Firefighting is expensive and machine learning tools are helping in analyses of forest fires to predict and prevent future disasters, here is everything you need to know on Machine Learning.

Every year destructive wildfire destroys many forests across the globe. With climate change and global warming, there is a growing concern amongst scientists and world leaders regarding how to combat natural calamities. In the U.S. alone millions of dollars are poured into disaster management and rehabilitation.

There is significant research being conducted in the space of wildfire disaster management and one of the biggest investments in technology is towards artificial intelligence and machine learning. Risk modelers such as Egecat, RMS, AIR is not developing fully fledged versions of the probable places which have a high vulnerability to wildfire and what factors influence the activity. Several factors such as climate change, weather conditions, and region create a conducive environment for a forest fire to break out.

These can be assessed by artificial intelligence tools. Machines are inherently well-versed when it comes to picking up information quickly and this is known as machine learning. It can analyze a richer dataset than traditional forecasting systems, thereby helping researchers make informed decisions quickly. Once a high-risk scenario is detected, drones can be commissioned to ensuing fires. This leads to effective utilization of resources such as firefighters, water and medication thereby helping the government protect their citizens.

Due to this rapid growth in ability, machine learning can help in urban planning and revolutionize disaster management and resource planning.

Here are the top ways a machine learning course is helping governments and organizations combat wildfire.

Aiding Rescue

One of the most important things when it comes to any natural disaster is rescue and rehabilitation. Time is of the essence during this crucial time. Finding survivors by using artificial intelligence tools which skim through social media data is a key development. Another component in machine learning is the ability to process historical data and deliver better disaster response management abilities i.e. using the limited resources in the best way possible.

Predictability of Wildfires

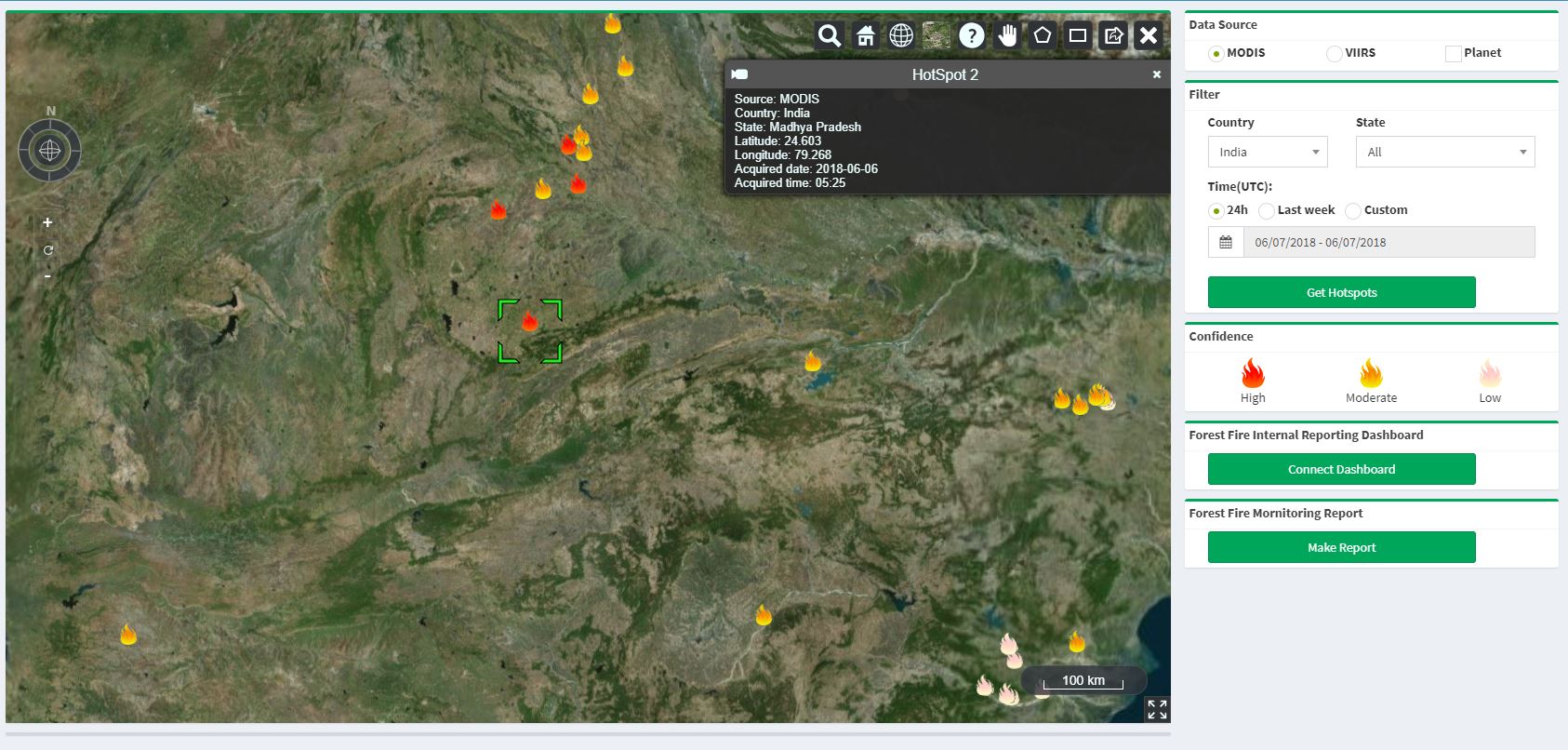

Machines can analyze vast amounts of historical and real-time data to get an understanding of the likely places where wildfires will hit. There are also able to determine the factors that influence the magnitude of the fire. These possible predictions can help researchers prepare ahead of time and help mitigate the damage.

Insurance Risk Assessment

There is a massive potential for machine learning to grow in the insurance industry when it comes to assessment and allocation. Real-time data processed by machines can be used in complement with prediction tools to help understand the risks and allocate resources better, thereby cutting down on the losses. Insurers can align their interest in disaster resilience, safety and urban development in partnership with the government due to machine learning.

Conclusion

When forest fires are detected early using machine learning, it can help firefighters deal with blazes, help in recovery and prevention.