Last updated on October 31st, 2025 at 10:30 am

If you landed here, you’re probably at a crossroads in your finance career – wondering whether the CMA (Certified Management Accountant) credential is your next big leap. Becoming a CMA isn’t a fancy title for your resume. It’s a career move that makes companies see you as a strategic partner, not someone who balances books.

The CMA Certification is more than a mere credential; it is a gateway to global opportunities, greater strategic influence, and the ability to add real value to any organisation. But understanding CMA eligibility is the first critical step. Like many, you might have assumed the process would be complex. The truth is, CMA was designed for dedicated, diverse professionals who want to make an impact.

So if you’re curious to know about the CMA eligibility, let’s break down exactly what it takes to begin your journey.

Picture a company reviewing its budget for the next quarter. Managers look at the numbers and see costs and revenues. A CMA, however, pinpoints inefficiencies, models various scenarios, and recommends decisions that maximise profitability while controlling risk. This is the CMA difference: using advanced management accounting and financial strategy skills to optimise performance and drive sustainable growth.

CMA Eligibility Criteria

To apply for the CMA course, you need to tick a few boxes. The process isn’t mysterious, but it’s worth mapping out before you dive in. Here’s what every candidate must meet:

| CMA Requirement | Details |

| Minimum Education | Bachelor’s degree (any discipline) |

| Professional Experience | 2 years in management accounting or financial management (can be completed within 7 years of passing exams) |

| CMA Age Limit | No upper age restriction; minimum age is 18+ |

| Exam Structure | Two-part exam (Financial Planning & Strategic Financial Management) |

| Membership Requirement | Must be a member of the Institute of Management Accountants (IMA) |

Think of these as non-negotiables – the baseline to prove you can handle the depth demanded by global employers.

Watch this expert guide on preparing for CMA exams:

CMA Educational Requirements

The biggest CMA eligibility filter is your degree. I have seen students stressing about whether their undergrad major would fit. Good news: As long as you have a bachelor’s from an accredited institution, you’re in.

The field? Flexible. Whether you studied accounting, economics, finance, or even business administration, you qualify. Got a degree that’s not in traditional “finance”? Don’t worry. Many CMAs come from diverse academic backgrounds – I’ve met engineers, marketers, and science graduates who went on to clear the CMA.

If you’re still pursuing your degree, there’s a smart catch: You can sit for the CMA exam before graduating. However, you’ll need to finish your degree within 7 years of passing both parts. This helps you get a head start while you wrap up college.

If your degree’s from a non-accredited institution, expect some additional paperwork & verification from IMA – it’s their way of ensuring fairness and global standards.

Did You Know?

According to the IMA, 69% of CMAs say the certification significantly helped their professional growth, and CMAs earn on average 21% more than their non-certified peers, highlighting the tangible career and financial benefits of the credential.

CMA Qualification Requirements: Work Experience Criteria

Once you’ve got your degree or are finishing it, the next big piece of the CMA puzzle is hands-on experience. The CMA is not about what you know – it’s about what you can do with it.

Here’s where credibility gets built. The CMA requires two years of full-time work experience in management accounting or financial management. If you read that and panicked about job titles, breathe easy: the IMA is open about what counts.

Approved Work Profiles

- Financial Analyst: Prepares financial reports, budgets, and forecasts.

- Cost Accountant: Manages cost structure and financial planning.

- Risk Manager: Identifies and mitigates financial risk.

- Treasurer: Manages corporate liquidity and financial planning.

- CFO or Finance Manager: Leads financial strategy and decision-making.

Learn more about the benefits of CMA certification in this blog: Is the CMA Certification Worth It?

Pro tip: Don’t underestimate part-time or internship roles. If your responsibilities fit in and you can prove impact, IMA may count it.

CMA Age Criteria

I’ve heard many aspirants talk about-

Can I pursue CMA after graduation?

Who is eligible for CMA?

Is there any age limit for CMA?

Let’s bust a common myth: there’s no upper age limit for the CMA. You need to be at least 18 to enrol. If you’re a recent graduate or a seasoned professional wanting to pivot, the CMA is open to you.

I’ve seen candidates switch career tracks in their 30s and 40s, achieving promotions and international roles after earning their CMA. It’s refreshing to know you’re never “too old” to jump in – and experience outside finance can be a bonus.

If you are wondering if the US CMA is worth it, here’s a video that explains the career potential of the CMA.

India CMA vs US CMA: Eligibility Comparison

If you’re a finance professional thinking about your next big career move, you’ve probably wondered whether to go for India CMA or the US CMA. Both certifications offer unique benefits and career paths.

This table shows how the India CMA and US CMA compare on eligibility, helping you choose the one that matches your goals.

| Aspect | India CMA | US CMA |

| Can start after 12th grade | ✔️ | ❌ |

| Bachelor’s degree requirement | ❌ | ✔️ |

| Prior professional experience required | ❌ | ✔️ |

| Age flexibility | ✔️ | ✔️ |

| Multi-level exam (more than 2 parts) | ✔️ | ❌ |

| Widely recognised globally | ❌ | ✔️ |

| Focus on cost control & Indian regulations. | ✔️ | ❌ |

| Fast completion (1-2 years) | ❌ | ✔️ |

| Membership Required | ✔️ | ✔️ |

Can Indian CMA Holders Pursue the US CMA?

If you’re already an India CMA, you’re probably curious about how it affects your chances of pursuing the US CMA. The good news? It can actually work in your favour.

- Academically, holding an Indian CMA typically means you have completed a bachelor’s degree recognised by the Institute of Management Accountants (IMA), satisfying the US CMA’s degree requirement.

- You will still need to register as an IMA member and fulfil their membership criteria for the US CMA program.

- The US CMA requires two years of relevant work experience, which can be completed before, during, or up to seven years after passing the exams. This is similar but somewhat stricter than the Indian CMA’s practical training requirements.

- Having an India CMA won’t exempt you from the US CMA exams, but it gives you a solid head start. Think of it as a springboard – perfect for taking your career global, with the US CMA recognised across North America, Europe, and the Middle East.

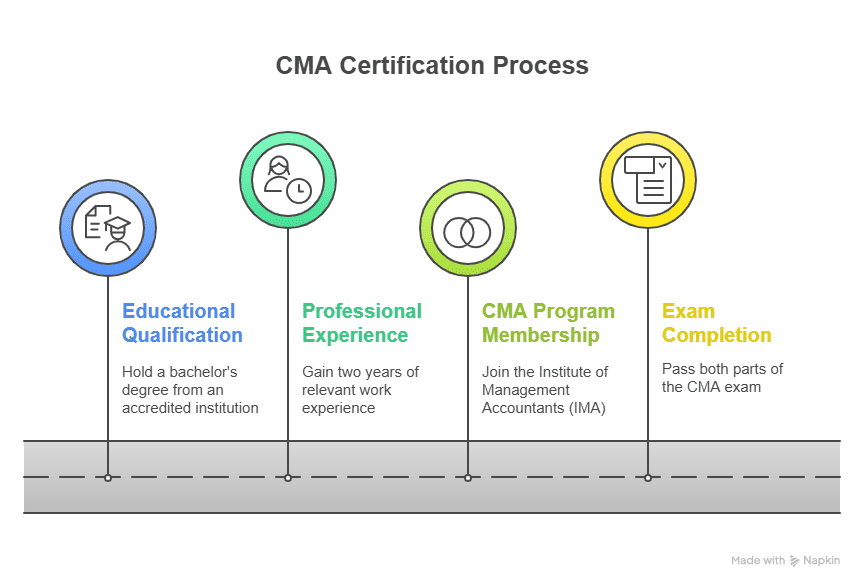

CMA Course Eligibility: Steps to Enrol

So, you’ve met the eligibility criteria. What next? Here’s the step-by-step map to becoming a CMA:

- Register for IMA Membership: No IMA membership, no CMA. You must get registered with IMA.

- Meet the Educational Requirement: Hold (or pursue) your bachelor’s degree.

- Fulfil Work Experience Criteria: Two years in management accounting or financial management (completed within 7 years of passing exams).

- Prepare for the CMA Exam: Leverage coaching programs for content, practice, and mentorship.

- Schedule & Pass Both Exam Parts: Successfully clear Part 1 & Part 2 for certification approval.

FAQs

Here are some frequently asked questions about CMA eligibility.

Is CMA easier than CA?

Great question, and one I asked myself too. The CA (Chartered Accountant) exams in India have a low pass rate (around 13-18%), whereas the US CMA global pass rate runs closer to 45-50%. The CMA focuses intensely on management accounting & strategic finance. With smart preparation strategies, the CMA is generally seen as more accessible, though demanding in its own domain.

Can I do CMA after 12th?

You can start CMA exam preparation after 12th, but you will need to earn a bachelor’s degree in any discipline to register and complete your certification. Many candidates start preparing in college and sit for the CMA soon after graduating.

What are the CMA course fees?

Fees vary by coaching institute, location, and extra resources. Expect CMA exam-related costs (IMA fees, exam fees, membership) in addition to any tuition investment. It’s smart to budget between ₹75,000-1,25,000 for IMA fees plus any coaching support.

Can I do CMA without a degree?

No, it is mandatory to hold a bachelor’s degree to pursue the CMA certification. You can attempt the exams before graduation, but you’ll need to finish your degree within 7 years of passing both parts.

Can I do CMA without an accounting background?

Yes, the CMA values analytical and strategic finance skills more than educational background. Your major doesn’t have to be accounting, business, or economics; even engineering backgrounds work.

Is there a CMA age limit?

No, there is no upper age limit for CMA. You need to be at least 17 years of age while registering for the Indian CMA Foundation. To be a member of IMA US, you need to be at least 18 years of age.

What are the CMA course eligibility requirements for work experience?

To meet the CMA course eligibility criteria, you need two years of professional experience in management accounting or financial management. You can complete this requirement before or well within seven years after passing the exam.

What are the CMA exam prerequisites?

The CMA exam prerequisites include passing two exams (Financial Planning & Performance + Strategic Financial Management), completing the required work experience & maintaining an active IMA membership.

How long does it take to complete the CMA certification?

On average, candidates complete the CMA course eligibility requirements in 6-8 months, but honestly speaking, the timeline depends on individual preparation, exam schedules, & work experience completion.

Key Takeaways: CMA at a Glance

🔹 Global Recognition – 100+ countries

🔹 Duration – 6 to 12 months (avg.)

🔹 Pass Rate – ~45-50% worldwide

🔹 Avg. Salary Uplift – 58% higher than non-CMAs (IMA Global Survey)

🔹 Exam Parts – 2 (Financial Planning & Strategic Financial Management)

Your Path to CMA Certification

Over the past decade in finance, the most dramatic career transformations I’ve witnessed weren’t from “routine accountants.” They were people who saw numbers as strategy, not just the past reports, and the CMA was often the difference between the two. The CMA Certification is more than a credential. It’s a mindset, a community, and a toolkit for those who want to influence how businesses work and grow.

If you’re ready to see your numbers translate into real decisions, pursue promotion, or work with global teams, this is your launchpad. The CMA will push you, teach you, and if you’re willing to invest, even open doors you didn’t expect.

You’ve now got the full map of CMA eligibility, right from education to exams to experience. The next step is action. Whether you’re a student mapping your career or a working professional seeking a global edge, CMA is your gateway to leadership in finance. Start by checking your eligibility boxes today. Join Imarticus, enrol in the US CMA in collaboration with KPMG in India, and begin your CMA journey. The sooner you start, the faster you’ll lead.