What makes several individuals come together and create innovative things? It’s leadership and team building. This blog looks at the power dynamics of these activities and how they work together to create a winning formula. Let’s get into how leadership and team building activities work together to create a foundation for trust, communication and goal achievement.

Why You Need Leadership and Team Building Exercises

Here is the reality: individual brilliance won’t get you fintech dominance. You will require a combination of leadership and team building exercises.

Think about it. Without leadership your team will struggle to find direction, and individual skills will be operating in silos. Communication will break down deadlines will be missed and team members will be frustrated.

Leadership isn’t a solo act. It needs to be paired with team building activities to open up your team’s potential. These activities go beyond icebreakers. They are designed to build trust, communication and problem-solving skills.

How Collaboration Works

To disrupt the industry and get groundbreaking results something more is needed: collaboration.

Collaboration is the act of working together to achieve a common goal. It’s about combining the diverse strengths and perspectives of a team to create something greater than the sum of its parts.

In fintech, where complexity and rapid change are the norm, collaborative teams are the key to accessing revolutionary solutions. To understand more about how collaboration works in a team setting, undertake a senior leadership course.

Here is how a typical collaboration setting happens in a corporate company.

| Stage | Description | Mode | Example | |

| Preparation | Define goals, roles, and responsibilities. Establish communication channels and tools (e.g., project management software, video conferencing). | Online/offline | The team lead creates a shared document outlining project goals and assigns tasks. | |

| Information sharing | Brainstorm ideas, and share documents and updates. | Online/offline | The team uses a shared whiteboard tool for brainstorming or circulates a document with updates. | |

| Discussion and feedback | Provide constructive criticism, discuss challenges, and find solutions. | Online/offline | The team holds a video meeting or in-person meeting to discuss ideas and provide feedback. | |

| Decision-making | Vote on options, reach a consensus or have the leader make the final call based on discussion. | Online/offline | The team uses a voting tool online or takes a physical vote to choose a course of action. | |

| Action and progress tracking | Assign tasks, track deadlines, and monitor progress. | Online/offline |

|

Why Collaboration Matters in Fintech

When team members with different skill sets come together they can challenge each other’s ideas, spark creativity and identify solutions that one person might miss. Think of a coder working alongside a financial analyst, their combined expertise could create a secure and user-friendly financial app.

Through team building activities that go beyond icebreakers, team members learn to trust and rely on each other. Open communication becomes the norm workflow becomes more efficient and the work environment more positive.

When challenges arise a collaborative team will face them head-on, utilising each other’s strengths to find solutions. This sense of camaraderie and shared purpose becomes the driving force for goal achievement.

Examples of Collaboration in Fintech

Several fintech companies have already proven the power of collaboration. Take Nubank, the Brazilian digital bank famous for its mobile banking platform.

Developers, designers and financial experts work together to continuously improve the user experience and create new financial products. This collaborative approach has made Nubank one of the top digital banks in Latin America. Hence, why it is a perfect example of leadership and team building going hand in hand.

Another example is Robinhood, a commission-free online brokerage platform. Robinhood collaborates not only with its teams but also with its users. They actively ask for user feedback and suggestions and incorporate them into the platform.

Common Team Building Activities

Team building activities are more than just a fun day out. With every activity you do for your team, you are investing in a stronger more effective team. Use these different types of leadership and team building activities and see what they can do for you:

-

Physical challenge courses

These outdoor obstacle courses push teams to their limits physically and mentally. Team members have to rely on each other’s strengths, communicate effectively and solve problems together to get through the course.

-

Mental challenge activities

Activities like logic puzzles, scavenger hunts with cryptic clues or even escape rooms use critical thinking and communication. Working under a time constraint adds an extra layer of pressure, so clear communication and strategic decision making.

-

Connect the dots

A part of leadership and team building activity is to help the team see how the skills they used during the activity apply to their daily work.

-

Set goals for improvement

Set achievable goals based on the debriefing work with the team to identify areas for improvement and set actions.

-

Volunteer activities

Giving back to the community is a great way to bond and it shows that you care for leadership and team building. Working together towards a common goal outside the office gives a sense of shared purpose and allows team members to connect on a deeper level. This can improve communication, empathy and overall team morale.

-

Social events

Casual team lunches, game nights or even volunteering for a local sporting event can provide a relaxed and fun environment. These seemingly simple activities allow team members to interact outside of work and find common ground.

-

Role-playing scenarios

Simulating real-life situations such as client presentations, conflict resolution or negotiation scenarios allows team members to practice their communication and collaboration skills in a safe space.

-

Strengths assessments

Knowing individual strengths is key to team building. Personality and skill assessments can help team members see not only their strengths but also those of their colleagues. This allows for better task delegation and a culture of appreciation for diverse skills.

Choosing the Right Leadership Approach

There’s no one-size-fits-all approach to leadership. The best approach will depend on your team, the challenges you face and the company culture. Here’s a look at some common leadership styles and their application in fintech:

- Transformational leadership: This style inspires teams to go beyond their current capabilities and work towards a shared vision. A transformational leader ignites the passion for financial inclusion within your team and gets them to develop solutions for the underserved.

- Democratic leadership: Leadership and team building are both greatly seen in this type of leadership. This style involves team participation and empowers individuals to bring their ideas to the table. This is particularly useful when the speed of innovation is key.

- Situational leadership: This style adjusts to the team’s level of development and the task at hand. A leader might be more directive with a new team and hands-off with an experienced team on a well-defined project.

Find Your Leadership Style

So how do you find your style? Here are some tips one can follow.

- Self-reflection: Reflect on your strengths and weaknesses. Are you charismatic or analytical? Do you like structure or flexibility?

- Observe and learn: Observe successful leaders you look up to. Analyse their leadership styles and see what you like most about them.

- Practice makes perfect: Put your leadership into practice! Volunteer for leadership roles within your team or community. Participate in leadership and team building exercises to get experience and hone your approach.

What Skills to Look For in a Good Leader

While a good CV is a good start, true success lies in finding candidates with specific skills. Here’s a guide to help you in your search:

Technical skills: This is the foundation of your team’s ability to innovate and develop solutions. Look for individuals with expertise in:

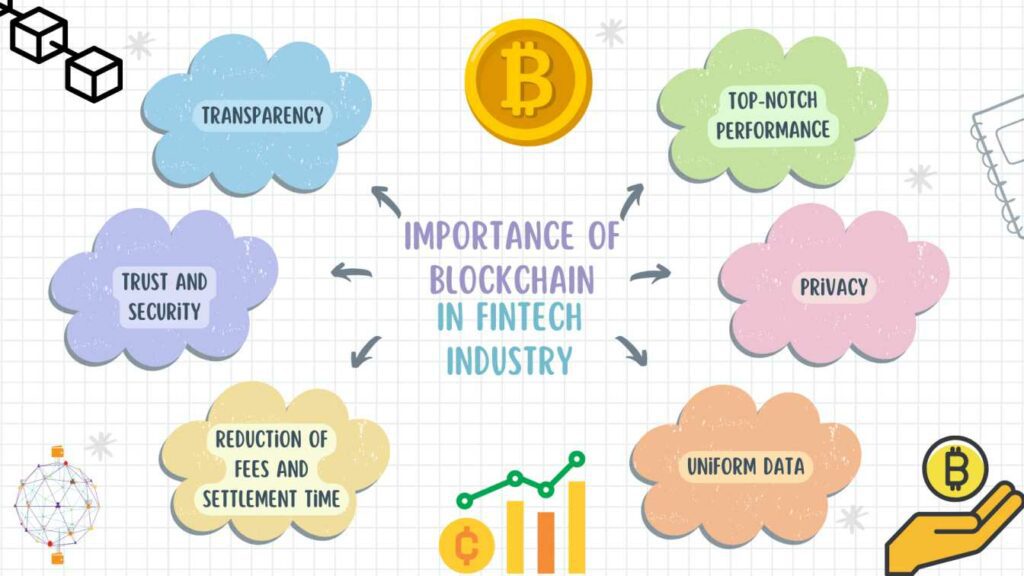

- Blockchain technology: Understanding blockchain technology and its applications in financial services is becoming more important.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are transforming the fintech industry from fraud detection to personalised financial products. Look for candidates with knowledge of these technologies and their applications.

- Cybersecurity: With more and more online financial services, cybersecurity is key. Look for individuals with expertise in data protection and system security.

- Data analytics: The ability to collect, analyse and interpret data is critical to gaining insights and making informed decisions in fintech.

Beyond technical prowess, your team needs a strong understanding of the financial world. Look for individuals who possess:

- Financial products: Know the products.

- Regulatory awareness: Fintech is heavily regulated. Look for people who know the rules.

- Market awareness: Understand the markets.

Additional Skills

Here are some additional leader-like qualities that can help in leadership and team building.

Problem-solving and analytical skills: The ability to solve problems is the lifeblood of fintech. Look for people who can:

- Think: They should be able to analyse complex situations, spot problems and come up with innovative solutions.

- Be adaptable: Fintech is always changing so your team needs to be able to handle the unknown.

- Data-driven: Problem-solving in fintech often involves data analysis. Look for people who can use data to make decisions.

Beyond the Leader Skills

Beyond leadership style, certain natures make a good fintech leader. Here are a few:

- Vision: A clear and compelling vision is the north star that guides the team to a shared goal.

- Communication: Communication is the bedrock of strong teams. A leader who can communicate goals, expectations and progress builds trust and transparency in the team.

- Positive work environment: A leader who creates a culture of respect, inclusion and psychological safety lets team members flourish.

Emerging Fintech Trends in 2025

Leadership and team building can be exciting, especially when it comes to trends. Here are some trends that will change the role of a fintech leader:

- Remote work models: The traditional office might be giving way to a more distributed workforce. As remote work models become more common, leaders need to build a remote work culture that enables collaboration and team building across distances.

- Data-driven decision making: Data is the lifeblood of the fintech industry. Leaders who can use data analytics to get valuable insights and make decisions will be ahead of the game. This means understanding data analysis tools and being able to turn data into action.

- Fintech ecosystems: The future of fintech is collaboration and interconnected ecosystems. Think of fintech startups, established financial institutions and technology companies working together.

Wrap Up

The journey of leadership and team building doesn’t stop here. Now’s the time to act, to spark the fire in your team and get them to fintech greatness.

ISB Fintech Senior Leadership Programme. Start here. For experienced professionals. Dive in. We’re talking blockchain, artificial intelligence, and machine learning —the emerging tools of the trade.

So, are you ready to take the reins and lead your team to fintech dominance? Register for the ISB course as the future of fintech awaits.

Frequently Asked Questions

- Why are leadership and team building activities important for success in fintech?

Fintech demands more than individual smarts. You need a powerful combination: strong leadership and well-designed leadership and team building activities. These activities are more than icebreakers.

- What are some examples of leadership styles covered in the ISB Senior Leadership Programme in Fintech?

The program explores various styles including transformational leadership, democratic leadership, and situational leadership, all with applications specific to the fintech industry.

- What other skills are essential for the ISB program?

Leadership and team building activities are important, but so are technical skills, financial knowledge, problem-solving abilities, and finesse for continuous learning.

- What is the connection between leadership and team building?

Strong leadership lays the groundwork for a successful team. Team building activities then help members collaborate and achieve common goals. They go hand in hand.