Last updated on November 5th, 2025 at 03:52 pm

Chasing the CPA certification? You’re not just adding letters after your name – you’re stepping into a world where your financial expertise drives smarter decisions and defines leadership.

But before you dive in, one question probably stands out – What is the CPA eligibility, and am I qualified to apply? If that’s what you’re wondering, you’re not alone – every CPA journey begins exactly there.

Becoming a Certified Public Accountant (CPA) means positioning yourself as a trusted global finance leader – someone who doesn’t just crunch numbers but shapes business strategy and advises top organisations. For anyone serious about rising in the finance world, ready to go global, the CPA is a badge of credibility and mastery. It sets you apart, opens global opportunities, and changes not just where you work but how you work.

This guide simplifies everything you need to know:

What education do you need?

How does your work experience count?

The step-by-step application process

And how Indian students and professionals can meet the CPA eligibility requirements smoothly.

🎫Think of CPA eligibility as your boarding pass. It tells that you’re qualified to take the CPA exam without unexpected hurdles.

What is CPA?

If you’ve ever wondered what is CPA and what it truly means to be a Certified Public Accountant. You can think of it as an elite designation of global finance professionals trusted to keep businesses financially sound and strategically sharp.

The CPA certification is awarded and governed by the American Institute of Certified Public Accountants (AICPA). It is considered the gold standard in accounting and finance. It’s not just another certification – it’s proof that you understand the language of business at the highest level.

As a CPA, you’re not limited to audit and tax roles. You’re a strategic advisor, helping organisations make smarter financial decisions, ensure compliance, and plan for long-term growth. From global firms like Deloitte and EY to Fortune 500 companies, CPAs are at the heart of every major financial conversation.

In simple terms, if you’re someone who loves numbers but wants to go beyond them – to influence business outcomes, shape financial policies, and lead teams across borders – the CPA course is your passport to a global accounting career.

CPA Eligibility Requirements: Your Golden Ticket to Certification

Before you begin with your CPA journey, it’s important to know what CPA eligibility really means. Simply put, it’s the set of educational and professional requirements you need to meet before you can sit for the CPA exam or earn your license.

Think of it as your starting checklist – ensuring you have the right academic foundation, relevant work experience, and necessary documentation before you leap.

While the exact CPA eligibility criteria can vary depending on the state board you apply through, the essentials remain the same everywhere:

- Education: A recognised bachelor’s degree in accounting, finance, or a related field

- Credit Hours: A certain number of credit hours (usually 150) in accounting and business subjects

- Experience: And in some cases, a few years of verified professional experience under a licensed CPA.

Meeting these CPA qualifications is your first step toward unlocking worldwide opportunities in finance.

Why Work Experience Matters?

Think of it like learning to drive. You can read the traffic rules and watch “how to drive” videos all day – that’s your theory. The instructor is right there beside you – guiding your hands on the wheel, helping you understand what to do in real situations, pointing out where you can improve, and building your confidence one drive at a time. Only after that real practice can you go and take the driving test to earn your license.

The CPA works the same way. You don’t just study and pass exams – you need real, hands-on work experience under a licensed CPA. This ensures you’re not just good at theory, but confident in handling real financial decisions in the workplace.

A Quick Analogy for Credit Hours

Think of the CPA credit hour requirement like training for a marathon. Your bachelor’s degree has already given you that solid foundation – just like being reasonably fit before you start serious training. But to be fully race-ready, you need some focused preparation. In this case, it means taking a few extra accounting and business courses.

Just like those last training runs help you cross the finish line, those additional credits make sure you’re fully prepared and eligible to take the CPA exam.

Core CPA Eligibility Criteria: A Detailed Look

Here’s a quick look at the core eligibility requirements most CPA candidates must meet:

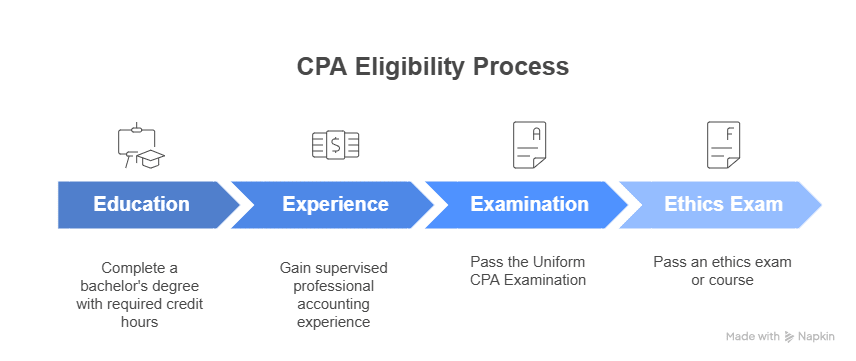

Education

- You’ll typically need 150 semester hours of education. This is usually around a bachelor’s degree plus additional coursework.

- Most candidates meet this through a B.Com + M.Com, B.Com + MBA, or a CA/CMA qualification from India.

- Your degree should include 24-30 semester hours of accounting and business-related subjects.

Experience

- Some U.S. states also require 1-2 years of supervised professional experience under a licensed CPA.

- This ensures you have real-world accounting exposure alongside academic knowledge in areas like public accounting, government, or industry, involving financial analysis, auditing, tax, or management accounting.

Examination

All candidates must clear the Uniform CPA Examination, which consists of four sections:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

- Discipline Section: This is a choice-based specialisation, allowing you to focus on your career path – Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), or Tax Compliance and Planning (TCP).

Ethics Exam (in select states)

A few jurisdictions also require an ethics exam or course to confirm your understanding of professional integrity and ethical practice.

US CPA Eligibility for Indian Students: What You Need to Know

Coming from India, you have some unique considerations, but rest assured, thousands of Indian candidates are in the same boat – and they’re sailing through just fine.

Here’s what usually happens for Indian students pursuing CPA:

- Degree Equivalence: Your Indian degree – be it B.Com, MBA, CA, or CMA – can meet the educational requirements. However, depending on the U.S. state, you might need to add extra credit hours through coursework or certifications to reach the 150-semester-hour mark. Many Indian students pursue a Master of Commerce (M.Com) or a Chartered Accountancy (CA) qualification to fulfil this.

- Credential Evaluation: You’ll need to get your academic credentials evaluated by an authorised agency (e.g., NASBA International Evaluation Services, WES) to verify their equivalence to U.S. standards. This step is routine and supported by most states to which Indian candidates apply.

- Examination Centres in India: Great news: you can take the CPA exams right here in India at approved testing centres (such as Prometric Centres). No need for an expensive trip abroad, unless you want to!

- Experience for Licensure: For licensing, you’ll need relevant experience – usually one to two years – under the supervision of a licensed CPA. This experience can be tracked alongside your studies or even after passing your exams, often from India.

📍Flexible Exam Centres:

Picture booking a movie ticket at your local theatre instead of having to travel to another city. CPA exams can be taken at approved centres in India, so you don’t have to fly halfway across the world – making the whole eligibility and exam process much more convenient.

Step-by-Step CPA Application Explained

Getting started is often the hardest part, so here’s a simple checklist you can follow for your CPA application process:

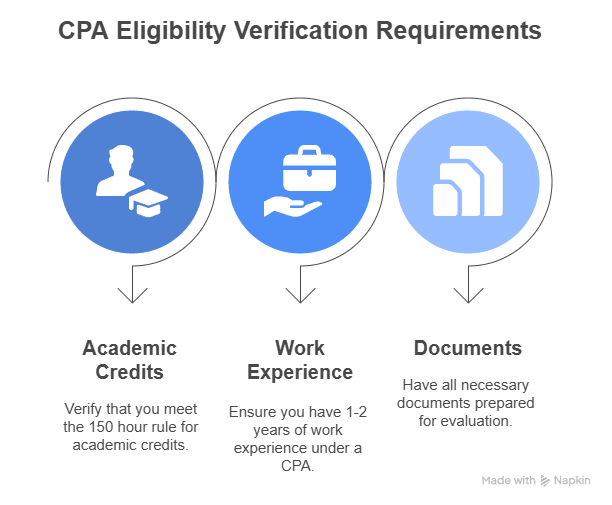

- Verify Your Eligibility – Check if your education background and experience align with your target state’s requirements.

- Submit Your Application – Apply through the state board and submit your academic transcripts and credential evaluations.

- Get your Authorisation to Test – Once approved, you’ll receive an Authorisation to Test (ATT) so you can schedule exams.

- Prepare for and pass the Exams – Pass all four exam parts within 18 months with the use of study guides, coaching, and practice tests.

- Complete Required Experience – Fulfil your supervised work experience as per state requirements.

- Apply for the CPA License – After exams and experience, apply for licensure and start your global career as a CPA.

This process looks daunting on paper, but breaking it down like this reveals it’s totally doable.

Note– Missing or misinterpreting even one requirement can delay your progress significantly – something no one wants after putting in hours of hard work and exam preparation.

CPA Exam Pattern & Modules 2025: What to Expect

Let’s talk about the CPA exam- and no, it’s not a daunting test. It is a well-designed challenge that really puts your skills to work in scenarios you’ll face in the real world. After all, the CPA isn’t about memorising endless rules; it’s about proving you know how to apply them when the stakes are high.

CPA 2025 Exam Structure

The CPA 2025 exam structure tests how well you can apply accounting and business concepts in real-world scenarios – not just how much you can memorise.

| Category | Details |

| Exam Format (2025) | 3 Core sections (mandatory for all) + 1 Discipline section (choose based on your career path). |

| Exam Duration | Each section lasts 4 hours, giving you enough time to showcase your knowledge and judgment. |

| Passing Score | You need a minimum score of 75 on each section. |

| Exam Window | You must pass all four sections within an 18-month rolling period. |

| Question Types | Multiple-Choice Questions (MCQs) and Task-Based Simulations (TBSs) that mimic real-world scenarios. |

For a comprehensive guide on the most challenging CPA exam section and strategies to conquer it, explore this detailed blog post on the hardest CPA exam section.

The CPA Exam modules are listed below:

| Section | Focus Area | What It Covers |

| Auditing and Attestation (AUD) | Auditing, Risk & Ethics | Audit procedures, Reviewing Financial Records, Assessing Risks, Ensuring Internal Controls are strong, and Professional Ethics. |

| Financial Accounting and Reporting (FAR) | Financial Reporting | Preparing and Interpreting Financial Statements under frameworks like US GAAP and IFRS. |

| Regulation (REG) | Taxation & Compliance | Tax Laws, Business Regulations, and Professional Ethics. |

| Discipline Section | Specialisation | Business Analysis and Reporting (BAR): Financial reporting, analysis, and technical accounting. Information Systems and Controls (ISC): IT governance, security, and internal controls. Tax Compliance and Planning (TCP): Advanced tax planning and compliance. |

What’s interesting is that the exam blends traditional multiple-choice questions with task-based simulations. These simulations throw real-life scenarios your way – you’ll be analysing data, making calls, and writing up communications just like you would on the job.

If you’re serious about laying a strong foundation for your accounting career, this blog can help you ace your CPA exam preparation and achieve career readiness in just 12-18 months.

Why Getting CPA Eligibility Right Matters

When you earn your CPA license, it isn’t just a career milestone; it is a transformation. You won’t be seen as someone who knows only accounting; you will be a trusted financial advisor whose insights drive growth and shape strategy.

If you’re serious about making the CPA certification your next big career milestone, understanding your eligibility isn’t just a formality – it’s absolutely critical. Getting this step right up front sets the entire stage for your success and ensures your CPA journey is smooth and focused.

So take a moment. Verify your academic credits. Check your work experience records. Get those documents in order. Because this isn’t just preparation – it’s your first smart move toward a career where you’re recognised not just for what you know, but for the impact you create.

Discover the earning potential of a US CPA in India and abroad, as this video reveals the top career paths, salaries, and global opportunities available to CPA-qualified professionals.

CPA Eligibility vs CA, ACCA & CFA – Quick Comparison

Choosing the right professional qualification starts with understanding who can apply. Here’s a quick eligibility comparison for top global certifications:

| Criteria | CPA (US) | CA (India) | ACCA | CFA |

| Minimum Qualification | ✅ Bachelor’s Degree | ✅ 10+2 | ✅ 10+2 | ✅ Bachelor’s / Final Year |

| Commerce Background Needed | ❌ | ✅ Useful | ❌ | ❌ |

| Extra Credit Requirement | ✅ 150 Credits (Bridge Possible) | ❌ | ❌ | ❌ |

| Work Experience Before Exam | ❌ | ❌ | ❌ | ✅ Required for Charter |

| Global Recognition | ✅ Very High | ❌ Limited | ✅ Good | ✅ High |

CPA stands out because its eligibility is straightforward, globally recognised, and flexible for both students and working professionals.

Is CPA worth it?

Absolutely – and not just on paper. But beyond the numbers and requirements, what truly matters is how the CPA can change your career journey in real life.

As a B.Com graduate in India, who always dreamed of working in a global finance environment but felt unsure where to begin. Once you have learned all that was needed with a few additional accounting credits, a credential evaluation, and the right guidance, the path suddenly becomes much clearer.

You can work as an Audit Associate at a leading Big Four firm. The CPA doesn’t just upgrade your qualification – it expands your opportunities, confidence, and career direction.

Why Choose Imarticus for Your CPA Journey

I’ve seen how daunting this whole process can be, and that’s where Imarticus Learning steps in. They don’t just teach CPA content; they guide you through eligibility, application, and exam preparation with care and expertise. Join Imarticus Learning’s CPA program to fast-track your journey with:

- Expert instructors who know the CPA rules inside and out.

- Flexible study options that suit your pace.

- Tailored support for Indian students navigating the US CPA system.

- High-quality study materials with premium access and mock exams to build confidence.

If you’re unsure where to start, guided coaching can make the process clearer.

Imarticus Learning helps learners understand eligibility, complete evaluations, prepare for exams, and build confidence with mentor-led support.

Key Takeaways

✅CPA eligibility means meeting education (bachelor’s + credits), experience (1-2 years supervised), and exam requirements specific to your jurisdiction.

✅Indian degrees such as B.Com, M.Com, MBA Finance, CA, or CMA can fulfil educational criteria, but be ready for variations state-by-state.

✅CPA is accessible with the right guidance and preparation, even if you’re not a CA or don’t have an accounting background.

✅With focused effort, clearing the CPA in 1 year is achievable.

Discover how you can transition from CPA to CFO with expert guidance, real-world learning, and the essential leadership skills to excel at the top of your finance career.

FAQs on CPA Eligibility

If you’re thinking about the CPA eligibility, you probably might have a few more questions buzzing in your head. Here are a few frequently asked questions to clear things up about CPA eligibility.

Who is eligible for CPA?

Anyone with a recognised bachelor’s degree (or equivalent) with around 120-150 semester credit hours in accounting and business-related subjects is eligible for CPA. Most US states also expect 1-2 years of professional experience under a licensed CPA before granting your license.

If you’ve done a B.Com, M.Com, MBA (Finance), or hold professional qualifications like CA or CMA, you’re already on the right track – though the exact requirements vary by state.

Can I do CPA directly after 12th?

Not yet – you can’t jump into the CPA right after Class 12. You’ll first need to complete your bachelor’s degree with the required accounting credits.

Some states may allow you to sit for the exam in your final year, but you must finish your degree before applying for the license.

Is CPA harder than CA?

CPA and CA have different focuses and difficulty levels; CA is intensive in Indian tax laws, audit, and accounting, renowned for its low pass rates. CPA is rigorous with a global outlook, emphasising U.S. GAAP, auditing, and regulations, but is often seen as more accessible with structured preparation. Which is “harder” depends on your background and exam preparation approach.

Can I become a CPA without being a CA?

Absolutely! You don’t need to be a CA to become a CPA. As long as you meet the education, exam, and experience criteria set by your state board, you’re eligible – no prior certification required. Imarticus Learning guides students through the evaluation and state selection process so you can choose the right state board based on your educational background.

What is the minimum educational requirement to be eligible for the CPA exam in the US?

Most U.S. states require candidates to have 150 semester hours of education. This typically means a bachelor’s degree (around 120 hours) plus an additional 30 semester hours of coursework in accounting and business-related subjects.

Can Indian students take the CPA exam?

Yes, Indian students are eligible to take the CPA exam. They must meet the educational requirements – usually 150 semester hours, which is often achieved through a combination of Indian degrees like B.Com + M.Com, B.Com + CA, or B.Com + MBA and have their academic credentials evaluated by an authorised agency for U.S. equivalency.

Is an M.Com or CA qualification sufficient for CPA eligibility?

Yes, B.Com + M.Com, B.Com + CA, or B.Com + MBA typically help meet the 150-hour requirement.

However, it’s smart to get your credits pre-checked. Imarticus Learning helps you assess whether your degree combination meets the credit hour and subject-specific criteria for your target CPA state board.

Your CPA Eligibility: The First Step Toward Global Success

Getting your CPA eligibility sorted is more than just a requirement – it’s your entry pass to a global finance career. The CPA isn’t just about knowing numbers. It’s the ability to think like a leader, making strategic decisions, and becoming the professional companies trust at the highest level.

And the best part?

With the right guidance, the journey is absolutely achievable. You don’t require a commerce background or years of experience to begin your CPA certification journey. Take that first small step with clarity, a simple plan, and confidence.

So take a moment – check where you stand, see what’s required, and start at your own pace.

You’re closer than you think. Your future as a globally recognised CPA is waiting.