The FRM Course Structure offers an authoritative guide for finance professionals who want to become risk management experts.

More than 90,000 charterholders work worldwide in 190+ countries. FRM designation has been proclaimed as the gold standard in risk certification (GARP).

The two-part course combines rigorous and applied theoretical concepts to produce candidates with sound analytical skills and strategic understanding.

In an economy where banks have to battle challenges ever emerging—market volatility to cyber-facilitated fraud—the need for skilled FRMs has never been higher.

What is the structure of the FRM course?

The structure of the FRM course consists of Part I and Part II, each addressing a distinct array of competencies:

- Part I addresses fundamental tools and quantitative techniques.

- Part II addresses case studies and practical usage, and advanced subjects.

This sequential structure allows candidates to familiarise themselves with concepts like probability, statistics and valuation before applying these to cases of credit, market and operational risk.

FRM Syllabus and Modules

FRM syllabus and modules cover all risk management areas of study. Study hours need to be spent on weightage and difficulty:

Part I Modules

- Foundations of Risk Management

- Quantitative Analysis

- Financial Markets and Products

- Valuation and Risk Models

Part II Modules

- Market Risk Measurement and Management

- Credit Risk Measurement and Management

- Operational Risk and Resiliency

- Liquidity and Treasury Risk Measurement and Management

- Risk Management and Investment Management Techniques

The average exam candidate spends 120–150 hours per part to pass, a testament to the complexity of FRM modules and syllabus.

| Exam Part | Modules Covered | Weightage | Exam Format |

| Part I | 4 modules (Foundations; Quantitative; Markets & Products; Valuation) | 50% | 100 MCQs, 4 hours |

| Part II | 5 modules (Market Risk; Credit Risk; Operational Risk; Liquidity; Investment Techniques) | 50% | 80 MCQs, 4 hours |

Understanding the FRM Exam Format and Topics

It is essential to know the FRM exam format and syllabus for adequate preparation:

- Question Type: Multiple-choice questions (MCQs).

- Number of Questions: 100 for Part I; 80 for Part II.

- Exam Duration: 4 hours for Part I; 4 hours for Part II.

- Exam Dates: May, August and November annually.

- Pass Rates: Typically ~45% for Part I, ~55% for Part II. (Kaplan Schweser)

Strategic study plans stay up to speed on heavyweight topics like quantitative methods and credit risk measurement, thereby equipping candidates to tackle the FRM exam syllabus and content head-on.

Global Risk Management Certification – Why FRM?

Selecting the FRM credential has several benefits:

- International Acceptance: Respected by professionals in 190+ countries.

- Networking: Personal access to GARP chapters, webinars and yearly risk summits.

- Compensation Boost: 20–25% average salary bump on certification (Payscale).

- Increased Demand: Risk Management career is expected to grow by 18% by 2030.

In contrast to other certifications, the FRM’s sole emphasis on risk measures, modelling and governance makes it the world’s greatest global risk management certification.

Unique “Learning by Doing” Model

Imarticus Learning supplements the traditional FRM Course Structure with an experience-based, practice-focused learning mode:

- Case Study Workshops: Learn from historical market failures and bank collapses.

- Simulation Labs: Execute proprietary software to simulate portfolio exposures.

- Capstone Projects: Construct risk structures for idealised firms.

These “learning by doing” build application skills and close the gap between theory and practice.

Financial Risk Management Career Path

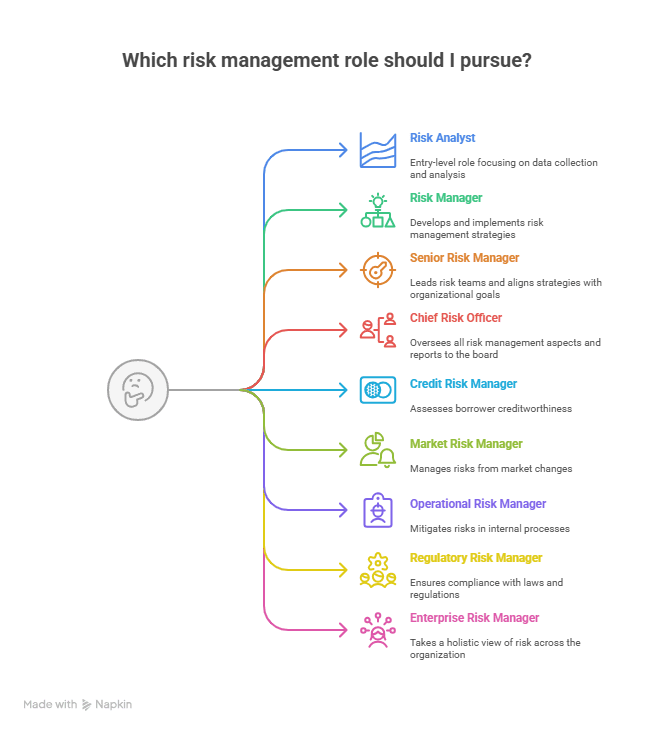

Earning the FRM certification provides access to varied career paths:

- Risk Analyst

- Credit Risk Manager

- Market Risk Specialist

- Operational Risk Consultant

- Chief Risk Officer (CRO)

Other new roles are:

- ESG Risk Specialist – Assess environment, social and governance risks.

- Fintech Risk Advisor – Consider digital asset and cyber risks.

- AI Risk Model Developer – Create machine‑learning models to forecast risks.

| Role | Average Salary (India, ₹ LPA) | Key Responsibilities |

| Risk Analyst | 8 | Data analysis, risk identification |

| Credit Risk Manager | 12 | Credit scoring, exposure limits |

| Market Risk Specialist | 14 | Scenario analysis, hedging strategies |

| Operational Risk Consultant | 11 | Process audits, control frameworks |

| ESG Risk Specialist | 13 | Sustainability reporting, assessments |

| AI Risk Model Developer | 15 | Model creation, validation, backtesting |

| Chief Risk Officer (CRO) | 30 | Enterprise risk strategy, regulatory liaison |

FRM Course Benefits in India

India’s financial services industry increasingly sees the value in FRM certification:

- Regulatory Readiness: Compliance with RBI and SEBI regulations.

- Salary Hike: From ₹8 LPA to ₹14 LPA on average after certification.

- Local Network: More than 3,000 Indian FRMs from active GARP chapters.

- Global Mobility: Bank acceptance of credentials in Singapore, London, and New York.

Additionally, 75% of risk functions intend to incorporate AI tools by 2025, with a focus on the need for FRMs with technology-facilitated risk management capabilities.

Frequently Asked Questions

How many modules are there in the FRM syllabus and modules?

Part I has 4 modules; Part II has 5 modules.

What topics are there in the FRM exam format and topics?

Quantitative techniques, market risk, credit risk, operational risk, liquidity risk and investment methods.

How long will it take to complete FRM certification?

Generally, most test-takers pass both parts within 8–9 months, depending on study effort.

What are the career options following FRM certification?

Occupations are Risk Analyst, Credit Risk Manager, ESG Risk Specialist, AI Model Developer and CRO.

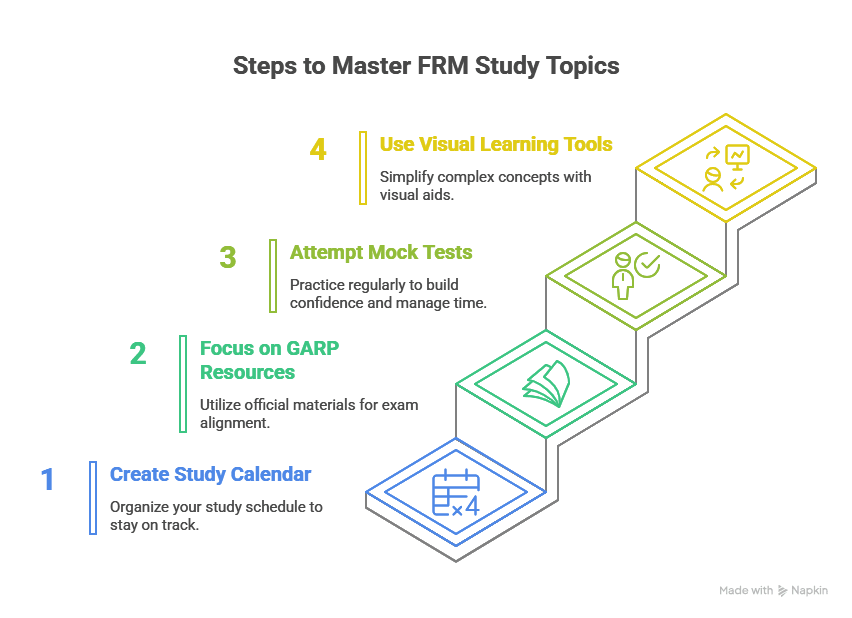

How do I prepare to pass?

Combine theory with case studies, mock test, simulation laboratories and group discussions.

How frequently is the FRM exam conducted?

Thrice annually—May, August and November.

Conclusion

FRM Course Structure is your one-stop manual to global risk leadership. With a blend of tough theory and interesting, interactive practice, it gives you achievement in sophisticated financial environments and propel strategic decisions.

Key Takeaways:

- Comprehensive Curriculum: Two parts guarantee supremacy of quantitative fundamentals and sophisticated applications.

- Industry Acceptance: Achieved acceptance by banks, asset managers, and regulators globally in 190+ countries.

- Career Growth: Ongoing high growth in compensation, a broad range of role opportunities and a speedy path to senior management.

Ready to Bring Your Career to the Next Level?

Enrol in the FRM Preparation Program at Imarticus Learning and become an upcoming risk manager today.

Begin Your FRM Journey Today