One of the most important concepts you’ll need to understand is the time value of money (TVM) if you want to pusue finance. It might sound a bit complicated at first, but take it from a professional himself, it’s actually a simple idea. Essentially, it means that money today is worth more than the same amount of money in the future. Why? Because money can grow over time by earning interest or returns. And for anyone interested in finance.

Knowing how to apply TVM will make you a more effective financial professional. However, from one professional to a future professional, here’s some advice. Take up a CMA USA course to dive deeper into these concepts. The reliable one will offer you a structured path to mastering them.

Let’s walk you through what is time value of money in this guide.

Time Value of Money: In Brief

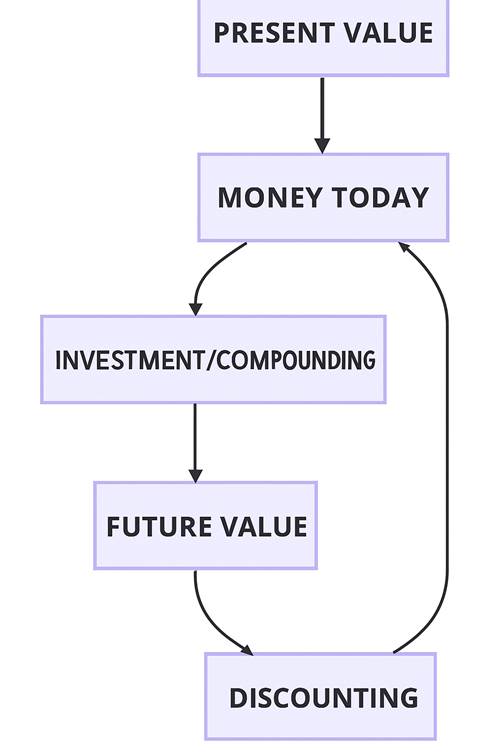

Time value of money (TVM) simply means that money now is more valuable than the same amount of money in the future. Why? Because money today has the ability to earn returns. If you have £1,000 today, you could invest it, and over time it will grow. In contrast, £1,000 you receive a year from now won’t have that same earning potential, unless you invest it.

Think about it like this:

If you had £1,000 today, you could invest it in a savings account or stocks and earn some extra money. But if you’re promised £1,000 in a year, it’s not quite as good. Sure, £1,000 is still valuable, but you could’ve made more with it if you had it today.

This concept is essential because it helps us understand how time affects money. Money isn’t just a simple “now versus later” decision. It’s about considering the growth potential of money over time.

Watch: What is Financial Modeling by Reshma – Imarticus Learning

TVM in Financial Management

As I’ve mentioned, the time value of money is a cornerstone of financial management. In fact, TVM is used in almost every decision made by businesses and individuals. When businesses decide whether or not to invest in a new project, they rely on time value of money to assess future cash flows.

TVM also helps businesses evaluate the cost of borrowing. Suppose a business is thinking about taking a loan. By applying TVM, they can determine whether the future loan repayments are justified by the money they’re receiving today. Without TVM, they could easily miscalculate the real cost of borrowing.

In my line of work, I have to use TVM when evaluating both personal and business investments. It’s one of the first things I look at to ensure that the expected future returns outweigh the cost of investing today.

The Time Value of Money Formula

As a financial manager, you’ll be constantly evaluating whether future returns justify present investments. To calculate the time value of money, there are a couple of formulas that financial professionals use to figure out how much money today is worth in the future, or vice versa.

To calculate the time value of money, there are a couple of formulas that financial professionals use to figure out how much money today is worth in the future, or vice versa.

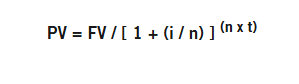

- Present Value (PV) Formula

Use this formula to learn how much a future sum of money is worth today:

PV = FV / (1 + r)^n - Future Value (FV) Formula

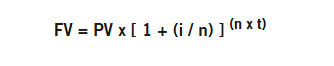

On the flip side, if you want to know how much money you have today will be worth in the future, you can use the future value (FV) formula:

FV = PV * (1 + r)^n

Where:

- PV = Present Value (what the future sum is worth today)

- FV = Future Value (how much your current money will be worth in the future)

- PV = Present Value (the amount you have today)

- r = Interest rate (the rate at which your money will grow)

- n = Number of periods (how long you plan to leave it invested)

Watch: US CMA Certification in India: Exploring the Scope and Opportunities in 2023 – Imarticus Learning

Conclusion

Using TVM in everyday financial choices, will surely help you get better at it. Take it from an expert. And one of the most structured ways to deepen your understanding of financial management is by enrolling in a CMA USA course. The Certified Management Accountant (CMA) USA program offered by Imarticus Learning provides a thorough approach to financial decision-making. It not only covers the time value of money but also how to apply it in a variety of financial situations, preparing you for real-world challenges in business and beyond.

Once you’re finished, you’ll not just have the tag ‘certified’ beside your credentials in your resume, but, you’ll actually have the skills you need to back it up. All in all, this course will set you on the path to becoming a financial professional who understands the principles behind every financial move.

FAQs

1. How does time value of money affect investment decisions?

TVM helps investors determine if future returns are worth today’s investment by calculating the present value of expected returns.

2. How is time value of money used in business projects?

TVM helps businesses evaluate the profitability of projects by comparing future cash flows with current investments.

3. Why is time value of money important for compound interest?

TVM explains how compound interest grows money over time, making long-term investments more valuable than short-term ones.

4. How does TVM help evaluate loan options?

TVM helps determine the true cost of loans by calculating the present value of future payments, helping you compare different loan terms.

5. How does TVM apply to retirement planning?

TVM helps estimate how much you need to save today to meet your retirement goals, factoring in time and interest rates.

6. How does TVM affect stock market analysis?

TVM helps investors assess the current value of stocks by considering future dividends and capital gains.