roles begin to form.

| Investment Banking Function | Type of Work Involved | Roles Commonly Linked |

| Capital raising | Valuation, documentation, pricing | Analysts, associates |

| Advisory | Strategic analysis, negotiation | Senior bankers |

| Execution | Trade processing, settlement | Operations professionals |

| Risk and compliance | Monitoring, controls, reporting | Risk and compliance teams |

This structure shows why the industry offers varied entry points. Not every role involves client meetings or deal negotiations, yet each role is critical to the outcome.

The clarity around what investment banking involves often shapes how people view the profession. So, understanding what an investment banker actually does and how these roles fit into the larger financial system helps you move beyond surface-level definitions and develop a grounded view of investment banking as a career.

Also Read: Investment Banking vs.Commercial Banking: Know the Difference

Who Are Investment Bankers

People often ask who are investment bankers? Investment bankers are professionals who manage these large transactions. The investment banker’s meaning goes beyond finance theory. They work under pressure. They handle deadlines. They balance client needs with market reality.

If someone asks what an investment banker is, I explain it this way. An investment banker helps clients make high-impact financial decisions. If someone asks what an investment banker does daily, the answer depends on the role.

Junior bankers analyse data. Senior bankers advise clients. All investment bankers work as part of a team.

Who Are Investment Bankers: Roles by Position

| Position in the Firm | Primary Focus | What They Do Day to Day | Nature of Work |

| Investment Banking Analyst | Execution and analysis | Build financial models, analyse data, prepare presentations, and support deal teams | Data-heavy and detail-driven |

| Investment Banking Associate | Review and coordination | Review analyst work, manage timelines, interact with clients, support deal execution | Mix of analysis and coordination |

| Vice President | Deal management | Oversee transactions, manage teams, and ensure deliverables meet client expectations | Execution focused with leadership |

| Director / Senior Banker | Strategy and relationships | Guide deal structure, support negotiations, and maintain client relationships | Strategic and client-facing |

| Managing Director | Revenue and origination | Source deals, advise senior clients, and drive business growth | Relationship and outcome driven |

‘Who are investment bankers?’ also depends on their position within the firm. Each position plays a specific role.

Also Read: What is Investment Banking and What Investment Bankers Do

Investment Banking Roles and Responsibilities

Investment banking roles follow a clear structure. Each role supports the deal process. Think of it like building a house. Some people design. Some people construct. Some people inspect.

Investment banking roles and responsibilities usually include:

- Researching companies and industries

- Building financial models

- Preparing client presentations

- Supporting deal execution

- Managing client communication

These tasks together define the investment banking work profile.

Investment Banker Positions Explained Simply

Investment banker positions are organised by seniority.

- Analyst

- Associate

- Vice President

- Director

- Managing Director

Each role has distinct investment banker roles and responsibilities.

Analysts focus on execution. Associates manage workflow. Vice Presidents oversee delivery. Directors and Managing Directors focus on strategy and relationships.

This structure supports smooth work in investment banking.

Front Office Roles in Investment Banking

Front office roles in investment banking deal directly with clients and transactions. These roles generate revenue for the firm.

Front office roles include analysts and associates who work on mergers & acquisitions, and capital raising.

The analyst role in investment banking is usually the entry point. The investment banking analyst role involves building models, creating presentations, and analysing financial data.

An investment banking associate reviews an analyst’s work. Associates also coordinate with clients and internal teams.

These roles form the core of investment banking roles at the execution level.

Investment Banking Analyst Work Profile

The investment banking analyst’s work profile is demanding. Analysts work long hours. They focus on accuracy.

Typical tasks include:

- Financial statement analysis

- Valuation using standard models

- Industry research

- Pitch book preparation

This explains what investment bankers do at the junior level.

Investment Analyst and Investment Banking Analyst

Many people confuse an investment analyst with an investment banking analyst. An investment analyst studies securities to generate returns. They may work in asset management or research. An investment banking analyst focuses on transactions. Deals. Advisory work. Both roles exist within investment banking and financial services, but their objectives differ.

Investment Banking Fundamentals That Shape Roles

Investment banking fundamentals guide every role. These fundamentals include:

- Accounting principles

- Corporate finance concepts

- Valuation methods

- Risk assessment

- Market dynamics

Without these fundamentals, investment banking work becomes mechanical. Strong fundamentals allow bankers to think clearly under pressure.

Understanding the roles and functions within investment banking brings structure to a field that often appears complex from the outside. When responsibilities are seen in context and connected to real outcomes, the industry becomes easier to navigate, and career choices become more informed.

Also Read: How BCom Graduates Can Secure a Job in Investment Banking?

Investment Banking Operations and Why They Matter

When people picture investment banking roles, they often imagine deal rooms and client calls. Yet a large part of investment banking work happens quietly in the background. Investment banking operations ensure that every deal completed on paper actually settles in reality.

Think of it like online shopping. You place an order. Payment goes through. The product arrives. If any step fails, the experience breaks. Investment banking operations work the same way. Trades must be confirmed. Cash must move. Securities must settle.

This explains what the work of investment banking beyond advisory is. Investment banking operations connect systems, people, and rules. These roles protect accuracy and trust.

Investment Banking Operations Professional Work Profile

An investment banking operations professional focuses on control and precision. Their role begins once a deal is executed by the front office.

Common responsibilities include:

- Trade confirmation and validation

- Settlement processing

- Reconciliation of accounts

- Regulatory reporting

This investment banking work profile suits people who enjoy structured processes. The work is detailed. Errors are not tolerated. Each task supports the larger investment banking meaning and functions.

Certified Investment Banking Operations Professional

Many professionals formalise their skills through certification. An investment banking operations professional understands the full trade lifecycle.

This certification supports roles in settlements, compliance, and post-trade operations. It is popular among finance roles for freshers who want stable entry points into investment banking roles. These roles offer predictable growth and strong domain depth.

The Certified Investment Banking Operations Professional program offered by Imarticus Learning is designed around how investment banking operations actually function inside banks. The curriculum focuses on the complete trade lifecycle, clearing and settlements, control checks, and regulatory workflows that operations teams handle daily. This structured exposure helps learners step into investment banking roles with clarity on processes and systems, making the transition into operations, post-trade, and control functions smoother and more sustainable over time.

Also Read: Investment Banking Course Fees vs ROI: Is It Worth It?

Did You Know?

The global merger and acquisition deal value crossed 3 trillion dollars in 2023. This scale explains why investment banking roles attract attention worldwide.

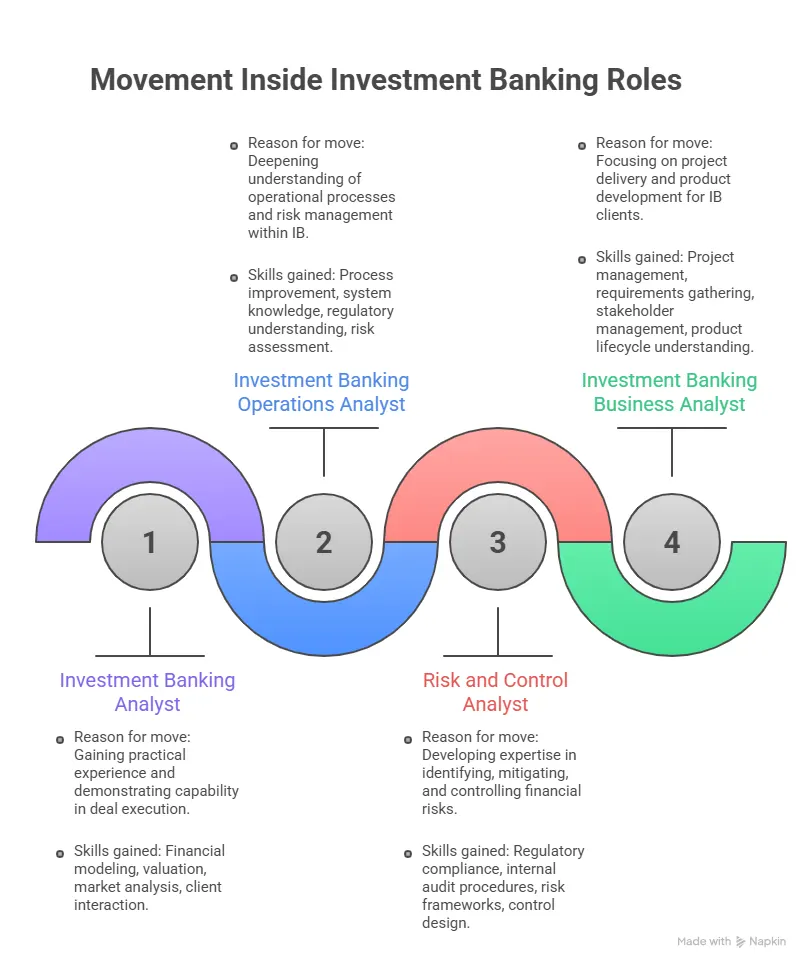

Investment Banking Risk Management Roles

Investment banking risk management focuses on one question. What can go wrong? Markets move fast. Prices change. Clients default. Systems fail. Risk teams identify these threats early. Investment banking risk management includes:

- Market risk analysis

- Credit risk assessment

- Operational risk control

These roles work closely with investment banking operations. They protect the firm and clients. This work explains what is meant by investment banking at an institutional level.

Certified Banking Compliance Professional

Rules shape finance. Compliance ensures that rules are followed. A certified banking compliance professional works on regulatory checks. They ensure that transactions follow laws. They review processes. They monitor reporting. Compliance roles support the functions of investment banking by reducing legal and reputational risk.

Investment Banking Business Analyst Role

The investment banking business analyst acts as a bridge. They connect technology with finance. Banks use complex systems. Business analysts study workflows. They improve efficiency. They reduce errors. This role suits people who enjoy logic and systems thinking. It plays a growing role in modern investment banking operations.

Commerce Investment Banker and Accounting-Driven Roles

A commerce investment banker brings strong accounting knowledge. Balance sheets. Cash flows. Tax rules.

The role of a chartered accountant in investment banking is well established. CAs work in valuation, due diligence, and transaction advisory.

Their expertise supports accurate pricing and clean execution. This strengthens investment banker roles and responsibilities across teams.

Also Read: The Skills That Separate Top Investment Bankers from the Rest

Certifications That Support Investment Banking Roles

Certifications help align skills with roles. Some widely used certifications include:

- Chartered Investment Banking Analyst

- Certified Investment Management Analyst

- Certified Banking Compliance Professional

Each certification supports a different segment of investment banking roles. Some focus on advisory. Some focus on operations. Some focus on compliance.

Choosing the right certification depends on the type of work in investment banking you prefer.

Certifications That Support Investment Banking Roles

| Certification | Primary Focus Area | Investment Banking Roles It Supports | Type of Work It Aligns With |

| Certified Investment Banking Operations Professional (CIBOP) | Trade lifecycle, clearing and settlements, control processes, risk checks | Investment banking operations professional, operations analyst, post-trade support roles | Execution, control, process, and compliance |

| Chartered Investment Banking Analyst (CIBA) | Investment banking fundamentals, valuation, and deal processes | Investment banking analyst, associate, advisory support roles | Analysis and deal execution |

| Certified Investment Management Analyst (CIMA) | Investment analysis, portfolio construction, asset allocation | Investment analyst, research roles supporting investment banking | Market analysis and investment evaluation |

| Certified Banking Compliance Professional | Regulatory frameworks, compliance, governance | Compliance analyst, control roles within investment banking | Control and regulatory oversight |

| Chartered Financial Analyst (CFA) | Corporate finance, valuation, and financial analysis | Advisory roles, research support, and senior analytical roles | Deep financial analysis and decision support |

| Financial Risk Manager (FRM) | Market risk, credit risk, operational risk | Investment banking risk management roles | Risk identification and mitigation |

| Chartered Accountant (CA) / Certified Public Accountant (CPA) | Accounting, audit, and financial reporting | Valuation, due diligence, transaction advisory roles | Financial accuracy and reporting |

Also Read: CIBOP Course Benefits For Your Investment Banking Career

Finance Role for Freshers in Investment Banking

Finance role for freshers often begins outside front office roles. This is common and practical. Entry-level investment banking careers include:

- Investment banking operations analyst

- Risk analyst

- Business analyst

- Compliance analyst

These roles build strong foundations. They expose freshers to real transactions. Over time, professionals can move across investment banking roles based on performance and interest.

To Become an Investment Banker Step by Step

To become an investment banker, clarity matters.

→ Start with fundamentals. Accounting. Finance. Valuation.

→ Choose a role aligned with strengths. Advisory. Operations. Risk.

→ Build experience. Projects. Live exposure.

This gradual path supports sustainable work in investment banking.

Investment Banking and Financial Services Ecosystem

Investment banking does not exist alone. It operates within investment banking and financial services. Asset management. Wealth management. Corporate banking. All interact with investment banking teams. This ecosystem explains why investment banking roles require coordination and communication.

Also Read: How to Break into Investment Banking: A Step-By-Step Guide for Students

Did You Know? Over 70% of global banking fines relate to operational and compliance failures. This data shows why operations and risk roles matter deeply in investment banking.

Investment Banker Positions and Career Progression

Investment banker positions follow a clear ladder. Each step changes how time is spent. Early roles focus on execution. Senior roles focus on judgment.

The usual progression moves from analyst to associate. Then to the vice president. Then to the director. Finally, to the managing director. This structure supports long term work in investment banking.

As responsibility grows, the investment banking work profile shifts. Analysts work with data. Associates manage flow. Vice presidents manage delivery. Directors and managing directors guide strategy.

This evolution keeps investment banking roles balanced across skill levels.

What to do in Investment Banking at the Early Career Stage

People often ask what to do in investment banking during the first few years. The answer is simple. Learn the process. Understand the product. Build accuracy. Early years focus on discipline. Precision. Speed. These habits shape long-term success in investment banking roles.

What to do for Investment Banker Aspirants at Mid-Career

Mid-career choices matter. Professionals often refine direction at this stage. Some move deeper into advisory. Some shift to investment banking operations leadership. Some move into risk or compliance.

Programs from Imarticus Learning help professionals reskill for specific investment banking roles without breaking career continuity.

What is the Work of an Investment Banker at Senior Levels

Senior professionals define outcomes. They speak with founders. They guide boards. They shape deal terms. At this stage, what an investment banker does changes daily. Meetings replace spreadsheets. Strategy replaces execution. Relationships matter.

This explains what the work of an investment banker is beyond numbers. It is decision-making under uncertainty.

Also Read: Investment Banker: The Modern Roadmap from Classroom to Wall Street

Salary Outcomes in Investment Banking Roles

Compensation in investment banking roles is structured around responsibility, risk ownership, and contribution to revenue. Pay is not random or uniform across titles. It follows a layered system that balances fixed stability with performance-driven rewards.

At every level, investment banking salary in India reflects two questions. How critical is the role to the deal process? How much accountability does the role carry when outcomes change?

Core Structure of Pay in Investment Banking

Investment banking roles typically follow a two-part compensation model.

- Fixed salary that provides income stability

- Variable bonus that reflects performance, deal activity, and firm results

| Investment Banking Role | Typical Salary Range (India) | Notes |

| Operations Analyst | ₹4-8 LPA | Entry-level operations support roles in investment banking operations. |

| Investment Banking Analyst | ₹6-14 LPA | Entry-level front office role for freshers with exposure to financial modelling and research. |

| Associate | ₹15-30 LPA | Mid-level role managing analysts and supporting deal execution. |

| Vice President (VP) | ₹25-45 LPA | Senior execution role with significant responsibilities across deals. |

| Director / Senior VP | ₹40-70 LPA | High-level client management and strategic transaction roles. |

| Managing Director (MD) | ₹1 Cr + | Top leadership role with major revenue and client responsibility. |

(Source: Glassdoor)

How Operations and Control Roles Are Paid

Investment banking operations, risk, and compliance roles follow a more stable structure. Key traits include:

- Higher fixed to variable ratio

- Bonuses tied to firm performance rather than individual deals

- Predictable income growth over time

These roles trade upside for consistency and lower volatility.

What Actually Drives Salary Growth

Across all investment banking salary ranges, pay growth depends on:

- Increased responsibility

- Exposure to complex transactions

- Ability to manage risk and people

- Trust from seniors and clients

Titles matter, but accountability matters more.

Breaking into investment banking roles often feels unclear until the pieces come together. Understanding how hiring decisions are made, what firms actually look for, and how preparation translates into opportunity can change the way candidates approach the process.

Also Read: Who Earns More: Chartered Accountant or Investment Banker?

Why Choose Imarticus Learning for Your Investment Banking Operations Certification

Investment Banking roles demand more than surface-level knowledge of finance. They require a clear understanding of how transactions move through systems, how risk is controlled, and how accuracy is maintained at scale. For learners who want structured exposure to this side of the industry, specialised training in investment banking operations provides a practical entry point.

The Investment Banking Course by Imarticus Learning are designed around real workflows inside banks, helping aspirants align their skills with how Investment Banking Roles actually function on the ground:

- Industry-Recognised Certification: You earn the Certified Investment Banking Operations Professional (CIBOP) credential that is respected within the financial services domain and designed specifically for careers in investment banking operations, treasury, and clearing services.

- Hands-On Practical Training: The program uses interactive teaching methods, case studies, and real-world projects that mirror the work done by operations and risk teams in live investment banks.

- Flexible Learning Options: You can complete the program in either a compact 3-month full-time or a 6-month part-time mode, fitting both early professionals and students with schedules.

- Interview Assurance Support: CIBOP includes guaranteed interview opportunities with multiple top hiring firms, which improves your chances of landing your first role in investment banking operations.

- Strong Placement Outcomes: The program reports high placement rates and support for securing roles at leading global firms, with alumni working across major investment banks and financial institutions.

- Alignment with In-Demand Skills: The curriculum builds skills that employers actively seek, including securities operations, compliance, risk management, and trade life cycle mastery.

- Extensive Industry Network: You gain exposure to 1,000+ hiring partners and an active community of learners and alumni who work across global finance roles.

- Suitable for Finance Freshers: The program is tailored for graduates and early professionals with 0-3 years of experience, making your transition into investment banking roles more structured.

- Proven Track Record: With tens of thousands of learners trained over the years, the program has built a legacy of shaping careers in investment banking operations.

FAQs on Investment Banking Roles

As clarity around Investment Banking roles builds, doubts naturally move from definitions to real-world outcomes. Here are a few frequently asked questions that address how these roles function in practice, helping you connect understanding with realistic career decisions.

What are the 4 main areas of investment banking?

The four main areas within Investment Banking Roles include advisory, capital markets, operations, and risk. Investment Banking Roles in advisory focus on mergers and fundraising. Capital markets roles manage issuance and distribution. Operations roles ensure settlement and accuracy. Risk roles protect capital and reputation.

What positions are there in investment banking?

Investment Banking Roles include analyst, associate, vice president, director, managing director, and operations professionals. Investment Banking roles also include compliance, risk management, and business analyst positions that support transactions.

Who earns more, a CA or an Investment Banker?

Earnings depend on role and seniority. Investment Banking Roles at senior advisory levels often earn more due to bonuses. Chartered accountants in Investment Banking Roles earn strong pay in valuation and advisory. Many professionals get into an investment banking course from Imarticus Learning to align skills with top finance roles in this field.

What is the main role of the investment bank?

The main role of the investment bank within Investment Banking Roles is capital raising and advisory. Investment Banking Roles help companies raise funds, manage acquisitions, and structure financial decisions that support growth.

What skills are needed for investment banking?

Investment Banking Roles require financial analysis, attention to detail, communication, and time management. Investment Banking Roles also demand resilience and ethical judgment in high-pressure environments.

What is the Investment Banking salary?

Investment Banking roles in India offer strong salary growth as experience and deal exposure increase. Entry-level analysts typically earn around ₹6-10 LPA, with opportunities to rise to ₹10-18 LPA within a few years and beyond that to ₹18 – 30 LPA or more as responsibilities increase. Mid-level roles such as associates and vice presidents often see total compensation in the range of ₹25 – 60 LPA or higher, while senior leaders and managing directors can earn ₹60 LPA – ₹1 Crore+. The Investment Banking course with Imarticus Learning can help candidates build the skills that support entry and growth within these pay ranges.

What is the lowest position in investment banking?

The lowest position in Investment Banking Roles is usually an analyst or an operations analyst. These Investment Banking Roles build core skills and expose professionals to live transactions.

What are the 4 branches of investment banking?

The four branches within Investment Banking Roles include advisory, capital markets, operations, and risk management. Each branch supports stability and execution across the investment banking system.

Building a Clear Path Through Investment Banking Roles

Investment banking roles are not built around a single path. They exist across advisory, execution, operations, and risk. Some roles demand speed and constant client interaction. Others demand accuracy and process control. Each role supports the same goal. Helping large financial decisions move from idea to outcome.

Understanding investment banking roles early changes how careers unfold. It helps students choose roles that fit their strengths. It helps professionals avoid random moves. It also brings clarity to what daily work actually looks like inside banks.

Many people enter investment banking through operations and control functions. These roles offer structured exposure to real transactions. They build confidence with systems, regulations, and risk. Over time, this exposure opens doors across multiple investment banking roles.

For students who prefer clarity, process, and strong foundations, formal training in investment banking operations can create that entry point. The Investment Banking Course offered by Imarticus Learning are designed around how banks actually work. They focus on live processes rather than theory alone. That practical grounding often becomes the difference between understanding investment banking roles and working inside them.

The investment banking world rewards preparation. When skills align with roles, careers move with direction instead of chance.