In the evolving landscape of finance and risk management, the FRM Certification has gained a strong reputation for its depth, credibility, & global recognition. If you’re someone aiming for a successful career in risk management or finance… understanding the nuances of this credential can be your stepping stone to a thriving future. In this comprehensive guide, we break down everything you need to know about the- FRM Certification in 2025—from course details to exam structure, eligibility criteria, & the promising career path it opens up.

What is FRM Certification?

The Financial Risk Manager (FRM) Certification is a globally recognised credential offered by- the Global Association of Risk Professionals (GARP). It equips professionals with the knowledge & skills needed to assess & manage risk in financial institutions. Whether…you’re looking to deepen your understanding of credit risk, market risk, operational risk, or investment management, this certification can be your gateway.

FRM holders are regarded as experts in financial risk analysis and are often preferred by top employers including investment banks, asset management firms, hedge funds, and regulatory agencies.

FRM Course Details 2025

The FRM course details 2025 have been structured to reflect the current and evolving challenges in financial risk management. The course is divided into two parts:

| Part | Focus Area | Key Topics |

| Part I | Tools to assess financial risk | Foundations of Risk Management, Quantitative Analysis, Financial Markets and Products, Valuation and Risk Models |

| Part II | Application of risk management tools | Market Risk, Credit Risk, Operational and Integrated Risk Management, Liquidity and Treasury Risk, Risk Management in Investment Management |

Each part is a standalone exam & must be passed sequentially. However… candidates have the flexibility to study at their own pace.

For more in-depth guidance, you can explore our FRM Certification Course designed in collaboration with industry experts.

FRM Exam Structure

The FRM exam structure is designed to test a candidate’s analytical ability and practical application of risk management concepts. Here’s a snapshot:

| Exam Part | Duration | No. of Questions | Format |

| Part I | 4 hours | 100 | Multiple Choice |

| Part II | 4 hours | 80 | Multiple Choice |

Both exams are paper-based & are typically held in May and November each year. Candidates must pass Part I to be eligible for Part II.

If you’re wondering about the difficulty level, check out this blog on How Hard is the FRM Exam to get honest insights from exam takers and experts.

FRM Syllabus and Subjects

The FRM syllabus and subjects are updated regularly to reflect the latest trends & practices in risk management. As of 2025, the syllabus includes:

Part I Subjects:

- Foundations of Risk Management

- Quantitative Analysis

- Financial Markets and Products

- Valuation and Risk Models

Part II Subjects:

- Market Risk Measurement and Management

- Credit Risk Measurement and Management

- Operational and Integrated Risk Management

- Liquidity and Treasury Risk

- Risk Management and Investment Management

- Current Issues in Financial Markets

Each subject carries different weightage in the exam, & a thorough understanding is crucial for success.

FRM Eligibility Criteria

One of the reasons- why the FRM Certification is accessible is its straightforward eligibility requirements. Here’s what you need to know:

| Requirement | Details |

| Education | No minimum educational requirement |

| Experience | Two years of relevant work experience required post-certification |

| Exams | Pass both Part I and Part II |

You can appear for the Part I exam without any prior work experience, making it an attractive option for students and entry-level professionals. Learn more about eligibility and the step-by-step process in our detailed FRM Certification Course.

FRM Certification Benefits

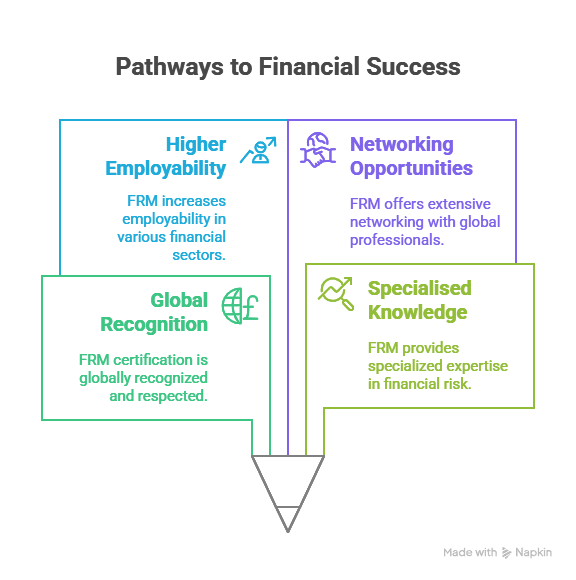

Pursuing an FRM Certification comes with a host of advantages that make it a wise investment for finance professionals:

- Global Recognition: It is accepted in over 190 countries and recognised by top-tier financial institutions.

- Specialised Knowledge: It equips you with focused expertise in financial risk, unlike broader finance certifications.

- Higher Employability: Opens doors to roles in risk management, asset management, investment banking, and more.

- Networking Opportunities: Connect with a global community of over 60,000 certified FRMs.

If you’re comparing certifications, this article on FRM vs CFA will help you understand which credential aligns better with your career goals.

Career After FRM Certification

The career after FRM certification can be both lucrative and intellectually fulfilling. Here are some popular roles that FRM-certified professionals often land:

| Job Title | Industry | Average Salary (INR) |

| Risk Analyst | Banking/Insurance | 8-12 LPA |

| Credit Risk Manager | Corporate Finance | 10-18 LPA |

| Market Risk Specialist | Investment Banking | 12-20 LPA |

| Operational Risk Consultant | Consulting | 9-15 LPA |

These roles are not only high-paying but also provide a platform for global mobility and long-term growth.

Financial Risk Manager Course: A Smart Choice

A well-structured Financial Risk Manager course can significantly boost your chances of clearing the exams and applying your knowledge effectively. Opt for courses that include:

- Live online classes with expert instructors

- Case studies and practical projects

- Access to mock tests and question banks

- Career support and job assistance

Imarticus Learning offers a comprehensive FRM Certification Course that ticks all these boxes. It’s tailored for aspiring risk professionals and combines academic rigour with real-world applications.

Is FRM Certification Right for You?

The FRM Certification is more than just a credential…it’s a testament to your capability in managing complex financial risks. From the updated FRM course details 2025 and dynamic FRM exam structure to the comprehensive FRM syllabus and subjects… this certification is designed to produce world-class risk professionals.

To hear directly from successful candidates… watch this video about the FRM experience that provides candid feedback on preparation strategies and job outcomes.

FAQs

1. What are the FRM course details 2025?

The 2025 course includes two parts covering risk foundations, quantitative tools, and advanced risk applications.

2. What is the FRM exam structure like?

It has two parts: Part I with 100 MCQs & Part II with 80 MCQs, each lasting 4 hours.

3. What topics are covered in the FRM syllabus and subjects?

Topics include market risk, credit risk, operational risk, valuation, & current financial issues.

4. Who meets the FRM eligibility criteria?

Anyone can take the exam, but two years of relevant work experience are required for certification.

5. What are the FRM certification benefits?

Global recognition, higher salary potential, and demand across top finance firms.

6. What’s the career after FRM certification like?

You can work as a risk analyst, market risk manager, or credit risk specialist in global firms.

7. Which roles can I get after completing the Financial Risk Manager course?

Roles include risk consultant, treasury analyst, and operational risk associate.

8. Is there a difference in FRM course details 2025 vs earlier years?

Yes, 2025 includes updated topics and more focus on real-world risk scenarios.

Conclusion

The FRM Certification is more than just a credential—it’s a testament to your capability in managing complex financial risks. From the updated FRM course details 2025 and dynamic FRM exam structure to the comprehensive FRM syllabus and subjects, this certification is designed to produce world-class risk professionals.

With clear FRM eligibility criteria, a broad range of FRM certification benefits, and a rewarding career after FRM certification, it’s a compelling choice for finance professionals looking to future-proof their careers. Whether you opt for self-study or join a structured Financial Risk Manager course…your journey to becoming a certified FRM can begin today.

Ready to take the next step? Explore the FRM Certification Course by Imarticus Learning and start building your future in financial risk management.