Last Updated on 7 months ago by Imarticus Learning

In corporate finance, only few positions are more influential, and the Chief Financial Officer is one of those positions. But how is one supposed to ascend the ladder toward this highly coveted role? Seizing this Career Path as a CFO will enable a finance person who is eyeing the next big move or an ambitious executive who has been setting long-term objectives.

Usually, the CFO Career Path is a twisted one and definitely not about sitting by a desk and crunching numbers. Making really tough managerial decisions with people from all walks of their lives and being taught over and over-again while doing so. In this blog, we’ll take you through the steps to the CFO position, the milestones you’ll need to achieve, the skills you’ll need to acquire, and actionable plans to accelerate your financial leadership process.

Table of Contents

- Introduction to the CFO Career Path

- Steps to Become a CFO

- Key Milestones on the Financial Leadership Journey

- CFO Roles and Responsibilities Explained

- Essential Skills for an Executive Finance Career

- Advancing in Corporate Finance: How to Accelerate Your Journey

- Enrol in a Global CFO Programme to Fast-Track Success

- Key Takeaways

- FAQs

- Conclusion

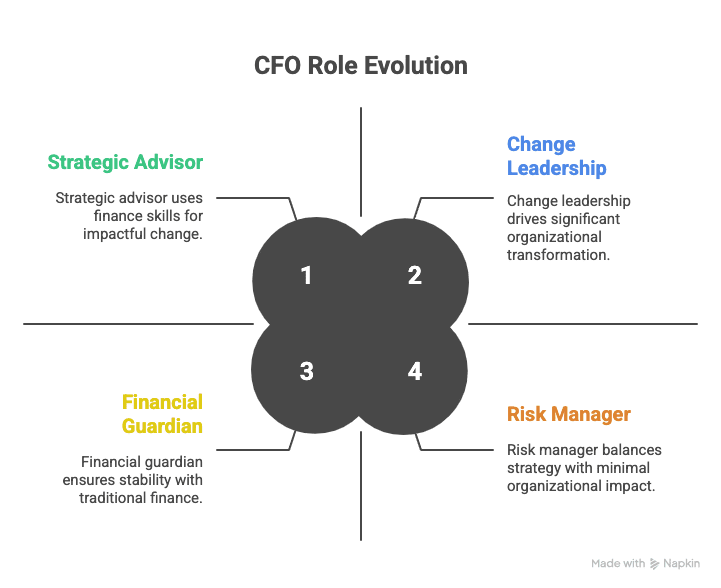

The CFO Career Path is usually seen as – the pinnacle of success for finance professionals. However, contrary to popular assumption, there is no one, fixed recipe to be followed. CFOs these days have multiple hats to wear: they’re strategic advisors, financial guardians, risk managers, and even change leaders.

In a world of business powered by ongoing transformation, CFOs are now called upon to provide more than fiscal know-how. They need to provide vision, insight, and the skill to lead organisations through change and development. If you are committed to developing your executive finance career, grasping this changing role is the beginning.

Steps to Become a CFO

The CFO career path demands meticulous planning, continued development, and the exposure. Since no two journeys are alike, however, most successful CFOs have somewhat similar career patterns that they follow.

Usually.. many of them begin their careers in accounting, audit or investment banking and consulting. Then, these professionals get into senior finance roles, receiving exposure to financial operations, strategy, and leadership.

Steps to Becoming a CFO:

- Earn a bachelor’s degree in accounting, finance, economics, or an associated field.

- Seek professional certifications (e.g., CPA, ACCA, CFA).

- Gain experience with financial reporting, budgeting, and analysis.

- Advance to mid-level finance positions like Finance Manager or Financial Controller.

- Develop strategic capabilities and cross-functional capabilities.

- Seek advanced leadership education or executive education.

- Become senior finance leadership positions (e.g., VP of Finance, Director of Finance).

- Exhibit strategic thinking and sound business acumen.

Educational & Career Milestones

| Step | Description |

| Bachelor’s Degree | Foundation in finance, accounting, economics |

| Professional Certifications | Enhance credibility (CPA, CFA, ACCA, etc.) |

| Early Career Roles | Financial Analyst, Auditor, Consultant |

| Mid-Level Roles | Finance Manager, Controller |

| Senior Leadership | VP of Finance, Head of Finance |

| CFO Appointment | Top financial strategist and decision-maker |

Key Financial Leadership Milestones

Financial leadership is defined by certain milestones that reflect readiness for increased responsibility. It’s not about job levels.. it’s about developing influence, strategic acumen & leadership presence.

Achieving these milestones provides you with the experience and exposure necessary to lead complex financial activities at the executive level.

Critical Milestones on the CFO Career Path:

- Financial fundamentals mastery: reporting, budgeting, and forecasting.

- Leading cross-functional teams and projects.

- Crafting business-wide financial strategies.

- Attaining international exposure or operating globally.

- Assembling effective relationships with C-Suite and board members.

- Implementing organisational change and transformation efforts.

- Managing investor and stakeholder communications.

Strategic impact and communication abilities are now included among the most sought-after skills among CFO candidates by boards, based on Deloitte’s 2024 CFO Survey.

CFO Job Responsibilities Defined

CFO job responsibilities and roles are crucial for anyone on the CFO Career Path. The days when balancing the books was the only role of the CFO are over.

The modern CFO is a strategic business partner who contributes to long-term vision formulation, financial sustainability, and sustainable growth. The role has expanded from the traditional financial oversight to include the realm of technology along with areas of risk management and corporate governance.

Primary CFO Roles and Responsibilities:

- Financial planning, budgeting, and forecasting.

- Management of cash flow, capital structure, and financial risk.

- Driving M&A activity and investment policies.

- Driving compliance with regulations and standards.

- Advising the board and CEO on finances.

- Leading digital change in finance.

- Constructing and guiding top-performing finance organizations.

Table: CFO’s Shifting Role

| Traditional Responsibilities | Emerging Responsibilities |

| Financial reporting | Strategic decision-making |

| Cost management | Technology and digital initiatives |

| Compliance oversight | ESG and sustainability leadership |

| Budgeting and forecasting | Risk management and crisis preparedness |

Key Skills for an Executive Finance Career

To be successful at an executive finance career takes much more than technical knowledge. Although financial sophistication forms the core, potential CFOs also need to develop a wide range of skills that combine leadership, strategic vision, and creativity.

In today’s fast-evolving global economy, businesses want CFOs who can not only read numbers, but can also spin the story behind numbers—and use this story to steer the organisation in the right direction.

Top Skills to Master on the CFO Career Path:

- Financial literacy and analytical mind.

- Leadership and team management skills.

- Strategic thinking and business acumen.

- Communication and stakeholder engagement.

- Digital and technological acumen.

- Change management and resilience.

- Risk management skills.

- Emotional intelligence and high-pressure decision-making.

Based on McKinsey & Company’s CFO Insights, CFOs increasingly function as agents of business transformation.

Moving Up in Corporate Finance: How to Fast Track Your Career

Most finance professionals are curious about how they can differentiate and accelerate their journey along the CFO Career Path. The solution is deliberate career steps, ongoing learning, and assertive leadership.

Waiting for opportunities will not do. You must pursue experiences that create strategic abilities, international experience, and executive presence—three cornerstones that drive advancement within corporate finance.

The Steps to Fast-Track Your Financial Leadership Journey

- Seek executive education and leadership development programs.

- Volunteer for significant projects outside the core finance scope.

- Establish mentorship and senior leadership relationships.

- Seek international assignments or cross-border experience.

- Acquire skills in fast-emerging fields such as digital finance and ESG.

- Stay current on industry trends and thought leadership.

- Proactively manage your personal brand and executive presence.

Quick Insight: The Harvard Business Review highlights that CFOs with global, cross-functional, and tech-driven experience are in high demand among Fortune 500 companies.

Enrol in a Global CFO Programme to Fast-Track Success

If you want to fast-track your CFO Career Path, invest in a globally recognized executive programme for future CFOs. The Chief Financial Officer Programme at the London Business School, available in partnership with Imarticus Learning, helps you exactly do that.

This top-tier programme provides you with the latest in financial leadership skills, strategic awareness, and the global exposure to succeed at the most demanding echelons of corporate finance.

Enrol Now: Chief Financial Officer Programme by LBS & Imarticus Learning

Key Takeaways

- The CFO Career Path is -dynamic, requiring strategic, financial, and leadership excellence.

- The path of becoming a CFO requires education, varied experience & ongoing development.

- Top-level success depends on mastering CFO jobs and responsibilities.

- Developing executive finance skills goes beyond technical finance.

- Advancing in corporate finance proactively relies on -global exposure, mentorship, and strategic opportunity.

- Formal executive programs such as the LBS CFO Programme can make a huge difference.

FAQs

1. What is a typical CFO Career Path?

A typical CFO career path generally involves roles such as -Financial Analyst, Finance Manager, Financial Controller & Vice President of Finance before entering the role of CFO, supported with further qualifications and leadership development.

2. How long does it take to become a CFO?

It takes between 15-20 years, on average, to reach the position of CFO.. this figure varies on the basis of one’s career choices, industry, and educational background.

3. Do CFOs require professional certifications?

While not a must- certifications such as CPA, CFA, or ACCA are a great way to add credibility and enhance an individual’s competitiveness for the CFO Career Path.

4. Which industries offer the quickest CFO Career Path?

Technology, financial services, and private equity generally offer somewhat faster finance leadership career pathways propped up by rapidly evolving financial landscapes.

5. What’s the most severe challenge confronting new CFOs?

The new CFOs face a huge load of expectations from stakeholders, manage digital transformation, and adjust to global financial volatility.

6. How do I cultivate strategic thinking as a finance professional?

Strategic thought can be cultivated by working on: cross-functional initiatives, engaging in executive education & keeping up to date with business trends.

7. Is global experience essential for CFOs?

Yes, global exposure is more and more sought after, as CFOs tend to oversee financial operations in more than one region and will have to deal with various markets.

8. Can one be a CFO without an accounting background?

Yes, although most CFOs have an accounting background, some also have an investment banking, consulting, or operational finance background.

9. How significant is digital literacy for CFOs?

Digital literacy is extremely important since CFOs today drive finance transformation through technology, data analytics, and automation.

10. What is the benefit of joining a CFO leadership programme?

Such programs offer structured education, international views, peer networking, and real-world insights that speed up preparation for the CFO position.

Conclusion

The journey to getting to becoming the CFO must be as intellectually challenging as it is rewarding. However, upon fully appreciating the CFO Career Path, developing the essential skills, and creating and seizing new opportunities for growth on your own, you are almost a guarantee of reaching the top levels of finance leadership.

With the right mindset, right strategic moves, and a world-class education like the LBS CFO Programme, the way to the top is greatly shortened. So remember, the future will never belong to the ones that do just understand numbers—but rather to those who can lead; inspire, and really affect lasting business change.