Last updated on October 31st, 2025 at 04:04 pm

Introduction

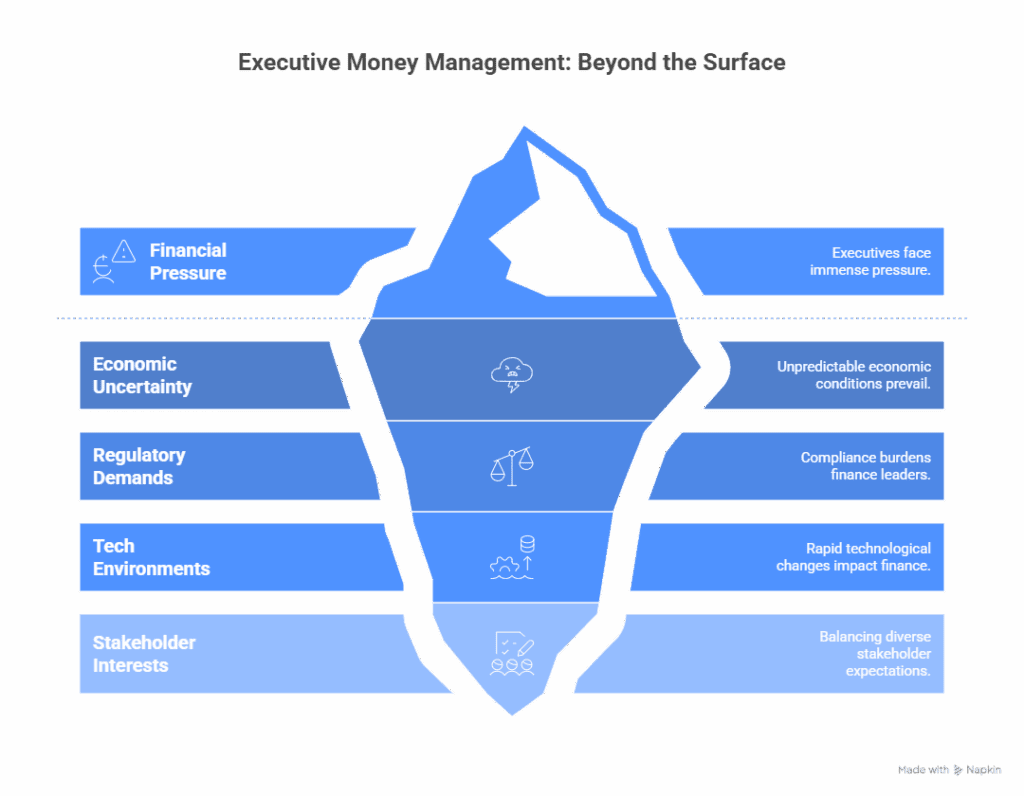

Let’s be realistic — money management at the executive level is not merely about keeping an Excel sheet under control. It involves making strategic choices in real-time, reconciling the interests of stakeholders, and predicting outcomes under extremely volatile conditions. Whether you are a CFO for a multinational or a business leader managing more than one department, pressure to make correct financial choices is humongous.

In the current corporate environment, finance leaders are confronted with a war zone of economic uncertainty, regulatory demands, and changing tech environments. As stakes are greater, so is the requirement for sound leadership financial competencies and advanced decision-making. Let’s dive in-depth into the most urgent money-connected challenges that executives currently face, and how an Executive Finance Program can be a game-changer.

Executive Finance Challenges in a Fast-Moving Economy

As economies leap back and forth at light speed, executives have to respond with the same speed. What was effective in the boardroom last quarter may already be yesterday’s news.

Financial executives tend to be running after real-time information. They are under pressure to make high-value choices without always having the luxury of having all the information. The pressure of ensuring business continuity while adjusting financial strategies to emerging regulation, digital transformations, and evolving customer behaviors is great.

Key Executive Finance Challenges Include

- Balancing short-term liquidity and long-term objectives

- Managing market uncertainty and inflation threats

- Adjusting internal financial policies to conform to new compliance standards

- Harmonizing ESG (Environmental, Social, Governance) thinking with decision-making

McKinsey Report: Just 11% of finance chiefs consider themselves ready for abrupt macroeconomic shocks.

Corporate Budgeting Challenges and Sophisticated Financial Choices

Corporate budgeting is more than just doling out money — it’s about putting the right priorities in place according to company strategy. Budgeting is too often a game of tug-of-war between departments, deadlines, and executive vision.

Executives often struggle with implementing agile budgeting systems. Conventional methods just aren’t flexible enough to react to the latest trends or crises. In addition, budget planning can be an overly time-consuming administrative process that constrains bandwidth for more strategic decision-making.

Common Corporate Budgeting Challenges:

- Slow approval cycles

- Static annual planning models

- Disconnection between budget and actual-time performance data

- No cross-functional transparency

| Budgeting Challenge | Description |

| Delayed Approvals | Multiple stakeholders slowing down budget sanctioning |

| Static Planning | Inflexibility to adapt to new priorities mid-cycle |

| Forecast Mismatch | Disconnect between projected and actuals |

| Transparency Gaps | Siloed information creates inaccurate allocations |

Strategic Financial Planning in Volatile Markets

Strategic budgeting takes foresight over the long term, but how do you make plans when the market is not cooperative? Executives usually have to forecast earnings in the face of economic turmoil, supply chain disruptions, and changing consumer sentiment.

Financial planning must be flexible. Leaders require adaptive structures that facilitate scenario modeling, risk analysis, and data-driven forecasts. This is where the Executive Finance Program comes in — empowering leaders with adaptable planning tools and analytical decision-making frameworks.

Strategic Financial Planning Must Account For:

- Scenario planning and sensitivity analysis

- Investment prioritization in uncertain conditions

- Aligning financial objectives with business vision

- Harnessing real-time data and AI forecasting capabilities

Harvard Business Review: Scenario planning to overcome uncertainty.

Managing Cash Flow in the Midst of Operating Pressure

Profitable companies can get into trouble with bad cash flow. Cash is king, and for executives, it is about ensuring the company never experiences a liquidity crisis.

The problem is in aligning collections, payables, inventory cycles, and investment in capital. Additionally, in expanding organizations, executives need to ensure subsidiaries and teams are in sync with central financial controls — no easy task with an operation across geographies.

Challenges in Cash Flow Management:

- Tardy receivables and high DSOs (Days Sales Outstanding)

- Inventory holding problems

- Unpredictable input costs

- Lack of visibility among business units

Key Tactics for Cash Flow Improvement:

- Digitised collections and invoicing systems

- Dynamic forecasting for cash

- Reduced payable cycles through early payment discounts

- Monthly working capital reviews

PwC: Cash flow visibility key to resilience.

Leadership Financial Skills and Team Accountability

Financial literacy at the executive level isn’t merely about number-crunching. It’s about being a strategic thinker, a data storyteller, a stakeholder influencer, and a financial literacy builder across teams.

Finance leaders of today must mentor, delegate, and get cross-functional teams to deliver. Many executives, however, do not have formal training to build others’ finance skills. This is where leadership finance capabilities come in — particularly in cascading strategy intent down the line.

Top Leadership Financial Skills Required:

- Converting difficult financials into meaningful insights

- Cross-functional team alignment on financial KPIs

- Delegating and checking financial tasks

- Coaching non-financial leaders on fiscal responsibility

Weak Financial Leadership Symptoms:

- No cost ownership in teams

- Inconsistent reporting accuracy

- Teams making budget decisions in silos

- Poor finance and operations alignment

How an Executive Finance Program Can Help

If you find yourself nodding your head to these challenges, it might be time to take a formal learning experience. A well-designed Executive Finance Program provides more than just armchair knowledge — it’s a tactical toolbox for today’s financial leaders.

Imarticus Learning’s Postgraduate Certificate Programme for Emerging CFOs by IIM Indore is aimed at empowering finance leaders with today’s best tools, leadership methods, and decision-making frameworks adapted to the complexity of real life.

Why This Programme is a Must:

- Learn from best IIM faculty and industry practitioners

- Concentration on leadership, valuation, M&A, digital finance

- Networking with high-level finance professionals

- Simulations and capstone projects in real life

Key Takeaways

- Executives confront sophisticated executive finance dilemmas in a changing economy.

- Pain points commonly shared are corporate budgeting challenges and cash flow management.

- Effective financial leadership skills are crucial to leverage and make decisions.

- A formal Executive Finance Program enables professionals to lead with purpose and speed.

FAQs

Q1: Why executives require specialized finance training?

Executives make high-risk decisions, and without sophisticated financial education and strategic models, they can make expensive mistakes. Specialized training bridges this gap with experiential education and leadership tools.

Q2: What are some of the telltale symptoms of ineffective executive-level financial planning?

Symptoms include missing targets, overrunning budgets, decision-making out of cycle, and a lack of departmental alignment. These tend to be the result of poor forecasting or strategic misalignment.

Q3: Why does budgeting become a bottleneck within big organisations?

Budgeting creates issues when it is too rigid, is not collegial with departments, or does not include real-time input. This slows down progress and causes miscalculation of resources.

Q4: Why is cash flow more significant than profitability?

Profit is abstract until it’s realised, whereas cash flow is the immediate fuel that energises the business. An organisation may be profitable but still crash because of inadequate liquidity.

Q5: How do finance leaders make teams more accountable?

Through the establishment of clear financial KPIs, training, dashboarding & ownership, finance leaders can instill more accountability across departments.

Q6: What is the significance of scenario planning in executive finance?

It enables leaders to assess various outcomes & prepare proactive responses, especially in volatile markets.. thus enhancing resilience.

Q7: Can digital tools help overcome challenges of executive finance?

Yes. Applications like AI-based forecasting, automated reporting, and ERPs supported by cloud infrastructure provide real-time insights and minimize human error in financial processes.

Q8: What is the ROI of an Executive Finance Program?

The payoff comes in enhanced decision-making, better team alignment, accelerated promotions, and more organisational impact. The learning pays off in terms of long-term value.

Q9: How do leadership financial skills differ from technical skills?

Leadership skills are concerned with influence, communication, decision-making, and team building, whereas technical skills are concerned with financial modelling, analysis, and reporting.

Q10: Is the IIM Indore Executive Finance Program relevant for mid-career professionals?

Certainly. It’s geared for mid to senior finance leaders wanting to move into strategic positions or CFOs in their future.

Conclusion

Managing the corporate finance environment is no longer an exercise in numbers. It’s vision, flexibility, and power. From managing macroeconomic uncertainty to building a financially savvy team ethos, executives today require more than experience — they require constant upskilling. Adopting an Executive Finance Program can be the difference between money management and money mastery.